Student Loan Moratorium Extended to January 31st – What Should I Do?

This past week, the Biden Administration extended the existing student loan moratorium out to January 31, 2022. The moratorium went into effect March 13, 2020 through the CARES Act in response to the COVID outbreak. It was initially set to expire September 30, 2020 and then first extended to September 30, 2021. The program applies to Federal Student Loans owned by U.S. Dept of Education; it does not apply to private loans. If not sure, check with your loan servicer. During the announcement of this latest extension, the press release made clear this would be the final extension. For those wondering how to get these Federal loans - fill out the FAFSA, regardless of income.

So now what should you do? Note the student loan debt did not go away, the required payments are just deferred. Also note this blog post applies to the traditional 10-year repayment plans, not the income-driven repayment plans with various rules and restrictions.

What does the moratorium do?

It provides relief in three ways: 1) pause required loan payments; 2) set interest rate accrual to 0% during deferral; and 3) put a freeze on defaulted loan collections. Yes, the 0% accrual rate applies to those currently in school also. However, it does not reduce the amount of principal and past interest accruals up to March 13, 2020.

What if I kept (or started) making my payments during this time?

The entire amount paid would go toward paying down the principal amount of the loan (after any accrued interest to 3/13/20 and fees). Some may have needed the payment relief if they lost their job due to COVID. Others may have used the excess funds for other savings purposes but paying down debt is still a good thing since you will have a lower balance subject to interest rates once the moratorium ends at the end of January.

Will my payment be the same when the moratorium ends? Will it take longer to pay off the loan?

Your loan servicer will likely recalculate your required payment based on the principal balance at the end of the moratorium, original loan interest rate and remaining repayment period. The moratorium time period (3/13/20 – 1/31/22) will be excluded from the 10-year repayment period so yes, the final loan expiration will be extended. You can always prepay earlier.

So how much will this moratorium save in interest costs on the student loan?

Nothing if you stopped making all payments. That is because the loan will resume at the same rate with latest outstanding balance after 1/31/2022. The same amounts are still there, you just need to start paying again.

For those who kept making principal-only payments during the moratorium, using the assumptions below you will have saved about $2,160 on loan interest.

Hopefully the lower loan payments in both cases provided needed relief during COVID. If you were not impacted financially from COVID, ideally the extra cash was used to pay off higher-cost debt, increase a reserve fund or added to a Roth IRA or other tax-qualified accounts. If the funds sat in a checking account earning 0% or spent on consumption items, only a delay in the same payments was gained.

The group that benefited without changing any payment behavior were active students. Interest accrues for students with unsubsidized Federal loans while in school but payments are not required until six months after graduating. Loans accruing at 0% during the moratorium will result in lower total loan amounts to pay off after graduation.

Assumptions:

- Graduated in May 2019 and took out maximum undergrad Federal Student Loans each year of $5,500 + $6,500 + $7,500 + $7,500 = $27,000

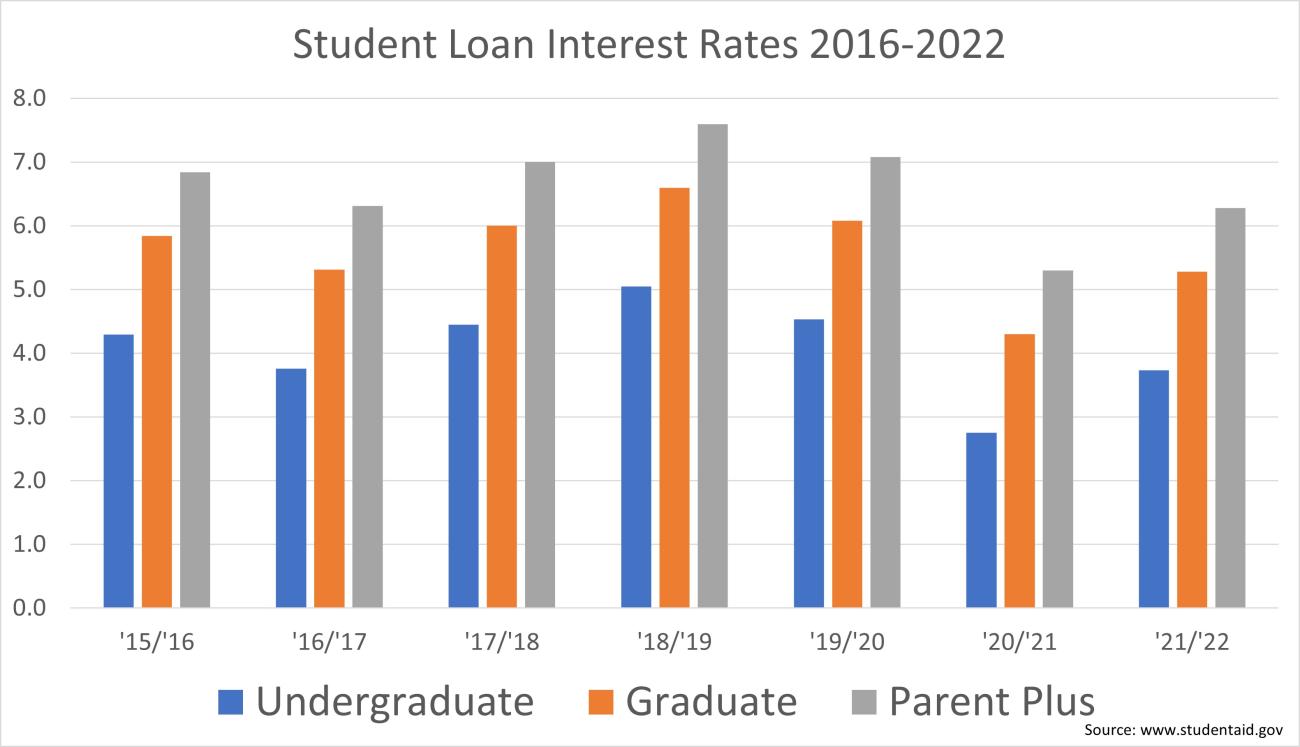

- Average loan rate for undergraduate would be 4.42% using following table

- NOTE: student loan rates for the ’21-’22 school year have just been released and increased from last year, but still relatively low

What will my new monthly payment be next February if a kept making principal payments during the moratorium?

It will go down from about $310 to $260 per month. This is because the loan will still be amortized over the remaining 9.75 years in my example above but you had been paying down the principal, reducing it by an additional $4,600.

What if I hadn’t been making any payments but start now for last five months?

If you stopped payments completely during the moratorium but want to get your budget conditioned for resuming student loan payments – and knock off some principal – you could make five months of principal payments (assume $200/mth in my example) starting this September. This will reduce your new payment from the $310 down to about $295 when payments resume next February. If you are already directing the extra funds to some of the items mentioned in italics above you can continue for a few more months but be ready to shift cash flows back to the required loan payments come February.

I hope that was helpful. Programs like this are intended to provide relief for unexpected events out of one’s control. As things resume to normal, so too is the normal process of resuming your obligations. Be sure your budget is ready.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com