It’s Happening… Annual Benefits Enrollment for 2026

If you haven’t yet, you soon will receive notice about the upcoming annual benefits enrollment from your employer. This enrollment period allows employees to update benefit choices and review new benefits. For relatively new hires, this may be a welcome opportunity to revisit decisions made during the first month on the job when you were drinking from a fire hydrant. Some of you may view this as an annoying annual ritual to passively click on last year’s choices. I recommend taking the time to review all the options and adjust for your latest circumstances, including tax brackets at both federal and state. For each $1,000 tax deductible choice, the extra money in your pocket would be:

- $270 if in 22% Fed bracket and flat 5% state tax

- $420 if in 37% Fed bracket and flat 5% state tax

- $470 if in 37% Fed bracket and marginal 10% state tax

Now that I have your attention let’s proceed. Dollar limits for 2026 have not been released yet from the IRS for all programs (as of 10/20/25) so amounts below reflect 2025 values unless explicitly noted as 2026. 2026 amounts are expected to go up slightly with inflation adjustments.

Health Insurance

This is by far the benefit that gets the most attention. Be prepared for an increase in premiums of possible in the 9.5% area according to a recent WSJ article. The first priority may be verifying the network of doctors in a plan or whether specialty drugs are covered or if more common drugs like GLP-1 are being restricted. Coverage can change each year so be sure to verify. Another priority should be looking at the different deductible choices given your medical care utilization and the trade-off of a higher deductible (amount you pay before any insurance kicks in) with lower monthly premiums. Also verify if routine physicals and other preventive services are covered before hitting the deductible and amount of coinsurance (% of total cost you pay) after the deductible is met. This can make the high-deductible plans more tolerable – trading known lower monthly premiums in exchange for unknown potential medical bills before hitting the higher deductible. This may also make Health Savings Accounts available with extra tax benefits (see next section).

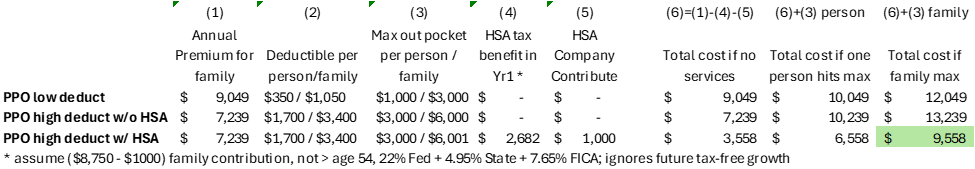

The following framework will help determine what type of coverage is best. This same concept can be used for other insurance like dental and vision (likely utilization better known but no HSA benefits).

- Calculate the annual premium for plans offered

- Verify % you pay for different services after deductible met (coinsurance)

- Look at deductibles and max out of pocket per person and per family

- IMPORTANT: add the tax benefits of HSA and any employer contributions

- Compare totals for a) no services; b) one person hits max; c) family hits max

After considering the tax benefits of an HSA and potential employer contribution, the high-deductible plan may come out ahead even if you hit family max – OFTENTIMES PROVIDED YOU USE IN-NETWORK SERVICES AND HAVE FUNDS TO PAY OUT OF POCKET. You may think you have the funds given the HSA and employer contribution, but note those amounts go in over the year via payroll and you may have a large medical expense early in the year.

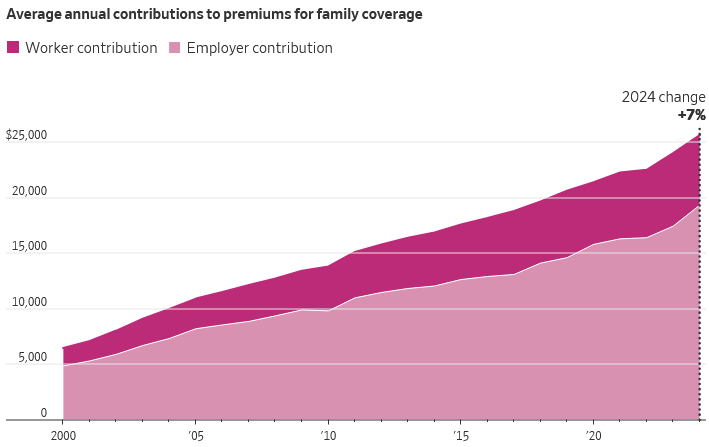

The graph below (Source: WSJ) shows the average cost for family coverage for traditional plans. The graph ends with 2024 data but the trend is instructive. If an employee leaves a company before eligibility for Medicare at age 65, they are often surprised at the high cost of medical insurance. This is because the employer has been paying a large portion of the total cost.

Health Savings Accounts (HSA)

Related to the health insurance choice is whether a particular health plan with a high enough deductible makes it eligible to use a Health Savings Account (HSA). Some employers even contribute a portion into this fund lowering the cost even further. Another benefit you may find is your healthcare utilization goes down since the initial dollars are covered by you, changing the mindset of “just go, it is covered by insurance.” To qualify, your underlying health insurance plan must be a High Deductible Health Plan (HDHP). For 2026 the minimum deductible for an HDHP is $1,700 for individual and $3,400 for family. The max out-of-pocket amounts are $8,500 individual and $17,000 family. Be sure this potential out-of-pocket amount fits your or family needs. If so, choosing this plan with an HSA allows a fully deductible contribution (you + any employer contributions combined) of $4,400 for individual and $8,750 for family for 2026. If you contribute via payroll, you also avoid the 7.65% FICA tax. There is also a $1,000 (same as last year) catch-up contribution if age 55 or over (not 50 like an IRA). An important distinction is that funds contributed to an HSA do NOT need to be spent each year. In fact, ideally health expenses can be covered from other funds and let this account grow tax-free provided it is later used for medical expenses. If you have an HSA and later switch to a non-HSA plan, you can continue to hold and use if wish the HSA funds, you just can’t contribute new dollars.

Health Flexible Spending Accounts (FSA)

A very similar sounding but very different account type is an FSA. These accounts allow tax deductible contributions of $3,400 per FSA for 2026. If a working spouse also has an FSA an additional $3,400 can be contributed to their plan but you can’t submit the same expense to each plan. As you incur out of pocket medical expenses you request reimbursement from the FSA. You do not need to have an HDHP plan to utilize these accounts. However, a key distinction is if not enough medical expenses were incurred to drain the account from reimbursements for a given calendar year, you forego most of the remaining balance. For 2026, you are allowed to carryover $680 of unused funds into the following so be sure not to overfund your expected out of pocket health costs.

Dependent Care Flexible Spending Accounts (DCFSA)

Similar to a Health FSA, this account type is available for dependent care expenses and should be one all families with children sign up for. Common eligible expenses include daycare services, preschool or pre-k programs, before and after care programs, summer camps and nanny care. This is not related to a certain health plan, but you do have to have qualified dependent care expenses to use it. Tax deductible contributions of $7,500 (single or MFJ filers) are allowed for 2026. A family in the 22% bracket with flat 5% state tax would see a tax benefit of $7,500 x (.22 + .05) = $2,025 tax savings. Yes, you read that correctly!

Disability Insurance

Have you ever seen those AFLAC commercials? That is referring to short-term disability. But what if you had an injury or illness that prevented you from working for more than a few months? Long-term disability insurance provide income if this happens. Not all employers will offer this benefit and some may offer but the employee must pay the premiums – either in full or to supplement that base provided. I recommend you select this coverage. This insurance covers a % of your salary – typically 60% or 67% - up to a cap of say $10,000/month or more. There is a deductible expressed in months (usually 3) before the benefits begin. It may cover your own occupation disability for the first 2 years, then you must be unable to do any occupation after that to qualify for continued benefits (check details of plan).

Most people wouldn’t hesitate to get life insurance if they have children but don’t think about disability insurance. This is equally important, even if don’t have children, because it is your future earning power while alive but disabled that is covered to help pay your bills if disabled. The chance of becoming disabled during working years is greater than death.

Life Insurance

Most employers may pay for a base amount of insurance expressed as multiple of salary – typically 1x or 2x salary. Amounts above $50,000 generate some pesky tax implications you might see on your paystub. Additional life insurance amounts are offered for purchase with no underwriting. However, premiums are higher due to the potential for adverse selection. Because of this, you can likely find better rates if you purchase life insurance outside the company and go through underwriting, unless you have a known health issue. Finally, note the premium from the company benefit may seem low relative to say a 10- or 20-year level term quote. But be aware the annual premium from work policy will go up each year based on age while the level term quotes are fixed for that duration.

How much insurance should you purchase? That is outside the scope of this blog post. Consider who would be financially impacted by your lost income if you pass early and be sure to consider any Social Security Survivor benefits and other savings built up over time that will reduce the amount of insurance needed as savings build up. This analysis is part of our comprehensive financial plan so contact us if need help.

Coverage for children may also be offered. Yes the premiums are low but that is because fortunately the death rate among children is extremely low. There is no lost income to protect but some view as coverage for burial expense. I wouldn’t.

Accidental Death and Dismemberment (AD&D) Life Insurance

Related to life insurance, some companies offer an AD&D policy. Typically this coverage requires you to pay the full premium. I do not recommend these policies. The financial impact of an early death to your survivors is the same whether die from an accident or not. I recommend getting the required amount of life insurance needed to cover your survivors, and skip this and other specialty death life insurance policies.

401k/403b and Retirement Savings

Technically this is not part of the annual benefit enrollment since you can change your elections to participate, contribution amount and of course investment selections throughout the year. However, this is a good time to review the latest investment choices across all asset classes, verify the latest crediting rate on Stable Value Funds (very likely still lagging) and confirm both a Traditional and Roth are offered. If currently in a lower tax bracket, it likely makes sense to use a Roth but be sure to consider any state tax deductions. Call us if need help. Also be careful when entering your contribution % as there are different boxes for ‘pre-tax’, ‘Roth’ and for some plans ‘after-tax’ (see below).

One change to be aware of for those age 50+ is the treatment of catch-up contributions. If your income from that same employer was above $145,000 in 2025, you MUST direct your catch-up contribution to a Roth 401k only and lose any tax deduction. The catch-up amount is $7,500 but for those age 60-63 by the end of the year, you can do $11,250. For clarity, the $23,500 base contribution can still go to either a Traditional or Roth.

Three other features to look for in your 401k/403b and Retirement Savings:

- After-tax contribution (different than Roth) which allows for additional savings above the $23.5k limit for 2025 that can be converted to a Roth IRA after contribution.

- 457 Plan common if work in education or hospitals that may allow you to save an additional $23.5k depending on the plan.

- Check if the company offers a pension plan (not many do) and appreciate the extra value of that benefit vs. competing job offers.

While not part of employee benefits, remember you can also contribute to an IRA if savings capacity allows. The amount is $7,000 if under age 50 with an extra $1,000 catch-up for those older – but no extra for ages 60-63.

Other Benefits

Other types of benefits may also be offered. Vision, dental, wellness, legal advice, commuter costs and educational reimbursement are some common benefits. Review what is offered to see if have an upcoming need over the next year and weigh the cost of premiums vs. value of services if expect will utilize. Provided you stay within the network, vision and dental plans may be worthwhile. And don’t forget the tax benefit. For example, if a company benefit offers to purchase commuter tickets with pre-tax dollars, and a commuting couple is each paying $150/month and in the 22% + 5% state tax brackets, that is a tax savings of ($150 x 2 x 12) x (.22+.05) = $972 in annual tax savings. That will cover an audiobook subscription for the commute – but be sure to save some listening time for The Financial Translator!

If you are fortunate enough to have a solid benefits package, be sure to take a closer look this year and select the benefits that fit your latest needs – at least for the next year!

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com