Medicare Premiums for 2019 – Small Increase Except for Highest Earners

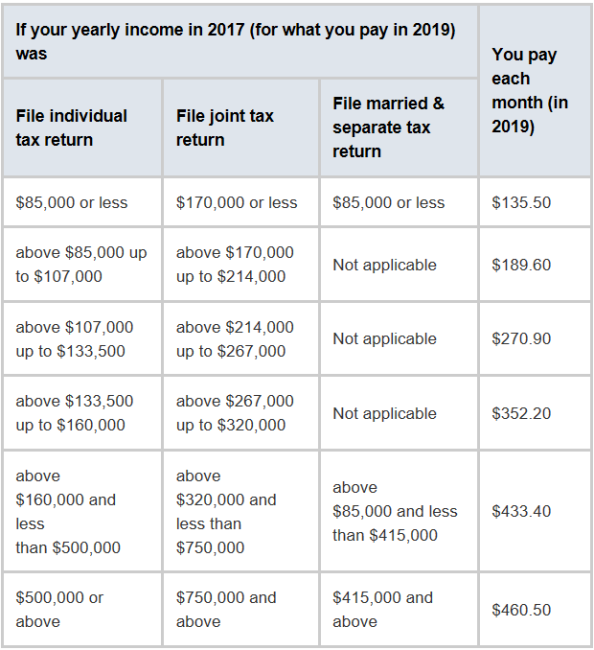

The 2019 Medicare Part B premiums have been set. There is a small increase of 1.1% or $1.50/month for the standard premium up to $135.50/month. Those with a higher income that are impacted by income related adjustments (IRMAA) have the same % increase but will see a slightly higher dollar increase. The one major change is a new income tier for the highest earners. Those retirees making more than $500,000 individual / $750,000 joint are subject to a new IRMAA tier and will see a $31.80/month increase. But for the majority, you will actually see most of that 2.8% COLA adjustment hitting your bank account in 2019. Enjoy!

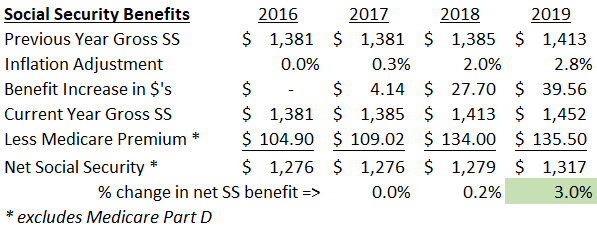

For those receiving Social Security benefits the past few years, you know the percentage increase in the net benefit has been basically flat. Even though there was a 2% COLA increase in 2018, almost all that was consumed by the higher Medicare premiums that had to catch up from previous years' "hold harmless" provision impacts. As the table below illustrates, the percentage increase in your net benefit will very likely be even higher than the 2.8% COLA since Medicare premiums only increased 1.1%.

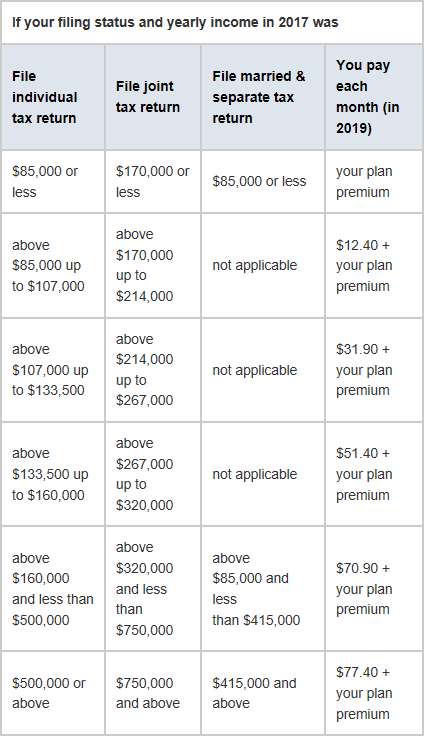

Those retirees with higher income as defined by Modified Adjusted Gross Income (line 37 with adjustments from Form 1040 tax return) pay an additional premium amount above the standard premium, called the Income-Related Monthly Adjustment Amount, or IRMAA. The tables below show the total Part B premiums paid (standard premium + IRMAA) and Part D premium adjustments only for the different income brackets. As mentioned, Part B IRMAA adjustments also went up by 1.1% and a new high-income bracket was introduced. The Part D IRMAA adjustments actually went down slightly and also had the new bracket. Note that Medicare uses your tax return from two years ago – 2017 tax return is used for 2019 premiums. If you had a major life-changing event since 2017 or that was a unique tax year, consider completing Form SSA-44 for potential IRMAA relief.

Medicare Part B

Medicare Part D

Source Medicare.gov

Here is a quick summary of how the typical retiree eligible for Medicare covers their health care coverage (excluding dental, vision, LTC):

- Medicare Part A (Hospital Insurance) is paid from payroll taxes – your good friend FICA – by current workers (currently 1.45%). Your taxes went to pay retirees while you were working. See my earlier post on the financial health of Social Security and Medicare.

- Medicare Part B (Medical Insurance) premiums discussed above only cover 25% of the true cost. The other 75% is paid from general revenue from taxpayers.

- Medicare Part D (Drug Coverage) is a separate premium that also has a surcharge for higher incomes (see second table above).

- Many people also purchase Medicare Supplement policies to cover the deductible and co-payments for Medicare. This is a separate premium typically paid to private insurers.

- Finally, there is also a Medicare Advantage Plan that combines Part A and B (and most D, dental, vision) and Supplement but the details should be reviewed carefully including doctor network coverage and potential for underwriting back into a Medicare Supplement policy if you want to switch back in future years.

So not only is the inflation adjustment relatively high for 2019 Social Security benefits but the modest increase in Medicare premiums and no more "hold harmless" impacts means you can actually enjoy the increase in your bank account. That is something to be thankful for!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com