Financial Framework for Early Career

To the recent college graduates – Congratulations! As you begin your first job (and to those a few years in), there will be many financial-related topics requiring your attention. In this blog post, I share some financial advice for those early (or not so early) in their career in a Q & A format. This is an update to my previous blog post – “No Dad Jokes, just Dad Financial Questions”. The topics in this blog post include:

- Live within your means

- Understand paycheck deductions

- Why a budget is important (and doesn’t have to be awful!)

- Have a reserve fund

- Participate in employer 401k or 403b … and Individual IRAs

- Roth vs. Traditional?

- Investment fundamentals

- Employee benefits beyond 401k/3b

- Good debt vs. bad debt

- Priority on the many demands for your cash

Q1. What does “Big hat, no cattle.” mean?

A1. Avoid it by living within your means. It is an expression from ‘Millionaire Next Door’ describing people who appear wealthy given their lifestyle but have very little savings.

Of all the things listed, this is probably the most important and applies all through life. Getting the first career paycheck is exciting and likely a nice increase from past jobs. It can be tempting to go out and get those nice things your parents or other older adults have – luxury apartment, lavish furnishings, new car and other things. Yes, you can likely step things up a bit, but don’t overdo it relative to your current income.

Q2. My salary is $60,000 per year. Why isn’t my monthly paycheck $5,000?

A2. Employer withholds three types of tax on your behalf, deducts insurance premiums and directs 401k/3b savings.

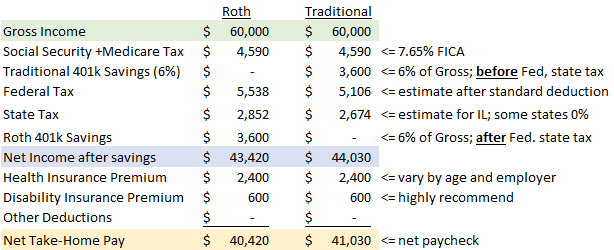

It is important to understand your paycheck and concepts like gross vs. net income, taxes (Federal, State and FICA), health premium and other insurance deductions and the impact of a Traditional vs. Roth 401k on taxes. Here is an example assuming a $60,000 gross income for an Illinois resident (state taxes vary; some have 0%). I show the difference between using a Traditional vs. Roth 401k (I expand in Q6. later). For now, note that a Roth contribution is not tax deductible and results in a slightly lower net paycheck. However, no further taxes are due on that amount including investment growth which can be a very good thing if currently in a low tax bracket.

Q3. What is a budget and how would it help me?

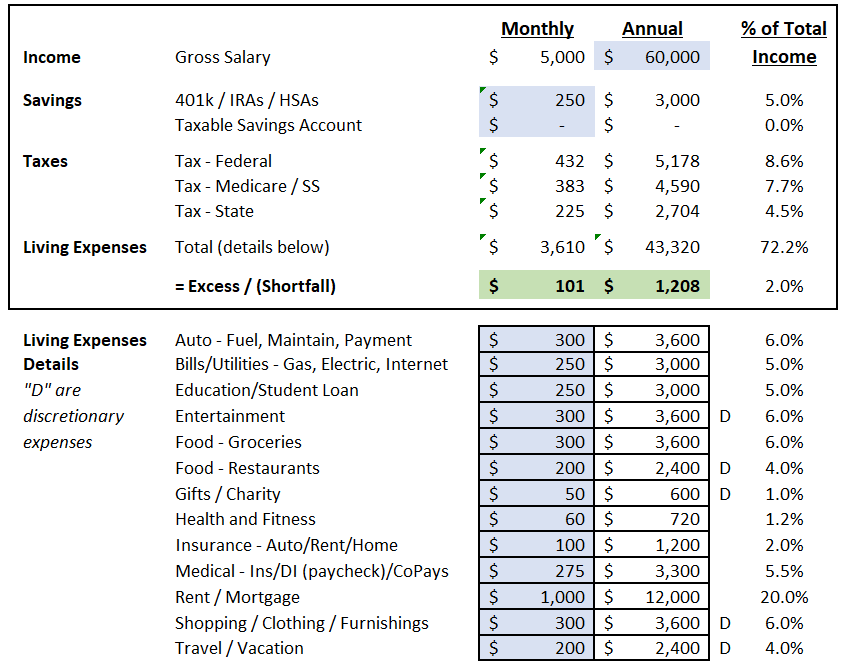

A3. See where gross (not net) salary goes between savings, taxes and major expense categories. You have to measure to manage.

After understanding the deductions of a paycheck, now check if the net take-home pay will cover living expenses and adjust living standards and savings up or down accordingly. The best tool to answer that is a budget. I refer to it as a “savings generator” since you likely will find some discretionary items that can be directed towards other priorities or savings. A simple spreadsheet (or pen and paper) is a great starting point to see what expected to spend on each major category and how that total compares to net take-home pay. Once the amounts are set by category (the budget), use convenient tools like our PVWM Portal, YNAB, Mint or others to track actual spending vs. your target by category. Here is a high-level example (everyone has different category priorities). Be sure to start with gross income and account for taxes, savings and insurance deductions from the paycheck. I intentionally put ‘Savings’ before expenses to ‘pay yourself first’.

Each person has their priorities of where they want their hard-earned dollars to go. If want to compare your priorities to national averages, here is a link to the “2021 Consumer Expenditures” report from the US Bureau of Labor Statistics. The report includes graphs of expenses as a % by major category for different age and income levels if you drill in deep enough.

Q4. What happens if I have an unexpected large expense not budgeted?

A4. You need a reserve fund.

The budget above covers known, recurring items throughout the year. You may also need to cover unexpected expenses like a car repair, travel for weddings, out-of-pocket medical costs or even a job loss. Because of this, don’t put all your extra savings in a 401k or IRA. Establish a savings fund with after-tax dollars to put a safety valve on your finances. A credit card may give you some flexibility but you want to get in the habit of paying that off each month. See the next section on using tax savings from the 401k for the first year to help kick this off and consider using a Roth IRA for double-duty.

A related but separate topic is a known, large expense item coming up in the next couple years (or sooner). That should be handled with a dedicated savings plan not intended for retirement, and those savings, like a reserve fund, should be directed to an account that does not have withdrawal restrictions – like you have in 401k/3b or Trad IRAs - and should be invested in safer securities due to shorter time horizon (see Q7. later)

Q5. My employer offers both a 401k/403b. Should I participate? Can I also do Individual IRAs?

A5. Yes participate, especially if the employer matches part of your contribution. You can also add to IRAs.

If your employer offers a 401k and you are eligible (may have to be employed for short while), I strongly encourage you to participate. Not only is this a great vehicle to kick-start your tax-advantaged savings, oftentimes your employer will match part of your contributions up to a limit. Think of the company match as free money or a 100% return on your investment and should save at least up to that limit. Be aware these funds should be viewed as inaccessible until retirement and will incur a 10% penalty if withdrawn before age 59.5 (there are exceptions but don’t use as base plan). See the later section on investment fundamentals on how to invest. Those looking for the “easy button” can choose a Target Date fund that includes the year you turn age 65-70.

In addition to 401k/3b if available, everyone can contribute up to $6,500/year into an individual IRA provided they have taxable compensation at least that high. Those 50 and older can add an extra $1,000. If a Traditional IRA is used, the contribution may be deductible depending on income level and whether have retirement plan at work. For single tax filers who have a 401k/3b at work, modified adjusted gross income must be below $73,000 to be fully deductible; if no plan at work there is no income limit for deduction. If a Roth IRA is used, modified adjusted gross income must be below $138,000 to contribute the full amount. Recall there is no deduction for a Roth. A Roth IRA could also be used as a ‘large ticket’ reserve fund since contributions (not earnings) can be withdrawn without penalty or tax. Only use in a true emergency but this is a way to begin funding a Roth sooner while also building up a separate reserve fund.

Q6. Should I use a Traditional or a Roth for 401k/403b and IRAs?

A6. Traditional v. Roth mainly depends on tax brackets, now and in future.

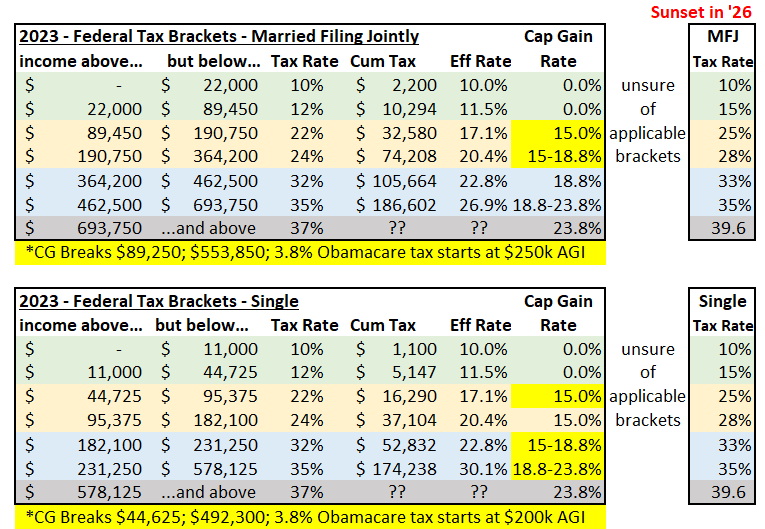

Another important decision is whether to use a Roth or Traditional. There are many unique factors to consider but don’t let that prevent you from starting – you can always change where to direct future contributions later. The key difference is a Traditional 401k gives you the tax deduction up front but must pay taxes when withdraw the funds later. The Roth 401k is the opposite. The key driver in deciding is your current tax rate vs. expected rate when withdraw. Early in your career you may be in a low tax bracket and a Roth may be optimal. Also consider your state income tax which a deduction will offset. The table below shows the Federal only tax rates for Joint and Single filers. A very strong lean is to use a Roth if in 12% or lower bracket and Traditional if 32% or higher. More considerations come into play if in the 22% or 24%, including state tax rate, but at young ages and potential for higher tax rates as soon as 2026, continuing with a Roth in these brackets may also be prudent.

One twist on this is to use a Traditional 401k the first year and direct the tax savings from deduction to help establish a reserve fund (an extra $600/year in my paycheck example at beginning).

Q7. How should I invest this money after I save in a 401k/3b/IRA, dedicated near-term goal, or reserve fund?

A7. Carefully. Determine how you will feel when the market drops 20+% (your risk tolerance) and how soon you need the funds.

Investing doesn’t have to mean 100% equity investment. You should also invest differently for retirement, near-term savings goal and reserve fund. Terms that capture these concepts are the following:

Risk tolerance – complete a risk questionnaire to determine how you react to market swings among other things. This helps guide what portion of the portfolio can be in risky assets. Don’t take large risks if can’t sleep at night, but also recognize the higher the risk, the higher the potential rewards.

Asset allocation – summarizes what % of your portfolio should be in equity, bonds, alternatives or cash. Within each are more sub-categories that I won’t get into here but be aware of them (large v. small; developed v. emerging; investment grade v. high yield bonds; etc.).

Time horizon – if funds not needed for a long time and risk tolerance is high, a large portion of a portfolio in equity may be prudent. However, even if a high risk tolerance, if funds are needed near-term (say next few years) then lower risk assets are appropriate so not exposed to large pullback right when funds needed. Since by definition a reserve fund may be needed tomorrow, that account should be in cash equivalent holdings.

Q8. My employer offers other benefits beyond 401k/3b. Should I consider them?

A8. Absolutely. Medical insurance is top of mind but consider an HSA option and also look at disability insurance.

For health insurance, I encourage you to look at the different options and trade-offs of premium costs (both you and employer) and potential out-of-pocket costs. A key driver to the premium/cost trade-off is driven by the deductible – the amount you pay for unexpected health costs (most routine preventative check-ups are covered) before insurance kicks in. Hint – higher deductibles lead to lower fixed-cost premiums and since the first $xx dollars is on your dime, it encourages you to think twice about running to the doctor for the sniffles. This extra savings is passed to you in the form of lower premiums and less out-of-pocket costs. If you have a qualified high-deductible plan (check with employer) you can open a Health Savings Account, contribute up to $3,850 as single ($7,750 if family), get full tax deduction, and it grows tax-free and even comes out tax-free if used for qualified health expenses. If over age 55 can add extra $1,000.

Many think of life insurance next but that is very likely only needed if you have children (or others financially dependent on your salary if you pass). If that need is there, you can likely find better coverage in private markets unless in poor health.

Often overlooked however is disability insurance. Is there anyone dependent on your salary if you are still alive but not able to work? Yes, you! The chance of being disabled during your working years is greater than dying. I strongly recommend having this coverage.

Q9. Can’t I just borrow to cover my expenses? Is there good and bad debt?

A9. Do NOT borrow for ongoing living expenses (pay off credit cards monthly!). Some large ticket items can be helped with debt – provided it is the good kind.

If you find your net paycheck from Q2. above does not cover expected living needs from budget in Q3., then you need to adjust spending downward and savings – but factor in some savings, especially if 401k/3b match. Note that a credit card is a form of debt – borrowing short-term to pay for things. It is ok (and convenient) to use a credit card to pay for things but because the interest rate is very high, be sure to pay off the full balance each month. You may find the occasional large ticket credit card purchase requires a few months to pay down but be aware of how and how soon it will be paid down before purchasing.

Good debt is borrowing money to help purchase large ticket items that hold or appreciate in value, provided the debt payments fit into ongoing budget. Examples include a mortgage on a home or student loans on your career. Again, calculate the monthly debt payment required and how fits into budget before taking on the debt. It can also apply to car loans on depreciating vehicles, provided it fits in the budget and length of car loan is less than when next vehicle will need to be purchased.

Bad debt is borrowing money on things that are consumed or depreciate in value that would normally blow apart your budget. Examples include ongoing balances of a credit card or vehicle and “toy” loans that exceed the amount that fits in your budget or a loan duration that is stretched too long in order to make payments fit the budget.

Q10. I can’t do all these savings, pay off my student loans and still have fun. What are the priorities?

A10. There will be limited resources (money, time, other) and it is critical you recognize that and prioritize. Here is what I would do. How about you?

This all sounds great in theory but you may be thinking there’s no way to do all these things, especially early in your career. You are right.

But that doesn’t mean you shouldn’t have a plan to not only start where can, but step it up when able. It also provides a framework to consider some sacrifices now, making the future rewards all the sweeter.

Here is a general savings and debt paydown priority to consider – used in conjunction with establishing a budget and push on last two bullet points where can:

- 401k/3b savings up to employer match (free money, though restricted access)

- Pay down high-rate credit cards each month

- Have at least half to one month of expenses in bank account as reserve fund … or slightly less in bank and add to Roth IRA as double duty tax advantage + reserve fund (since contributions accessed without penalty)

- HSA if available – this has best tax treatment for medical costs; can reduce reserve fund for “health-related” component

- Verify remaining “good debt” has reasonable rate 4-6% interest and stick with amortized payoff provided have solid savings plan with excess, not all to extra spending

- With excess savings, after max out Roth, HSA and establish a reserve fund – and 401k savings on solid footing - fund any near-term goals in taxable account with safer asset allocation

- Then go back and add more to 401k (up to $22.5k; extra $7.5k if 50 or older), establish taxable savings account or get the 12-month clock ticking on an I-Bond to later take the place on a portion of reserve fund.

After you get settled into a job, other financial related topics or further complexities will arise. Rather than overwhelm you with more details now, I will stop and let you focus on getting started. If need help, look for an advisor who offers services without requiring large investment minimums. We offer “base planning services” with no minimums and a fixed annual fee component to help you understand and motivate these small steps now that will pay large dividends in the future. Don’t lose sight of your goals and dreams, keep things in context, take action … and stay curious.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com