Reminder of Key OBBBA Tax Provisions

It may be a bit early for some to gather tax documents for the 2025 tax return preparation. While W2 forms from employers and 1099-R for IRA withdrawals may be available, the 1099-Consolidated statements typically don’t arrive until mid- to late-February. But one should always have their tax planning strategy ready to implement throughout the year, including the latest tax law changes.

This blog post will focus on the changes from the One Big Beautiful Bill Act (OBBBA) signed into law on July 4, 2025. I will first provide a summary table, then expand upon the provisions starting with those that were effective for 2025, followed by new changes for 2026. Your Tax Form 1040 is a two-page summary of all the tax return details. One should be familiar with this summary and the different definitions and tax treatment of income. See my recent blog post which provides a nice overview and references an actual Form 1040.

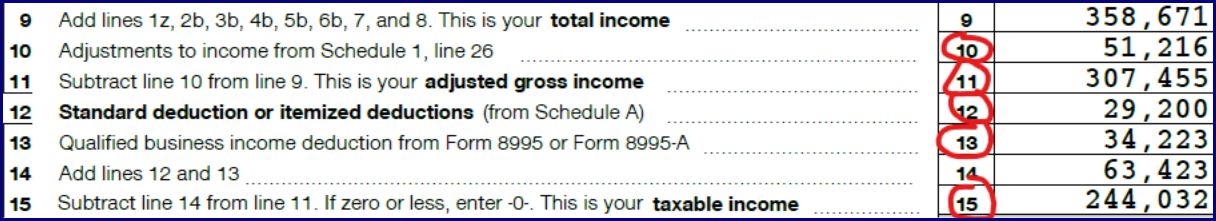

One important distinction is the difference between “Adjusted Gross Income (AGI)” and “Taxable Income”. There are also over six different “Modified” versions of AGI – called MAGI – so be careful. For this blog post topic, you can use AGI as a very close approximation of MAGI mentioned. Below is an image from the relevant lines from a 2024 Form 1040. Notice that AGI is after the Schedule 1 deductions but before the standard or itemized deductions, including the new “Social Security Deduction” discussed below.

All right… let’s go!

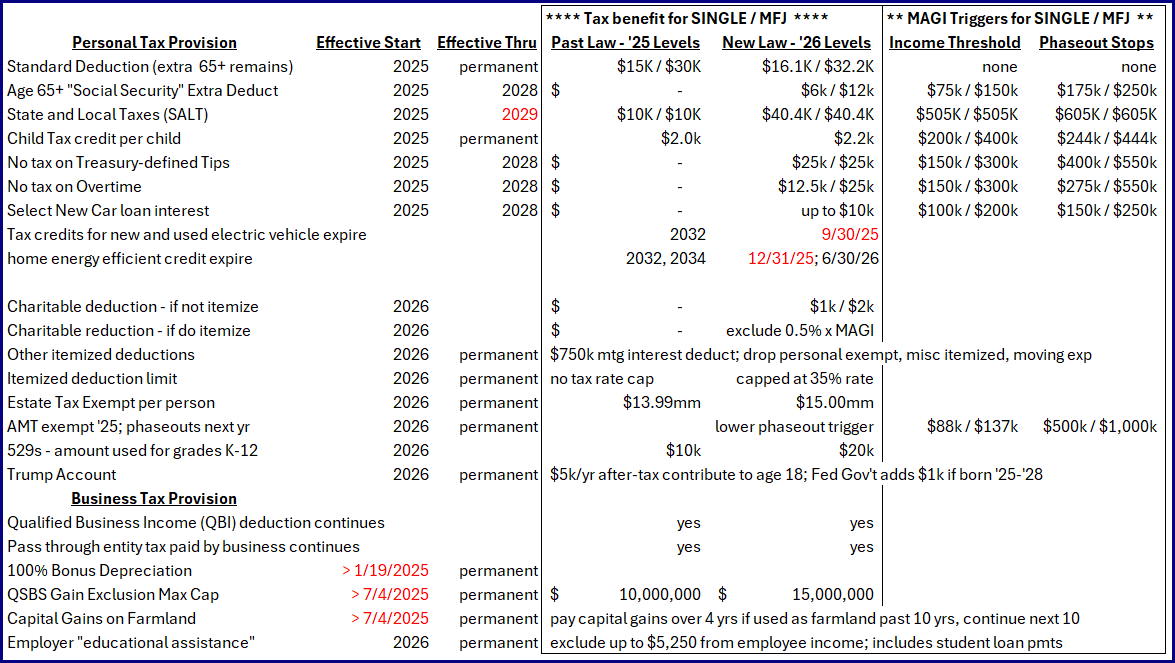

Summary Table of Key OBBBA Provisions and related effective dates

Before jumping into the details, here is a summary along with effective and expiration dates and income level triggers. Throughout this blog I summary Single vs. Married Filing Jointly by two numbers with a “/”. For example, income levels where start to lose the $6,000 SS deduction is expressed as $75k / $150k. I will also only focus on Federal taxes.

Key provisions that started in 2025 and still effective

These provisions impacted your 2025 taxes. They may open more room to recognize income in a given tax bracket, so if you missed out last year, be aware for 2026 and take action!

Standard Deduction

- Not limited by income

- Extra $750 for Single filer; $1,500 for MFJ in 2025, adjusted for inflation

“Social Security Deduction” if age 65+

- Extra $6,000 per person if 65+, but begin to phaseout if MAGI above $75k / $150k

- Deduction reduced by 6% of each dollar above MAGI; gone if above $175k / $250k

- Driven by MAGI; standard or itemized deductions do NOT lower MAGI (but QCDs do!)

- Note up to 85% of Social Security benefits may be added to AGI depending on income

- Pushed some taxpayers to $0 taxable income; could realize more income at 0% tax rate but watch out for SS tax torpedo

State and Local Tax (SALT) – i.e. state income and local (property) taxes

- One of itemized deduction components; if total itemized below Standard then this is n/a

- This is one provision where tax benefit dollar amount is the same for Single and MFJ

- Was $10k and now up to $40.4k; phaseout if MAGI above $505k for both

- Deduction reduced by 30% of each dollar above MAGI; gone if $605k

- For some may open up more Roth conversion capacity or get them out of higher bracket

Child Tax Credit

- Another provision where tax benefit dollar amount is same for Single and MFJ

- Phaseout if MAGI above $200k / $400k; reduced 5% each $; gone $244k / $444k

New miscellaneous deductions

- Tips, overtime, new car loan interest

- Deduct $25k in tips; $12.5k / $25k in overtime; $10k interest on select new cars

- See MAGI phaseout levels in table above

Various Business Provisions

- Qualified Business Income (QBI) deduction and Pass-Thru entity tax paid continues

- 100% Bonus depreciation – was even back-dated to 1/19/2025

- Increase in Qualified Small Business Stock exclusion from capital gains (with conditions)

- Spread out payment of capital gains tax over four years for qualified farmland sales (if used for farming last 10 years, expect to continue next 10; document intent upon sale)

Key provisions that become effective for 2026

Here are the new ones to begin incorporating, along with those from 2025 still around!

Charitable Deduction Changes

- If use standard deduction:

- able to deduct charitable donations from taxable income

- Up to $1k / $2k for Single and MFJ; must be cash donations and no income limit

- If itemize deductions:

- Must exclude 0.5% of MAGI from the amount donated to charity

Itemized Deduction Limit

- In past itemized deductions would offset income at any bracket, including the top 37%

- Maximum tax rate can offset is now 35%; a 2% higher rate on itemized amount if in 37%

Alternative Minimum Tax (AMT)

- Reduced phaseout triggers back to 2018 levels but kept initial exemption amounts

- Drops back to $500k / $1,000k, about $125k / $250k lower than 2025

Federal Estate Tax Exemption

- Per person exemption will increase from $13.99mm to $15.0mm

- This annual increase is about 3x the amount if assumed a 2.5% inflation adjustment

- NOTE: be aware some states have separate State Estate Tax

529 Provisions

- Amount can use for K-12 tuition expanded from $10k to $20k

- NOTE: be aware each state 529 plan must pass provisions to get state tax benefit

Trump Account – accounts begin opening in 2026; applies if child born ’25 – ‘28

- Once opened, Fed Gov’t will add one-time $1,000 for child born 1/1/2025 – 12/31/2028

- Up to $5,000/yr of after-tax contributions allowed up to child age 18; withdrawal limited

- Must invest in US equity index product with max fee of 0.10%/yr

- In general, taxed like Traditional IRA – grow tax deferred but withdrawals taxed

- $1,000 seed money very nice; explore other savings alternative before adding own

- Interesting comment from Marc Faber on what happens once run into tough times

Business Provision

- Educational assistance, including student loan payments, favorable for ER and EE

- Can exclude up to $5,250 from employee income for qualified education cost, including student loan payments paid by employer as benefit.

I hope this refresher on the key OBBBA provisions will remind you of the changes you enjoyed in 2025 and some new ones to add to the list to further enhance potential tax savings. Be sure to claim what is yours. Reach out for help.

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com