Asset Class Returns - 2/28/2023

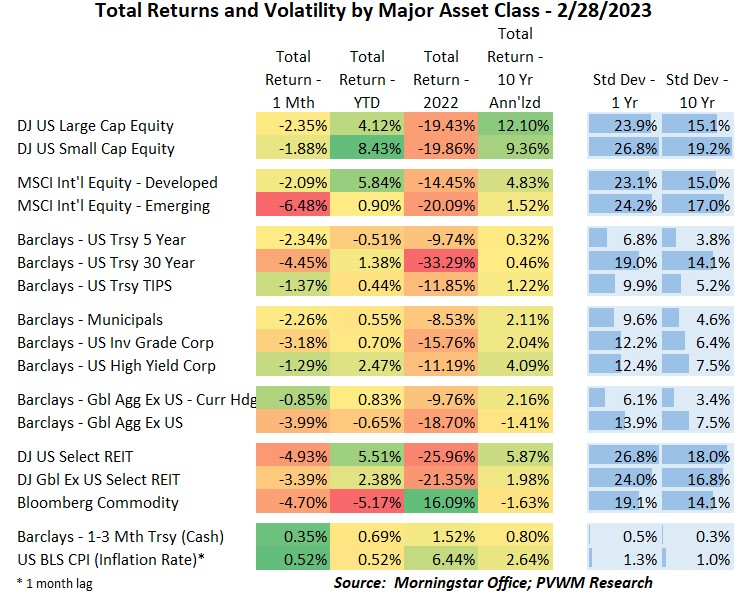

Recall the year started off strong in January with all major asset classes higher except for commodities. The bond market was also pushing against the Fed, with rates falling across all maturities in anticipation of Fed rate cuts later in 2023. Then a red-hot January jobs report was released in early February and rates rose substantially, retracing the drop in rates from January and a bit more. This was reinforced by hotter than expected inflation readings – CPI mid-month and PCE end of month. Looking at the table above, Emerging Markets and REITS had the largest losses for the month, though long-dated treasuries saw similar losses, down about 5%.

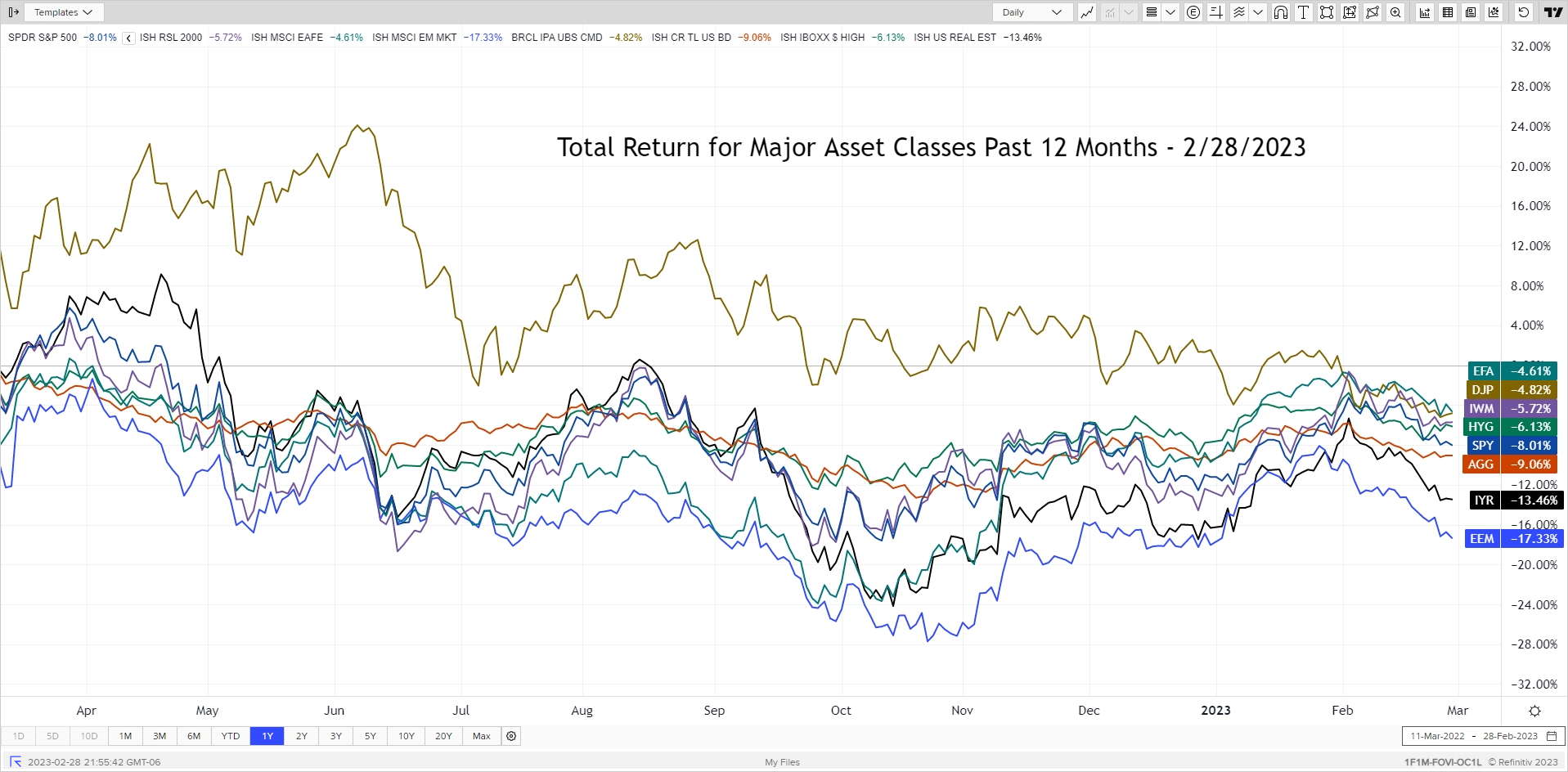

The major asset classes graph below shows the total returns for the past 12 months. You can see the reverse in returns starting at the beginning of February for all asset classes. It is interesting to note the two extremes are both international equities – developed markets (EFA) leading while emerging markets (EEM) trailing the most. The next two lowest returns are from rate sensitive asset classes. US REITS (IYR) were not only hit by the reversal in rates but also some cracks showing up in commercial real estate. The US Bond Index (AGG) is down but note you are now getting paid a reasonable yield on the index which offsets some price loss. Unfortunately the losses are seen quickly with rising rates but the yield is slowly earned over the course of the year. At the sector level, Tech and Industrials saw the highest return while Energy and Utilities were laggards.

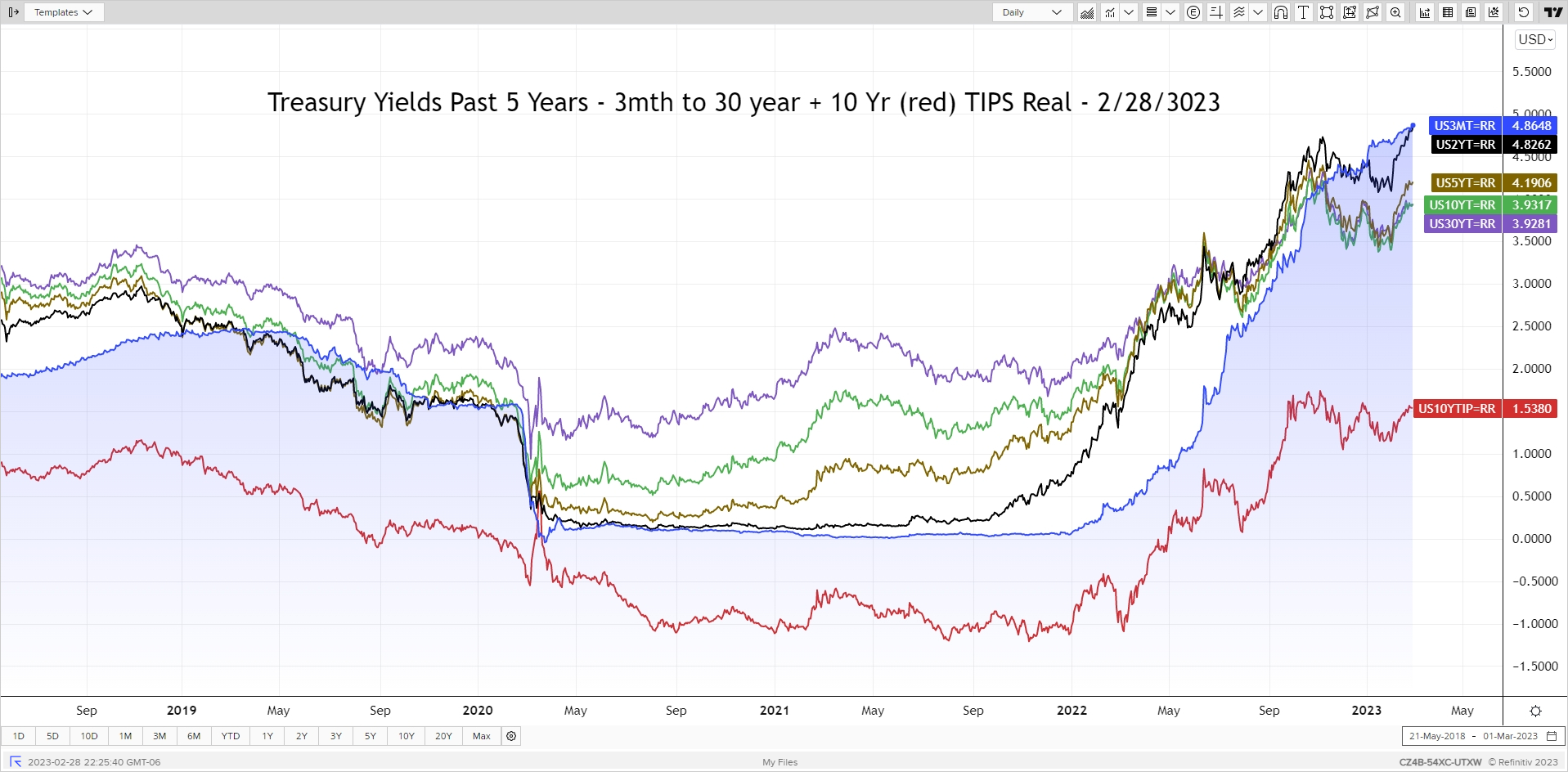

Rates reversed course at the beginning of February and are now higher than beginning of year levels, though not as high as the peak last fall – except for short-term rates. There was a significant repricing of likely rate hikes in the future which can be seen by the rapid rise in 2-year rates (up about 0.70% for February alone). The slow and steady 3-month Treasury Bill continues to top the chart at over 4.85% but the 2-year is rapidly catching up. Unfortunately this rate rise is showing up in higher mortgage rates after a welcome drop in mortgage rates in January. Real yields on TIPS also rose back to relative highs, clocking in above 1.50% again. Recall with a TIPS bond you get this fixed real yield plus actual inflation (via an increase in par amount of the bond).

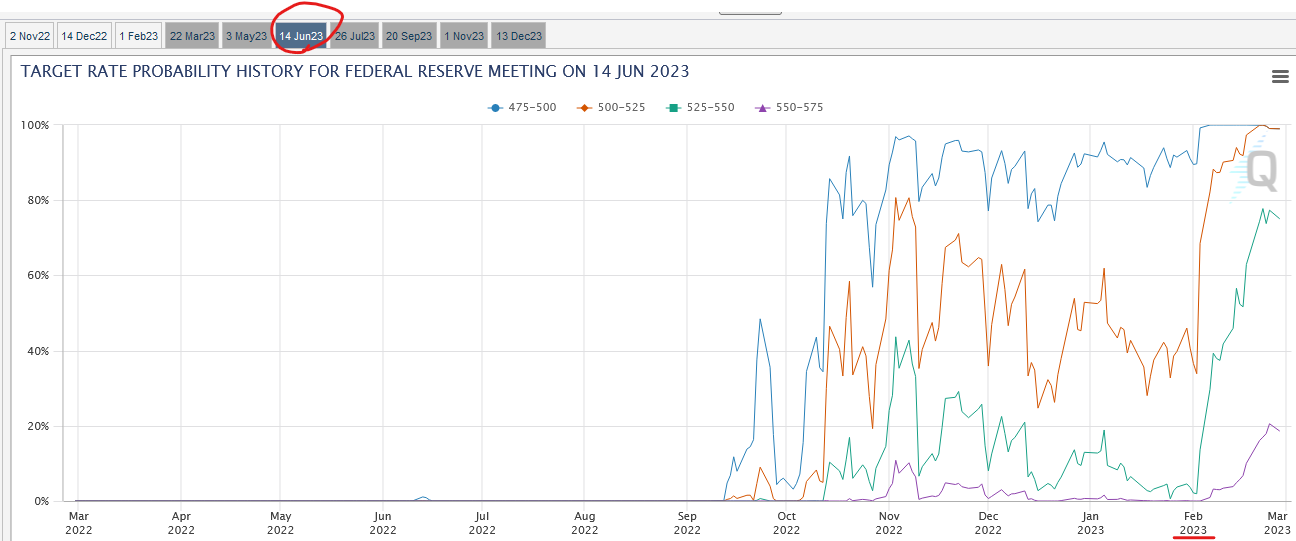

It was quite surprising how much the market reversed its view of the likely Fed path on rising interest rates. This is captured nicely by the CME FedWatch graph below. After the FOMC meeting on February 1st the Fed Funds target range stood at 4.50% to 4.75% and the probability of two more rate hikes as implied by Fed Funds futures was less than 50% (see orange line below). After the strong jobs report and higher than expected inflation readings, the chance of not only another 0.50% but even a 0.75% increase over the next three meetings now is being priced in at close to 80% likelihood (green line). A 1% higher level from here even has a 20% chance priced into the market (purple line). This is a significant shift. The next FOMC meeting concludes on March 22 and includes the Fed’s updated economic projections. In addition to the target Fed funds rate at year-end 2023, the inflation estimate will also be interesting to note.

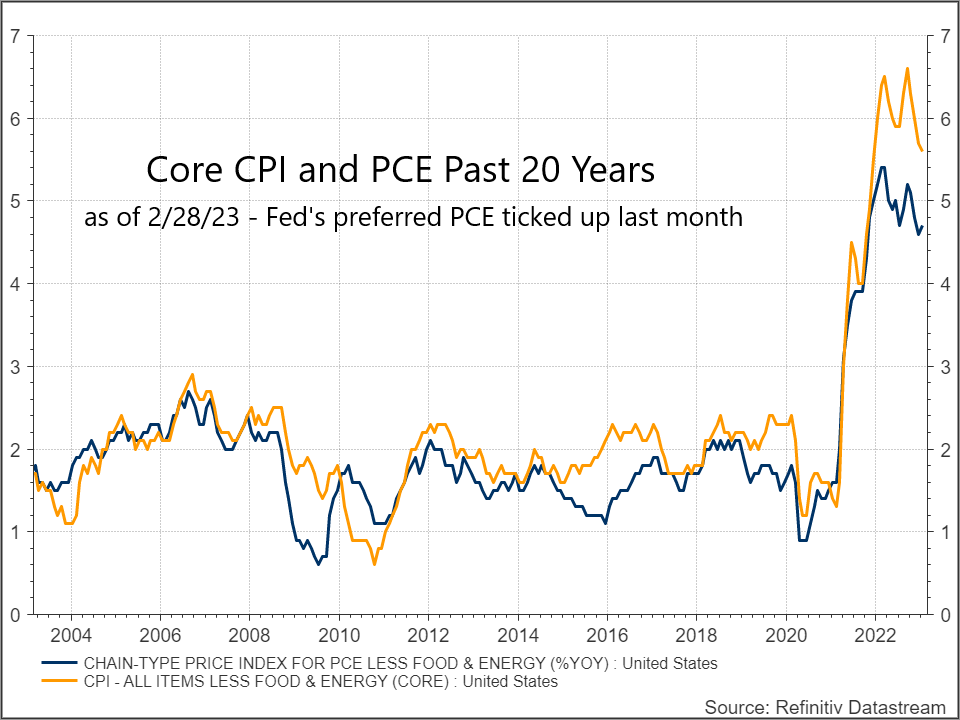

Given the focus on inflation, a key driver of current Fed action, below is a graph of two different measures of core inflation (excluding the volatile food and energy components). The Consumer Price Index (CPI - orange) is the inflation reading commonly reported in the media and released mid-month while the Personal Consumption Expenditure (PCE - blue) is the index the Fed follows and is buried in the Personal Income report at the end of month. Recall the Fed’s stated target is getting inflation back down to 2%, though some believe that may need to be adjusted up a bit. Regardless, a long way to go which is why short-term rates are rising.

With Chicago winters, it is nice if the first part of the year goes by quickly. And for those looking to enjoy some after-work daylight, enjoy the “spring forward” on March 12th. Sorry early-bird exercisers!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com