Using Thin Mints and FAQs from My Lovely to Explain GameStop

The news this past week was dominated by stocks like GameStop and AMC, brokerages like Robinhood, and the little guy taking down the short-selling hedge funds. Other notable stories include Brady and Bucs going to the Super Bowl and Anheuser-Busch not running a Budweiser Super Bowl commercial (though still running Bud Light and other related ads), but I digress.

There are many moving parts involved with GameStop and Robinhood. I am going to start with a story to explain Thursday’s action when some forms of buying particular stocks were limited (could still sell). I will then revert to a Q&A format to touch upon various questions posed to me or important points to clarify from my week of reading articles and Twitter feeds.

My story of a Mom in charge of Girl Scout Troop cookie sale.

Jane is the mother of a Girl Scout and has been collecting the cookie sale orders and money for the Troop to submit to the Local Council and ultimately Girl Scouts of the USA. Jane is well-organized and runs a tight ship, so this has been routine for the past few years. She always gets last minute orders from parents (usually more Thin Mints) but it always works out in the end.

This year, orders for Thin Mints poured in from parents the week before the deadline. Jane could handle it and received checks for the orders but given the large size, she let the Local Council know to make sure orders could be filled. They said yes, but to be safe, also let Girl Scouts USA know.

Jane kept taking in Thin Mints orders, many via text vs. door-to-door, and collecting the checks immediately was becoming increasingly problematic. Some requested large orders but still had to verify with their family. Jane followed up quickly for checks but decided to submit all orders to the Local Council the morning of due date even if she didn’t have all the checks in hand. Besides, in the past Girl Scouts USA only needed a quarter of the money when orders were placed and the rest upon delivery.

During lunch Jane got a call from the Local Council saying that due to high demand of Thin Mints, Girl Scouts USA was requiring all money up front for Thin Mint orders only, not just the 25% they needed for the other cookies since a new cookie producer was added with higher costs. Jane would need to submit the funds by 3pm that day. Jane knew most of the parents were ‘money good’ but some text orders were from people she didn’t know and some non-committal. She was also receiving many texts for new orders of Thin Mints throughout the day but only had so much money in savings to cover orders without checks. She immediately texted back allowing a lower number of boxes of Thin Mints but not an increase, though still open for other cookie orders. Jane had to ask other Moms to pitch in to cover the orders’ cost. When a text came in at 2:55pm from Jane’s volunteer replacement for next year asking for 20 boxes of Thin Mints, Jane had to say, “sorry, we are only accepting cancellations of Thin Mints, but can take other orders.”

NOTE: Here is the last paragraph inserted with this week’s players.

During lunch Jane (Robinhood) got a call from the Local Council (clearing broker) saying that due to high demand of Thin Mints (GameStop), Girl Scouts USA (NSCC/DTCC) was requiring all money up front for Thin Mint orders only, not just the 25% they need for the other cookies since a new cookie producer was added with higher costs. Jane would need to submit the funds (100% collateral instead of 25% for select stocks) by 3pm that day. Jane knew most of the parents (traders/investors) were ‘money good’ but some text orders were from people she didn’t know (credit risk) and some non-committal (conditional orders). She was also receiving many texts for new orders of Thin Mints throughout the day (momentum traders) but only had so much money in savings to cover orders without checks (Robinhood capital). She immediately texted back allowing a lower number of boxes of Thin Mints but not an increase, though still open for other cookie orders (only allow sales of GameStop, not new buys; can still fully trade other stocks). Jane had to ask other Moms to pitch in funds to cover orders ($1 billion capital raise from Robinhood investors and bank lines Thursday afternoon). When a text came in at 2:55pm from Jane’s volunteer replacement for next year asking for 20 boxes of Thin Mints, Jane had to say, “sorry, we are only accepting cancellations of Thin Mints, but can take other orders.” (ticked off Robinhood traders in GameStop that may leave platform).

For those who want to dig deeper, here are some common Q&A's (I don’t have all the answers). Warning - it's long.

Q1 – First of all, where can I get some Girl Scout Cookies?

A1 – I can’t help, but ask your neighbor or friends – just be sure to pay up front!

Q2 – Before I ask about all the terms above, I know why Thin Mints are popular, but why did GameStop become so popular?

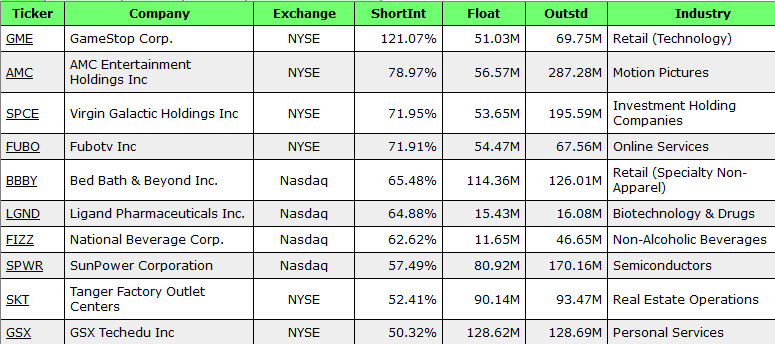

A2 – GameStop (and about 10-15 other stocks) got the attention of discussion groups on Reddit and other Social Media platforms most recently due to a large short position in stocks. These groups wanted to encourage many buyers to force a rise in price to knock out the short sellers (further explanation below).

Q3 – Who are these discussion groups and do they also issue buy ratings like other Wall Street firms?

A3 – Some of these discussion groups were in place for years and genuinely interested in discussing different stocks and what they were missing vs. the negative views of the marketplace. They do not publish research reports on stocks but that doesn’t mean they don’t look at a company’s business model and have a view. Yes, the price movement has gotten extreme this week but these groups should not be dismissed or ignored. Here is a WSJ article on one of the main Reddit forum participants who drove the action. Here is a post from Reddit WallStreetBets - r/wsb - from four months ago that described the plan (Source: Twitter feed from @chamath).

Q4 – What does a stock in a company represent and who trades it?

A4 – In general, a company issues a certain number of shares with each share representing a fractional ownership. During the initial public offering (IPO), investors give dollars to the company in return for the stock. The company uses the money to conduct business and generate profits. The amount paid per share is the share’s ownership of present value of future company profits plus a little (or a lot) of new deal heat. After the IPO, investors trade these limited shares with others, agreeing to a price. Fundamental investors focus on the present value of future earnings; Momentum investors focus on recent price movement. The resulting price can differ between these investors (sometimes substantially) leading to certain types of buyers dominating a stock at a given time. Note the company notices stock price movement but the price itself (except at extremes) does not directly impact the company’s operations. It can impact their behavior and incentives.

Q5 – What is this “short position in stocks” you speak of?

A5 – Most investors think of either owning or not owning a stock. If you like a company’s stock price (or price movement), you buy it. An existing owner of the stock who doesn’t like it can sell. These owners are “long the stock”. You may have heard the expression “buy low and sell high”. But what if you dislike the stock price and would prefer to “sell high and buy low”? This is called short-selling but the person selling the stock must first borrow the shares from someone who already owns it and pay the stock owner an agreed upon interest rate while they borrow (called securities lending). Once that person has use of the security, they can sell it to someone else with the hope of buying it back later at a lower price.

Q6 – Are you serious?! Don’t you have people “double owning” the same shares? And couldn’t they just keep going and have quadruple and even higher number of owners of the stock?

A6 – Kind of yes to the first part and no to the second. You do have people “double owning” the price movement but there is only one true owner. The owner gets the dividends (if paid by company), vote the shares and call the shares back when they want (subject to securities lending terms). However, the amount of shares shorted is limited to 100% (in theory) so it can’t just keep going to quadruple and higher levels.

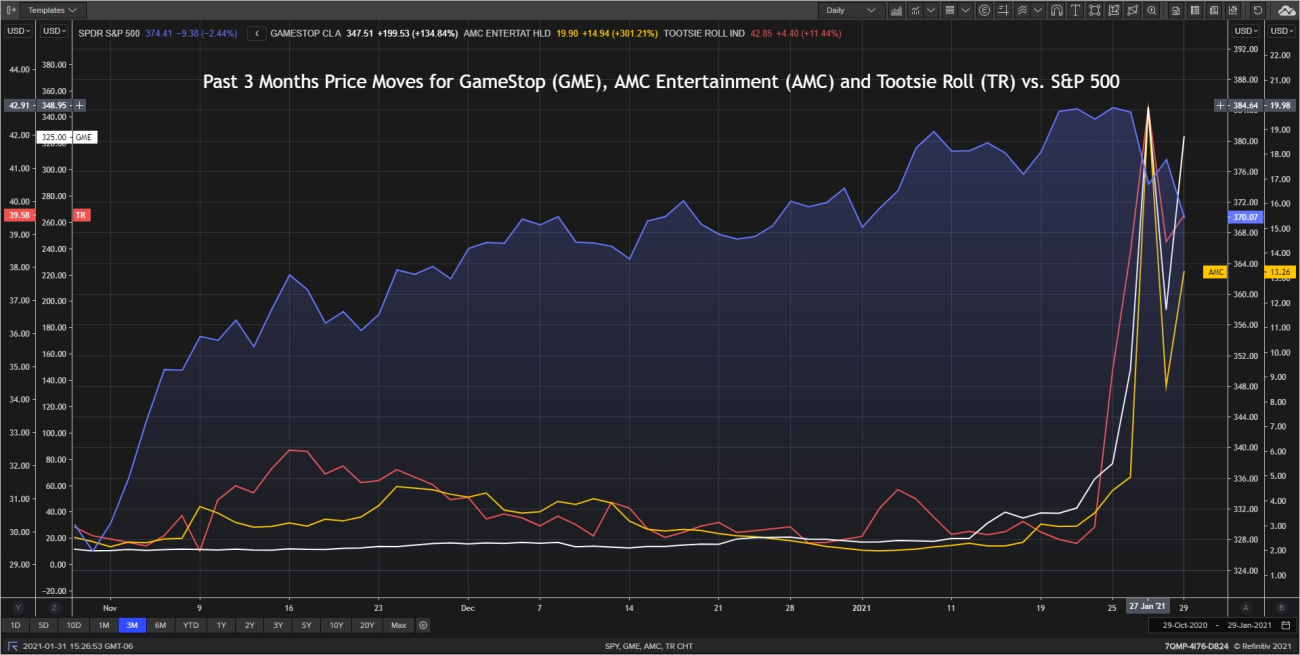

Q7 – So why did GameStop stock (not the company) and other stocks become as popular as Thin Mints? And didn’t they have over 100% short interest?

A7 – The answer lies in what can potentially happen when a large % of shares are shorted. But first supply/demand dynamics. When you have more buyers than sellers the price goes up; more sellers than buyers and the price goes down. GameStop (and about 15 other stocks) got the attention of discussion groups on Reddit and other Social Media platforms due to a large short position in stocks. The discussion groups realized if many people started buying the stock (or buying call options to get even more pressure – see later) they could force the stock price up causing the short sellers to incur large losses and close down the short – buying back the stock and driving the price even higher. And yes, GameStop did have over 100% by some measures and I expect will be a source of regulatory investigation. To be clear it was over 100% collectively, not from a single hedge fund.

Q9 – Aren’t these short sellers evil anyway and they have what’s coming to them?

A9 – Depends who you ask. Elon Musk doesn’t like them and offered “shorty shorts” after his stock went up strongly (but nowhere near GameStop). Others like short participants given their contrarian view on the stock and it keeps management focused. Short sellers can also help sniff out aggressive accounting practices or even fraud.

Q10 – How long has this been going on in GameStop? Have any short-sellers gotten hurt yet or were they bailed out by the government?

A10 – As mentioned earlier, the discussion groups have been in place for years. GameStop stock traded below $20 for some time. After January 12th the stock broke through $20 and hit $40 in two days, stayed there about a week and exploded to the upside with the most action occurring after Jan 25. A couple of short-sellers definitely got squeezed and were forced to close their short positions, adding even more buyers than sellers and pushing the stock price even higher. One in particular was Melvin Capital which required a $2.75 billion capital infusion announced on Monday Jan 25 from two private investors (not the government) – Citadel LLC (owned by Ken Griffin) and Point72 (owned by Steve Cohen where Melvin Capital founder used to work). Citron was also forced to close their shorts and announced the discontinuance of publishing short reports.

Q11 – What happens if/when the short sellers are gone, the momentum stops and holders of the stock realize the price is quite a bit higher than the present value of future earnings?

A11 – That is an interesting question. A few believe the fundamental price should be that high and will be happy to continue to hold. More than likely the price begins to fall as more sellers than buyers emerge but not clear when. Those that got in early may still take out a profit or continue to hold knowing they shook out the ‘evil short-sellers’. Others may lose a large % of their investment in this stock (but hopefully not a large % of their net worth) but they are ok with that because they rallied around their community and stuck it to the ‘evil short-sellers and the system’. Here is some recent price action for a few stocks on the "large short interest" list.

Q12 – Explain again in non-cookie terms Thursday's trading restrictions. Why was that needed?

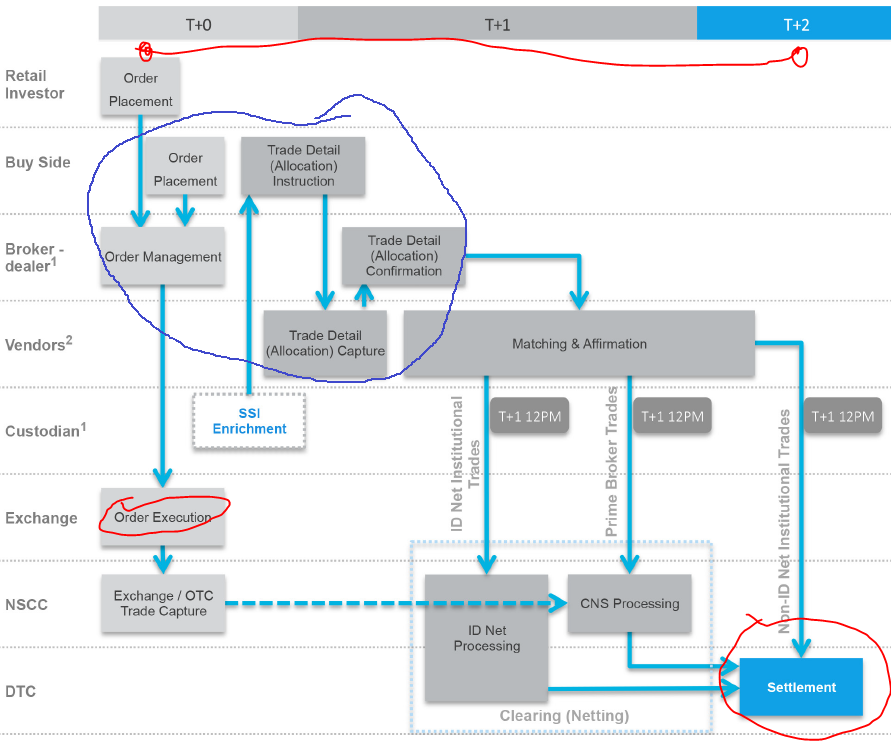

A12 – The main point to understand is even though a stock is traded at an agreed upon price, the actual dollars don’t exchange hands until two days later – called the settlement date or “trade date + 2” or “T+2”. The technology is there to handle immediately but the regulations and bank settlement process causes the delay. Robinhood fulfilled both executing and clearing functions (blue circle below). The NSCC/DTC is responsible for making sure everything settles. Since this step occurs two days later the NSCC always requires clearing firms to post a % of the net value of all trades for a given stock to minimize credit risk. The NSCC changed the amount required on Thursday given the large moves based on the Margin Liquidity Adjustment Charge in their power. If there is a chance one party won’t be able to deliver on their commitment on settlement date they want to minimize the financial impact. Robinhood also has a blog post explaining this process from their perspective.

Q13 – Is it common for NSCC/DTCC (and even some brokers) to change the rules overnight?

A13 – Not common but can happen. When you focus on the credit risk mitigation you can understand why, when volatility or price moves increase substantially there is more risk in the system. NSCC/DTCC and other clearing firms are responsible for making sure things settle properly and the system can survive and live to fight another day.

Q14 – The DTCC has quite the power. Is this a government agency or who owns them?

A14 – It is not a government agency and this is where things will get interesting to some skeptics. The DTCC is a user-owned by the major brokerages and banks involved in the settlement process. This may set off a group of readers. But I ask who should be put in control of this ultimate clearing entity – the government? I would say definitely no to that. The current ownership in my view strikes the right balance of incentive to keep the process functioning smoothly to help business continue but also have the right skill sets and disciplines for risk management when risks and potential loss is running high. Before there was the physical exchange of paper certificates with messengers and paper and pen. It cost a few more dollars per trade back then.

Q15 – If Robinhood allowed sellers but not buyers of GameStop, how were people able to sell?

A15 – With a different broker. Not all matching buys/sells occur on the same brokerage. Some larger brokerage houses who had more capital and more importantly a diversified business flow were able to take on new buys and still meet DTCC capital requirements. These would have been the opposite buy trades for the Robinhood platform sellers.

Q16 – You said Robinhood still allowed selling. How come I wasn’t able to sell GameStop when I wanted to on Thursday and Friday?

A16 – That may have happened due to trading halts put in place by exchanges for single stocks after the flash crash of 2010. If a single stock moves by more than 10% (up or down) trading is halted for 5 minutes. This is different than broad market decline triggers which have been around much longer and have different trigger %'s.

Q17 – I heard Citadel owned Robinhood. Is that true?

A17 – No. But they do have a business relationship. Robinhood doesn’t charge for trades but they do sell the order flow to market makers, including a large portion to Citadel Securities, a separate entity from Citadel LLC that invested $2 billion into Melvin Capital on Monday. Both are owned by Ken Griffin. Speculation among some participants swirled that Thursday’s action by Robinhood to restrict trading was driven by Citadel LLC, not the NSCC/DTCC, to help ease pressure on short sellers, including Melvin Capital. I do believe NSCC/DTCC was the direct driver, not Citadel or other players. The Citadel firms have firewalls between each entity but I’m sure this too may be part of the likely regulatory investigation.

Q18 – Ok, you are still with me so I’ll mention options. I hear Robinhood participants are heavy user of options. Does this add to the price action on a given stock?

A18 – Yes. In summary, you can purchase a call option for a fraction of the amount it would take to buy actual shares. If a dealer sold the option they must buy enough stock to hedge the risk. As the stock goes up in price they must buy more stock as the hedge. This leads to more stock exposure created by options (equivalent to the delta of the options) that can swing the market. As an example, if I wanted exposure to 100 shares of Tesla I could by the shares for about $79,000 or I could buy 1 March call option at current prices for about $8,400, or 10% of the money up-front. But… a big but… the March call will expire worthless in 47 days if Tesla trades at or lower than current. Near-term traders trying to push on a stock price may not care as much but you should and use them very, very carefully. GameStop options are currently much more expensive for a similar structure as above - about 50% - but likely in similar ballpark before January 12th when they started pushing it higher and vol picked up. This strategy was discussed heavily on Reddit discussion groups. A similar phenomenon was experienced last summer with some tech companies moving up very quickly in August and turning down very quickly in September.

Q19 – Are there any collateral market impacts? Do any ETFs hold GameStop?

A19 – When a fund gets the tap on the shoulder from risk management to shut a position down, the fund has to sell what it can. Often times that is high quality securities that have fallen the least (so far). This selling drives down the price of common holdings as occurred toward the close on both Thursday and Friday. If a larger hedge fund goes down or a clearing firm is not able to meet collateral (Robinhood had to raise funds on Thursday) that could cause turmoil in the broader markets. At the product level, the Retail ETF (ticker XRT) owns GameStop. XRT is structed as an equal-weighted ETF and GameStop started the year at 1.6% weighting (Source: Refinitiv). According to Bloomberg reporting on Friday it is now close to 20% weighting. The recent strong performance is dominated by GameStop. Given that ETFs can take physical delivery of the underlying stocks upon closing down could make the flows interesting since the stock is in high demand. If you owned XRT (or any of these stocks) in advance of all this, revisit your intent vs. current price levels.

Q20 – Do new rules need to be put in place by the SEC or is the current structure able to handle and all investors are big boys and girls and aware of the risks going in?

A20 – There will likely be enhanced enforcement of limiting short sales to 100% (or maybe lower down a bit for buffer). Beyond that, having the SEC or some other body stepping in to say when a given price is too high (or too low) is not a path I want to go down. There may be enhanced disclosures on how trading can be restricted due to collateral requirements while still allowing those who want to invest and trade continue to do so. When and how additional requirements are announced also warrants a review. But requiring additional capital during very volatile markets adds stability to the system and protects those investors not directly involved with a name like GameStop.

Q21 – So does this mean I shouldn’t just focus on “free trades” when searching for a trading platform like Robinhood?

A21 – Yes.

No honey, I am not invested in GameStop. Heck, I didn’t even get any Thin Mints.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com