Taxes – Base Understanding For Planning

This blog post provides an overview of different types of income and what tax rates apply on your income tax return – at both the Federal and State level. This is not formal tax advice but will increase your understanding of the 2021 return and motivate planning for 2022 – which occurs now, not in April 2023. I am not an accountant, nor do I prepare tax returns, but as a financial planner I understand these topics and go deep on tax planning for clients. Apologies in advance to accountants if I don’t explain more nuances but I want to keep it high level for general understanding – and I encourage all to reach out to their accountant for more details and expertise.

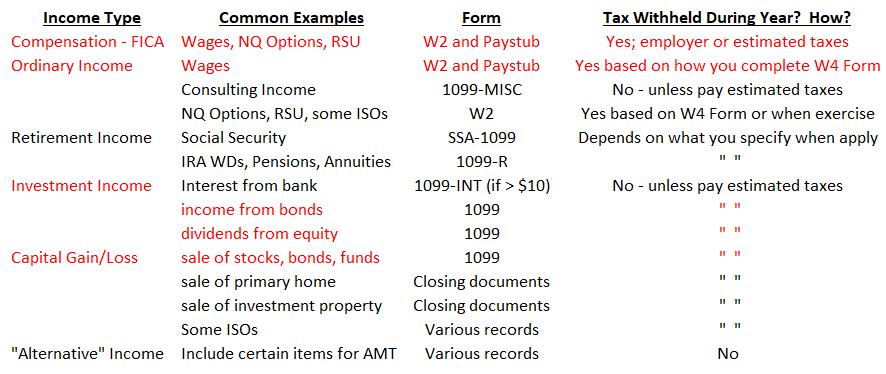

The first thing to understand are the different types of income and gains subject to taxes (see table below). You will see later that different tax rates can apply and some income amounts you have control over when realized. For those just starting in the workforce and taking over tax preparation from your parents, focus on the items in red. I also show the forms that summarizes these amounts; you likely receive in the “important tax document” mail. Forms are typically received in January or February by the entity holding or disbursing that income type. The final column shows whether any taxes were likely already withheld and paid during the year. The key point – you control how much, if any, is withheld (except FICA from employer). Be aware during the year and adjust accordingly – either by updating the W4 with employer or making estimated tax payments (for example, if large capital gains).

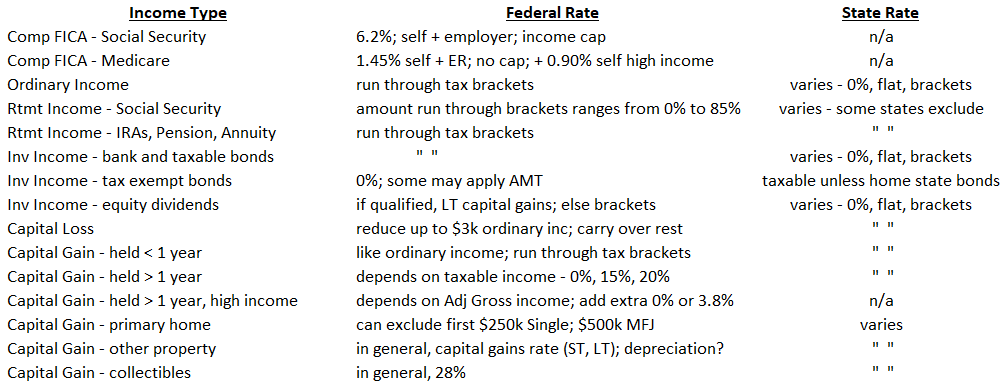

The next piece of the tax puzzle is to determine what tax rates apply to these different income types, both at the Federal and State level. Tax calculations are handled by software but the tax brackets and rates that apply to different income types is very important to understand. This is where your actions during the year (and some IRA/HSA moves the following spring) can make a huge difference in your final tax bill. It is also important to understand the difference from overall effective tax rate versus the tax rate that applies to the next $1 of marginal income. The latter drives tax planning; the former just summarizes the result. This is in the weeds but be aware the IRS has different definitions of “modified adjusted gross income” for determining income triggers for IRA deductions, Medicare IRMAA and taxable Social Security (called “provisional”) among others.

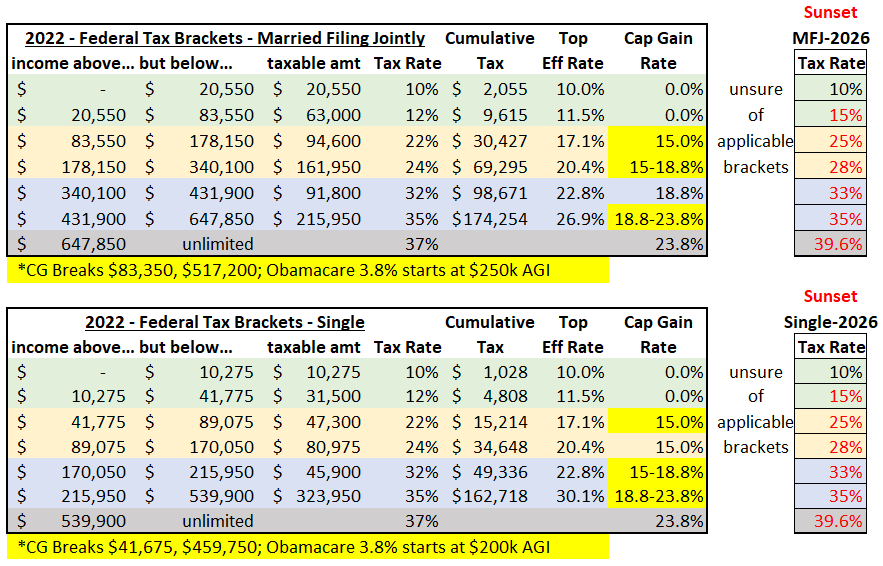

The tax brackets referenced above have an increasing marginal rate based on taxable income (after deductions). Tax brackets vary by filing type – Single, Married Filing Jointly, Head of Household and Trust. I only show the first two below but be aware a Trust (if it files own return, not all do) has very tight income brackets and hits the top rate just over $13,000 of income! Also be aware Congress proposed raising tax rates in 2021 but the bill didn’t pass (top capital gain rate of 28%; tightened thresholds where 35% applies; top rate to 39.6%). They will likely be at it again in 2022 so monitor and plan accordingly. If Congress does nothing, tax rates will revert back to 2016 levels starting in 2026 – commonly referred to as the sunset provision. NOTE: these are 2022 tax year thresholds to use for planning; your 2021 returns will use last year’s income brackets but same tax rates.

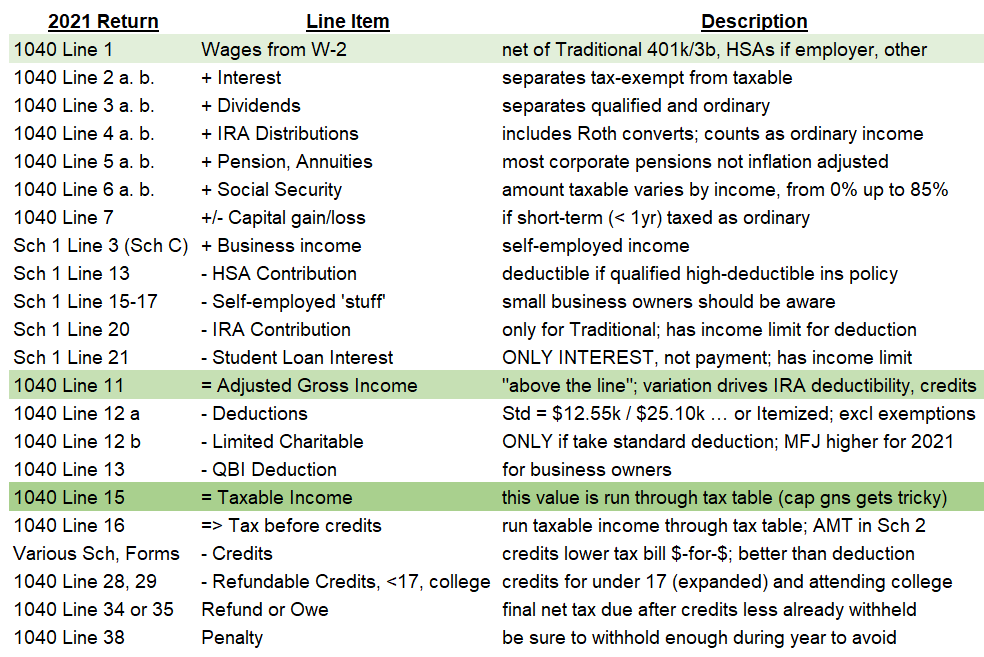

So how does all this come together? After making your decisions (some implicitly) during the year on withholding forms and income recognition (selling securities, partial Roth conversions, etc.), you gather the data for your accounting service of choice. There may be a final HSA or IRA contribution for the previous tax year if allowed. All the data above is run through the tax machinery and summarized on two pages of Form 1040 (with many supporting pages). You find out if more tax is owed (beyond what already withheld) or get some of own money back. Adjust your W4 and/or estimated payments if that number is too high in either direction, especially if a penalty! The table summarizes the key lines of 1040 and Schedule 1 so you can see where the above items drop in. There are strategies to manage most of these lines - topics for future blog posts or give us a call to discuss how we help our clients.

There are a few other taxes you may be exposed to not directly related to income taxes. I will not go into details here, but briefly:

- Estate – if net assets at death above high Federal exemption, taxed; states vary, can be lower

- Property – if own a home/land, local tax (not Federal) applies based on assessed value

- Sales – State and local authorities’ tax (no Federal) applies based on purchase price

- Candy / ice cream tax – applies to children of parents with sweet tooth, especially Halloween!

Whew, that was a lot! Don’t worry - each year will get more comfortable. With this base understanding, planning techniques can be employed to pick up extra risk-free return.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com