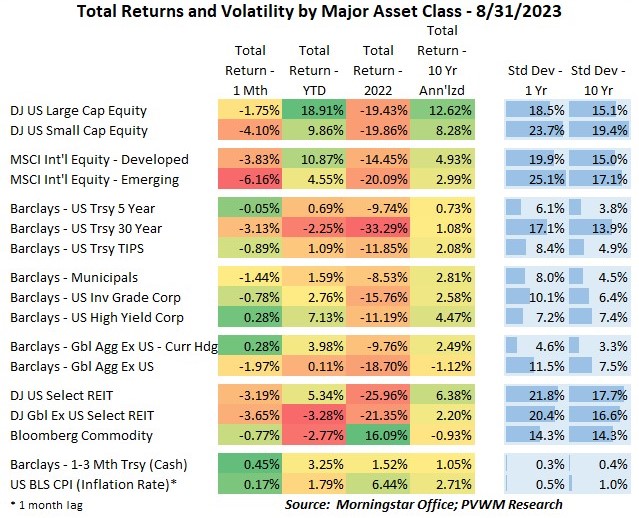

Asset Class Returns - 8/31/2023

The table above shows an overall negative month, though many markets were noticeably lower mid-month before holding steady, then turning upward in the last week. Fed Chair Powell speech in Jackson Hole leaned to the hawkish side (will keep rates high) but the markets didn’t seem to care. The US Large Caps were down just under -2% for the month while the US Small Caps fared worse, down just over -4%. International equities were also weak, especially Emerging Markets led by China. REITs didn’t fare any better, with the added headwind of higher rates. Speaking of which, most bond indices were down noticeably for the month with the exception of high-yield and non-US bonds.

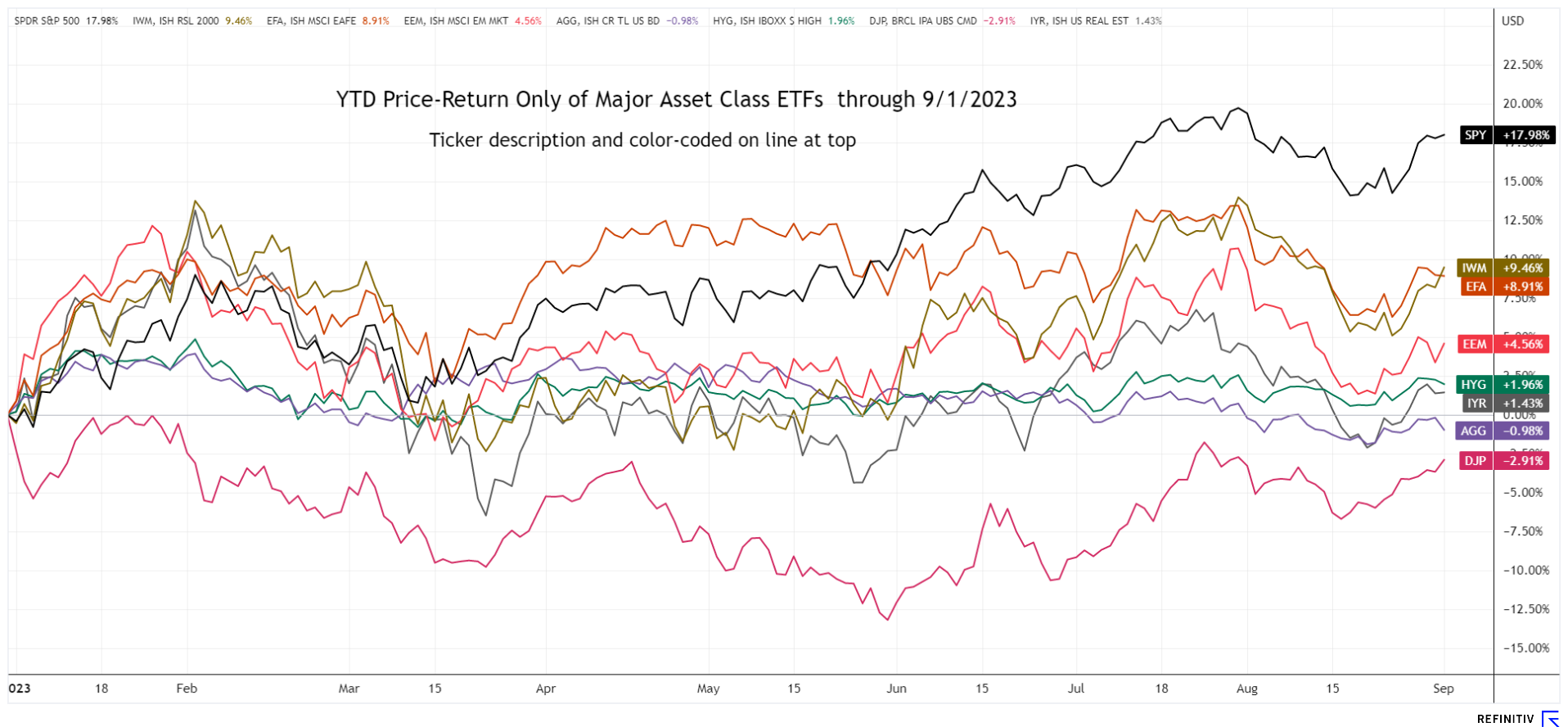

The graph below shows the usual YTD price-return of major asset class ETFs. You can see the relative peak from the end of July followed by a noticeable drop through mid-month before stabilizing, then rising again into month-end. The one exception would be the US Aggregate Bond index (AGG) – recall this is price only so excludes eight months of interest – which has been flat’ish on the year. You can see the largest drop for the month coming from emerging markets, but that asset class also reversed course. The surprise to me is the High Yield asset class which has been holding up all year. With the same reminder of price-return only, high yield has a nice carry (interest income) which is why the total return value in the table at top shows a much higher value (and different security v. index).

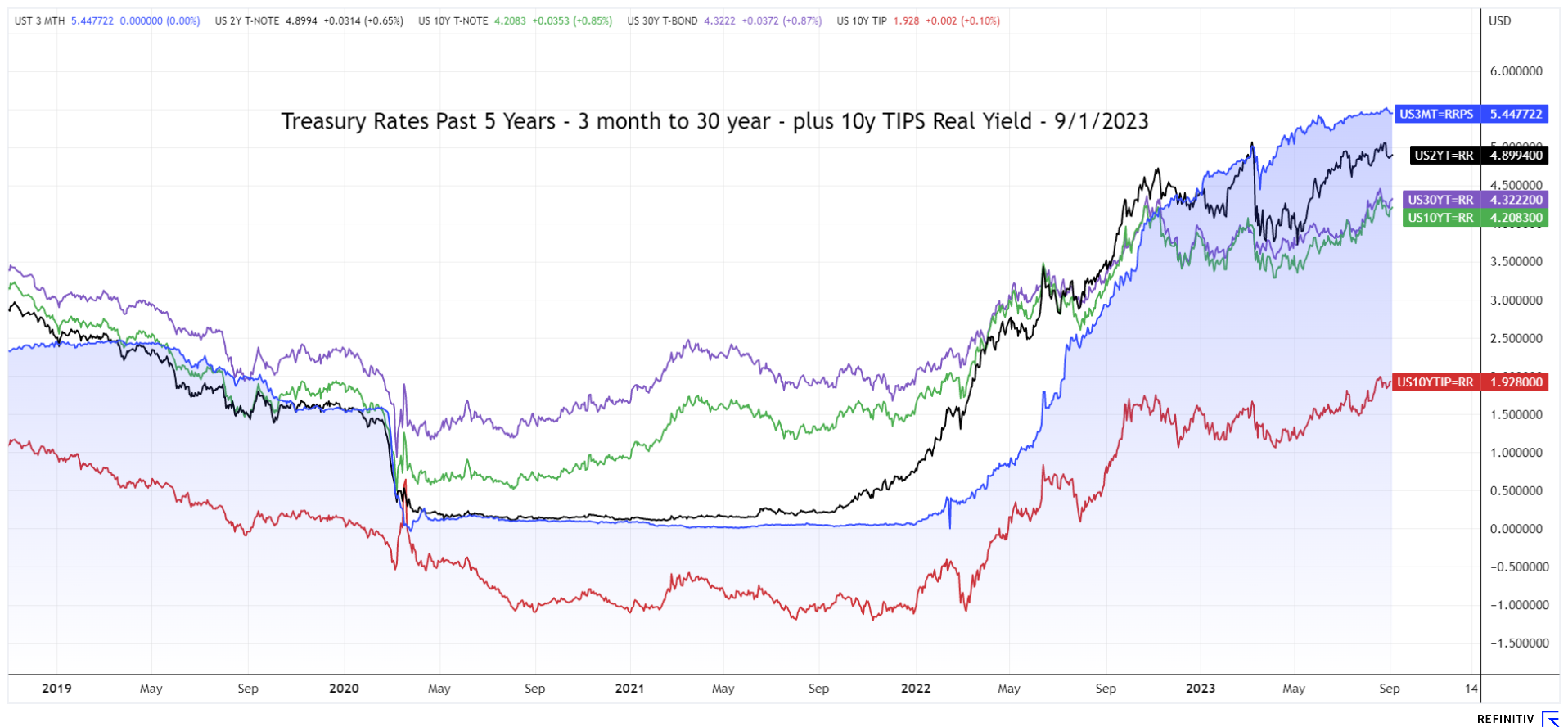

Turning to the treasury rate graph, all rates seem… higher again this month, with the exception of 2-year which is “unch’ed”. Yes the 3-month T-Bills are hovering around 5.45% and continue to taunt your bank accounts! I mentioned last month that the long-end (10-yr and 30-yr) was quietly drifting higher. The first part of this month the long rates continued moving higher but this time much louder – up about 0.20% - 0.25% the first few weeks alone. They cooled off a bit (rates fell) along with the equity rally late in the month but bears watching.

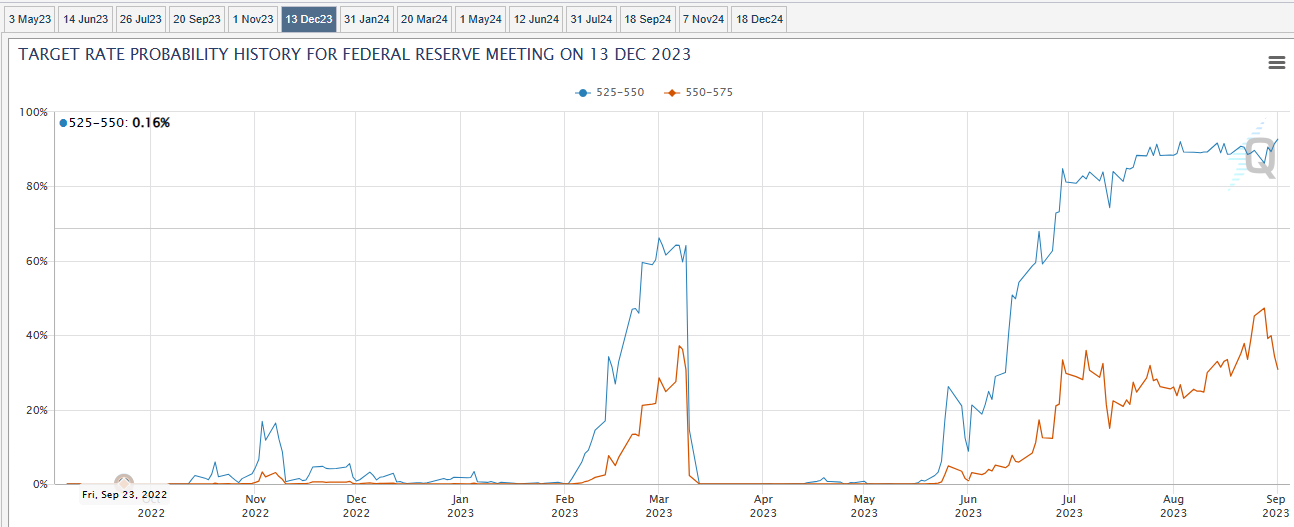

There was not an FOMC meeting this month. However, the Jackson Hole Economic Symposium was held and Powell gave a much watched speech on August 25th. Overall it was a hawkish speech – meaning no indications of cutting rates anytime soon. Powell remained consistent in that the Fed has done a lot already in raising rates and the effects will take time, but will continue to watch the data and raise if the Fed deems necessary. Powell also stated in bold terms that the Fed’s target inflation rate remains at 2%, putting ice water on some market participants speculating the Fed may be content with inflation in the ”mid-to-high 2’s”. Recall the Fed used PCE, not CPI, for their target. See my recent blog post on inflation. The Fed Funds futures market was pricing in close to a 50% chance of one more hike before year-end toward the end of the month, but dialed that back a bit after a slightly cooler – though still solid - jobs report last Friday (orange line; Source: CME FedWatch Tool - 9/1/2023).

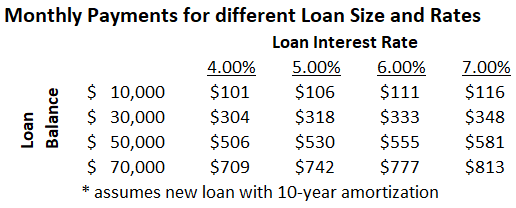

The special topic this month is student loans. After a 3.5 year moratorium on requiring student loan payments and freezing interest accruals, effective 9/1/2023 the interest started accruing again and monthly payments will be required starting in October. The impact on consumer spending remains to be seen but referencing the different monthly payments required on a new loan with 10-year amortization, the monthly amount required to be redirected in one’s budget can be substantial. Actual monthly payments required will depend on how long a loan was amortized prior to the March 2020 moratorium and loan terms.

Enjoy the still warm days and crisp evenings of September. … and the football!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com