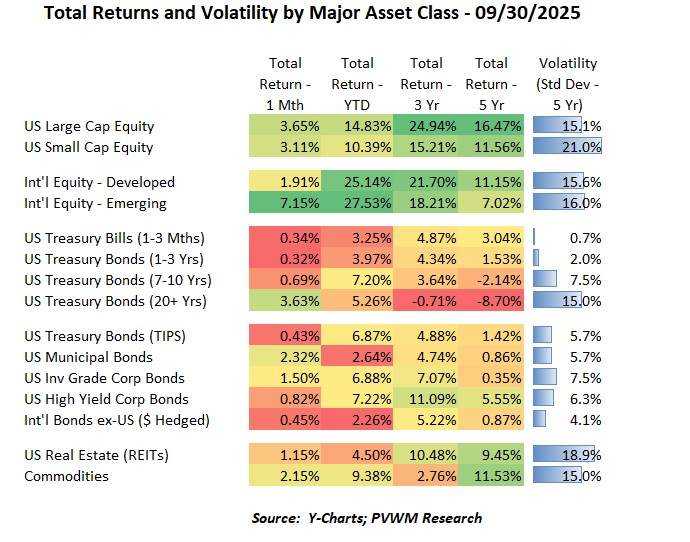

Asset Class Returns - 9/30/2025

Historically September can be a weaker month in the markets (and October also!) but not this year. Looking at the table above you will see all positive returns for the month. In fact, the only negatives on the entire table are from 3- and 5-yr annualized returns from long-dated Treasuries as the large losses from 2022 and 2023 still haven’t been recovered. And notice the annualized 5-yr returns for International equities have benefited from the current strong year. A few other things to note from this year:

- US Large and Small Caps were in line for the month, maintaining the YTD differential that narrowed last month

- Int’l Emerging Markets exploded this month, bringing it to the top for YTD returns, though Int’l Developed remains close behind

- Bond monthly returns may always seem “meh” but their YTD returns are quite respectable, especially given the relatively lower volatility (far right column)

- Muni’s had a break-out month up +2.3%, though still lag YTD; be sure to apply your own marginal tax rate to compare attractiveness relative to taxable bonds

- Commodities are showing solid YTD returns at +9.4%, driven almost entirely by Gold and Silver.

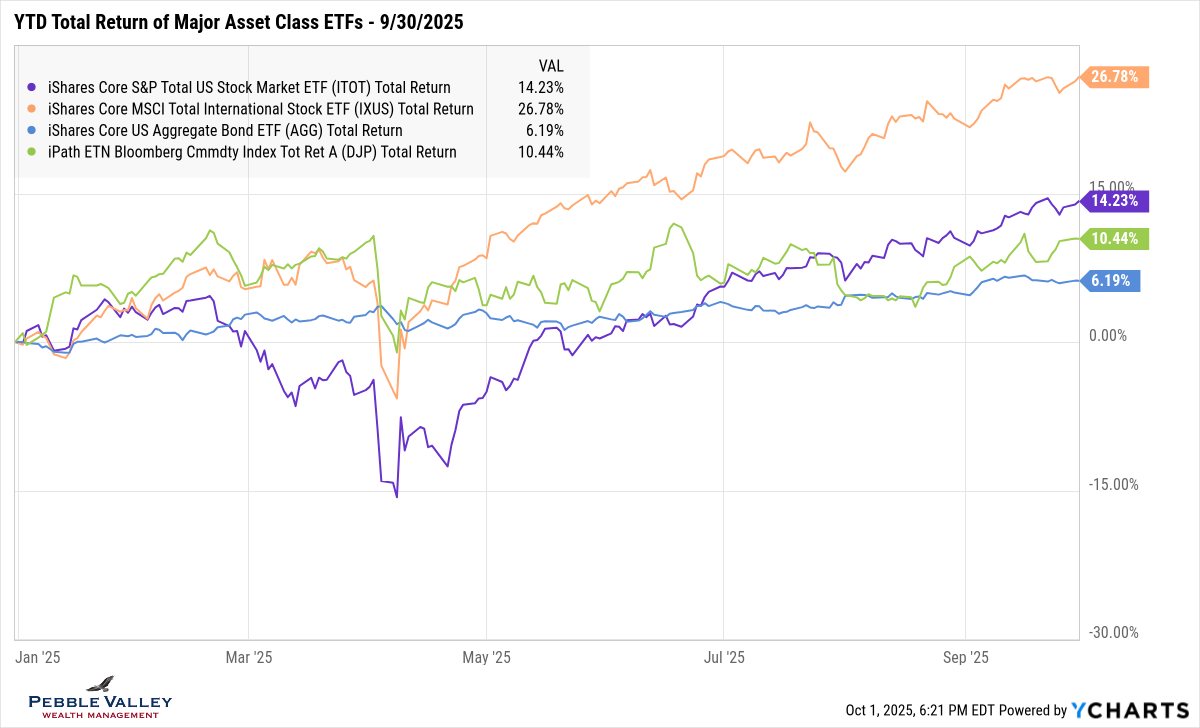

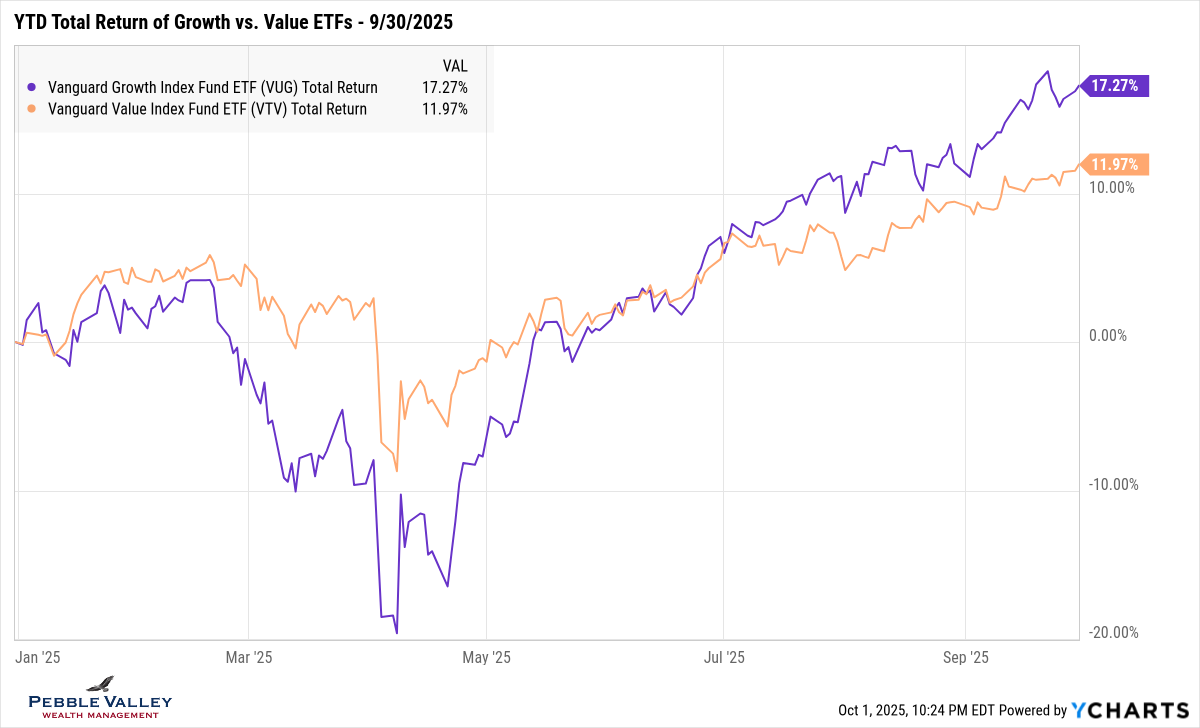

The graph below shows YTD total returns of major asset class ETFs. Starting this month, to provide a cleaner view, I combined US equity large and small caps into a total US equity ETF as well as combining Int’l equity developed and emerging. I also dropped the REITs. You can refer to the table above if want added granularity. The clean view shows very solid returns for nine months of work, especially in light of the -15% drawdown in early April for US equities. Bonds remain steady, clipping the coupon for the first half of the year but also picking up some price appreciation from lower rates recently. The next graph shows Growth vs. Value. After early year outperformance by Value and a 12% lower drawdown differential, Growth has steadily powered ahead, and picking up steam since early July.

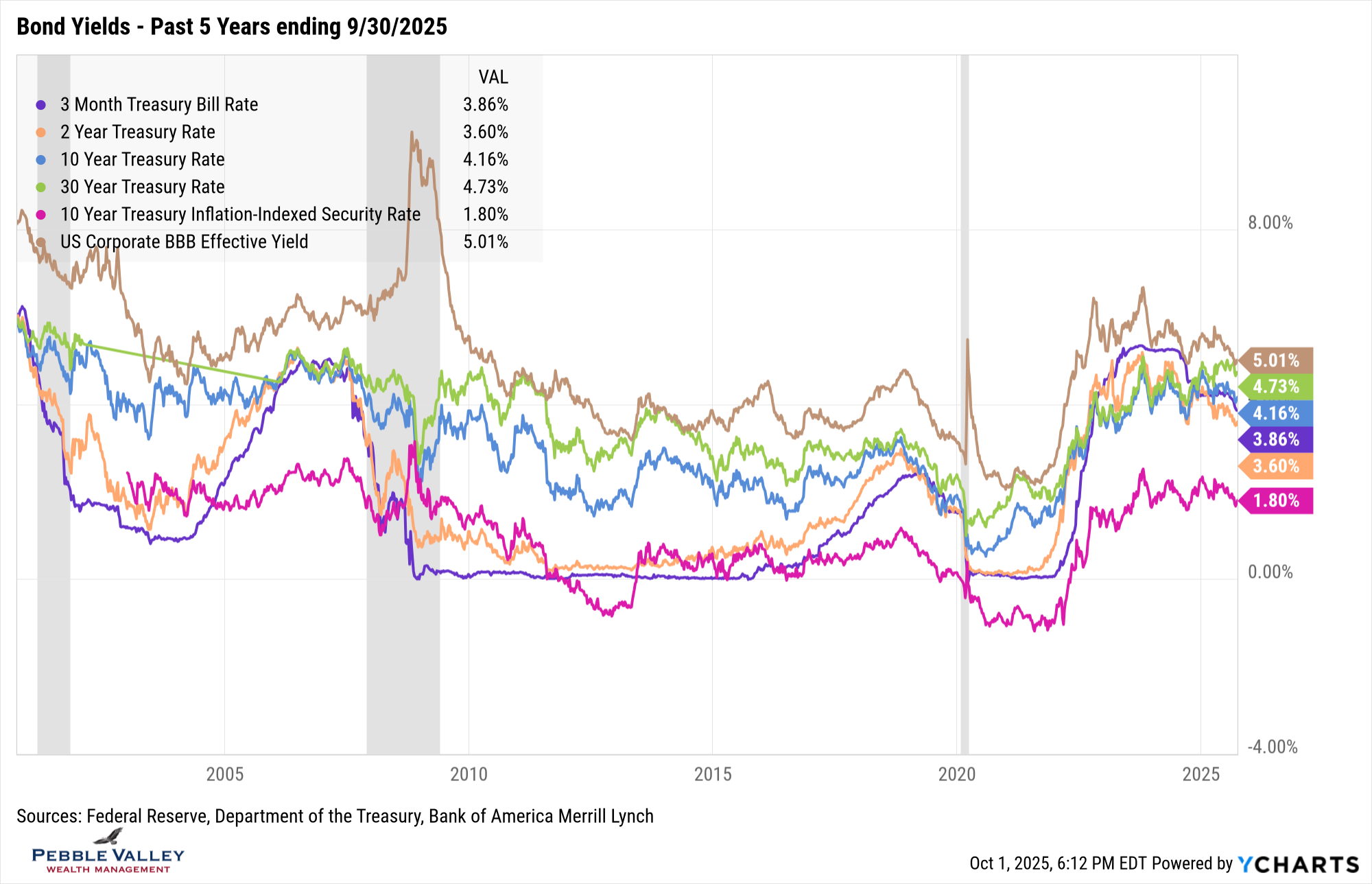

The bond yield graph for the past five years show yields staying bunched together recently, though the 10- and 30-year along with the BBB corporate yield continue to grind lower. If you squint – or just look at the #’s in the legend – you can see the BBB spread is now just 0.85% off the 10-year Treasury. Despite the FOMC cutting rates, the 2-year rate was up 0.01% for the month, demonstrating that it is not always what happens in the market on a given day that drives prices, but rather how it differed from market expectations. I haven’t mentioned that magenta line (10-year TIPS real yield) in awhile. It continues to hold or drift lower recently. As a friendly reminder, if you like a fixed 1.10% real yield + actual inflation on super safe money and you haven’t added up to $10,000 to I Bonds in 2025 yet, be aware the rate resets on Nov 1. Also note if you have older I Bonds you might be better off redeem and buy to step into a higher fixed rate. My clients know what I’m talking about.

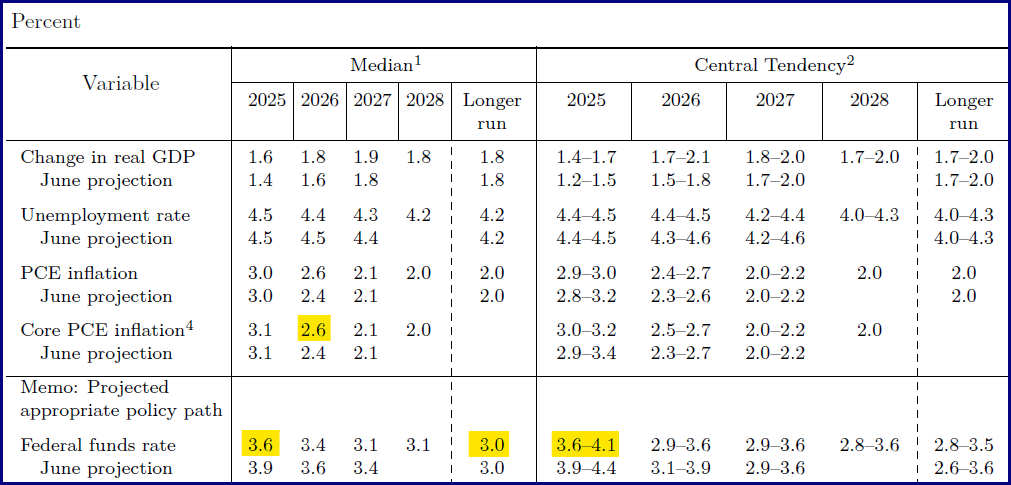

The latest FOMC meeting concluded on September 17th. The Fed delivered a 0.25% rate cut and provided a quarterly update of economic guidance via the Summary of Economic Projections (SEP). The statement that accompanied the meeting emphasized the slowing jobs market while acknowledging stubborn inflation. Unlike the July statement, there was more of a lean toward the downside risks to employment. This likely means a 0.25% at each of the next two meetings (Oct 29, Dec 10). That was the median estimate from the SEP also (see below). The Fed Funds futures market agrees, pricing in 90+% chance of a rate cut at each of these meetings (Source: CME Fedwatch as of 10/1).

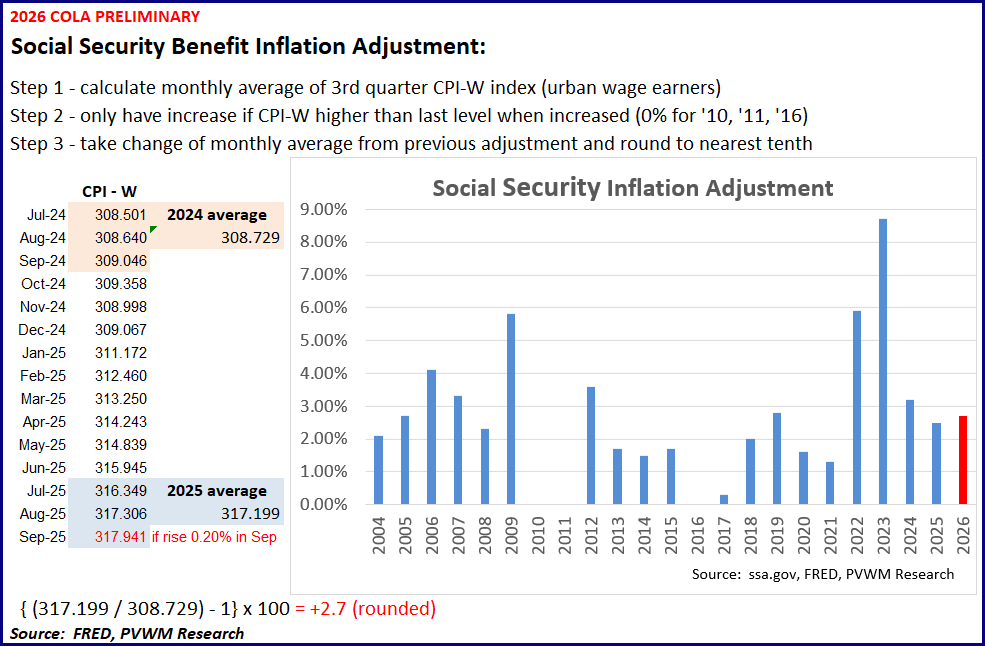

My special topic this month is an early estimate on the 2026 Social Security inflation adjustment. Recall benefits are adjusted for inflation each year based on the average Q3 CPI values and take effect the following January. The last CPI print needed for the calculation occurs Oct 15. Using the first two months’ CPI values and assuming a small rise in September, the likely adjustment will be in the 2.6 – 2.8% range. The increase for 2025 was 2.5%.

Enjoy all that the Fall season offers, especially the first part of the season.

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com