Summary of New Tax Bill (OBBBA)

The recent tax bill signed into law on July 4, 2025 – One Big Beautiful Bill Act (OBBBA) – is a comprehensive law that not only makes the tax cuts from 2017 permanent but also addresses other tax features and introduces new provisions. Some changes are effective for this 2025 tax year while others are delayed. Some expire after a few years while others are permanent. And for clarity, the term “permanent” means a future act of Congress will be required to change them.

The OBBBA is over 900 pages and includes many provisions. This blog post will summarize the key provisions that may affect most people but is not a comprehensive summary. This is my understanding based on research to date; verify details before filing returns. I am not an accountant but understand taxes well and do extensive tax planning with our clients. We analyze and recommend actions now for favorable impacts next spring while preparing tax returns – when it is too late for many of the actions. Reach out if this sounds appealing.

Before getting into details, it is important to have a high-level understanding of Tax Form 1040 – the two-page summary of all supporting Schedules and Forms from a complete tax return. Also understand the difference between gross income from working, adjusted gross income (AGI) and taxable income (after deductions) on 1040, and additional tax credits (the partial return of your money) on Form 1040 after taxes are calculated. Also note different rules and income level triggers vary if filing as Single vs. Married Filing Jointly (I won’t address other filing types here). Sound confusing? I’ve got you covered! See my recent blog post summarizing the key lines from your 2024 tax return. Different actions impact AGI vs. taxable income and other strategies to consider, so reach out for help.

All right… let’s go!

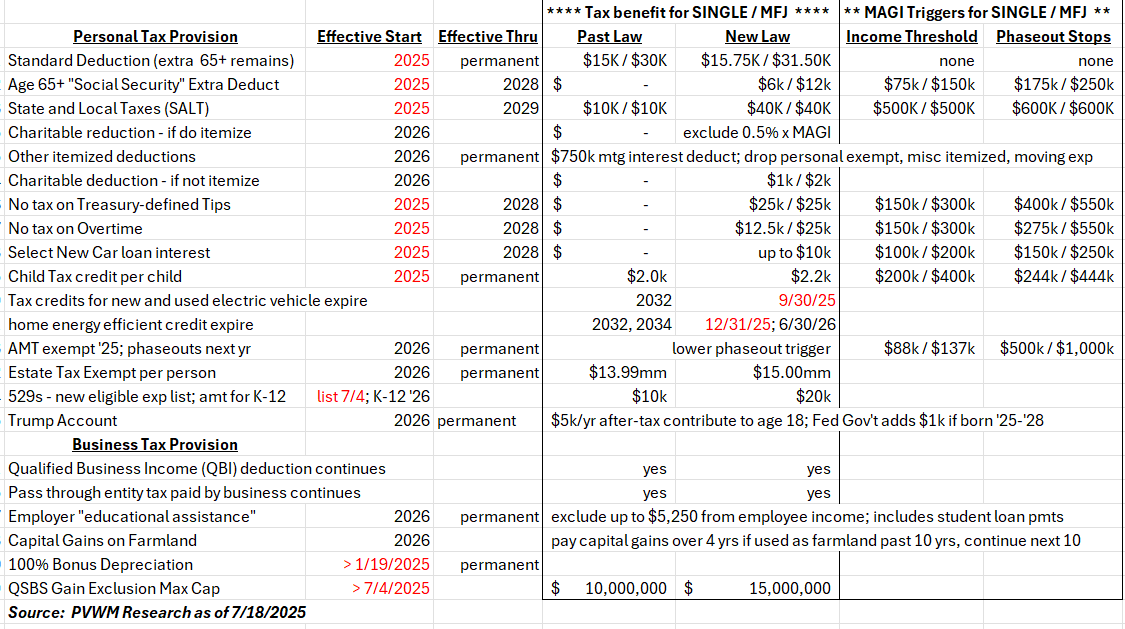

I start with a summary table of key provisions affecting most people, followed by additional bullet points by tax provisions. Please note the following:

- Some OBBBA provisions are effective this 2025 tax year while others in 2026

- Some provisions have an end date while others are permanent

- Most have different dollar amounts depending on filing status but a few do not

- Some don’t directly impact tax return but rather introduce or change existing policies

- I include a few “business-related” provisions at the end for business owners

Standard Deduction – EFFECTIVE 2025

- Not limited by income

- Extra $750 for Single filer; $1,500 for MFJ; inflation adjusted future years

- Dollar benefit = these amounts x marginal tax rate, including state for some

“Social Security Deduction” if age 65+ – EFFECTIVE 2025

- Not able to eliminate SS tax through reconciliation process so expanded deduction

- Note up to 85% of Social Security benefits may be added to AGI depending on income

- Estimates are about 66% of people didn't pay tax on SS before OBBBA; now about 90% will be excluded

- Extra $6,000 per person if 65+, but begin to phaseout if MAGI above $75k / $150k

- Deduction reduced by 6% of each dollar above MAGI; gone if $175k / $250k

- Note – see past blog post on ways to lower MAGI; std or itemized deductions do NOT

State and Local Tax (SALT) – i.e. state income and property taxes – EFFECTIVE 2025

- This is one provision where tax benefit dollar amount is the same for Single and MFJ

- One of itemized deduction components; if total itemized below Standard then n/a

- Was $10k and now up to $40k (actual if below); phaseout if MAGI above $500k for both

- Deduction reduced by 30% of each dollar above MAGI; gone if $600k

- Note – see past blog post on ways to lower MAGI; std or itemized deductions do NOT

Charitable Deduction Changes – EFFECTIVE 2026

- If use standard deduction:

- able to deduct charitable donations from taxable income

- Up to $1k / $2k for Single and MFJ; must be cash donations and no income limit

- If itemize deductions:

- Must exclude 0.5% of MAGI from the amount donated to charity

- If applicable, consider larger donation in ’25, pulling from future years

New deductions from taxable income – EFFECTIVE 2025 BUT END AFTER 2028

- Tips

- Another provision where tax benefit dollar amount same for Single and MFJ

- Can deduct up to $25k in tips; Treasury will define qualified tips later

- Begin to phaseout if MAGI above $150k / $300k

- Deduction reduced by 10% of each dollar above MAGI; gone if $400k / $550k

- Overtime

- Deduct up to $12.5k / $25k in overtime; phaseout if MAGI above $150k / $300k

- Deduction reduced by 10% of each dollar above MAGI; gone if $275k / $550k

- New car loan interest

- Another provision where tax benefit dollar amount same for Single and MFJ

- Deduct up to $10k in interest; new cars only; no leases; final car assembly in US

- Phaseout if MAGI above $100k / $200k; reduced 20% each $; gone $400k / $550k

Child Tax Credit – EFFECTIVE 2025

- Another provision where tax benefit dollar amount same for Single and MFJ

- Phaseout if MAGI above $200k / $400k; reduced 5% each $; gone $244k / $444k

Other Tax Credits – expiration dates moved up

- New and used electric vehicles expire on 9/30/2025 rather than 2032

- Various home energy credits expire on 12/31/25 or 6/30/26 rather than 2032 or 2034

Alternative Minimum Tax (AMT) – EFFECTIVE 2026

- Reduced phaseout triggers back to 2018 levels but kept initial exemption amounts

Federal Estate Tax Exemption – EFFECTIVE 2026

- Per person exemption will increase from $13.99mm to $15.0mm

- This annual increase is about 3x the amount if assumed a 2.5% inflation adjustment

- NOTE: be aware some states have separate State Estate Tax

529 Provisions – EFFECTIVE 7/4/2025 and 2026

- Expanded eligible expenses, including credentialing, effective if incurred after 7/4/2025

- Amount can use for K-12 tuition expanded from $10k to $20 effective 2026

- NOTE: be aware each state 529 plan must pass provisions for state tax benefit

Trump Account – EFFECTIVE 2026; Extra $1k added from Fed Gov’t if born ’25 – ‘28

- Actual account opening for those eligible won’t occur until mid-2026

- Once opened, Fed Gov’t will add one-time $1,000 for child born 1/1/2025 – 12/31/2028

- Up to $5,000/yr of after-tax contributions allowed up to child age 18; withdrawal limited

- Must invest in US equity index product with max fee of 0.10%/yr

- In general, taxed like Traditional IRA – grow tax deferred but withdrawals taxed

- $1,000 if applicable is nice; must analyze other savings alts for best after-tax return

Various Business Provisions – EFFECTIVE DATE VARIES

- Qualified Business Income (QBI) deduction and Pass-Thru entity tax paid continues

- Educational assistance, including student loan payments, favorable for ER and EE

- 100% Bonus depreciation not only effective now, but back-dated to 1/19/2025

- If invest in VC, small business start-up, larger cap on excludable gains (with conditions)

Like I said at the last of my previous blog post – who said taxes aren’t fun! Be sure to claim what is yours. Reach out for help.

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com