Expect higher inflation? Here are some “TIPS”, or perhaps your eye is on “I Bonds”

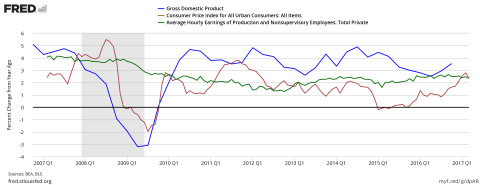

Inflation has been quite low for some time. That has been one of the silver linings of this low-rate environment - expenses have not been soaring as bond and cash returns provide little income. But what if inflation rises faster than recent history on the back of higher economic growth and wage pressure from a decreasing unemployment rate? This blog post will describe two types of securities that help offset effects of higher inflation - Treasury Inflation-Protected Securities (TIPS) and Inflation Savings Bonds (I Bonds).

Note a regular fixed rate bond pays the same coupon until the bond matures. That coupon (say 2%) may not feel as good if inflation is running at 2% or 3% and rising (the bond price will feel even worse!). A couple traditional strategies to invest in a rising rate environment may involve creating a bond ladder where part of the portfolio principle matures each year and is reinvested in higher rates or investing in bonds whose coupon resets to a higher rate as short-term interest rates rise (but watch the credit risk).

The most direct way to protect against inflation is investing in bonds whose payout is tied to inflation. Setting aside inflation-swaps for now, there are two main securities individuals may buy – Treasury Inflation-Protected Securities (TIPS) or Inflation Savings Bonds (I Bonds). Both securities are backed by the US Government and payouts are linked to inflation, but there are also many differences ranging from the amount you can buy to the price risk if real rates rise to the tax treatment. Before I get into these differences, I want to provide some background on two key concepts.

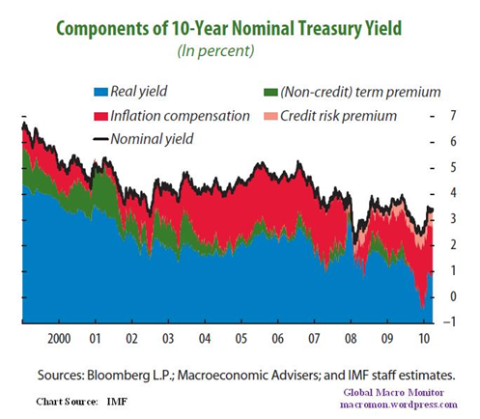

Nominal vs. Real Rates

The normal rate quoted on a bond is the nominal rate. The real purchasing power of a bond after inflation is the real rate. Focusing on these two major components, ‘real rate’ + ‘inflation rate’ = ‘nominal rate’. A regular treasury bond has a fixed principal amount that pays a fixed (say 2%) coupon for the life of the bond - called a nominal rate. That 2% coupon must compensate for both inflation and pay a real return for investing. TIPS start with a principal amount and pays a fixed (say 0.50%) coupon – called a real rate. The compensation for inflation comes from principal adjustments described later. The graphic below from the IMF shows these major components (and two others) through 2011.

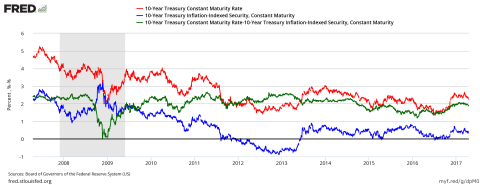

Breakeven Rate

The regular treasury bond with a 2% coupon will pay that amount off the same principal amount for the life of the bond. If the bond price is $100 then 2% will also be the yield of the bond. This is a nominal yield or rate. Using the same TIPS example as above with a price of $100 and 0.50% real coupon gives a real yield also of 0.50%. The fixed real coupon is applied to a growing principal amount based on actual inflation (could decrease if deflation). The difference between the nominal yield on a regular treasury bond and real yield on a TIPS bond is called the ‘breakeven rate’. If over the maturity of the bond you believe actual inflation will be higher than the breakeven rate, buy the TIPS bond; if you expect actual to be lower than breakeven, buy the regular treasury. The graph below uses the 10-year bond to illustrate this concept. The regular 10-year treasury has a nominal yield (red line). The 10-Year TIPS is quoted with a real yield (blue line). The difference between the two shows the extra yield a regular treasury received to compensate for inflation. This is called the breakeven rate (green line) because it captures the inflation rate that must be incurred over that time for the two bonds to be even (generally speaking).

With that as a backdrop, we can now get into the specifics of TIPS and I Bonds. The comparison table from TreasuryDirect does a great job of comparing the two security choices. I would pay special attention to the following differences and nuances. One interesting use of I Bonds is to use as an emergency fund after held for five years. Just be careful of the real rate that is set during the six months of I Bond purchase but is held fixed for the entire holding period. That current rate is 0.00%!

- Purchase Limits – TIPS can be bought in large size either when the bonds are first issued or in the secondary market; I Bonds are limited to $10,000 per calendar year.

- Earnings Rates – TIPS earn a lower fixed real rate based on a growing principal amount based on inflation; I Bonds earn a fixed real rate set at initial purchase + variable inflation rate.

- Taxes – both are subject to federal but not state tax; however the TIPS inflation-adjusted principal is subject to tax each year even though no cash is paid (aka ‘phantom tax’) while I Bonds can defer taxes until redemption.

- Disposal before maturity – yes TIPS can be sold in the secondary market but are subject to price changes if real rates change (if real rates rise, price falls); I Bonds must be held for five years to avoid 3-months’ lost interest and though the value won’t fall due to rising real rates, you are locking in the real rate at time of purchase.