New Contribution Limits for 2020

There are limits on the amount one can save in tax qualified accounts like 401(k)’s and IRA’s. For those age 50 and over (55 for HSAs) additional catch-up contributions are allowed. Some accounts also have income-related eligibility or deductibility requirements. The IRS recently published a couple notices updating these contribution limits along with tax bracket amounts and annual gifting exclusions.

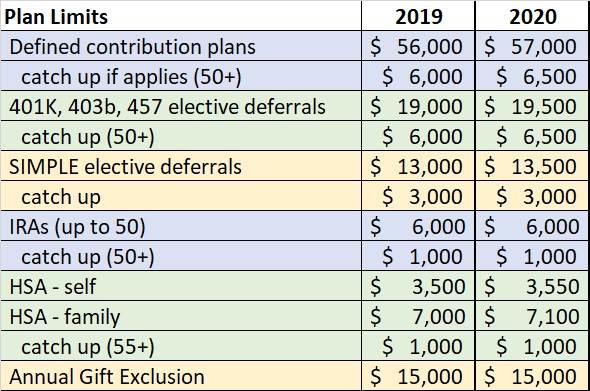

Here is a summary of the contribution changes. Be sure to take advantage of these vehicles if possible. If your employer offers a 401(k) match up to a certain percentage, be sure to participate – that is free money for you! Note there was NO increase in the individual IRA contribution limits.

For those interested in the details and IRS Section number references, here is IRS Notice 2019-59 for the contribution limits and IRS Revenue Procedure 2019-44 for tax brackets, gift exclusion and many other items, including the tax on arrow shafts, which is $0.52 per shaft for those wondering.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com