New Rates on Federal Student Loans - and Temporarily 0%

When the college bill hits your inbox, there are many sources that may be tapped. Ideally the estimated expense (actual results may vary!) was planned for a long time and earmarked savings were built up – ideally in a tax-advantaged 529 account. Other sources may also be tapped including parent’s current income, student's part-time job, other family members and even the tax benefits from education expenses if one qualifies.

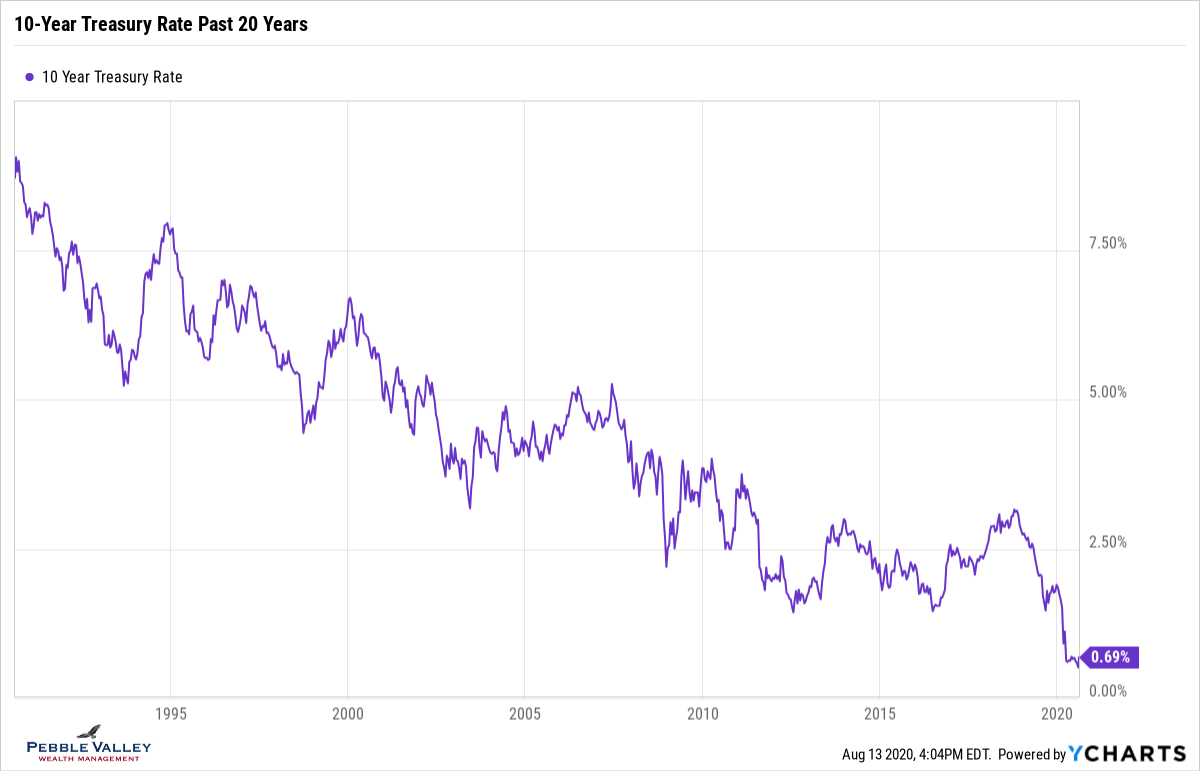

Another source which is the focus of this blog post is Federal Student Loans (not private loans). The most recent rate for undergraduate loans is 2.75% reflecting the lower rate environment. The graph below shows 10-year treasury rates over the past 20 years. Parents can be forgiven if they believe this rate is way too low given what they had to pay. Another added temporary bonus is currently Federal Student Loans are accruing interest at 0% - yes zippo – based on the CARES Act that was passed in March 2020 and was recently extended by executive order. Payments can also be deferred but must contact the loan servicer and be sure it won't impact any repayment programs you may be part of.

There are three types of Direct Federal Direct Loans

- Subsidized (undergrads only)

- Unsubsidized (undergrads, graduates, professional)

- PLUS (for parents of undergrads or graduates and professionals who need more borrowing).

The amount a student can borrow varies by year in school but is not a function of financial need. Whether or not a loan is subsidized is a function of need. You must complete the FAFSA Form to be eligible for any Federal Student Loan. While the interest rate is the same, the subsidized loan does not begin accruing interest charges until six months after graduation. The unsubsidized loan does begin accruing, though payments are not due until the same six months after graduation. There is also a private student loan market which is not addressed here. The rates for private loans are typically higher, require a credit check, typically do not have payment deferment options and are not eligible for income-based repayment plans.

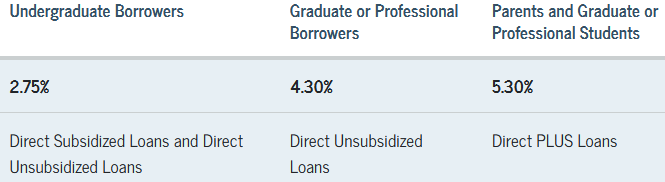

Here are the current rates for loans disbursed on or after July 1, 2020 and before July 1, 2021. Just two years ago, the respective rates were 5.05%, 6.6% and 7.6%. Also note the current one-time loan fee is 1.059% for Direct Subsidized and Unsubsidized Loans and 4.236% for Direct PLUS Loans.

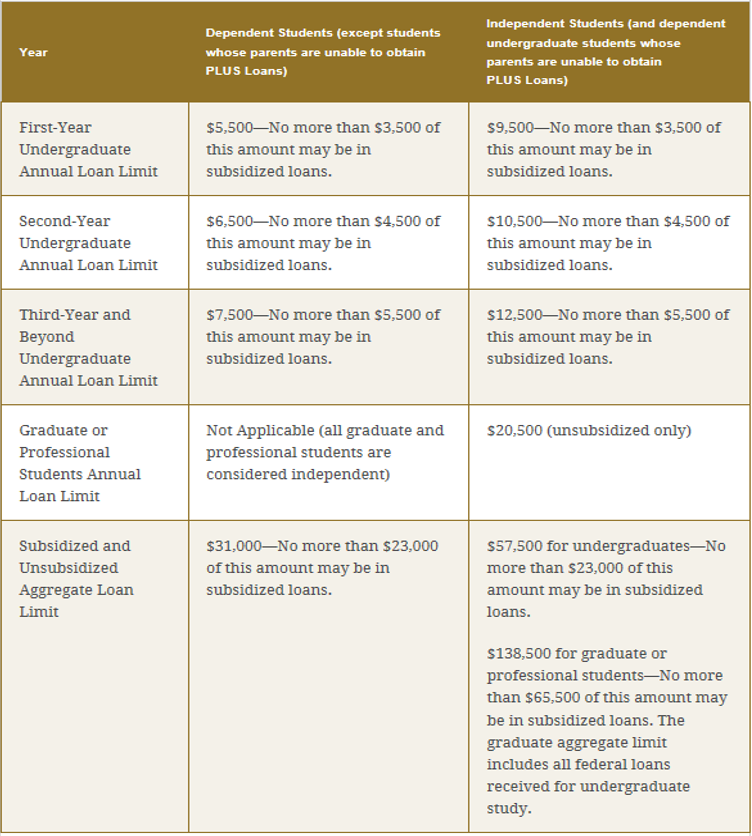

Here is a summary of the maximum amounts that can be borrowed by year. The aggregate limit is shown at the end. The maximum annual award for Direct PLUS loans is the actual cost of attendance minus any other financial aid and therefore not listed in this table.

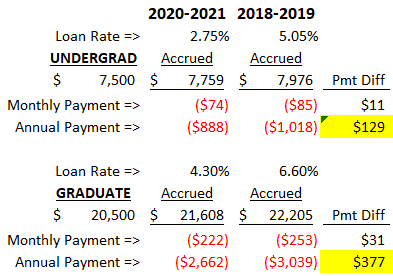

So what does this rate change mean for monthly and annual payments? I compare the difference in payments using current vs. rates from two years ago when at a relative peak. Because the current rate is so low I only show the impact of borrowing one year at the maximum amount (rather than low rate for all 4 years of undergrad; 2-3 years of graduate). I also assume the full amount is borrowed on August 1st (in reality half done Jan), graduation occurs May 1st and loans are repaid over ten years. The current lower rate will decrease the annual payment by $129 for the undergrad and $377 for the graduate student - from just one year of borrowing. NOTE: I ignored the temporary 0% interest rate which is an added benefit.

These low student loan rates fall into the silver lining category of the COVID clouds of 2020. So does ice cream...

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com