Last Minute Tax-Planning and Documents for Accountant

It is tax season. Many have already gathered the necessary documents - W2’s, 1099’s, etc. – to their accountant while others are putting it off - for now. This blog post will help both groups have a better understanding what the various tax documents include and the type of taxable income it represents – which drives the tax rates applied. There are also a few last-minute planning topics that can still be executed for the 2023 tax year that I will start with.

Please note this is not formal tax advice. I am not an accountant, nor do I prepare tax returns. But as a financial planner, I understand these topics very well and perform detailed tax planning for our clients to give them more control and minimize tax surprises. Reach out if that sounds appealing.

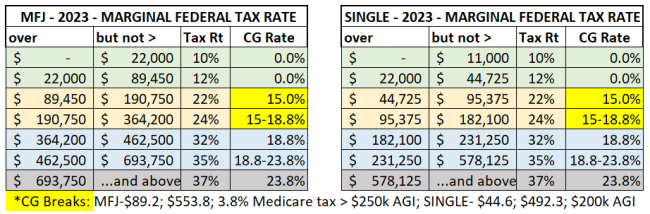

In general, income can be taxed as ‘ordinary’ or ‘capital gains’. Capital gains from something held one year or less is taxed as ‘ordinary’ (plus an extra Medicare tax); gains if held greater than one year has more favorable rates (but still the Medicare tax!). Below is the Federal Tax brackets for 2023 tax year. You can reference my past blog post (and podcast!) where I provide a broad overview of the different types of taxes.

Last-minute tax planning moves for 2023 Tax Year

IRA Contributions

- Allowed to make 2023 tax year contributions up to tax filing deadline

- Everyone with taxable income is allowed to contribute to an IRA

- Spouses can rely on other spouse’s income if none of own to make a contribution

- Even if participate in employer’s 401k/403b, can still contribute to IRA provided enough taxable income on W2

- The amount deductible and whether eligible for direct Roth can be limited based on Modified Adjusted Gross Income and other factors

- Depending on circumstances, a backdoor Roth may be attractive

- Maximum contribution for 2023 tax year is lesser of eligible taxable compensation or $6,500; extra $1,000 catch-up if 50 or older

- Many miss out on IRA contribution opportunities; call for help to get what is yours

Health Savings Account (HSA) Contributions

- Allowed to make 2023 tax year contributions up to tax filing deadline

- Anyone with a qualified High Deductible Health Plan (HDHP) is allowed to make tax-deductible contributions to an HSA, regardless of income

- Check with insurance provider if your medical insurance is HDHP

- Maximum contribution for 2023 tax year is $3,850 for single, $7,750 for family; $1,000 catch-up if 55 or older (not 50 like IRAs) and have own HSA account

- Unlike 401ks and 403bs maximums which only include employee contributions, HSA maximums must include any employer contributions

- If participate through work and payroll deduction but fell short of maximums, can contribute directly into HSA account – contact the custodian

Employer-related Retirement Plan Contributions

- While the employee-related contribution deadline has passed (SECURE gave exception for sole proprietor and single-member LLCs), employers can still make a tax-deductible contribution

- If you own a business, depending on type of retirement plan you have (if any), may be eligible to make deductible contribution

Common tax documents needed for accountant and information provided

W2

- Wages and compensation received from employer along with tax withholdings already paid for the tax year

- Any tax-deductible 401k/403b, Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) contributions are typically netted out of “box 1” wages; they may be broken out in other boxes

- If you have company stock options or grants be careful; look for additional documents

1099-MISC

- Income received in excess of $600 from non-employer sources

1099 Consolidated

- Related to non-qualified investment accounts; will not receive one for IRAs, HSAs, 401ks or 529s

- Taxable income related to securities held and or traded in particular account

- Dividend income – both qualified (taxed like long-term gains) and ordinary

- Interest income – both taxable and tax-exempt (like Muni’s)

- Capital gains – both short-term (< 1 year taxed liked ordinary) and long-term

1099-R

- Gross distribution and any tax withholdings from all types of IRAs (including inherited) and 401k accounts

- Will receive separate form from each account where withdrawal occurred

- Contains an IRS distribution code which determines how treated on tax return

- If you are over Required Minimum Distribution (RMD) age and have a Traditional or 401k account you should have one!

- Few key things to note:

- “Direct transfer” between qualified accounts generates 1099-R but not taxable

- Withdrawal from Traditional IRA for Roth conversion may say ‘taxable’ but in some circumstances, some or all may not be taxable using Form 8606

- Any Qualified Charitable Distribution (QCD) do not show on 1099-R; you must keep track and tell your accountant (custodian can’t verify each charity nor monitor $100k max across all IRAs - $105k max for ’24)

5498

- Contributions, transfers and conversions coming into IRA accounts

- Because contributions allowed up to tax filing, form not available until May

- Use year-end and latest monthly account statements to show contributions by tax year

- Note some contributions in a given calendar year may apply to previous tax year

- Everyone with taxable income (and spouses) are allowed to contribute to an IRA (even if participate in 401k/3b) but the amount that is deductible and whether eligible for direct Roth is based upon Modified Adjusted Gross Income

- Many miss out on IRA contribution opportunities; call for help to get what is yours

1099-SA

- Gross distribution from Health Savings Account (HSA)

- Provided distribution to cover a qualified medical expense, not taxable

- You must keep track of cumulative qualified medical expenses and withdrawals

- Unlike IRAs, you will NOT receive this form for HSA-to-HSA transfer

5498-SA

- Similar to 5498 for IRAs but this applies to contributions (not transfers) into Health Savings Accounts (HSAs)

- Rely on statements until May and be sure to watch which tax-year contributions apply

K1

- Similar to 1099-Consolidated but for privately held entities like Partnerships, S corporatations, Trusts, etc

- Shows income, dividends and losses for your share of an entity; how income from S Corporate gets transferred to personal tax return

- Tax treatment will vary; verify with Accountant on details

- Does cause extra accounting work and typically arrive late; be sure to invest enough size to warrant extra hassle

- If hold these types of investments in IRA, be aware of potential Unrelated Business Taxable Income (UBTI)

Donor Advised Fund (DAF) Contributions

- Typically available on annual DAF account summary statement

- Full value deductible in year of contribution; no deduction when later distribute to different charities

- Cash contribution or if donated securities, the resulting market value of sale in the DAF

- There is no tax-related form for withdrawals since full deduction when contribute

1099-Q

- Gross distribution from qualified education savings account like a 529

- You must keep track of qualified educational expenses – either from school or other

- The school should issue 1098-T showing tuition expense; you must handle other qualified expenses like room/board if living off-campus or computer equipment, etc.

529 Plan Contributions

- No Form prescribed by IRS since not deductible at Fed level; rely on statements to show contributions into the plan

- Unlike IRAs, these must be done by 12/31 of a given tax year

- There is no Federal Tax deduction but some states allow state deduction, up to limits

- Another example where many people miss out on these tax benefits; call if need help

Digital Assets’ related income – including gains from sales

- All taxpayers required a Yes/No at top of Form 1040 if involved with digital assets

- Read the instructions carefully… but in general…

- If buying and selling related to a security done in regular brokerage account the gain/loss would be captured on 1099

- However, if held digital assets directly and bought and sold, check with that custodian

As I was reviewing my past blog post on overview of taxes, I found a tax that doesn’t have ab IRS Form to capture contributions or withdrawals – though mostly withdrawals! It is the Candy / Ice Cream tax, which applies to children of parents with a sweet tooth! And on that note, Happy Easter!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. Interested in working with our team? Schedule a call by clicking here.