Risk – What risks are lingering in your financial life? (Part 2 – Beyond Investments)

Last month my blog post covered investment risks at the security and portfolio level. This post covers risks that an individual faces in their broader financial life beyond investments. Unlike investment risks which often can be summarized in a single metric, that is not always the case with these risks. But like investment risks, there are techniques and products to reduce their impact.

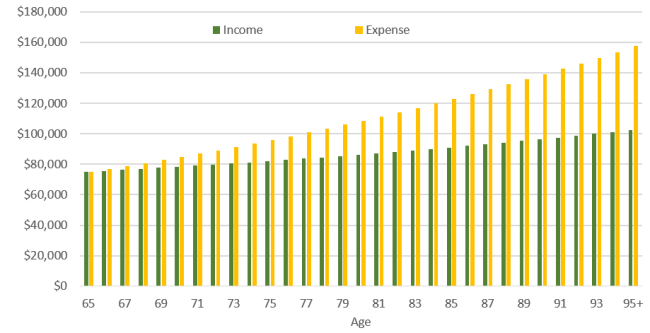

Inflation is the rate at which prices increase on items. Fortunately the rate of inflation in the US is typically low. But even when it continues in the 2-3% range, if one doesn’t plan for inflation in retirement the compounding effect can add up. While Social Security benefits increase with inflation each year, most corporate pensions do not. To illustrate the impact of inflation, consider a simple example where a person receives $25,000/year from Social Security and a $50,000/year corporate pension which covers their first-year expenses of $75,000. If inflation increases living expenses by 2.5% / year (also assume Social Security CPI rises by 2.5%/year) but pension benefits remain flat, the growing shortfall must be met by other savings. After just 10 years the shortfall is over $14,000/year, after 20 years over $31,000 and after 30 years almost $55,000.

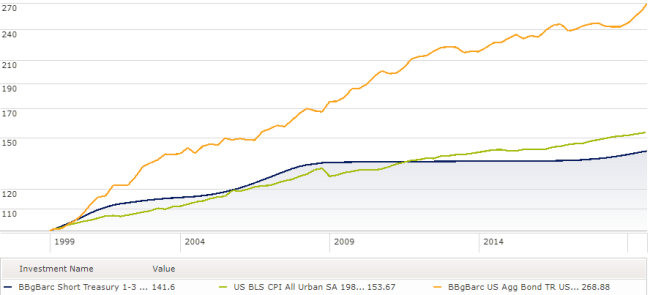

The other side of the coin on inflation is the slow deterioration of purchasing power if investments are too conservative and returns do not keep up with inflation. It may feel safe to invest in cash-like securities to avoid potential portfolio losses, but that portfolio will not keep up with the cost of living and slowly deteriorate the amount of goods that can be purchased. The blue line in the graph belows shows the growth of $100 of 3-month T-Bills; the green line is the growth of inflation. The individual should be aware of the impacts of inflation and plan for the increased costs. Also know whether pensions have an annual inflation adjustment. Monitor the investment portfolio return and whether it is keeping up with the cost of living.

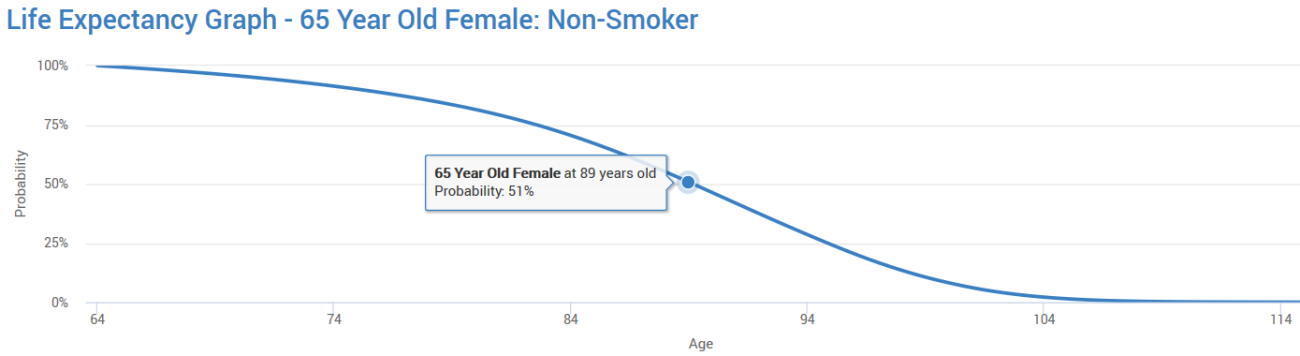

Longevity is living longer than expected. This can be a good thing when accompanied with reasonable health, but it also means your income and savings must last longer. If one assumes they will pass at life expectancy, they have a 50% chance of living beyond that age. It would be prudent to plan on living to a longer age and plan your spending needs accordingly. However, if one planned their spending needs as if they will live to age 100 for example, the standard of living may be short-changed as the probability of occuring is low. The individual can purchase a life annuity sold by insurance companies which promise to pay a monthly benefit (ideally with an inflation rider!) for as long as you live. Another annuity product almost all of us will have is Social Security. It even comes with an inflation rider. NOTE: not all annuities are complex with high costs. Basic life annuities can play an important role.

The opposite of longevity is an unexpected early death when someone else is relying on that future income for financial security. The classic example is if the primary breadwinner passes away early. Not only does future income need to be replaced for living needs, but continued savings for the surviving spouse’s retirement is also needed. One can estimate the present value of the lost income and savings that will need to be replaced. The individual can purchase life insurance which will pay an amount to the survivor. This amount is excluded from income tax (but not estate unless extra steps). There are also survivor benefits from Social Security for a young spouse with children below certain ages (assuming enough covered quarters of work). NOTE: if one does not have others relying on them for future security, financially speaking early death is not a risk.

There are some instances where a primary breadwinner does not die but is unable to work due to a disability. The impact is the same – lost income and future savings – but in this case the life insurance doesn’t pay a benefit since the person is still alive. Plus the disabled person continues to incur expenses and must save for their own retirement security. Those working a desk job may think this risk doesn't apply since able to continue working if physically disabled. However, don’t forget about mental disabilities and illnesses that require treatments with debilitating side effects that prevent working. The individual can purchase disability insurance – ideally with inflation rider! – to cover this risk. Many employers offer this benefit but the employee must select and pay for the benefit. Do it. Unlike life insurance, even if there is no one depending on your income, you are.

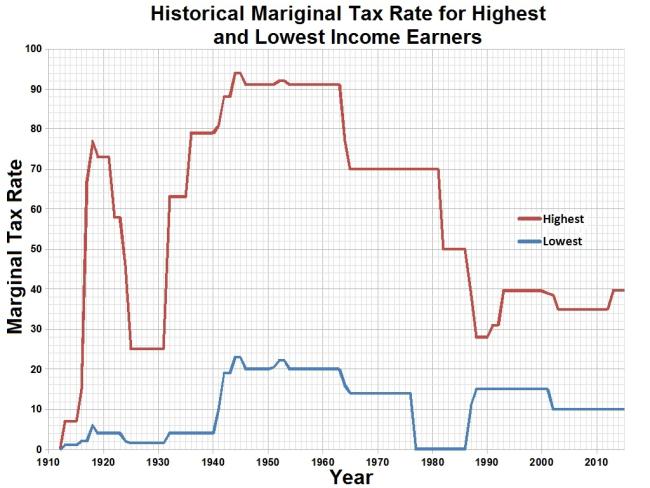

Taxes are a risk to the extent the rate changes. If tax rates go higher, more of your income and savings planned for your benefit goes to the government. If tax rates go lower, you may be happy for future income but there may have been a tax strategy done earlier when tax rates were higher and an extra tax cost was incurred than necessary. Another aspect of this risk is making sure one considers the tax hit when funds are withdrawn from certain accounts. A $500,000 portfolio in a Traditional IRA is worth a lot less than the same $500,000 in a taxable account with a high cost basis. The individual should be aware of marginal tax rates, historic levels and the latest political discussions about potential changes to tax laws and tax treatment of various savings vehicles. You can be certain taxes will occur but not the level. Consider diversifying the accounts where savings are held and take advantage of relatively low rates on some tax strategies like a partial Roth conversion, even if there is a 'risk' that rates could go even lower.

Health care is a risk we all face in terms of the amount and type of care needed. This can apply to hospital and doctor care that is typically covered by Medicare and supplement policies, but also special treatments or drugs required that require a higher level of shared cost through deductibles and co-pays. It could also apply to Long-Term Care needs, whether in-home care, assisted living or in a nursing home. The potential scenario should be considered in your financial plan to see how funded – perhaps additional savings or long-term-care insurance, if the premiums can be afforded. Medicare does NOT cover long-term-care (can cover some for limited days). If a need occurs and funds are depleted, Medicaid can cover but your choices of doctors and facilities may be limited. The individual can participate in some combination of Medicare Parts B, C, D and Medicare Supplement and should pay attention to the annual enrollment options. Long-term-care insurance is also available though the premiums may be high. In that case consider a shorter term for benefits or self-insuring at least a few years of coverage through additional savings or other sources like home equity.

Even the best laid plans need adapting. If a person exhibits a lack of spending flexibility they will find it difficult to adapt their financial plan to unexpected twists that life and markets can throw at them. If there is a sharp market downturn at the time additional funds beyond normal cash withdrawals are needed, it is best to lower one’s spending on discretionary items rather than blindly taking out the same amount from the portfolio regardless of market levels and distressed prices. This can be especially significant if it occurs during the early years of retirement when that principal was expected to kick off many years of future growth. The individual should be aware of this ‘bad retirement timing’ risk and be willing to adjust discretionary spending if necessary.

Insolvency is the risk that one of the financial institutions providing financial benefits goes bankrupt. I touched on this risk in my investment risks for individual holdings – called credit risk. Diversification was one way to manage credit risk. That is one technique that could be used if buying large annuity or life insurance amounts. Unfortunately for a pension you cannot spread that to other companies, though some pensions allow for a lump sum payment. There are many factors to consider on the lump vs. annuity decision (managing the portfolio, do in tax friendly transfer to IRA, other annuity sources). There are also industry and government protections in place up to certain limits. Similar to FDIC insurance for bank deposits, there is protection for insurance products (life, annuity, disability, etc) and private pension plans that mitigate this risk – again up to certain limits. The individual should be aware of these protection amounts (see helpful links on my website) and consider spreading large annuity and life insurance purchases to different providers.

There may be times – or a time going forward - when you are unable to make your own financial or health decisions. Life still goes on and certain things must get done. You should have a trusted person or organization able to step in and act on your behalf in unable. The individual should have the proper legal documents prepared by an attorney to cover these situations, including Powers of Attorney for Financial and Health Care as well as Medical Directives.

Finally, sometimes the biggest risk can be within – complacency. I just covered a lot of risks away from an investment portfolio that one faces in their financial life. You need to put a financial plan together and make sure these risks are identified and mitigated as best they can. Stay on top of changing tax laws and your financial plan versus how reality is playing out and make the necessary adjustments. Be sure your designated agents on Powers of Attorney and executor in your Will is still someone you want and keep beneficiary designations up to date as life changes. If all of this is a bit overwhelming and you need help organizing it all, reach out for help.

Don’t take the risk.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com