Banks – Concerned, but not Worried

Since the market close on Thursday, March 9th banks have been in the news. This may cause a person to ask if their money is safe and what this means to the economy and markets. This blog post provides a summary of key drivers of the recent bank closings and how similar issues may – or importantly may not – impact the banking sector at large. Note I am not a bank analyst and don’t know all the nuances of capital ratios and other key banking metrics, but three things are clear to me:

- this is primarily an interest rate loss issue of banks’ assets, not credit loss like in 2008;

- don’t borrow short and lend long; need to sell when depositors come knocking (especially if concentrated in one industry with large deposits); and

- Treasury/Fed/FDIC actions from March 12th will require FDIC insured limits and funding to be addressed when things settle down.

If your balance at an FDIC insured bank is under $250,000 for individual or $500,000 for a joint account, your deposits are fine. If above those amounts and at a larger bank without a large % of uninsured deposits, also fine given the recent FDIC action. And because of additional Federal Reserve credit lines granted to manage temporary interest rate losses, I remain concerned but not worried about the banking sector at large.

There is an expression that “the Fed keeps raising rates until something breaks.” This was definitely a break (as was “liability driven investing” problems in UK last September). One thing that hasn’t broken yet is inflation. FOMC – what say you? We will find out Wednesday.

I will use a Q&A format to help organize this longer blog post.

Q1 – What is the difference between interest rate risk and credit risk.

A1 – They both result in near term losses, but credit risk may result in permanent loss. In 2008, credit risk was the main concern as banks extended housing loans (along with a lot of leverage!) and when borrowers couldn’t make payments, houses had to be sold for values below the loans backing them. The quality of assets banks have purchased now are very high – treasuries and gov’t guaranteed mortgage-backed securities. The problem is the current value is well below $100 par value due to rising rate environment (rates up, bond prices down). If not forced to sell, the bond’s value will return to par at maturity if a high quality asset. The problem is, banks need to sell now to satisfy depositor withdrawals, incurring losses.

Q2 – How large can this interest rate loss be?

A2 – Pretty big given the large rate moves in 2022. It also depends on the maturity of the bond (be aware of a metric called duration). Using credit-risk free treasury bonds, here are total returns for 2022 of three different Bloomberg US Treasury Bellwethers (Source: Morningstar Office).

- 5-year treasuries: -9.74%

- 10-year treasuries: -16.33%

- 30-year treasuries: -33.29%

Q3 – Wow! But banks don’t buy assets with that long maturity, do they?

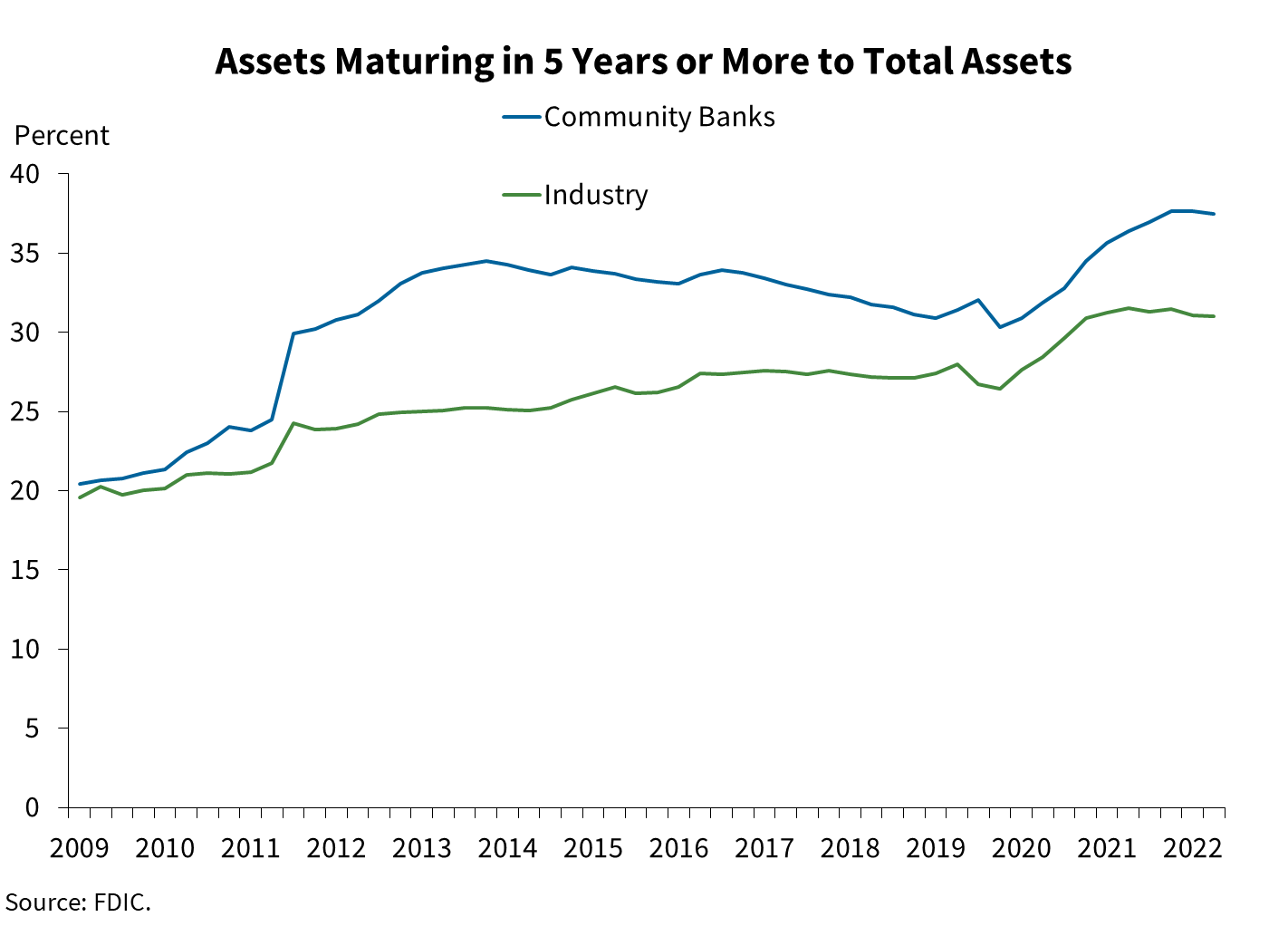

A3 – While very few banks are likely buying 30-year treasuries, they are definitely buying 5- and 10-year maturity securities and hopefully hedging some interest rate risk. While I don’t have balance sheet details of banks, some banks own gov’t guaranteed mortgage-backed securities. While the duration may have been shorter initially when assumed prepayments, the rapid rise in rates makes prepayments very unlikely now, causing the duration to get even longer and incur more losses. And in a low-interest rate environment (think the prior decade before 2022) banks may have stretched and bought a bit longer duration for the extra yield – ignoring that classic asset/liability mismatch dilemma. The graph below shows how the % of bank assets with these longer maturities has been growing over time, especially since 2020 when rates fell post-COVID.

Q4 – Don’t banks have capital to cover these losses?

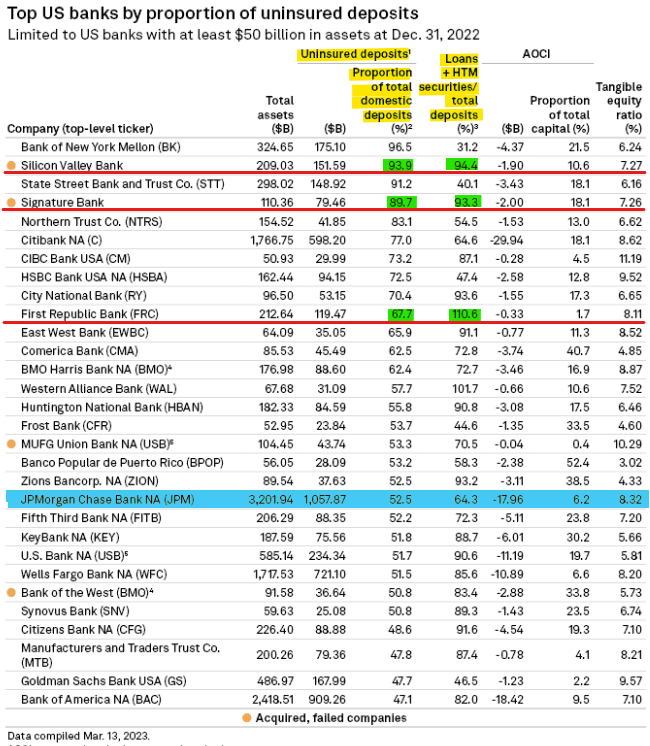

A4 – Yes. But if there is a sudden run on the bank in large size (I will explain SVB next) this capital can be eroded as assets must be sold and losses crystalized. If a bank announces an unexpected, urgent capital raise, that gets the attention of rating agencies, regulators … and the market. The table below shows the banks with the highest proportion of uninsured deposits. You can see the ‘tangible capital’ ratio on the right. However, if a bank has a large % of uninsured depositors which may have a faster trigger finger on pulling money and the % of assets that are tied up in illiquid loans and “held to maturity” bonds (usually longer duration), it won’t take long to make a dent on that capital if a run occurs. Reminder: I am not a bank analyst and different ratios and metrics should also be considered when analyzing banks.

Q5 – I’m on Q5. and you haven’t mentioned Silicon Valley Bank (SVB) yet! What the hell happened this past week?

A5 – Here is a brief summary of not only Silicon Valley Bank and the Fed response, but also a few other banks, including spillover effects to Credit Suisse which was better capitalized but faced other issues over a longer period. It met the same fate (UBS purchased on Sunday, 3/19).

- Silvergate

- This bank was in process of having an FDIC approved orderly wind-down just before SVB

- Bank with customer base almost exclusively with crypto-related firms

- FDIC was watching bank very closely earlier in year give withdrawal requests following crypto market turmoil

- Announced on Tuesday March 8th that an orderly winddown of bank would occur

- Silicon Valley Bank

- Over $200 billion in assets, majority of customers in tech industry including Venture Capital

- Bank grew quickly along with tech industry (only $50 billion assets in 2018), but deposits slowed and withdrawals increased during 2022

- Some customers had very large balances – above $100mm – deposited at the bank resulting in over 90% of deposits above the $250k/individual insured limit

- Appears the risk management was severely lacking; additional benefits to customers also included more lax underwriting and attractive rates on business and personal loans

- March 8th company announced large loss on securities sold to meet withdrawal requests and needed to raise additional capital

- Concentrated customer base in Silicon Valley started pulling funds on Thursday; by Friday over $42 billion was withdrawn and SVB ran out of capital as selling assets at loss

- FDIC shut it down Friday March 10th when couldn’t meet withdrawals and capital requirements

- On Sunday March 12th, Treasury/Fed/FDIC announced all depositors at SVB and Signature, including those above insured limits, would receive all funds; equity and bondholders of the bank were not protected

- A week later (March 17th), the parent company of the bank filed for bankruptcy

- Signature Bank

- Over same weekend as SVB, the FDIC announced takeover of this bank

- About half the size of SVB but also had high % of uninsured depositors which made it susceptible to a fast bank run, similar to SVB

- Also had some exposure to crypto related customers

- Uninsured depositors received same guarantee protection from FDIC as SVB holders

- First Republic Bank

- After SVB and Signature Bank closed, other mid-sized regional banks came under fire

- Banks with a high % of uninsured depositors were especially vulnerable

- First Republic Bank (also in CA) had very high concentration of assets tied up in loans and securities not intending to sell (accounting-speak is “held to maturity”)

- Concerns were growing that it may face similar fate as SVB so consortium of large banks deposited $30 billion in deposits as show of confidence and to help satisfy withdrawals

- The stock continued to fall through Friday, March 17th after also being downgraded to BB+ (below investment grade; news shows downgrade again Sunday 3/19)

- Given these events, need to monitor for a sale the week of March 20th

- Credit Suisse

- Unlike the banks above, this is a large global bank that is “systemically important” and was subject to more rigorous regulation and capital requirements

- Issues and concerns about bank had been going on for over a year

- The issue with SVB and run on bank brought heightened awareness and concerns back to Credit Suisse

- After major investor didn’t want to add more capital due to 10% regulatory cap, the Swiss National Bank stepped in to lend $54 billion on Thursday March 16th

- The market still wasn’t convinced and a deal with UBS was announced on Sunday March 19th; UBS would also be provided government backstops on potential losses.

Q6 – Was the SVB bank run typical for the banking industry or was the business model unique?

A6 – It was very different. The customer base was very concentrated in one industry – Silicon Valley tech and venture capital. The very high % of depositors over the insured limit – over 90% - is also an anomaly. And it wasn’t over the $250k by a little. Some firms were reported to have in the hundreds of millions of deposits there. When SVB reported their loss after market close on Wednesday March 8th, funds started to not only move out deposits on Thursday but tell other VC related partners to do the same. Since a large % of the customers were from the same industry, and the size of deposits per customer on the higher side, the run on the bank resulted in over $42 billion withdrawn before being shut down Friday. There is only so much cash and ready capital to satisfy the withdrawals before having to sell assets at that large, up to now unrealized, loss. It was now realized.

Q7 – What was the Treasury/Fed/FDIC regulatory response? Was that a good idea?

A7 – On Sunday March 12th the different Treasury functions announced that all depositors, including uninsured, would be made whole at SVB and Signature bank. They didn’t say all uninsured depositors are covered at other banks but rather each case is unique and have to be assessed. While adding near-term stability, this created (or further magnified) a two-tier system of “who’s in and who’s out” for deposit coverage. It also creates the incentive for people to pull money from smaller banks and put them in larger banks (the size of SVB and Signature or higher) to get the implied coverage. This exchange between Sen. Lankford and Treasury Secretary Yellen crystalizes the concept.

Also on Sunday March 12th the Fed announced a new Bank Term Funding Program that will offer loans up to 1 year to banks in exchange for high-quality assets (treasuries, MBS) that have unrealized losses described earlier. The kicker is banks can borrow based on 100% par value, not the depressed market value price. This will allow banks to tap the Fed for liquidity to satisfy withdrawals as if they were perfectly hedged against rate moves with the full value of assets available. No word on what happens in a year when the loan is due if these credit-risk free assets are still at a loss due to higher interest rates.

Finally, some may debate whether or not it was a bailout and if taxpayers are on the hook. It is true the bank equity and debt holders are not getting relief, just all depositors made whole, even if over the insured limit. But clearly there is a cost to provide support (from taxpayer funds) and future bank fee assessments to recoup the cost will be borne by bank depositors who were not involved with SVB or Signature and were working under the old insured limit rules. It is OK to have assessments based on current rules; it is another thing to come asking for more funds to cover those enjoying more aggressive benefits on uninsured activity.

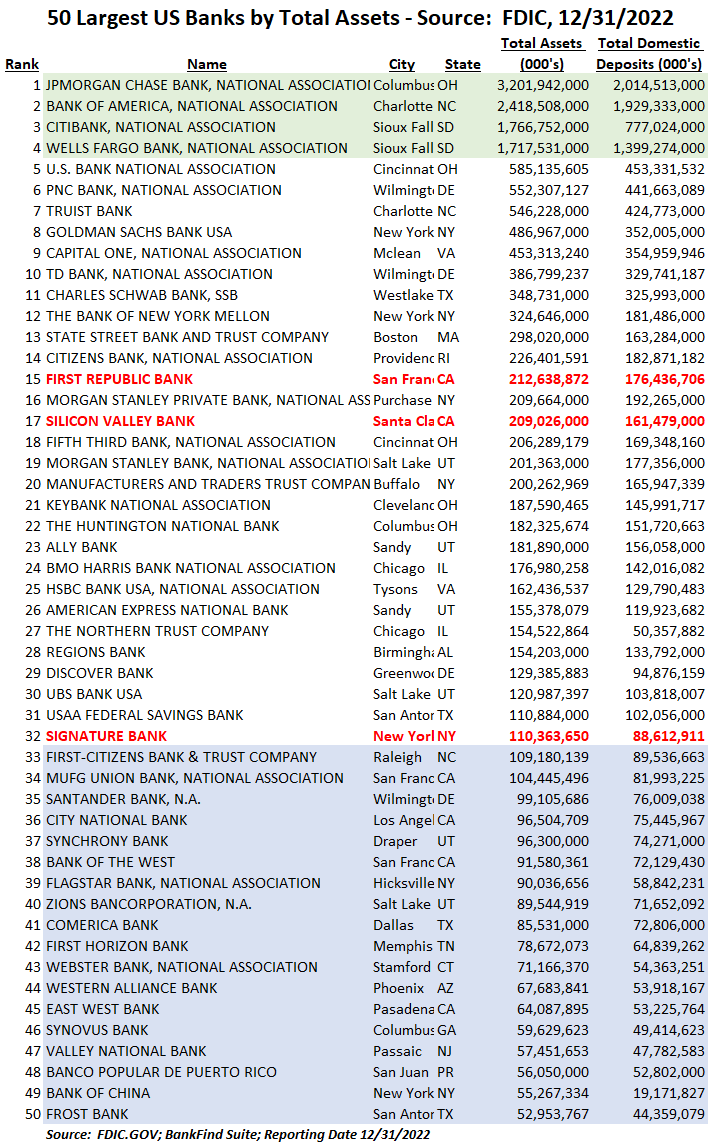

The table below shows the top 50 banks by asset size. The top 4 in green shade are designated as a “global systemically important bank” and deemed too big to fail. Given the Treasury/Fed/FDIC action on March 12th the next list of banks down to Signature Bank, while not explicitly deemed too big to fail, were deemed systemically important on an individual basis. The banks listed below that in blue shade are wondering if they would qualify.

Q8 – Is the Federal Reserve meeting soon? Will they pause? What did the ECB do last Thursday?

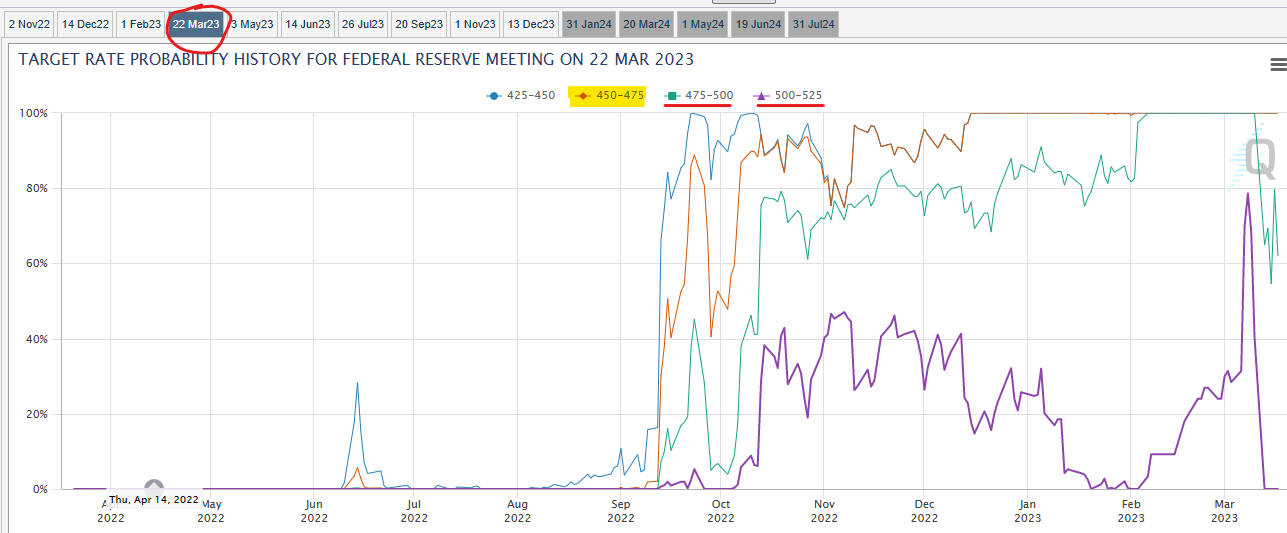

A8 – The next Federal Reserve meeting concludes Wednesday March 22nd. Before March 9th the market was expecting the Fed to raise rates at least 25bps and quite likely 50bps. After this bank news, those expectations have changed drastically to either no change or a 25bps hike. I believe they will raise 25bps. The other important part of this Fed meeting is the release of economic projections. One of those projections is where Fed Funds rate is expected by end of 2023 and next couple years. The market is pricing in cuts down to around 4% - a drastic change in sentiment from March 9th. The European Central Bank was faced with similar circumstances last week with Credit Suisse in the news but inflation running hot. They proceeded with their planned 50bps increase.

The graph below shows the implied probability of Fed rate hikes based on Fed Funds futures from CME Group FedWatch tool. You can see the implied probability of a 50bps hike went from close to 80% on Thursday March 9th to 0% on March 17th. A 25bps hike has an implied probability of around 60% while no change around 40%. The shocking thing to me is Fed Fund futures are pricing in significant cuts by the 12/13/2023 Fed meeting. At least 50bps cut is priced in as very likely; a 100bps cut – down to 3.50-3.75% range – is at an implied 20+% probability.

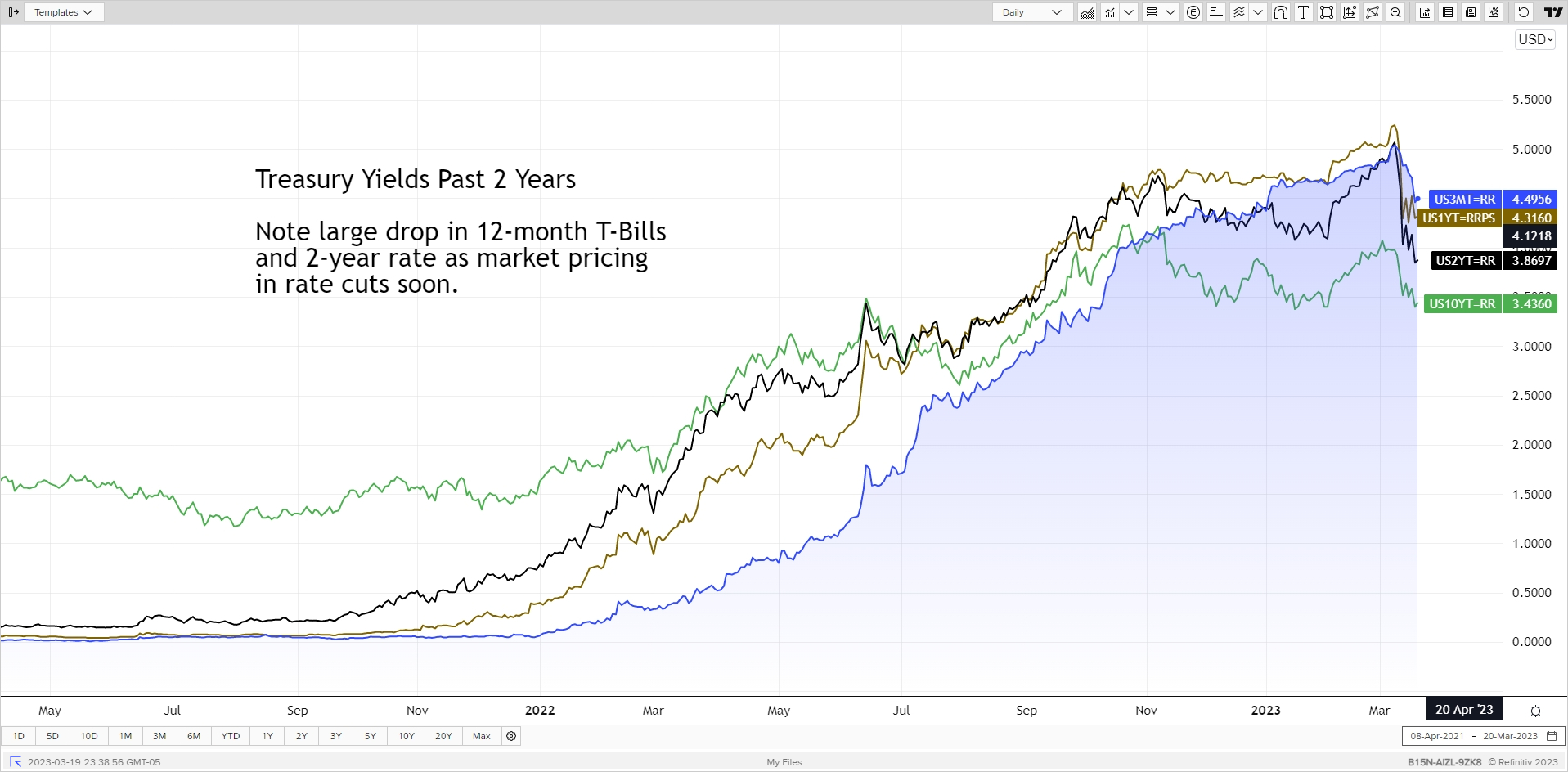

Q9 – What are interest rates doing?

A9 – Moving – a lot. 2022 was all about rising rates across the board and the impact on bond prices mentioned above but also mortgage rates and home equity lines of credit. Just before SVB news hit the 6-month Treasury Bill was over 5% causing people to look at what they were earning at the bank and considering alternatives. Depositors are not only moving to larger banks, but taking funds out of banks all together and investing directly into T-Bills and money-market funds – the latter can carry some credit risk depending on type of fund. The graph below shows some key treasury rates over the past two years. (see my Market Update blog post for 5-year history). The 2-year Treasury rate saw one of the largest drop across the curve as the market began pricing in rate cuts in 2023. You can see the 3-month T-Bill holding relatively steady as Fed likely to raise 25bps or pause, but the 12-month T-Bill also priced in the rate cuts. Also of note is these current rate levels only got us back to fall 2023 levels which tells you how fast things were moving up.

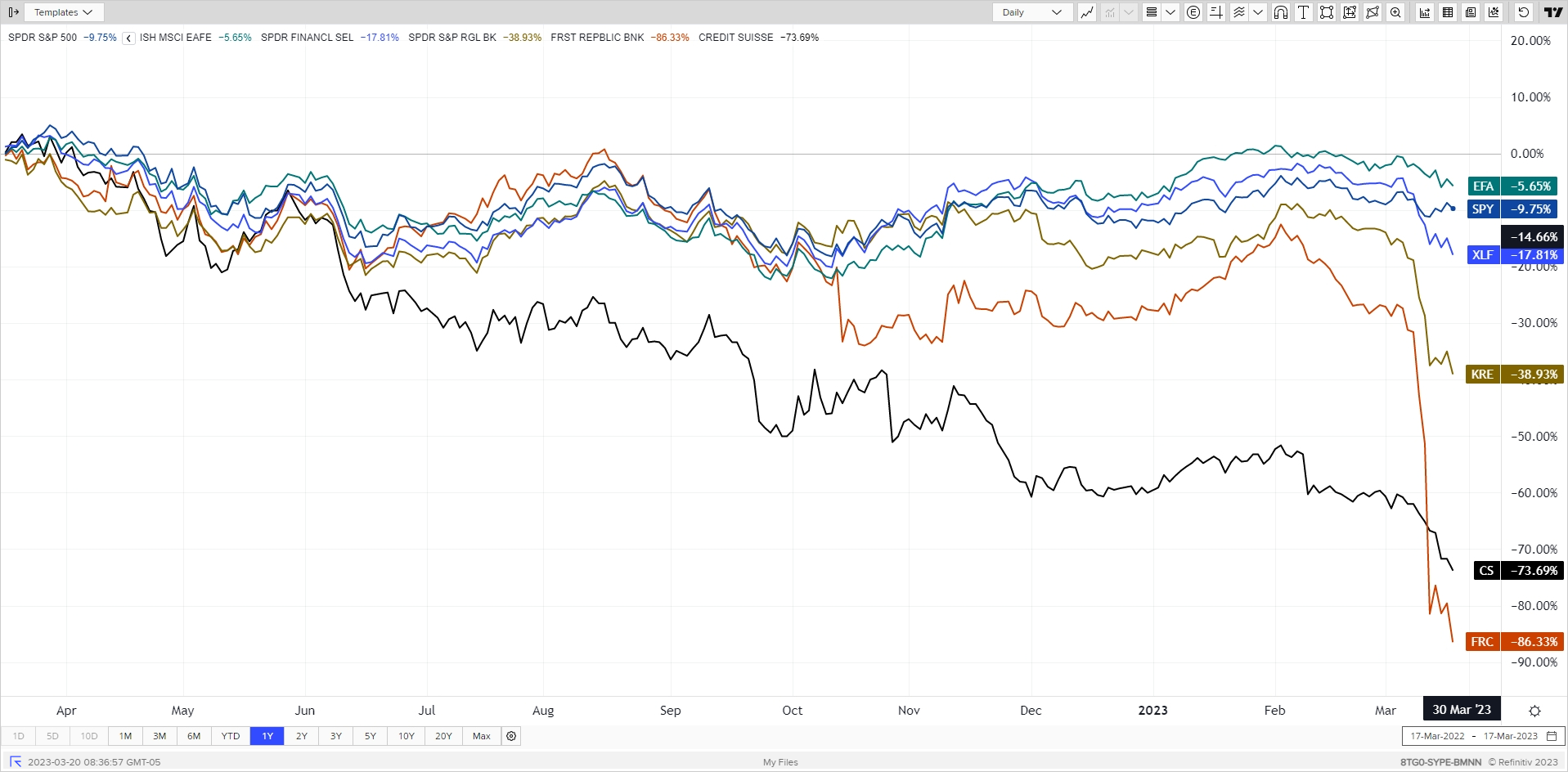

Q10 – What are equity markets doing?

A10 – Also moving, but not as much as you would expect – except for regional banks. Recall the market faced the headwinds of rising rates last year. After a brief rally in January of this year the market pulled back on expectations of continued rate rises. Given the current banking issues are a result of interest rate risk and not credit risk, it is not spreading to the broader market as much as one would expect. Financials are getting hit for sure as potential losses, pullback in lending and more capital requirements, especially for the smaller regional banks. On a medium-term basis however, I expect the pullback in the financial sector will weigh on growth in the economy. The graph below shows the US equity (SPY) and Int’l equity (EFA) total returns for the past year. The financial sector ETF (XLF) is down further but holds the larger banks and non-bank holdings like insurance companies. Regional banks ETF (KRE) definitely is taking a hit as equity holders of the midsize banks are more worried and selling. I end with two individual companies next in line of fire – Credit Suisse (CS) shows the markets saw troubles for awhile, and First Republic Bank (FRC) that despite getting the $30 billion deposit infusion and access to Fed lending, the market is leaning toward the bank not making it.

Q11 – Is there some credit risk on the banks’ balance sheets?

A11 – For sure. But relative to 2008, banks are required to hold much higher quality assets and subject to tighter loan underwriting. But they still have some risk. One area of credit concern, also related to fast rate moves, are real estate loans, especially commercial. To the extent a bank has high concentration here, that is worth monitoring… as the market has been doing recently.

That is a brief but broad summary of the recent banking events. Any time a series of banks go under is cause for concern. As the higher rate environment works its way through the system, pockets of stress pop up in places, or at least in different forms, than one may expect.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com