Asset Class Returns - 7/31/2025

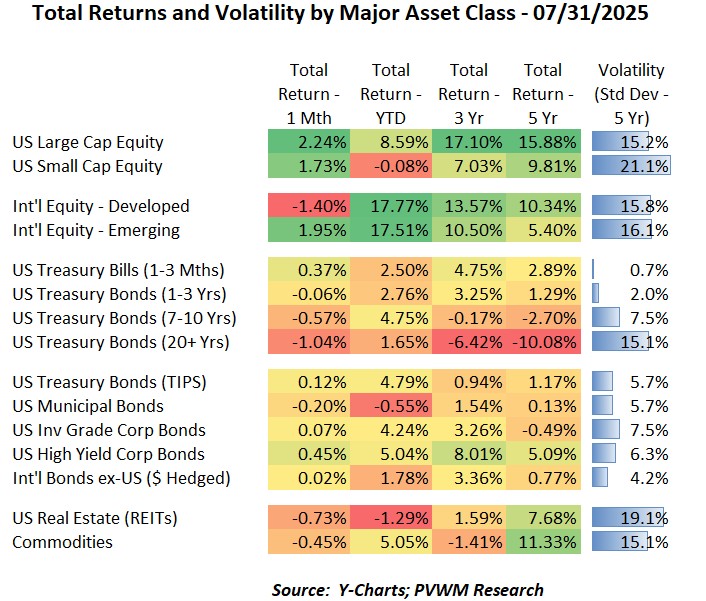

This month’s total return table was mixed. US equity – both large and small - had a solid month. The YTD returns for Large Caps are showing respectable returns, a far distance from where we were in early April. Small Caps have been putting up a good fight lately but still lag by about 8.5% YTD. International equities were mixed, with Developed markets down while Emerging powered ahead, showing similar monthly returns as US equities. The YTD returns for both Developed and Emerging are now on top of each other – and remain substantially higher than US equity returns. Treasury bond total returns were negative for the month, except for TBills. The long end of the curve continues to lag YTD as different dynamics – debt supply, lingering inflation uncertainty, lack of demand – continues to weigh on longer paper. The various credit-related indices are relatively flat for the month, indicating a slight tightening in spreads to offset the rise in treasury rates. Notable in the YTD column for bonds is the negative return for Muni’s. For investors in the higher marginal tax brackets, that asset class deserves some attention.

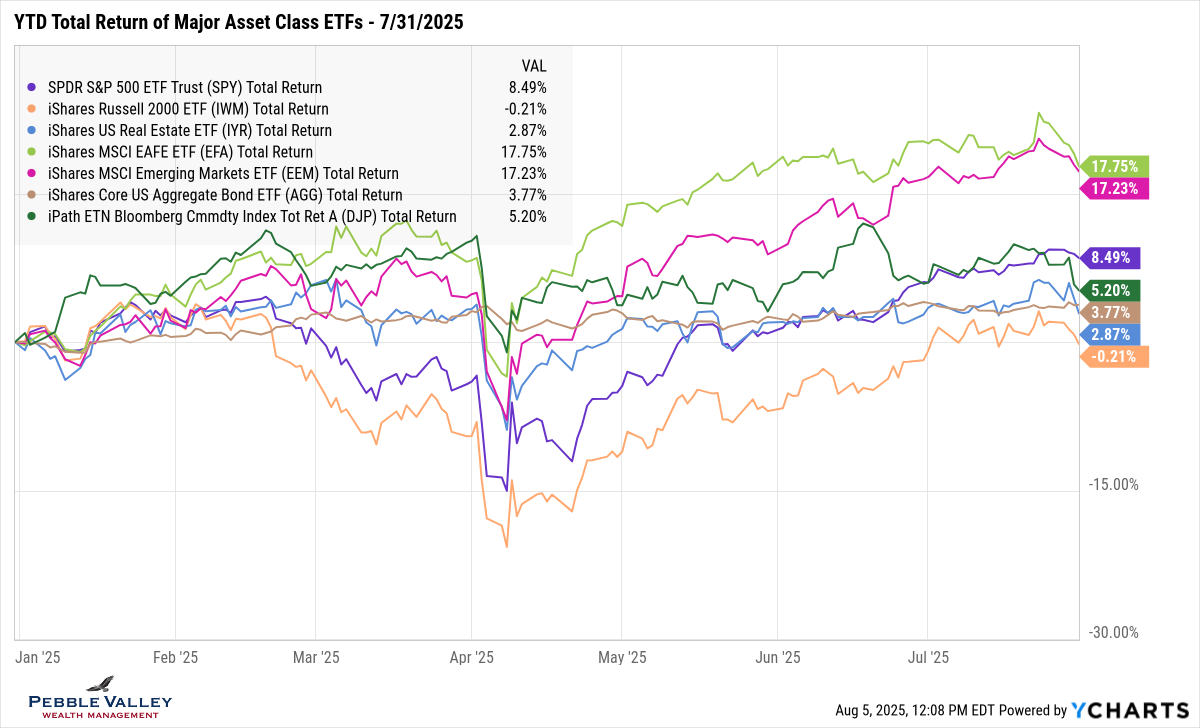

The graph below shows YTD total returns of major asset class ETFs. International equities remain on top but Developed markets saw the largest pullback at the end of the month. Of note is the slow grind higher for US Large Caps (S&P500) moving above the remaining pack while Small Caps registered the only negative YTD return. One asset class that just plods along is the US Aggregate Bond. Note the 3.77% YTD return includes the coupon (or interest) component. The relatively high interest rates is worth noting for the bond market as even if rates remain flat, you are picking up a nice coupon, with about 1/3 the volatility as equities.

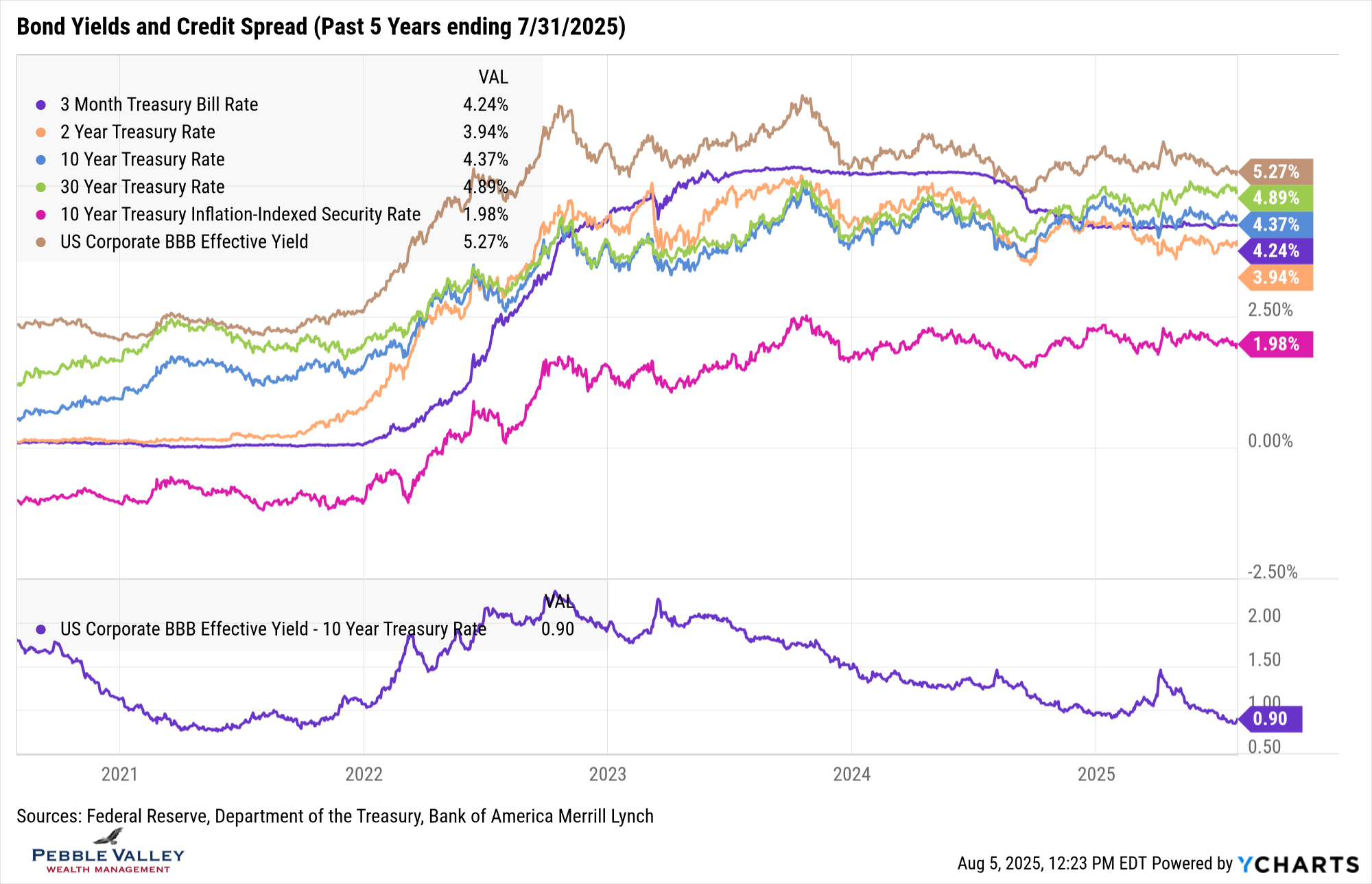

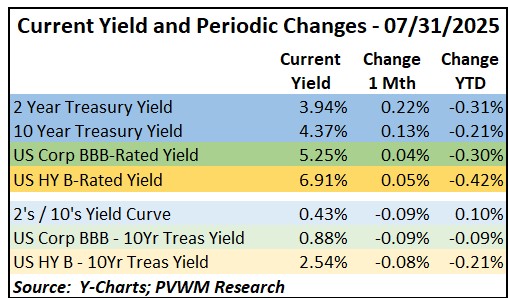

Yields rose for the month, with the 10-year Treasury up 13bps while the 2-year was up 22bps. Rates were up even higher mid-month before retreating. Note the graph data stops on 7/31/2025. I mention this because after the weaker jobs reports released on 8/1 (sizeable previous months’ revisions) the 2-year treasury yield is now about about 50bps below 3-month TBills vs. the 30bps you see below. The 10-year also fell, but only about 15bps. The long-end (30-year) yield remains stubbornly high. This month I also included the BBB credit spread at the bottom of the yield graph. The extra yield paid to take on credit risk continues to shrink as the market is paying investors less and less for taking on credit risk. High demand for bond investments and low expectations for a recession continue to keep that spread tight – for now. I still like staying up in quality and diversifying into non-credit investments.

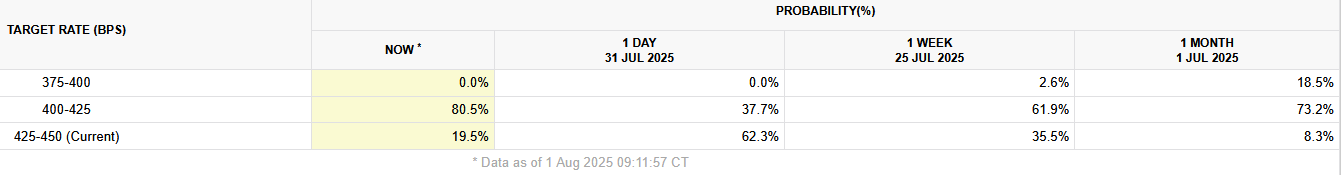

The FOMC meeting concluded on July 30th. Rates remained unchanged and the only “fireworks” was that two voting members dissented, meaning they went on record to state they thought rates should have been lowered. Chair Powell mentioned a couple times in the press conference that they will have two months of data released before the next meeting that concludes September 17th. The first major release came two days later with the jobs report which was weak. The other mandate of the Fed is inflation, and those levels remain elevated, thus causing the delay in rate cuts. The Fed Funds futures market implied a large swing in the probability of a rate cut at the September meeting last Friday, swinging from 38% to 81% based on the CME FedWatch Tool. The two-year treasury rate dropped 25bps on the day.

My special topic this month is the regulatory developments in crypto and the impact on the adoption of stablecoins. I believe this is a significant development and is worth following, even if not a believer in crypto. Here is a link to the GENIUS Act fact sheet which was passed into law on July 18, providing regulatory clarity, consumer protections and 1:1 backing of low-risk liquid assets like TBills. Want to learn more about stablecoins? Check out this primer from Coinbase, which has embraced Circle as their stablecoin of choice (and a financial interest). One criticism with stablecoins is they don’t pay out interest. While that is true, stablecoins focus on the secure, convenient PAYMENT aspect. The tokenization of money markets would focus on INTEREST and is the natural integration with stablecoins. In fact Circle has introduced USYC – a tokenized short-duration fund – to work closely with USDC – the stablecoin issued by Circle. Here is a recent podcast with the CEO of Circle.

Enjoy the last two months of summer! Yes, two months - embracing all that September offers those here in Chicago area. And did you like that YouTube version of the podcast on that last link? Watch for some exciting developments coming here…

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com