Decoder Ring for Tax Forms

Many of you have either completed your taxes or will complete over the next few weeks. Changes for 2020 tax year include a mechanism to claim stimulus checks if 2019 income was too high but not 2020 and an ‘above the line’ charitable deduction (extended for 2021 and expanded for joint filers). I recommend looking at your completed return and pay special attention to particular lines to help with future tax planning. I include a modified version of my original “tax decoder ring” to show where key information is found on the tax return. Hopefully when done using the ring, you will be more excited than Ralphie was in “A Christmas Story” with his message. Spoiler alert! This message is S-A-V-E-M-O-R-E-T-A-X-E-S.

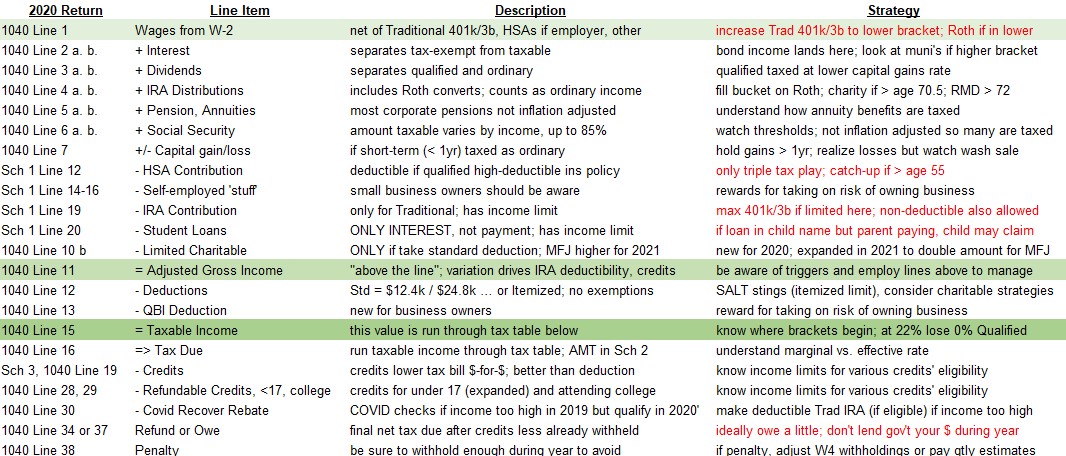

The table below references some of the key lines from your tax return. While fairly detailed, it is not intended to cover all tax details and shouldn’t be used as tax advice. For experienced tax filers, some of the lines may seem basic. But this summary can also be used by those just entering the work force and have already met their new friend FICA. I highlighted in red those items that may interest them. Do them a favor and forward this post!

Note the above is for federal taxes. Each state has their own tax code and some states have no state income tax. For those that do, most states start with Federal Adjusted Gross Income, not Taxable Income, and apply different deductions and exemptions. Most but not all states allow deductions (up to limits) for contributions or rollovers into 529 College Savings plans. States also vary on the amount of Social Security income that is taxed. Illinois goes as far as taxing very little retiree income, focusing mainly on investment income and capital gains (but they’ll get you on property and estate tax).

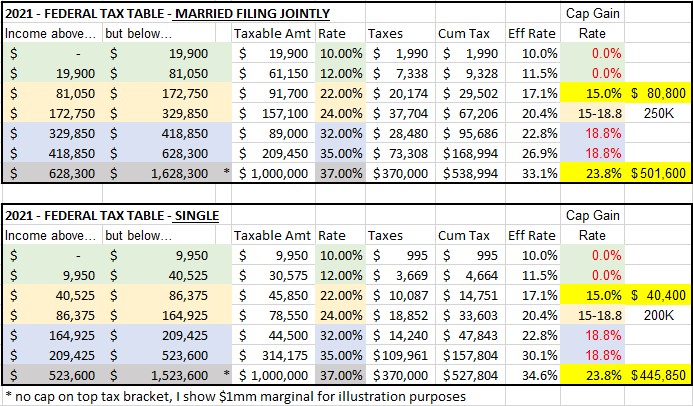

Here are the 2021 tax tables for planning this year. Note the capital gains and qualified dividend rate is 0% for the two lowest brackets. Also note the top capital gains rate kicks in at income levels BELOW the top income tax bracket. It will also be important to follow the tax proposals of the new administration including implementation dates and plan accordingly.

I hope this helps to better understand your tax return and provides ideas for tax planning throughout 2021. Contact me to discuss further. If nothing else, you got a cool “tax decoder ring”… and “be sure to drink your Ovaltine.”

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com