Your 2022 Tax Return is Talking – LISTEN!

Your 2022 tax return has likely been filed and you have the electronic or paper copy from the accountant or tax software. Before you toss it in your files, it is worthwhile looking at some key lines and engage in tax planning for 2023. This blog post will identify those items and highlight some common strategies to employ now that will impact your return next spring.

I will focus on Federal taxes only using the two-page Form 1040 summary. I may reference a few supporting Schedules and Forms but much information can be gleaned from these first two pages. There are different types of income captured on the return - the most important distinction is ‘ordinary income’ (taxed at higher rates) and ‘capital gains’ (depends on how long held). For more background, see my previous blog post – “Taxes – Base Understanding For Planning”. As a reminder, this is not formal tax advice but rather background information to help with planning. This is also not a comprehensive list of tax strategies available.

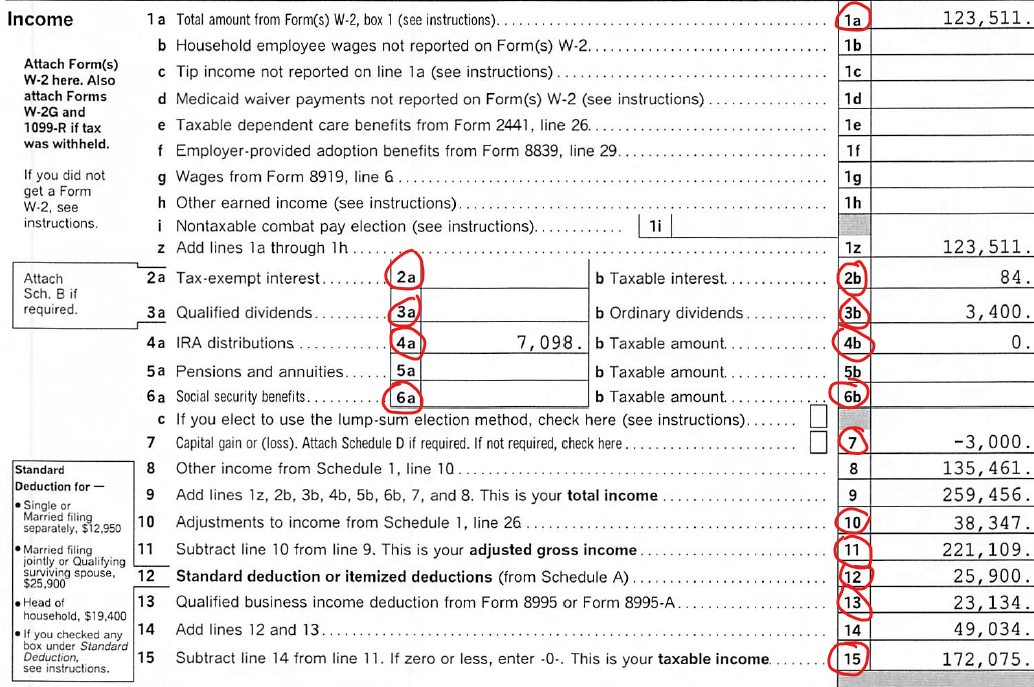

Below is an actual Form 1040 with key lines I will discuss circled in red. I will list two bullet points for each - the first a brief explanation of the number; the second some strategies to consider that will impact your 2023 tax return next spring. There are many complexities behind each so I will only highlight the strategies, not provide all the details. Reach out for help. Some of the lines identified may have $0 in this return but may apply to your situation. At the very end I show the marginal tax bracket tables.

Form 1040 – bottom of page 1, top of page 2

Line 1a – W2 income

- Wages from employment reduced by tax-deductible savings from payroll like Traditional (not Roth) 401k, Health Savings Accounts or Flexible Spending Accounts.

- Since no income limit on deductions, if in higher tax bracket be sure to max out these savings vehicles.

Line 2a, 2b – Interest, both tax-exempt (a) and taxable (b)

- Interest earned from bank savings (it’s a thing again!) and bond holdings.

- Bond income treated as ordinary income unless from most municipal bonds. Important to compare the pre-tax yield equivalent of muni’s - based on your marginal tax – to a taxable equivalent bond.

Line 3a, 3b – Dividends, both qualified and non-qualified

- Dividends paid from equity holdings like ETFs, mutual funds and individual stocks.

- Qualified dividends are taxed at long-term capital gain rate so be aware of which ETFs kick of qualified dividends and consider holding dividend paying equity in taxable account rather than non-muni bonds.

Line 4a, 4b – IRA distribution, both total withdrawn (a) and amount taxable (b)

- Total distributions listed in Line 4a withdrawn from Traditional IRAs/401ks from 1099-R, typically the amount needed to satisfy the required minimum distributions at older ages but also where Roth conversion amounts captured.

- Not all withdrawals are taxable; two common exceptions are after-tax basis in IRA (see Form 8606) or Qualified Charitable Distribution (QCD; if 70.5 or older and give directly to charity); Form 1099-R does NOT capture QCD amounts so tell your accountant! Are you in a lower bracket now but not required to withdraw? Consider a Roth conversion, but watch out for impact on other tax lines!

Line 6a, 6b - Social Security benefits

- Gross amount received is on Line 6a BEFORE Medicare premium deductions or tax withholdings. The taxable amount on Line 6b is based on something called “provisional” income. If that number is above $34,000 for single filers or $44,000 for joint filers, 85% of gross benefits will be added to your taxable income pile.

- The portion included in taxable income is either 0%, 50%, or 85% depending if above certain wage thresholds that are NOT indexed to inflation (so we are all marching toward 85% included in income); if fortunate to be below 85%, be aware of the “tax torpedo” triggered by other actions like Roth conversions or realizing capital gains.

Line 7 – Capital gain (or loss)

- Gain or loss realized from selling security; if held 1 year or less considered “short-term” and subject to higher ordinary income rates.

- THIS LINE IS A HUGE OPPORTUNITY FOR VALUABLE PLANNING. Since you control when to sell, be aware of time security held and if marginal capital gain will be taxed at 0%, 15%, 18.8% or 23.8% (yes, 4 long-term rates; yes, some at 0% and harvesting gains is a thing!) or at a higher ordinary income rate. Losses can offset gains; if losses dominate, then up to $3,000 can offset ordinary income; unused losses can be carried forward indefinitely for individuals.

Line 10 – Adjustments to income

- Look at Part II of Schedule 1 for the various deductions used to reduce taxable income (if qualify; many have income or other limits). Some can even be funded in the first few months of the following tax year before filing taxes.

- The types of deductions range from Health Savings Accounts (if high deductible plan, no income limit), Traditional IRA contributions (if income low enough), retirement plans for self-employed (Individual 401k anyone?!) or interest on student loans (income limits; has been 0% since March 2020 but that is changing no later than end of August 2023).

Line 11 – Adjusted Gross Income (AGI)

- This is just a calculation capturing all the numbers above and sometimes called “above the line” since before deductions. A very important number since many deductions, credits and other lurking tax items reference this number or a close variation. Be aware there are different definitions of “Modified Adjusted Gross Income (MAGI)” depending on the deduction or credit looking at – not all MAGI’s are defined the same!

- You may think there are no strategies to employ since a calculation, but your strategy is to be aware of which deduction, credit or other items dependent on this – and the different definitions of “modified” - and revisit the lines above for strategies to control. Two key drivers are extra Medicare premium triggers (IRMAA) and IRA deductibility.

Line 12 - Deductions – standard or itemized

- Allowed to reduce AGI by a ‘standard deduction’ or if ‘itemized deductions’ are higher (see Schedule A), use that number. There are additional ‘standard deductions’ if 65 or older.

- First thing to note is the ‘standard deduction’ is much higher after the tax changes in 2017 and state and local taxes (“SALT”) is capped at $10,000. This means many people now use ‘standard deduction’ and benefits of mortgage interest and charitable deduction for many are effectively worth $0 since get if “free” with ‘standard’. This increases the value of QCDs (see Line 4b) and larger charitable donations via ‘lumping’ or use of Donor Advised Funds (DAF).

Line 13 – Qualified Business Income deduction (QBI)

- Applies if a business owner or sole proprietor with either Schedule C or S-Corp income. Put in place in 2017 to replicate the lower corporate tax rate approved at that time.

- Underappreciated business planning line as it adds extra complexity to Traditional vs. Roth decision on retirement plan savings (if chose 401k plan). Also has income limits so watch any Roth conversion impact.

Line 15 - Taxable income

- Amount of income subject to taxes after various deductions and exclusions – sometimes referred to “below the line” income since after deductions. You would think this is the amount to run through tax brackets but that would be incorrect, unless you have no capital gains or qualified dividends.

- There is a lot going on with this number. Two key items to be aware of: 1) know what portion is subject to “long-term capital gains rate”; and 2) know your marginal tax rate based on what’s left. You may have more room for capital gains then realize or may find a portion of this number is taxed at 0% (see Line 7).

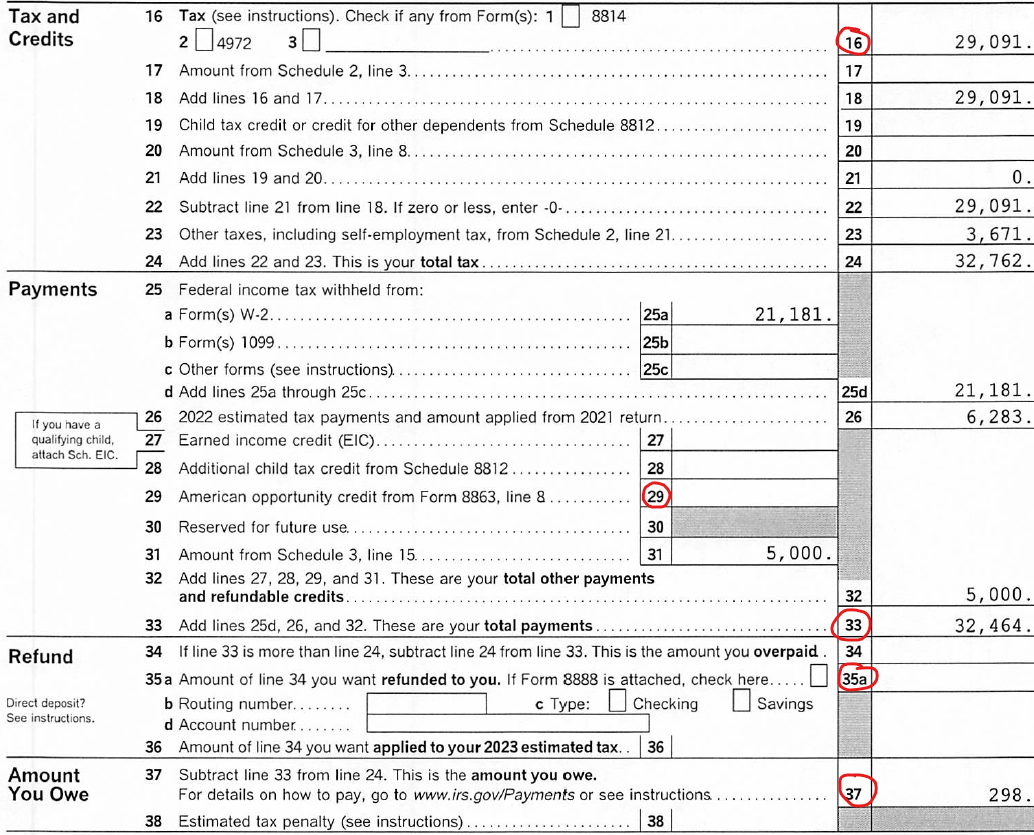

Line 16 – Preliminary tax based on Taxable Income

- Calculation – many calculations actually – to arrive at total taxes due before credits and offsets.

- Unlike Line 11 there are no strategies here. All the work is done on the lines above.

Line 29 (and others!) – Different credits

- Direct $ offset to preliminary tax calculated in Line 16. There are many, and most have different income limits and requirements.

- Look at all of them. In addition to looking at income limits and controlling if possible on previous lines, the Line 29 credit also requires incurring a portion of education tuition expense with non-tax-qualified money.

Line 33 – Total tax payments

- You control most of this number, either by properly filling out Form W4 with employer, making estimated tax payments up to 4 times a year or asking that taxes be withheld from IRA withdrawals (be careful with Roth conversions) or SS/pension payments.

- Read the next line summary, then take action to impact this number.

Line 35a or 37 – Refund or payment

- It is important to note the size of refund or amount you owe is NOT the only number that tells you if your tax bill is high or low. This is simply the end result of your planning.

- Ideally you should owe a little, but low enough to avoid penalties. There are ‘safe harbor’ amounts to pay and still avoid penalties. You should not rejoice if you received a large refund - that means you lent the government money throughout the year at 0% interest rather than using or earning for yourself.

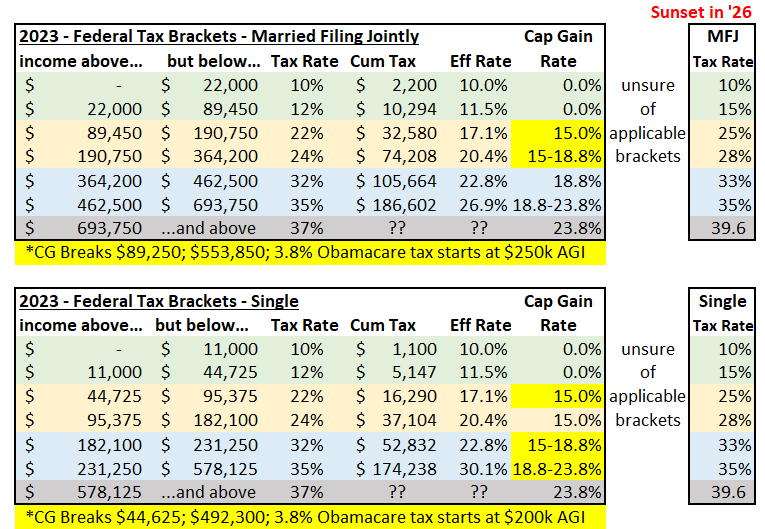

The tax rates that apply to various income described above is mostly captured by tax brackets – either ordinary income or capital gains rates. Tax brackets vary by filing type – Single, Married Filing Jointly, Head of Household and Trust. I only show the first two below but be aware a Trust (if it files own return, not all do) has very tight income brackets and hits the top rate just over $14,000 of income! Also be aware if Congress does nothing, tax rates will revert back to 2017 levels starting in 2026 – commonly referred to as the sunset provision. NOTE: the table shows 2023 tax year thresholds to use for planning now; your 2022 returns just completed used last year’s income brackets but same tax rates. A silver lining of high inflation – tax brackets were adjusted up nicely – except for SS thresholds and extra 3.8% Medicare tax… Newman!

Who said taxes aren’t fun? Ok, probably most people, but there is a lot of value to be picked up by understanding the key drivers. Happy tax planning … and call for help!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com