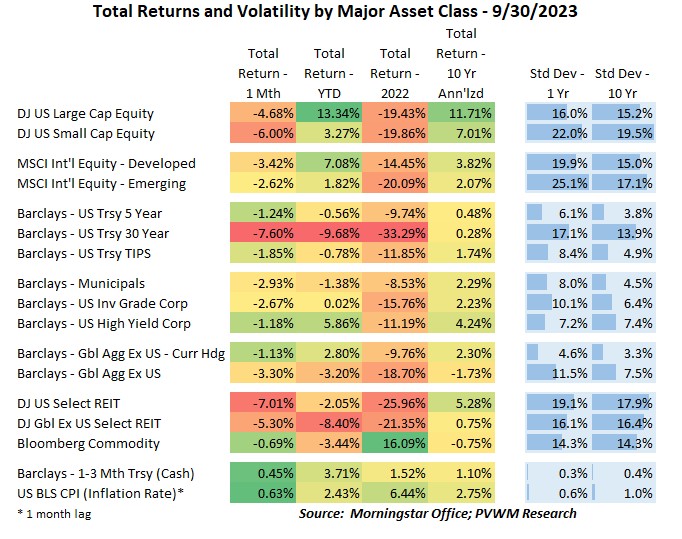

Asset Class Returns - 9/30/2023

All monthly returns are negative except cash and inflation. You will also notice the biggest negative belongs to long-maturity treasuries. The price sensitivity for 30-year bonds – called duration – is 16.2 which means if rates rise by 1% the first-order estimate of bond price change is -16.2%. For September the 30-yr Treasury rate rose about 0.50%. Using the duration formula to approximate how bad returns will be hit: price change = - duration x rate change. So 30-yr price change = -16.2 x +0.50% (0.0050 in calculator or spreadsheet) = -8.1% (0.081 in calc/sheet). That formula should be seared in the brain of every bond investor and you should always know what the approximate duration of the bond funds (or bonds) you are buying.

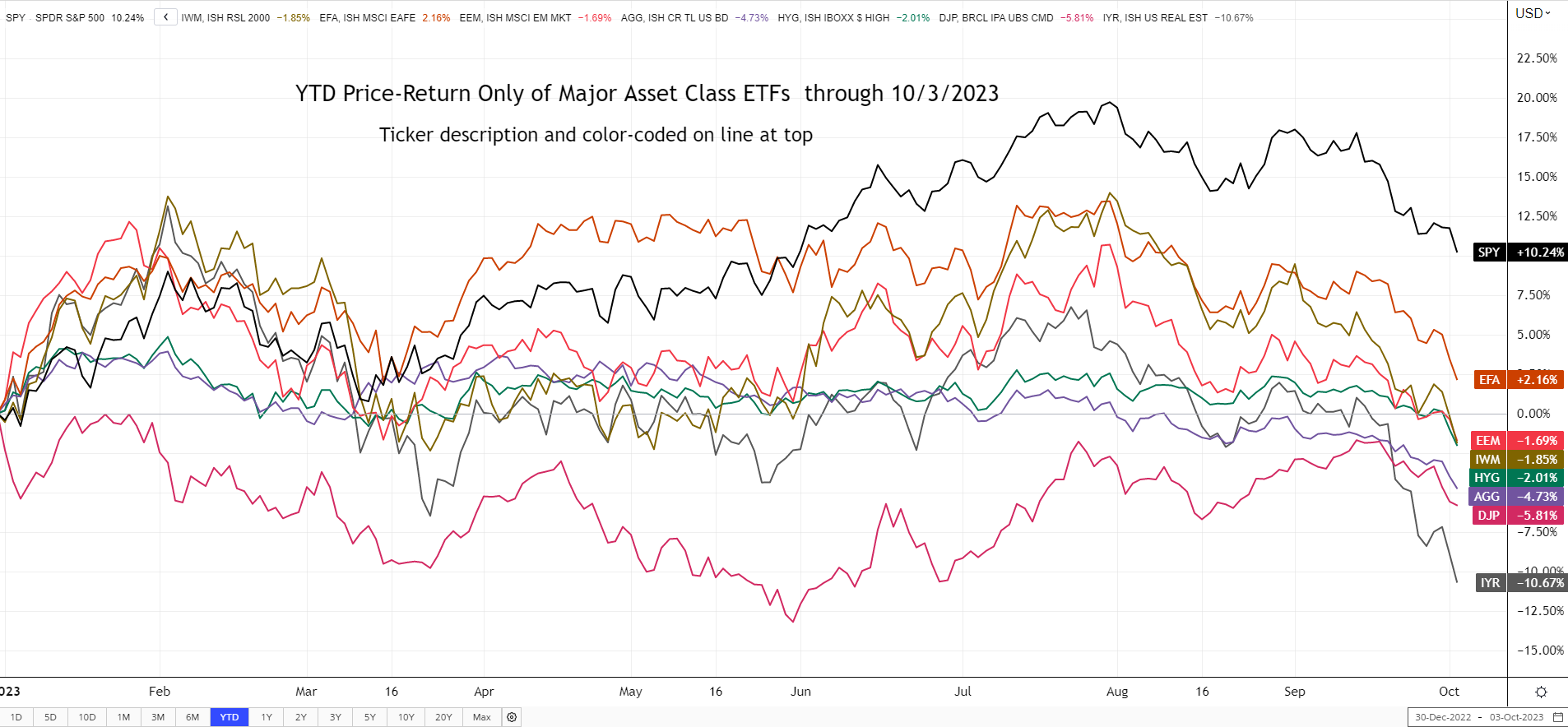

The graph below shows the usual YTD price-return of major asset class ETFs. The mountain peak from the end of July continues to look more distant after another month of a fairly significant pullback. The surprising thing is most of these major asset class ETFs are now negative YTD (note this is price only; ignores dividends and interest – fixed next month!). In addition to the bond ETFs (AGG, HYG) which had noticeable moves lower, notice the sharp drop off in REITs (IYR) as not only the rising rates impacted price but also the market is finally beginning to price in potential major headwinds in commercial real estate. I heard on a podcast recently that public REITs are the cheapest relative to private REITs in a very long time. However, my take is that private REITs have not been properly marked down yet like public markets do every day. Also note Commodities, while on the lower end of the return pile, held up relatively well recently with a kiss from the Energy sector.

Turning to the treasury rate graph – WOW!

As I mentioned in last month’s blog post, the longer end of the curve bears watching. You had to watch it quickly because it was on the move – higher. Even the real yield from 10-year TIPS (red line) moved in line with nominal rates, indicating it is not an inflation scare driving rates up recently but a repricing of bond risk based on a Fed who will likely keep short-term rates higher for longer and a large amount of treasury debt coming due to refinance. Oh yeah, the Fed also continues to not reinvest $95 billion each month from their balance sheet, adding more supply to the market. More supply => prices down => rates higher.

Yes the 3-month T-Bills are still hovering around 5.50%. I assume you have checked your bank statements by now.

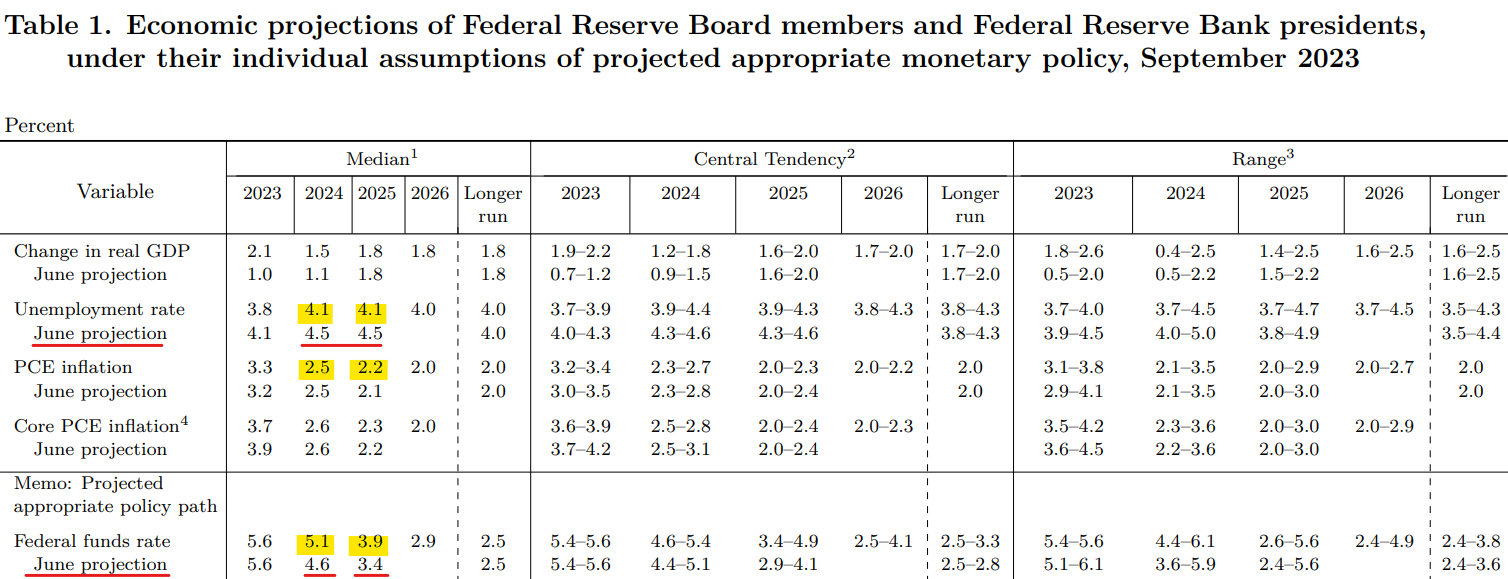

At the FOMC meeting that concluded September 20th, the Fed didn’t raise short-term rates and the statement had very few changes from the previous meeting. However, the main focus was on the Summary of Economic Projections that is released four times per year. It captures the views of Federal Reserve Board members and all twelve Federal Reserve Bank presidents (not just voting members). Not only did the collective median show the expectation of one more hike in 2023, it also showed the rate by the end of 2024 to be 0.50% higher than previous June estimate. If that wasn’t surprising enough, the other economic projections of GDP growth, unemployment and inflation continued to show a very mild economic backdrop that many call the Goldilocks scenario… just right. At least as projected…

With the recent release of “Dumb Money” – the movie about the stock frenzy of GameStop in early 2021 – I am providing a link to my blog post at that time that explains some of the key drivers of GameStop and other stock frenzy. If planning to see the movie, before you click on that luxurious seat at the theatre and butter up the popcorn, read my blog post for the backstory to see how many of the characters and key drivers are included in the movie.

Using Thin Mints And FAQs From My Lovely To Explain GameStop

Hello October – the best month of the year!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com