Asset Class Returns - 03/31/2020

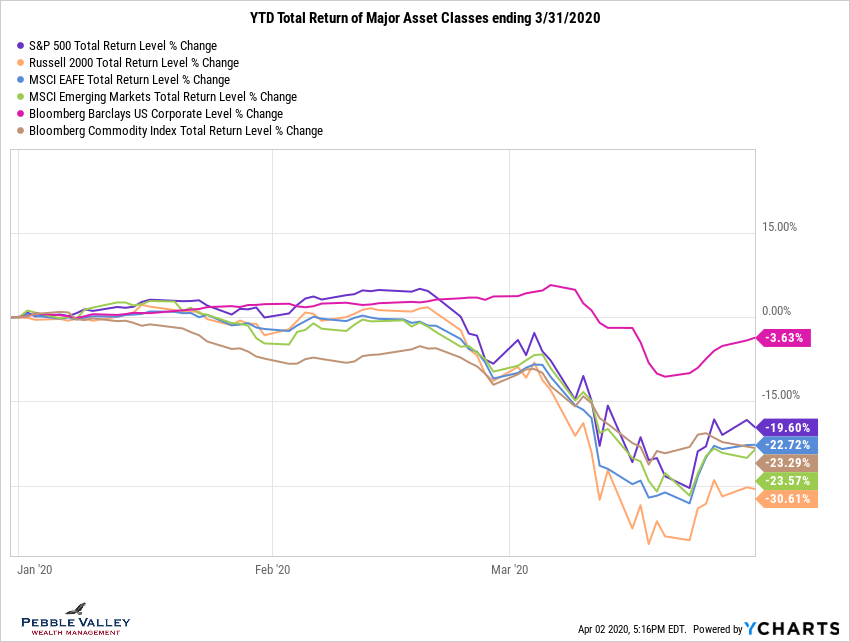

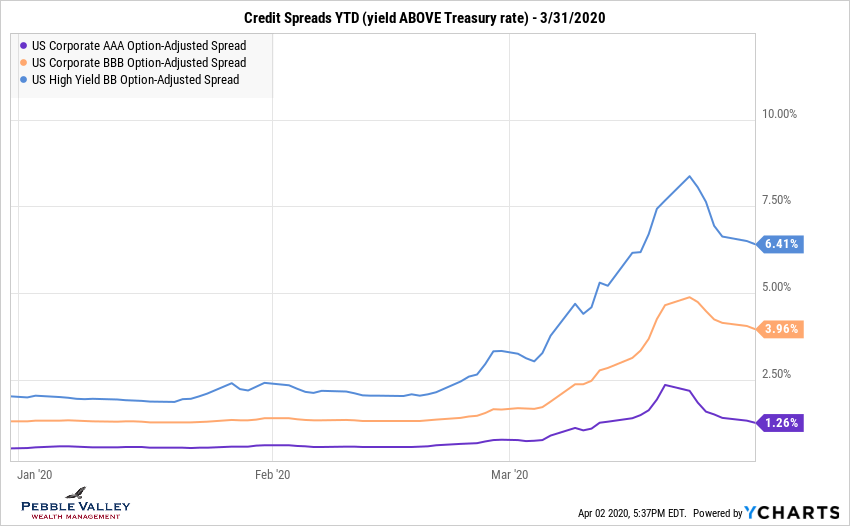

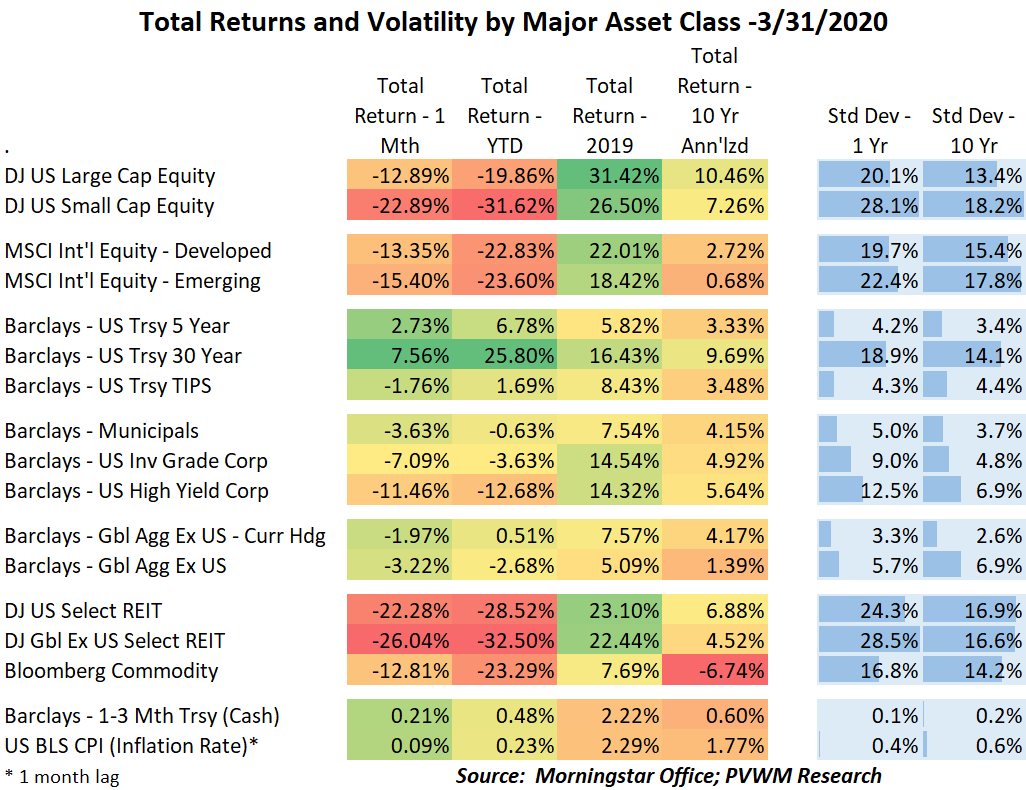

The market sell-off continued through the month of March at a very fast pace. On a total return basis, the S&P 500 was up over 5% on February 19 and fell to over -30% on March 23. Unlike late 2018, this time the credit markets also got hit.

I will briefly note some items and then let the graphs do the talking. My clients can reference the additional communications received over the past month.

- US and international equities were hit, with small caps under performing large

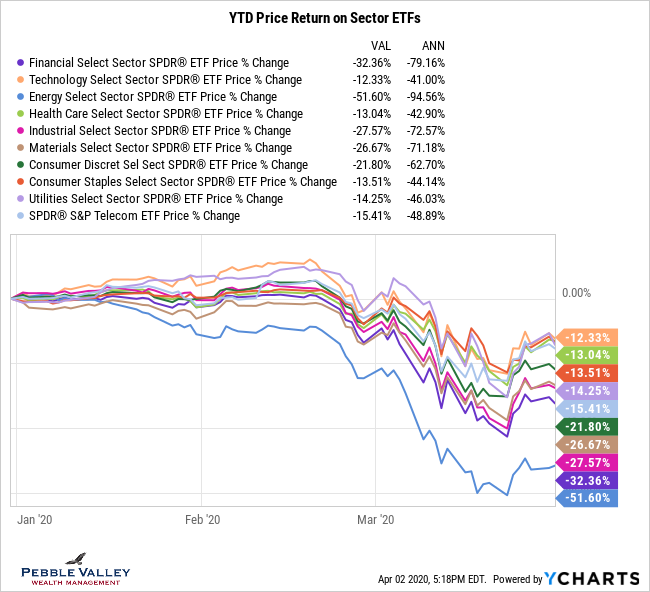

- Within sectors, Energy and Financials were hit the hardest on not only energy demand shock but oversupply due to Russia/Saudis hitting at same time

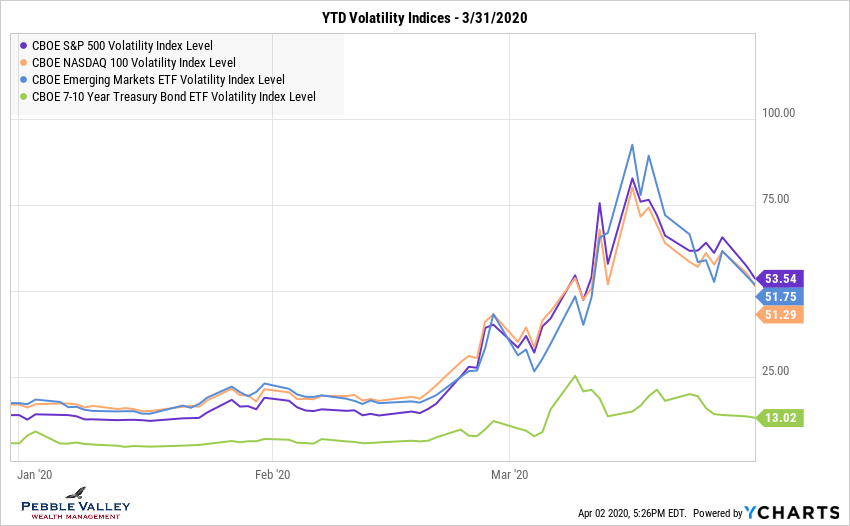

- Volatility indices rose from the sleepy levels of the teens to hold not only above 30 or 50, but even above 60 for a good part of the month

- Credit spreads widened dramatically on heightened credit concerns from energy initially, then the broader market with much of the economy shut down

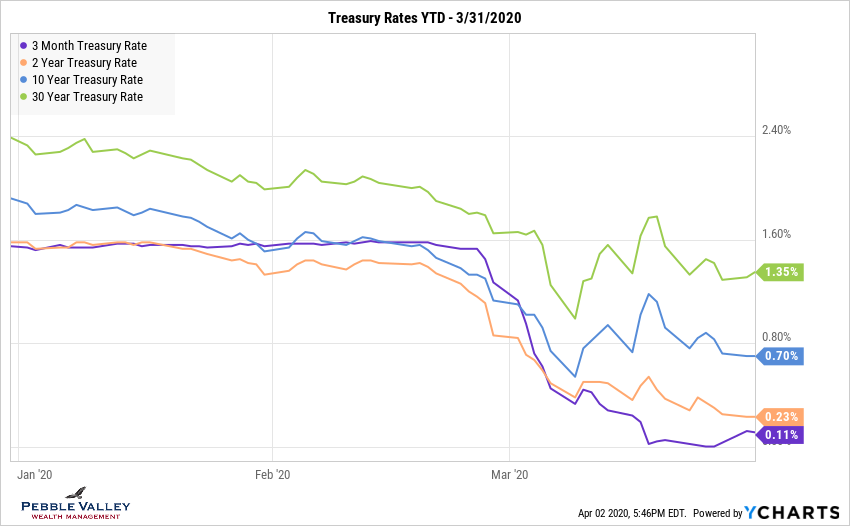

- The Fed has been active, not only with two intra-meeting cuts bringing Fed Funds target rate back to 0.00-0.25% (low savings rates again...), but also many Fed programs to add stability and liquidity

- Be sure to look at harvesting losses and be aware of tax filing deadlines, RMDs waived for 2020 and tax planning opportunities that presents.

Be safe.

LAST

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com