Social Security Inflation Adjustment for 2023 – 8.7%

A silver lining to the current high inflation…

Each fall after the release of September CPI data the inflation adjustment for Social Security benefits is finalized. The final CPI-W data point was released this morning. The result: an 8.7% increase for Social Security benefits in 2023! The Medicare premiums for 2023 have also been announced and there will be a reduction for standard premiums from $170.10 per month down to $164.90 per month (mainly due to restricting an Alzheimer’s drug that was available for some in 2022). IRMAA surcharges are only down slightly but at least the income thresholds also saw a nice 6.5% increase to $97,000 if single; $194,000 if filing jointly.

There is also an inflation adjustment that impacts current workers (based on a different index). The FICA tax includes both Social Security (6.2%) and Medicare (1.45% +). While the Medicare tax is applied to all income, there is a cap on Social Security which is adjusted based on wage inflation. The maximum earnings subject to the 6.2% FICA is rising by a similar whopping 9.0% to $160,200, resulting in an extra $818 taken from your paycheck over the year if your income is above those levels, double that if self-employed. See the end of this post for more details.

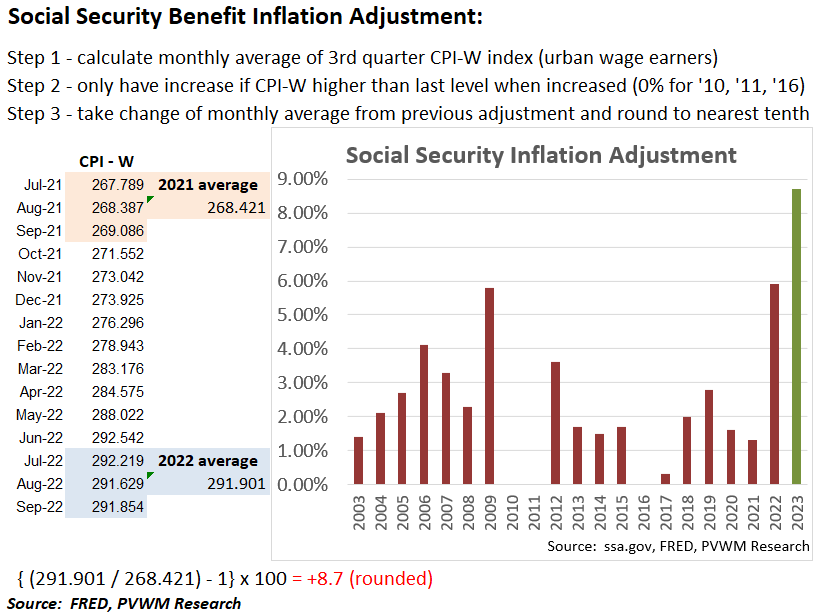

How is the SS benefit inflation adjustment determined?

The graphic below shows the steps to calculate the inflation adjustment and a graph of actual increases since 2003. This 8.7% increase handily exceeds the relatively large increases from 2022 and 2009.

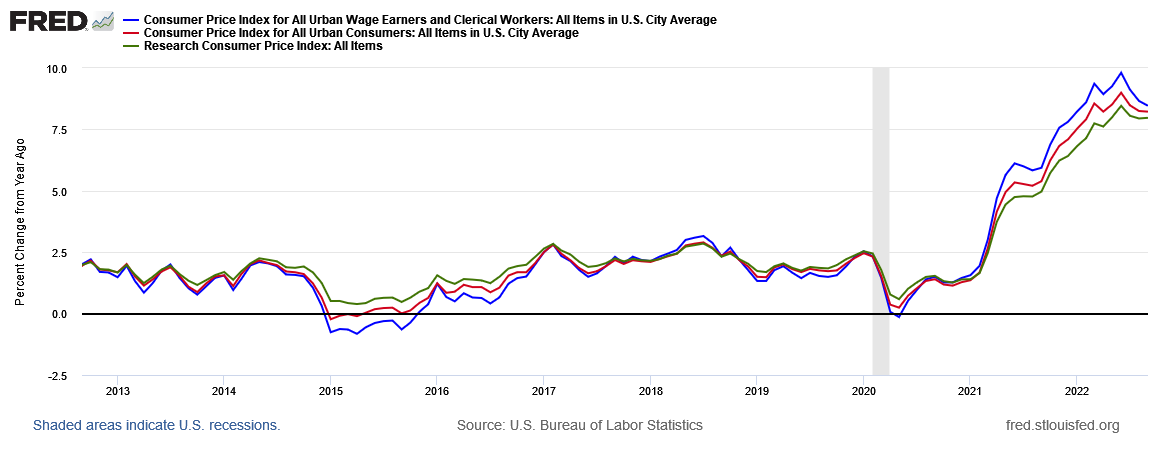

Different Inflation Indices

Note the inflation index used for Social Security is the non-seasonally adjusted index for wage earners (CPI-W, blue line below), not the more common seasonally adjusted index for all urban consumers (CPI-U, red line) reported in the media. There is also a Research Consumer Price index (green line) which captures the common basket of goods and services for those age 62+. There are years when the 62+ index can diverge significantly from CPI-W, mostly in years when there is a large move up or down. From 2017 through early 2020 the Research Consumer index was nearly identical to the others. It was about 1% higher during the spring of 2020 but has since lagged - quite substantially recently. In the camp of “be careful what you wish for”, the SS beneficiaries will be happy again to use the CPI-W this year. The graph below shows these indices over the past ten years (Note: shaded area is for recession). The common CPI inflation number in the news every month is the red line.

Current workers’ impact on FICA taxes

For those working and paying into Social Security (6.2% payroll tax for SS on wages up to $160,200 for 2023), the estimated increase in wages subject to this tax is based on a different index – the ‘national average wage index’ – calculated by Social Security. Recall there is an additional 1.45% payroll tax for Medicare that is applied to all wages (not capped), plus an additional 0.9% on earnings above $200,000 for individuals and $250,000 if married filing jointly (NOT indexed to inflation). Your employer also pays these taxes (or you if self-employed), except the extra 0.90%.

Check out my recent SS blog post for a deeper dive into the Social Security and Medicare financial status. Yes it will still be there for the concerned young workers, but expect a roughly 20% haircut if no Congressional action is taken – based on the latest Trustee report.

Similar to the higher IRMAA thresholds mentioned above, there are other inflation adjustments that will occur for tax brackets, standard deductions, estate tax exemptions and other items. The IRS will publish these likely later this month but expect a 7-8% range increase. Note however these will apply for the 2023 tax year, not the current year where you (hopefully) are actively tax-planning.

Enjoy the raise if receiving benefits; thank you for your added contributions if still working and making more than $160,200!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com