It's That Time of Year Again, Open Enrollment!

It’s fall; time for cool evenings, changing leaves… and employee benefits enrollment. Whether you are new to the company or have been there for years, review the benefits carefully and take full advantage of the offerings to help increase your financial security. There may be new benefits offered or changes to existing benefits so it is worth reviewing in detail rather than defaulting to last year’s choices. Also, be sure to review your beneficiary designations. Lastly, be aware of the enrollment deadline and begin reviewing in advance. Here are some considerations:

401k

A 401k allows you to save for retirement. If a traditional 401k, contributions up to $18,000 ($24k if over age 50) are tax deductible, regardless of income. Taxes on investment growth is deferred until withdrawn, then taxed (along with contributions) as ordinary income rather than capital gains. Typically the company will match your contribution dollar-for-dollar up to a certain % of pay, average 3-5%. This is free money - or could be viewed as 100% return on your investment with no risk. The downside is access to these funds are limited before age 59 ½. If you do withdraw for a need other than certain exceptions, there will be a 10% penalty, in addition to paying ordinary income taxes.

Roth 401k

Recently more companies are offering a Roth 401k option. The same contribution limits apply, as mentioned above, along with any company match. However, there is no deduction for the contributions. If currently in a low tax bracket (maybe lower income in early career) this may be an attractive choice. Since there is no deduction, there will be less take-home pay relative to a traditional 401k if you maximize the contributions.

After-tax 401k Contributions

This is different than a Roth 401k and not all plans will offer. This allows additional savings beyond the contribution limits on an after-tax basis and grow tax-deferred. The appealing feature is these contributions can be rolled into a Roth IRA upon separation from the company. This is a way to increase contributions into a Roth IRA without hitting eligibility or contribution limits.

Health Insurance

This benefit likely receives the most attention. If a spouse also has a company plan, a comparison of the two is prudent. Be sure to verify the health professionals in the plan’s network still meets your needs based on current expected utilization. Incentive savings may also be offered for healthy lifestyle choices (i.e. exercise, non-smoking, etc.). You may have noticed more high-deductible plans offered recently. This is likely to coordinate with Health Savings Accounts, provided they are a qualified High Deductible Health Plan (HDHP). There is a trade-off with lower fixed premiums but more out-of-pocket costs. Don’t underestimate the impact of being aware of true medical costs when you are responsible for the first portion, resulting in more informed medical spending.

Health Savings Accounts (different than Flexible/Health Spending Accounts)

A Health Savings Account (HSA) is the only account that allows the trifecta of taxes – deductible going in, not taxed while growing, and withdrawn tax-free if used for qualified medical expenses – provided you have a qualified high deductible medical insurance plan. Your employer may contribute part of the annual limit ($3,400 for individuals, $6,750 for family for 2017; extra $1,000 if over age 55). Unlike Flexible Spending Accounts, you DO NOT need to spend the amount contributed each year. In fact, if possible it is best to let these funds grow tax-free until retirement.

Flexible Spending Account

These accounts unfortunately have a very similar name to HSAs but are very different in the contribution limits and usage restrictions. The annual contribution limit is $2,500 and the funds MUST be used for that year or will be forfeited to the company – “use it or lose it”. Note these funds can’t be used for medical expenses if also covered by an HSA but can be used for vision, dental or dependent care.

Life Insurance

Some companies may offer free life insurance for some multiple of your salary – say 1x or 2x. Additional insurance can also be purchased up to certain limits. While convenient, the rates offered may not be the most competitive unless underwriting approval is a concern. Also be aware coverage goes away if you leave the company, requiring you to secure new coverage at your then age and health status. Consider covering your core life insurance needs outside of the company. Be sure to have new coverage in place before cancelling. This may require renewal for one more year while you secure coverage.

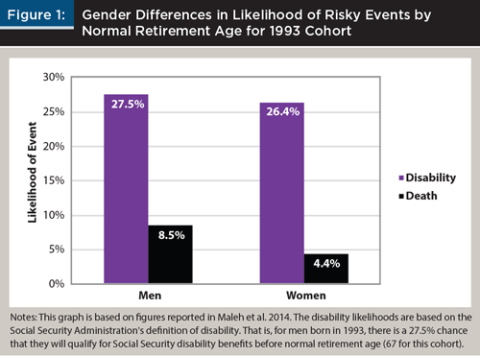

Disability Insurance

This is a benefit that is often overlooked but is an important benefit to provide financial security. Often people won’t hesitate to purchase life insurance for their survivors benefit to replace lost income, but don’t cover the scenario where income is lost due to a disability while still alive. It is true Social Security provides disability coverage, but is more restrictive in being approved mainly due to covering only if not able to perform any occupation, regardless of education or training. (Source Journal of Financial Planning May 2016)

Beneficiary Designations

It is important to understand that beneficiary designations overrule intentions expressed in a Will for a given account. Be sure your 401k and life insurance benefits reflect your latest wishes. Have you been married or had children recently? Make sure the beneficiary designation is updated.

Miscellaneous

See if any benefits apply in your situation. Some common benefits may include commuter cost tax breaks for transit or parking, child care, fitness center discounts or other discount programs.

Pensions – Defined Benefit or Cash Balance

Some of you may not even know what these benefits are since fewer employers offer them. For those who do, there is typically no choice to make but be aware of the value of benefits offered – either to compare different company benefit packages or the opportunity cost if retiring early.