Lemonade Anyone?

I focus this mid-month blog post on a market update given the recent volatility. At the end, I briefly mention some things to consider with these lemons.

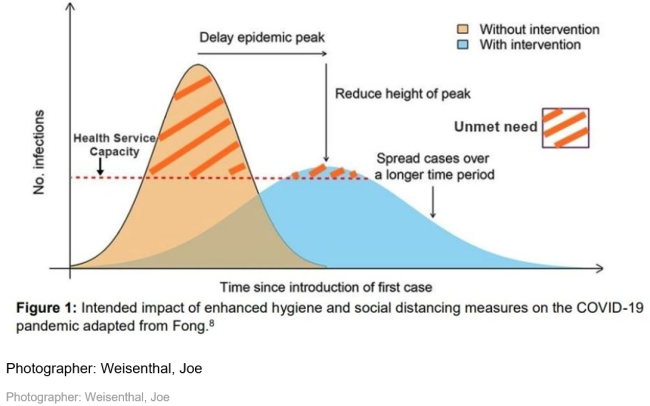

There was a very swift drawdown on markets this past month from coronavirus concerns and an added jolt from the energy sector. Back during the mid-January sell-off much of the focus was on the number of reported cases and death and how it compared to past outbreaks. The mortality rate once contracted was quite low and the quarantined areas were contained in China. Since then the number of countries reporting cases has gone global and travel and other activity restricted. Over the past week many major events have been cancelled and social distancing recommended to slow the number of cases hitting our medical resources at once and buy time for warmer weather and a potential vaccine.

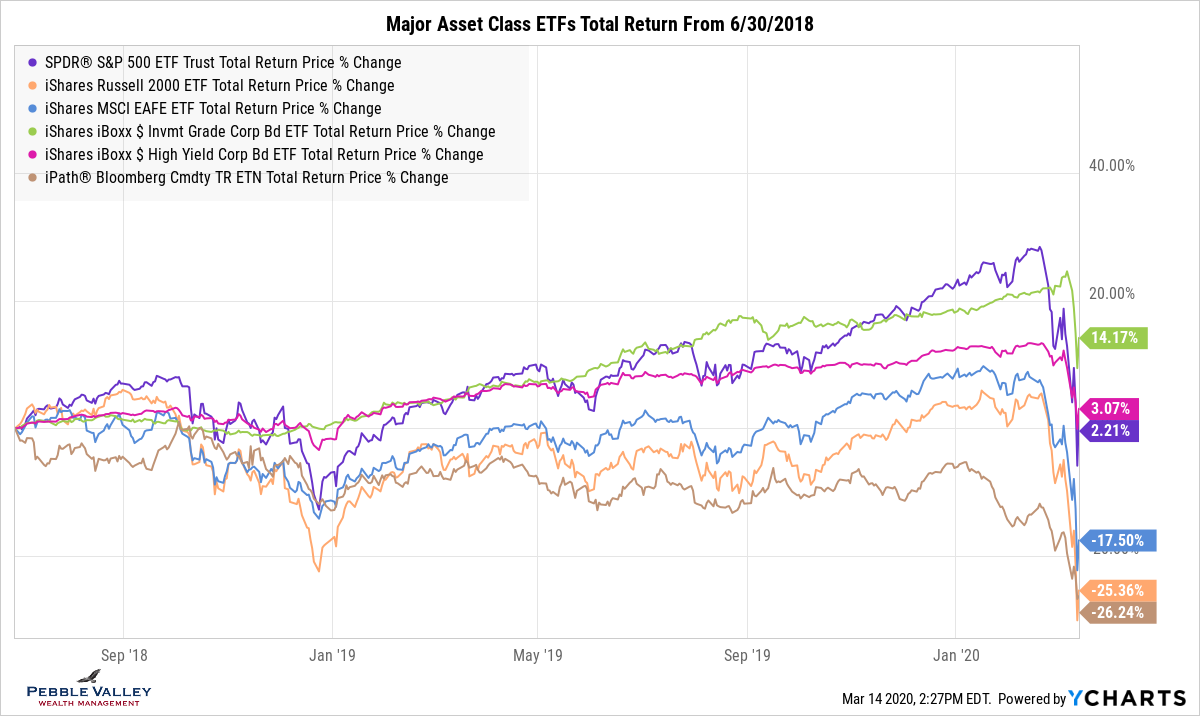

The near-term strategy of separation and containment will definitely have a major slowing on the economy - the question remains for how long. If the disruption is short-lived and some demand simply delayed, the longer-term economic impact will be impacted but perhaps muted. Future earnings will be impacted since some demand is gone and if continues for too long, push some countries (and sectors for sure) into a recession. Lower earnings lead to lower stock prices as the market is a forward-expectations pricing mechanism and uncertainty is priced in. Most equity indices have fallen more than 20% from recent peak which is labeled a bear-market correction. The graph below shows total returns since 6/30/2018 to capture the fall of 2018 sell-off. On a positive note, equities rallied into the close on Friday as government measures were announced. Lost in all this volatility was a very solid jobs report for February. While it doesn’t help sentiment, it reinforced the fact that the economy was strong going into this global crisis which was extremely fortunate.

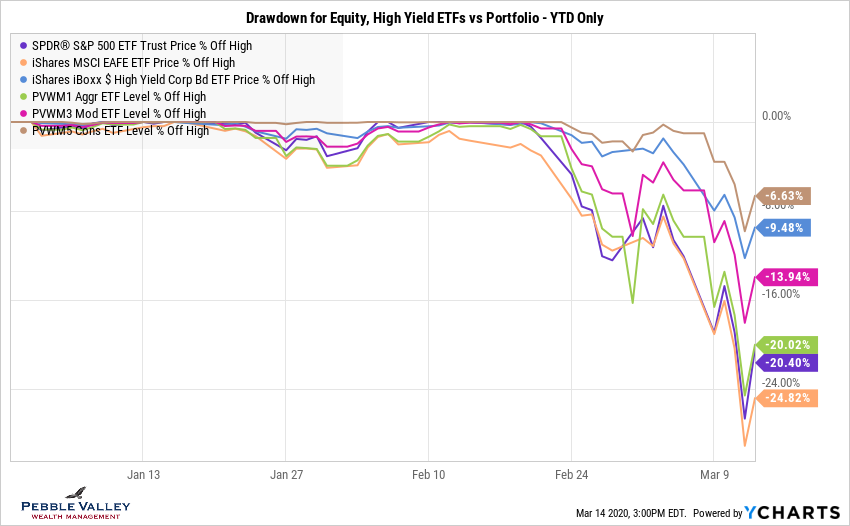

Another important concept is that investing doesn’t mean a portfolio is 100% equities but rather diversified across different asset classes. The % in each asset class will vary by a person’s risk tolerance. The market heard on the news is almost always related to a 100% equity portfolio. A diversified portfolio will fall less for more conservative allocations. This is captured in the graph below showing “drawdown” – the % a portfolio falls from previous high - for a few ETF's and blended portfolios of different degrees of aggressiveness. For a list of other risk measures to consider in your investments see my past blog post.

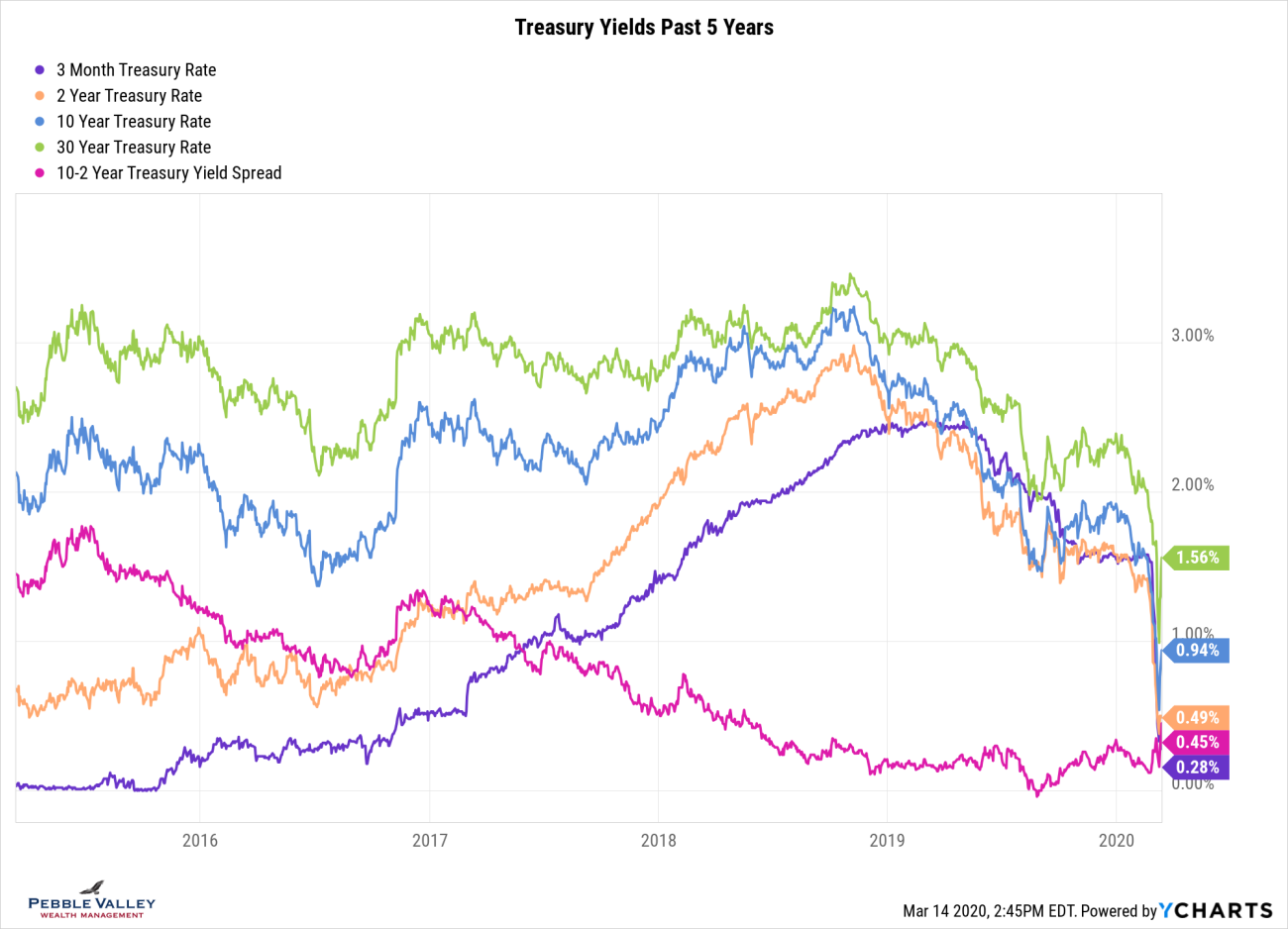

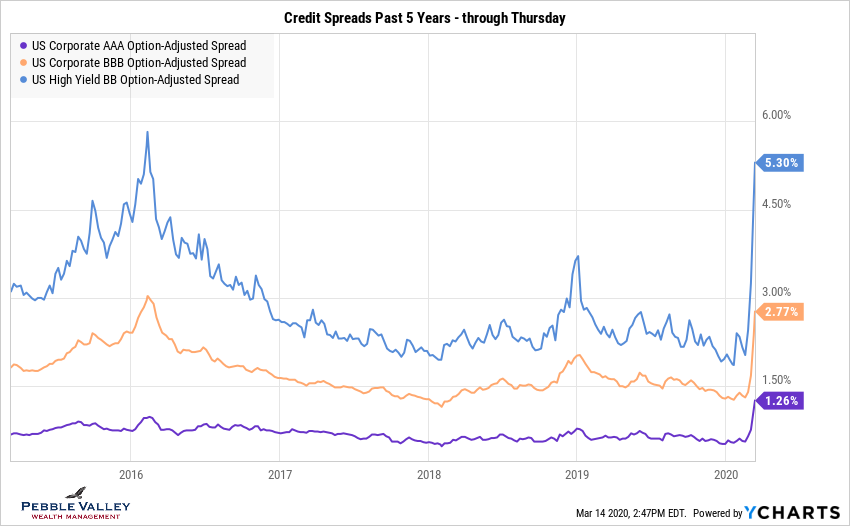

Not all markets are down in this environment. Treasury bonds and some alternative funds historically hold up quite well in this environment. This time is no different. And recall as bond prices go up the yield goes down. The entire US treasury curve (all maturities from 1 month to 30 year) were below 1% early this week. Non-treasury bonds from companies that can default are dropping in price as the extra yield needed for risk – called a credit spread - is rising as investors demand more for the potential of a default. This is most pronounced in the energy sector. The graph below shows the range of investment grade bonds AAA-BBB and the highest rating in high yield - BB.

The Federal Reserve initially cut rates 0.50% intra-meeting on March 3rd which was rare and the market said “thanks and I’ll have another” by pricing in another cut at the Fed meeting March 18th. This is called a monetary policy response. The fiscal responses (government spending money) already announced – and more drafted by Congress as I type – will provide some stability and relief to those most impacted.

How can you make some lemonade out of these lemons? Here are some things to consider if consistent with your overall financial plan and capacity. Be very careful with the details and seek help if unsure or don’t have the time, tools, focus or grasp of your overall financial picture.

- Use this recent experience to crystalize your true risk tolerance and asset allocation. If realized too much risk, after things stabilize work toward rebalancing.

- Depending on own mortgage rate and time left in house, consider refinancing. Be aware the system was overwhelmed with demand and current rates are not tracking the full drop in treasury yields.

- Investments in taxable accounts very likely have unrealized losses. Consider tax-loss harvesting but be very careful to retain similar but different enough exposure to avoid IRS wash-sale rules. Also be aware you can’t sell in one account and buy in another – even in spouse account or IRAs – to avoid the rule. Finally, there is no value in harvesting losses in IRAs or 401ks.

- You may have investments in taxable accounts that are better held in an IRA but perhaps large unrealized gains prevented you from switching. Revisit those gains and even if still positive, very likely much smaller now. And note the wash-sale rule doesn’t apply if taking a gain (or foregoing a small loss) so you can buy that same holding back in IRA if wish since no loss was claimed.

- If considering a Roth conversion for 2020, now may be a good time to proceed. Be aware previous tax-deductible amounts converted are included as ordinary income and may impact tax credits, excess Medicare premiums and others. Also note if required to take a distribution from IRAs (RMDs), you MUST complete that first before doing any Roth conversions.

- Only for professionals who fully understand option risk – implied volatility is extremely high right now and may present some opportunities within the context of portfolio management – not stand-alone flyers. Do NOT do this alone but worth noting and asking about.

Ahh… that was refreshing.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com