Financial Wisdom for the College Graduate

I distinctly remember two graduation gifts from my uncles and aunts that I enjoyed – a ‘Choose Your Gift’ catalog and a wallet. Another gift that will provide fond memories – though it may take a little while to appreciate! – is a list of common financial topics and habits that if done early in one’s career, will pay lasting gifts into the future.

Here are some important tips for a new college graduate to consider:

Live within your means

Of all the things listed, this is probably the most important and applies all through life. Getting the first career paycheck is exciting and likely a nice increase from past jobs. It can be tempting to go out and get all those nice things your parents or other adults have – luxury apartment, lavish furnishings, new car and other things. Yes, you can likely step things up a bit, but don’t overdo it relative to your income. Two of my favorite quotes that capture this concept – “It’s not what you make; it’s what you keep.” and from 'The Millionaire Next Door' book, avoid “Big hat, no cattle.”

Understand your paycheck deductions

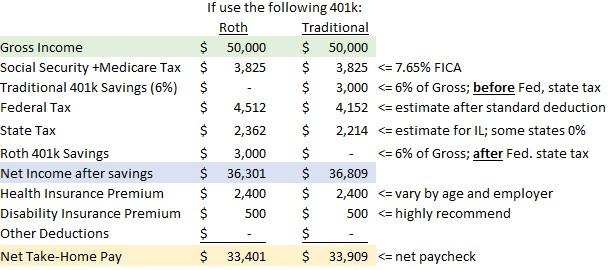

Before I talk about your savings generator (aka a budget) and 401k savings, it is important to understand your paycheck and concepts like gross vs. net income, taxes (including FICA!), health premium deductions and the impact a Traditional vs. Roth 401k has on taxes. Below is an example assuming $50,000 gross income for an Illinois resident.

Savings Generator – ie. a Budget

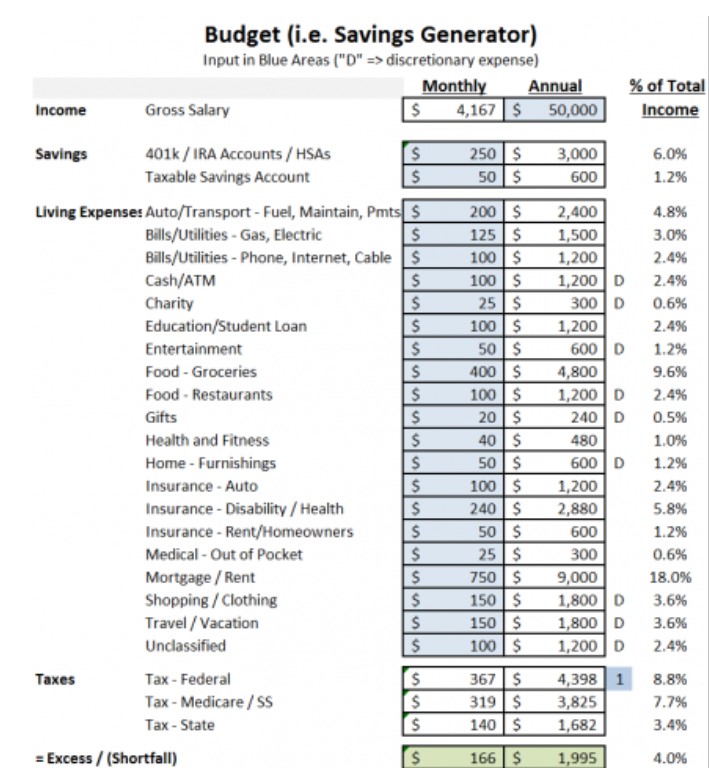

After understanding the common deductions from your paycheck, you may wonder if the net take-home pay will cover your other expenses and if savings should be changed. The best tool to help answer that is a budget. There are convenient tools to track spending but a simple spreadsheet (or pen and paper) will help establish a budget initially to see how to cover expenses and savings. Here is a high-level example. Recall the paycheck deduction example and be sure to start with gross income and include taxes, savings and insurance deductions as part of your budget. And it is important to "pay yourself first." It is intentional that I put the ‘Savings’ category before expenses. As a wise elder would impart whenever he got the chance - “save your money.”

Reserve Fund

It may seem at this point in life you won’t have a need for liquid funds to cover unexpected expenses – job loss (just hired), leaky roof (I don’t own), or the car breaks down (click Uber). But you will have an occasional need for unexpected cash outlays larger than the monthly budget. A credit card may give you some flexibility but you want to get in the habit of paying off the credit card every month. Because of this, don’t put all your extra savings in a 401k or IRA. Establish a savings fund with after-tax dollars to put a safety valve on your finances. See the next section on using tax savings from a Traditional 401k to kick-start this funding.

401k – Traditional or Roth

If your employer offers a 401k and you are eligible (may have to be employed for short while first), I strongly encourage you to participate. Not only is this a great vehicle for tax-advantaged savings, oftentimes your employer will match part of your contributions up to a limit. Think of the employer match as free money or a 100% return on your investment up to the portion they match. Try to contribute as much as possible to maximize this benefit (yes even tightening your budget a little more) but be aware these funds should be viewed as off-limits until retirement (yes accessible after penalties but view long-term; also why I mentioned reserve fund first).

Another important decision is whether to use a Roth or Traditional 401k. See my earlier blog post where I discuss this concept using a seed and harvest analogy. There are many unique factors to consider but don’t let that prevent you from starting – you can always change it later. In general, if in a low tax bracket now and expect to be higher later, a Roth may make sense until you are in a higher tax bracket and the deduction is more valuable. One twist on this is to use a Traditional 401k the first year to get the tax deduction, but direct the tax savings to help establish your reserve fund.

Also know where your contributions are invested. There is likely a default investment option but make sure it fits your needs and if you don’t understand, ask questions.

Other Company Benefits – Health and Disability Insurance

Be sure to look at all the company benefits being offered. In addition to a 401k plan, health insurance and disability insurance are other important considerations. For health insurance, I encourage you to look at the different options and trade-offs of premium costs (both you and employer) and potential out-of-pocket costs captured by terms like deductibles and co-pays. Hint – higher deductibles lead to lower fixed-cost premiums and encourage you to think about utilization since initial costs are on your dime. Disability insurance provides income protection if unable to work due to illness or injury. Even if office-related work, an unexpected illness can disrupt future earnings.

After you get settled into a job, other financial related topics will arise down the road. Additional savings goals for graduate school or a condo/home purchase will impact how you save and borrow. Rather than overwhelming you with more details, I will stop here and let you focus on getting started. But don’t lose sight of your goals and dreams, keep things in context… and stay curious.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com