This past month saw a strong march higher in … well… everything, even inflation (ok, cash was flat and will be for a while). And the YTD total return winner is not technology but rather the 30-year treasury at 30+%.

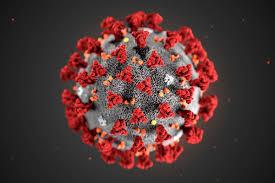

Given the increase in COVID-19 numbers and news coverage, this blog updates data I posted back in April and May. The overall picture doesn’t appear as dire as the headlines when you ask the data these four questions.

You have seen the headlines – “best quarter since 1998!”. But always remember the starting point of a given return metric and recall the level of uncertainty at the end of March.

To the recent college graduates – Congratulations! Your last semester didn’t go as planned in these unique times but an exciting future still lies ahead. Some of the topics in that future will be financial related. In this blog post I share some general financial advice for those early (or not so early) in their career in a Q & A format.

Ho hum… just another 5+% return for the month in US equities.

Here is an update to last month's post on COVID-19 including updated projections WITH NEW MODELING from IHME. I also graph the expanded testing taking place and favorable trends.

Will this year bring “April flowers and May showers” in the markets?

"If you're going through hell, keep going." - attributed to Winston Churchill

This is no April Fool's Day joke! Hopefully April showers will bring May flowers.

I focus this mid-month blog post on a market update given the recent volatility. At the end, I briefly mention some things to consider with these lemons.

That was fast.

In this post I take a deeper dive into three of the SECURE Act changes impacting people at different phases of life. And with a nod to the classic films once upon a time, the changes I discuss are good, great and downright ugly.