The ABCs of RMDs

In this blog post I will first discuss some foundational information on RMDs. I will then show a few examples of how it applies to owners of IRAs and inherited IRAs. I will end with a few tax planning tips.

An RMD is the minimum dollar amount the IRS requires to be withdrawn each year from certain tax-qualified accounts after reaching a certain age. If you were born after June 30, 1949 that age is now 72 thanks to the SECURE Act. For the rest, it was age 70.5. This applies to owners of non-Roth IRAs, 401k/3b, 457 and other defined contribution plans. While Roth IRAs are not subject to RMDs while the owner is alive, they are required for inherited Roth IRAs (they just aren’t taxable). Interestingly, Roth 401k/3b are subject to RMDs for the owner (a good reason to roll into Roth IRA!).

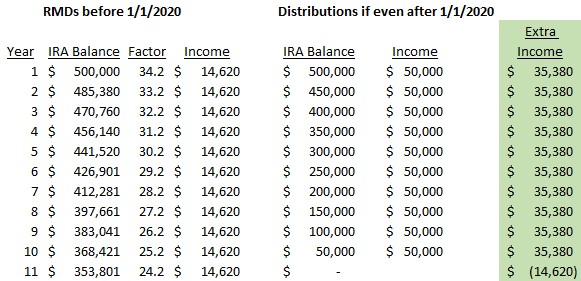

The calculation for the dollar amount of an RMD depends on whether it is an owner or inherited IRA, with further nuances within. For primary owners, the RMD amount is calculated by dividing the previous year-end balance by an IRS prescribed factor based on age. For non-spouse inherited IRAs acquired before 1/1/2020, the same applies except only the initial factor is based on age; subsequent factors are reduced by 1 each year. For inherited IRAs acquired in 2020 and later, unless you fall into one of five categories as “eligible designated beneficiary”, you must withdraw all the funds within 10 years of the original owner’s death. I will show various examples to illustrate.

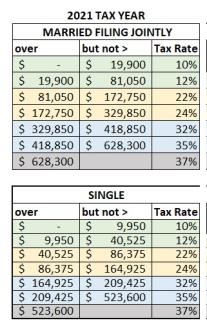

The amount withdrawn from non-Roth accounts that previously received a deduction for the contributions along with all investment earnings is subject to the Federal ordinary income tax rate (not the lower capital gains rate). Think of this as a tax on the harvest, not the seed. If a portion of the non-Roth funds are from non-deductible contributions (where they did tax the seed), IRS Form 8606 helps determine what portion of the withdrawal is taxable. Some states exempt certain types of retirement income from taxes, including tax-qualified withdrawals (IL is currently one of those states). Failing to withdraw a required amount may be subject to a 50% penalty tax on the missed withdrawal amount. However, if that happens first refer to IRS Form 5329 and talk with an accountant. Note these are required minimum distributions. You can always take out more if wish and pay the related tax (and a potential 10% penalty if below age 59.5 for non-inherited IRAs).

Here are some specific scenarios and how the RMD applies. Let’s first talk about IRA RMD’s while the original owner is still alive.

-

I was taking an RMD from my own IRA in 2019. What do I do? You should resume your RMDs using the same process. For example, if your 12/31/2020 IRA balance was $500,000 and you are age 75, your RMD = $500,000 / 22.9 = $21,834.06.

-

I turn age 70.5 this year. Are you saying I can skip this year? That’s right. Because you were born after June 30, 1949 your RMDs begin at age 72.

-

I turn age 72 this year. When do I have to take my first RMD? For the first year only, you are allowed to take your RMD by April 1 of the following year. However, be aware subsequent RMDs must be taken by December 31. If you delay the first year, you will have two RMDs in the same tax year which may push you to a higher tax bracket and other impacts.

-

I turn age 72 this year but am still working. Do I have to start taking RMDs from my IRAs? Yes.

-

Darn. What if 72, still working but have 401k/3b? It depends. Check with your Plan. Some allow you to wait until you retire. Be aware if you retire on or before 12/31 of a given year the first withdrawal must occur by the following April 1. If you rollover your 401k shortly after retire, be sure to verify if the Plan processed the first RMD or don't delay on your own or with help.

-

I have a few of my own IRAs and a couple 401ks. Do I have to take withdrawals from each one? For the IRAs, while you do have to add all the balances together to calculate your RMD, you are allowed to make that total withdrawal from a single IRA. For clarity this is for owner IRAs. Inherited IRAs are treated separately. However, each 401k must be calculated and withdrawn from each account (another good reason to roll into IRA).

I will now talk about inherited IRAs. Remember, RMDs apply to both Traditional and Roth inherited IRAs. The amount taken from the inherited Roth IRA is not taxable.

-

I was taking an RMD from an inherited IRA in 2019. What do I do in 2021? You should resume your RMDs using the same process, but subtract 2 from the factor used in 2019. (Note – no official guidance from IRS on this but consistent with other IRAs). For example, if your 12/31/2020 IRA balance was $500,000 and the factor was 34.2 in 2019, your RMD = $500,000 / 32.2 = $15,527.95.

-

I inherited an IRA in 2020. I didn’t withdraw anything in 2020. What do I have to do in 2021? It depends if you are an “eligible designated beneficiary”. An eligible designated beneficiary includes a surviving spouse, a disabled individual, a chronically ill individual, a minor child, or an individual who is not more than 10 years younger than the account owner.

-

If an “eligible designated beneficiary”, you can take the distributions over own life expectancy using the IRS tables (similar to the owner’s RMD table) and follow the same calculation methodology. A spouse can roll into own IRA (and not take if not 72 yet) or set up inherited IRA and begin RMD when deceased spouse would have turned 72 but still use own age in factors. Note once a child turns 18 they must switch to the 10-year rule described next.

-

Other beneficiaries must withdraw the entire account by the 10th calendar year following the year of the IRA owner’s post-2019 death. There is not a minimum amount required during each of those years, but all must be withdrawn by year 10.

-

The best withdrawal strategy if subject to the 10-year rule depends if a Traditional or Roth Inherited IRA and if need the funds for living.

-

For Roth since withdrawal amounts aren’t taxable, if funds not needed it may be best to leave until year 10 and enjoy continued tax-free growth.

-

For Traditional since withdrawals are taxable, it may be best to project next 10 years income and spread withdrawals to manage tax brackets and other tax impacts (Medicare premiums, lost credits, IRA contribution limits, college aid, etc.)

-

-

-

What if I inherit an inherited IRA – sometimes called a Successor Beneficiary? It depends on when the first IRA was inherited. I will describe the two most likely scenarios assuming non-spouse, non-eligible successor beneficiaries.

- If the first IRA was inherited prior to 2020, the Successor Beneficiary will follow their own 10-year rule.

- If the first IRA was inherited in 2020 or later (thus already following the 10-year rule), the Successor Beneficiary must complete the full withdrawal by the end of the original 10th calendar year following the original IRA owner’s death.

Here are a few tax planning tips related to RMDs.

-

Any changes coming to IRS factors for non-10-year rules? Starting in 2022 there will be new IRS factors to reflect longer life expectancy. The new factors will be about the same as existing factors for two years younger. For example, existing factors for age 72 is 25.6 and age 74 is 23.8. The proposed table factor for age 72 is 27.3 and age 74 is 25.5. This will result in about a 6% lower RMD amount which will lower taxable income.

-

I am charitably inclined. Is there anything I can do with IRAs? Yes – a Qualified Charitable Donation (QCD). You must be at least age 70.5 and limited to $100,000 donation per year. This allows you to make a donation directly from your IRA and have the proceeds count toward your RMD but not included in income. This is especially helpful if you don’t itemize deductions. Even if do itemize, this reduces “above the line” income, possibly saving on extra Medicare premiums. Be sure to let the accountant know since the 1099-R statement doesn’t specify QCDs but rather shows the full amount withdrawn.

-

I am in a lower tax bracket but my IRA beneficiary is either currently in higher or will be after taking the higher Traditional IRA distributions over 10 years. Anything to do? Consider converting part of your IRA to a Roth IRA at least up to your existing tax bracket. If you are confident won’t need the funds, consider filling up to the tax brackets of your beneficiary(ies). Another related scenario to “fill the bracket” is impact of surviving spouse filing as single which has tighter brackets but likely very similar RMDs keep coming. The table below shows the impact of a 50-year-old beneficiary under the old and new rules of RMDs for a $500,000 balance assuming 0% portfolio growth and taking RMDs evenly over 10 years. The tax tables are shown to see the potential impact of being pushed to a higher bracket.

There you have it – the ABCs of RMDs. There were a few more scenarios to describe than I anticipated when I envisioned this blog post but I hope you found a scenario that was helpful.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com