iPhone May Be Under Tree, But I Bond May Belong In Reserve Toolbox

iPhone, iPad… and I Bonds? No, not Apple bonds; rather the inflation-linked savings bonds from US Treasury. You may be familiar with treasury bills, bonds, or EE bonds from Treasury Direct, but inflation-linked bonds – called I Bonds – are also offered. The real coupon rate has been very low, often 0%, over the past 10 years but the latest bond has a real coupon of 0.50%, the highest since November 2008. Adding CPI inflation to this 0.50% makes for attractive, safe security.

Before I get into the details of an I Bond, I want to remind readers of the benefits of having a reserve fund for unexpected expenses or a sudden loss of income. As a general rule of thumb, having six months of expenses (perhaps 50% for discretionary) that can be accessed quickly without worry of potential market loss at that time and no withdrawal penalties are key. For many, this means savings account at the bank or money market in a taxable brokerage account. The returns may be lower but the key is safety and liquidity. NOT on this list would be traditional IRAs or an equity holding. As an aside, Roth IRAs may serve double-duty as a reserve fund but be aware you are limited to the amount you can put in each year ($5,500 in 2018 provided income above). So if you have an unexpected large cash need and a Roth IRA is the only reserve fund, it could take a couple years to replenish your retirement savings.

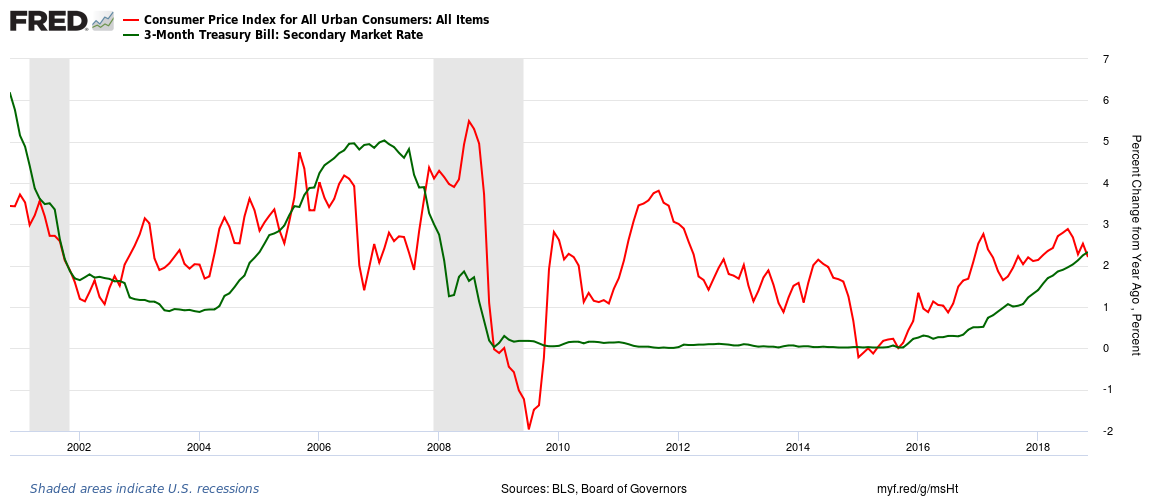

Using 3-month treasury bills as a proxy for a typical rate earned on a reserve fund (bank savings will pay less), notice that inflation eats away at the purchasing power. The green line is the yield on 3-month treasury bills; the red line is CPI inflation. Again the purpose of a reserve fund is safety and liquidity, but it would be nice if you could keep up with inflation also - and even earn a bit extra in a fixed real yield.

One such security is the I Bond issued by US Treasury. Think of these as a savings account that resets the interest rate earned every six months. This rate equals a fixed rate for the life of the I Bond PLUS the inflation rate as measured by CPI-U. Note this is the full headline CPI, not core which excludes food and energy. If there is a deflationary period (when the red line goes below 0% above), the I Bond will never return below 0%. And unlike Treasury Inflation Protected Securities (TIPS), I Bonds are not subject to market price risk (i.e. potential loss) as rates rise.

The fixed rate (real rate) is set every May and November with the latest fixed rate at 0.50%. The current inflation component is 2.33% so new deposits between Nov 1, 2018, and April 30, 2019, will earn an annualized rate of 2.83% which will be credited over the first six months. The crediting rate beyond May 1, 2019, will always have the 0.50% fixed rate plus the new CPI component. New contributions after May 1, 2019, will be in a new I Bond with a new fixed rate set at that time, plus the CPI adjustment. As an aside, the current EE Bonds crediting rate is 0.10%, even below the fixed rate of current I Bonds.

Here is a link to the I Bond section of Treasury Direct. For a deep dive on how the crediting rate is calculated and the historic rates - both fixed real rate and inflation component - click here.

The main negative is the loss of 3 months’ interest if you withdraw funds in the first 5 years. As you are building up this time buffer, you can either count the extra inflation protection as compensation for this risk or maintain another reserve fund source during the initial years. You may find the extra return over a bank savings account will compensate you quickly for this risk.

You are limited to making $10,000/year contributions to the electronic version of I Bonds. There are no taxes due while accumulating but upon withdrawal, the interest earned will be taxed as ordinary income at the federal level; there are no state or local taxes. There is the potential for tax savings if used for education purposes but income limits apply.

So if you want to begin building a safe, inflation-protected, and liquid (fully liquid after 5 years), set up an account at TreasuryDirect.gov and begin adding to the I Bond. If you want a cool productivity-enhancing device - I hope you have been a good boy or girl!

Merry Christmas and Happy New Year!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com