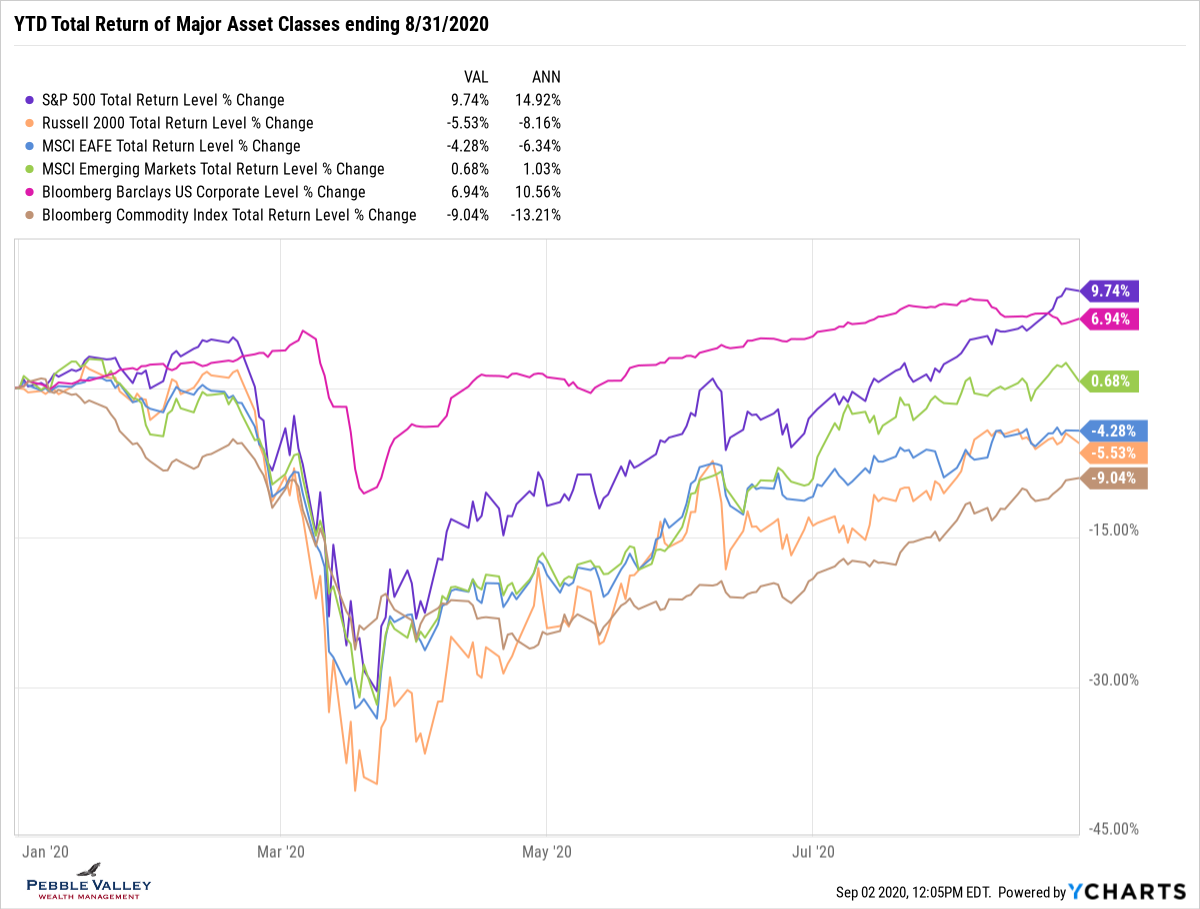

Asset Class Returns - 08/31/2020

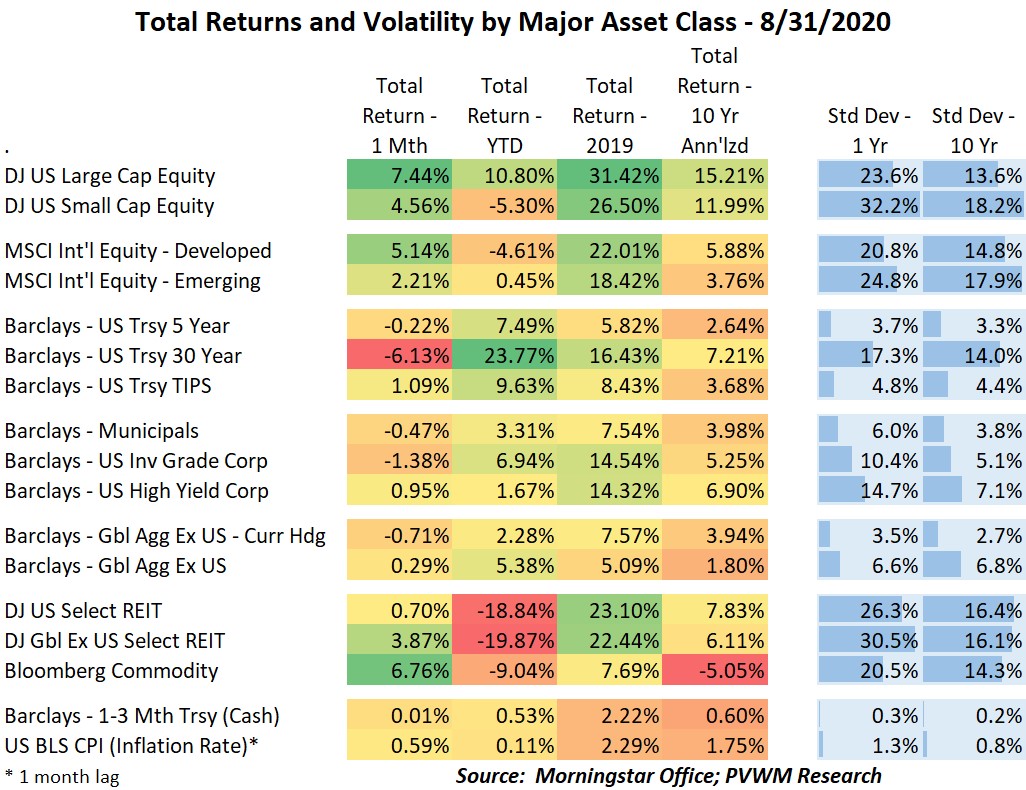

The major risky asset classes continued their march higher. US Large Caps overtook the corporate bond index for the YTD winner on this graph (I show NASDAQ next… the ultimate winner). International and Small Caps had a little dip at the end of the month but showed solid monthly returns as seen in the table at very bottom of this blog post.

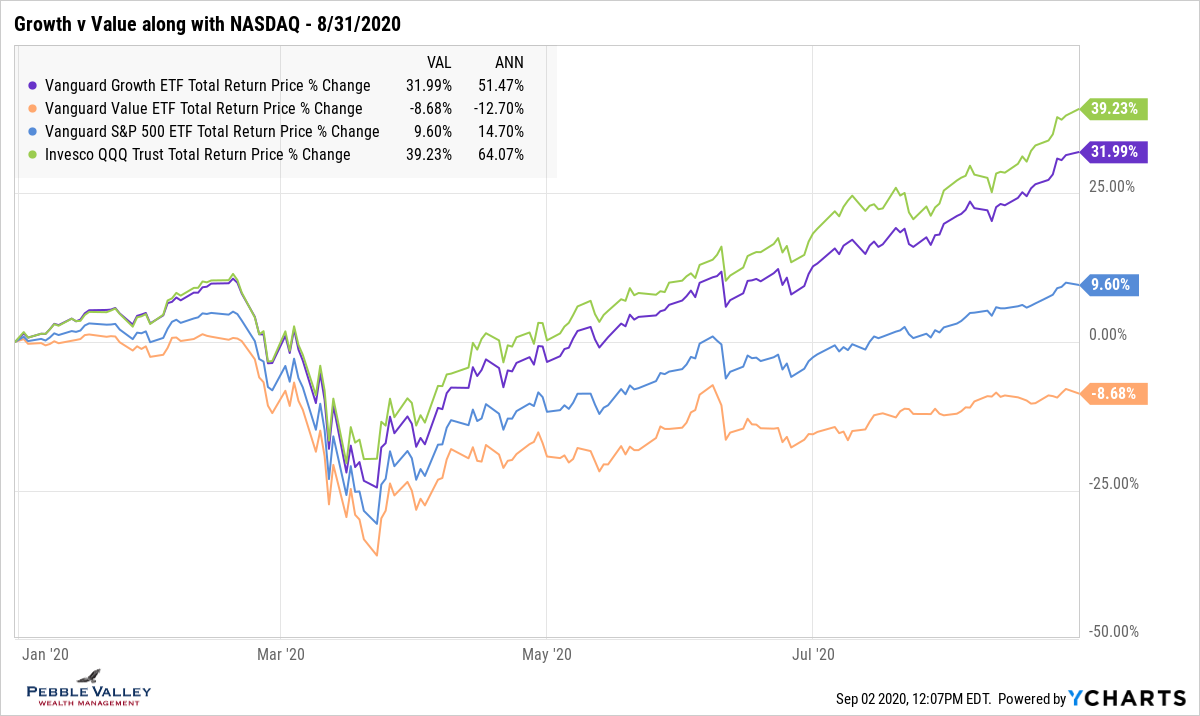

The technology story continued its summer heat. This is the same chart from last month – showing US large caps split by Growth and Value along with the red-hot tech-heavy index. I guess there is a difference from last month – QQQ is much higher and the dispersion from Growth vs. Value much wider - now over 40% relative outperformance YTD!

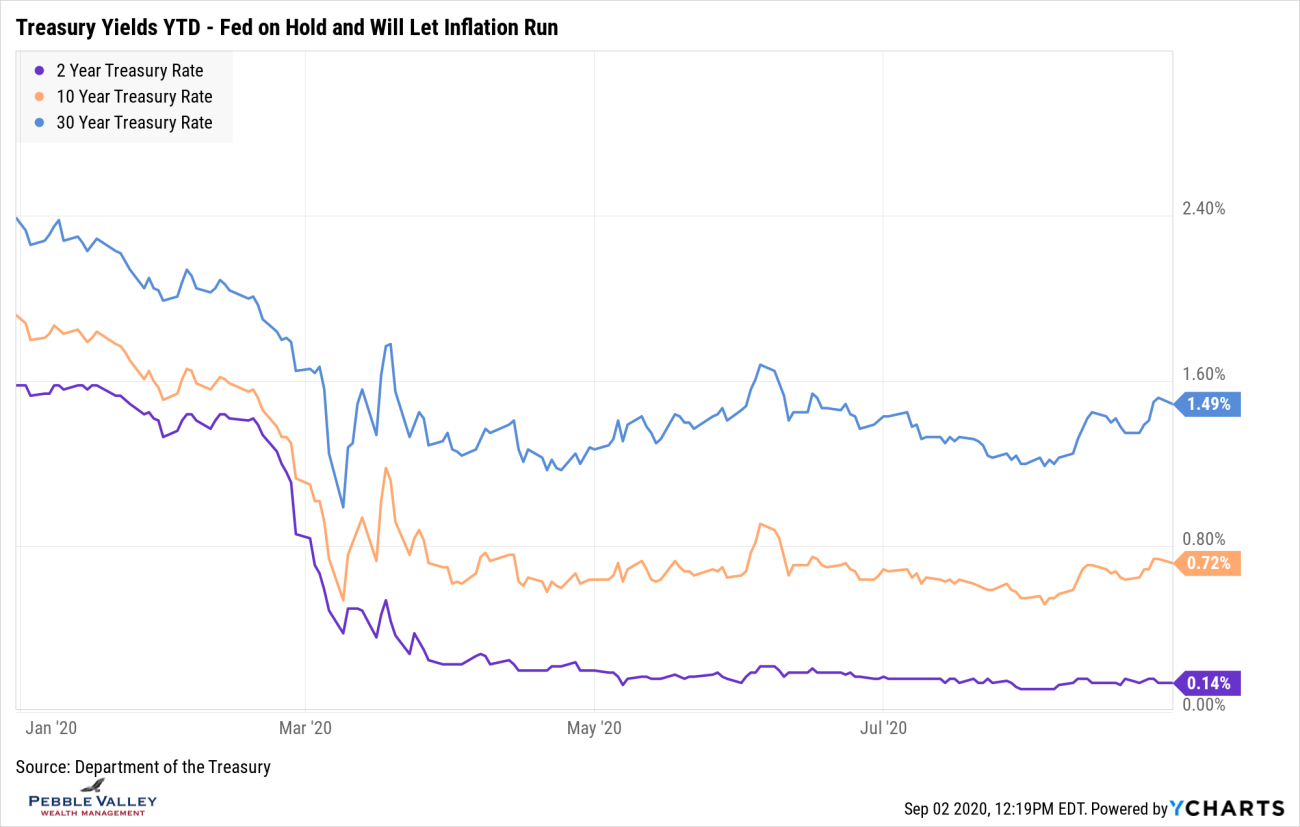

The only negative monthly returns in the table at the bottom are related to rates. At the Kansas City Fed’s Economic Policy Symposium in late August, Fed Chairman Powell formally announced the Fed’s policy to let inflation run over the Fed’s target of 2% as it “seeks to achieve inflation that averages 2 percent over time.” This caused a slight sell-off on the longer end of the curve, resulting in rising rates. The graph below shows the rates for different bond maturities. On a related note of keeping rates lower for longer, note the continued deviation of the global bond index with a currency hedge in the table far below. As the dollar weakens, non-USD denominated assets will outperform, all else equal.

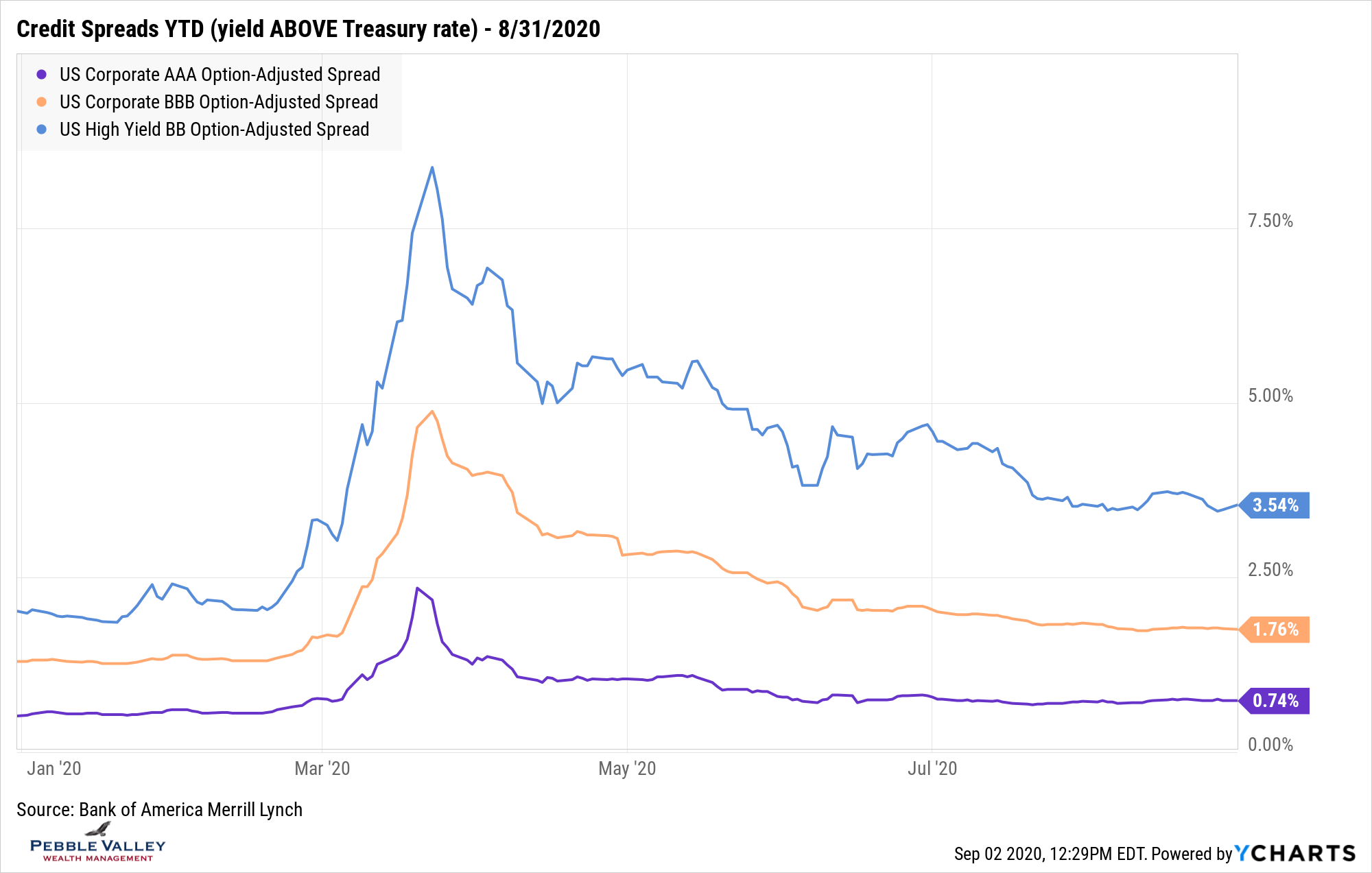

Sticking with the rate theme, the next graph shows the credit spreads – the extra yield ABOVE treasury rates – received from lending money to riskier credits. Spreads have come in quite a bit (less perceived risk) from the late March turmoil before the Fed stepped in. However, the spreads are still wider than Valentine’s Day when the respective AAA, BBB and BB spreads were 0.56%, 1.31% and 2.04%. One must always be careful with non-treasury bonds but investment-grade credit continues to receive attention as treasury rates remain low.

Since I was just on a paddle board and the cicadas are still chirping… continue to enjoy the sun and ice cream. Let's go!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com