Happy New Year… Including Lower RMD’s

In your financial life, a new calendar year resets many tax-related items – taxable income, realized gains, new tax brackets – and for 2022, new IRS Life Expectancy Tables used to calculate Required Minimum Distributions (RMD’s).

This blog post is not intended to be an exhaustive list of all possible scenarios applicable to IRA RMD’s (see previous blog post), but it will cover three common scenarios and point out which two are impacted by new IRS tables.

#1 – Owner of IRA over age 72

This is the most common scenario for owners of Traditional IRAs. The firm holding the IRA likely lets you know the RMD amount. That amount must be withdrawn before 12/31/2022 to avoid a 50% tax penalty on any required amount not withdrawn. The new RMD amount will be about 7% smaller using the new life expectancy tables updated by the IRS (except for advanced ages). Before I explain the new factors used, here are four quick reminders.

- Age when RMDs are required to begin is now 72, not 70.5

- Roth IRAs are not subject to RMDs for owners, but are for beneficiaries (just not taxable)

- The full RMD is treated as ordinary income unless sent directly to charity

- If using qualified charitable distributions (which can begin at 70.5, limit $100k/year), be sure to withdraw before any RMDs.

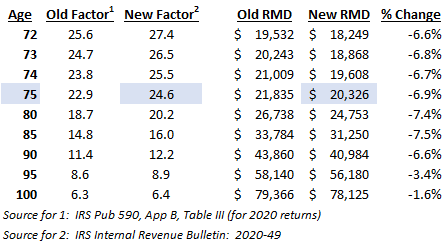

On to the calculations. The table below summarizes the factor from the old and new IRS tables. The RMD amount for a given year is determined by taking the previous year-end Traditional IRA balance divided by this factor. If your Traditional IRA balance at 12/31/2021 was $500,000 and you turn 75 during 2022, your RMD will be $500,000 / 24.6 = $20,326 instead of $21,835 using the old tables (6.9% reduction).

#2 – Beneficiary of IRA inherited before 2020

Beneficiaries of IRAs inherited prior to 2020 - both Traditional and Roth – also make use of an IRS table to determine their RMD. The most common beneficiary scenario (there are exceptions) requires using the age of the beneficiary in the year following death of IRA owner, find the factor in a different IRS table (Pub 590, App B, Table I) and divide that into the previous year-end IRA balance. Each subsequent year uses the same calculation but the factor is reduced by 1. The firm holding the IRA may have done this calculation provided you added the extra dates required.

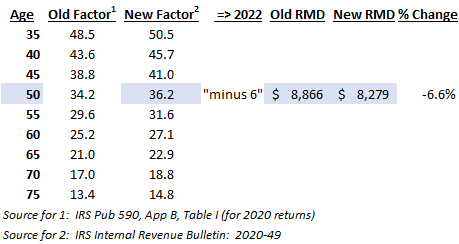

Under the new IRS tables, you must go back and find the new factor based on your age the year following owner’s death, then reduce that factor by 1 each year leading up to 2022 for this year’s factor. Following years will continue to reduce the factor by 1 each year. Using the old and new tables below, if your IRA balance at 12/31/2021 was $250,000 and assume you turned 50 in 2016, the year following the death of IRA owner (and at least 10 years younger than IRA owner) your factor for 2022 will be 36.2 – 6 = 30.2 resulting in an RMD of $250,000 / 30.2 = $8,279 rather than $8,866 under the old tables (6.6% reduction).

And yes, it is true you must take RMD’s for inherited Roth IRAs; they are just not taxable. For those of you saying – “Holy crap! I haven’t been taking any inherited Roth IRA RMD’s. Am I going to be hit with 50% penalty on each amount for each year?” I am not an accountant nor can I give tax advice, but I recommend you talk with one. They will very likely suggest you withdraw the cumulative RMDs now, then refer to IRS Form 5329 and look for “Waiver of tax for reasonable cause” section. The accountant’s guidance here will be extremely valuable – like potentially “50% of missed RMD’s” valuable.

#3 – Beneficiary of IRA inherited after 2019

Beneficiaries of IRAs inherited after 2019 - again both Traditional and Roth – must abide by a different set of rules thanks to the SECURE Act. Again, there are exceptions, but this post will assume the beneficiary is NOT an “eligible designated beneficiary”. In this case, you are required to withdraw the entire account by the 10th calendar year following the year of the IRA owner’s death. If you inherited a Traditional IRA you should consider your next 10 years’ expected taxable income and withdraw accordingly (for funds not needed) to manage the tax impact through potentially higher tax brackets. For a Roth IRA (for funds not needed; assume tax rules don’t change), it may be best to leave funds in the IRA until the 10th year. That way they continue to grow tax-free and no taxable impact in the year withdrawn.

Under the new IRS tables (again for non-eligible designated beneficiaries) – NO CHANGE since no factors are involved. Keep marching along with your same strategy described above.

… may you live a long, happy life!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com