What is a Credit Score and What are the Driving Factors?

It is not always possible to pay for everything up front. The most common examples are a home or new vehicle purchase. There are also things you could pay up front but instead charge them on a credit card and pay it off monthly after receiving a paycheck. In all these instances, the use of credit is being used. You receive a loan from an institution with a promise to pay it back with interest over defined terms.

But how does the institution know how likely you are to pay back the loan?

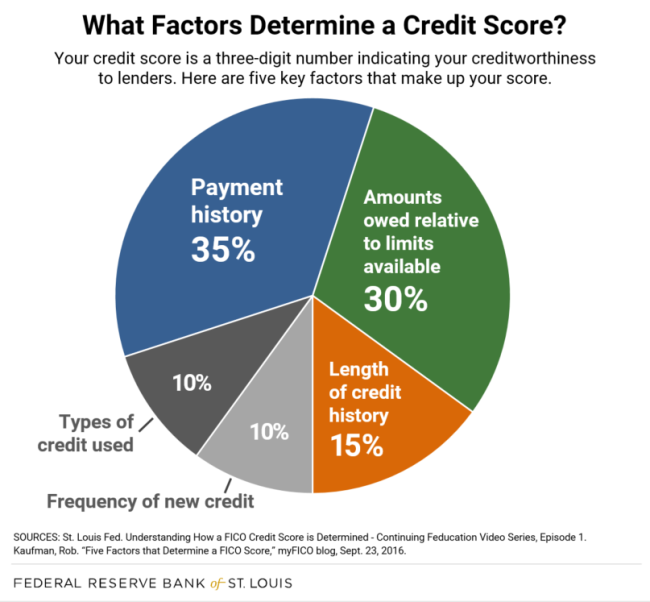

In addition to normal underwriting practices like whether purchasing an appreciating or depreciating asset and resources to pay off the loan, institutions also look at your creditworthiness. A common metric that summarizes past use or abuse of credit is captured in a credit score. The most common one used is the FICO score.

There are five key factors that go into the FICO score. This recent article from the Federal Reserve Bank of St. Louis explains these factors, how they impact your overall score and ways to improve creditworthiness. Below is a nice graphical summary. Do you say “yes” to new credit card offers when shopping? That falls under the “Frequency of New Credit” category and is a negative.

There are three major credit bureaus (Experian, TransUnion and Equifax) that capture an individual’s credit history. You are allowed to receive a free copy from each firm once every 12 months. To help monitor credit activity throughout the year, consider requesting a report from a different firm every 4 months. The free report shows each outstanding loan and recent payment history. It also shows if you or an institution (after you gave permission) checked your credit history. This is called a soft inquiry and does NOT impact your credit score. The report will also show if a new loan was applied for and the resulting checking of your score. This is called a hard inquiry since tied to new application and DOES impact your credit score since new credit capacity is being requested. One thing the free report does not show is your actual credit score. You can also request that from the same credit bureau for a reasonable fee. If you are in the process of applying for a loan you can ask your lender for a copy.

Having a good credit history will make lenders more willing to provide credit at more favorable rates when needed. Be aware of what drives your credit score, pay your bills on time and be sure to check your credit report.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com