Asset Class Returns - 7/31/2023

In the spirit of a hot summer month, this month’s market summary will be a touch shorter. Many of the things associated with August - lazy, hot, vacations, back to school, two supermoons – may also apply to the markets at this time. After a very strong start to the market there may be complacency; returns have been red-hot; not all market participants may be engaged; the impact of easy money and stimulus may provide an education to investors; and the monster returns during the first part of the year may look like “once in a blue moon”.

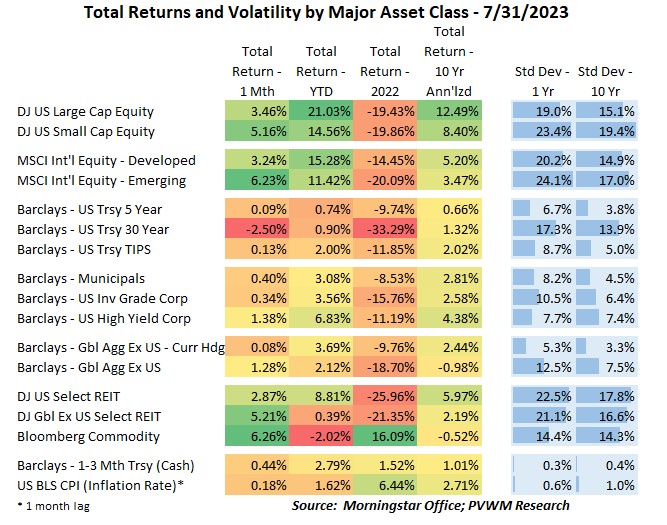

The table above shows another solid month of returns for the risky assets. Even REITs and Commodities had large returns as a weaker dollar gave the nod to Int’l REITs and energy sparked a rally. Bond asset classes didn’t fare as well, especially the longer maturity bond index which doesn’t need a large move in rates to deliver a negative return with a duration over 17. Recall, an approximate price change for bonds equals (change in rates) x (- duration) – so if rates rose a full 1% there would be about a 17% drop in value (quiet you convexity people – it’s August!). And as a friendly reminder, note the 2nd-to-bottom cash row that returned over 2.79% for the first 7 months alone. Be sure to mind your cash pile and put it to work.

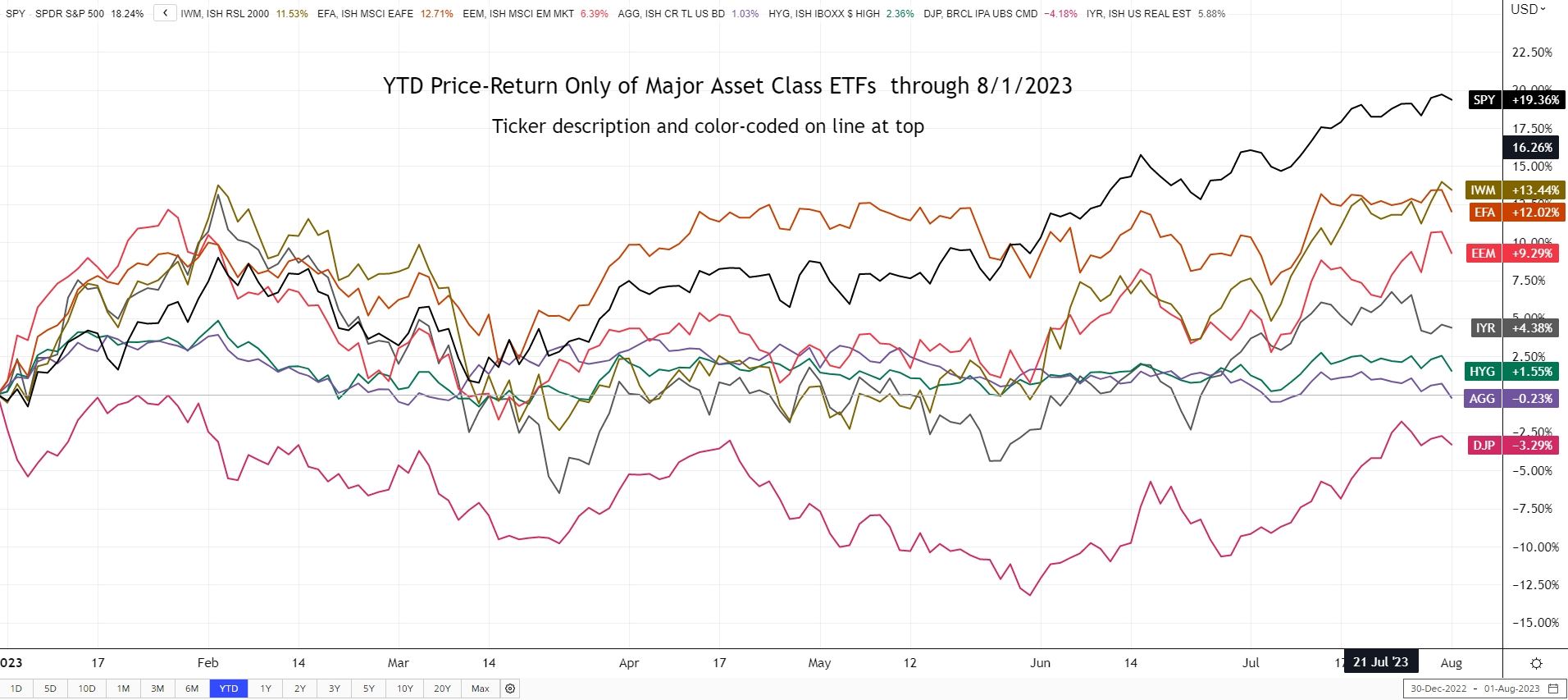

The graph below shows the usual YTD price-return of major asset class ETFs. Last month I included a graph of a new “index” the S&P492 that was drastically lagging the S&P8 (handful of tech names). July saw the returns broaden out to more sectors. The US small caps (IWM) moved to the second highest return YTD on the graph and while commodities (DJP) remain negative, they made up some return ground in July. The bond indices (AGG, HYG) continue to ‘meh’ along (but note I only show price return) and REITs (IYR) remain surprisingly resilient.

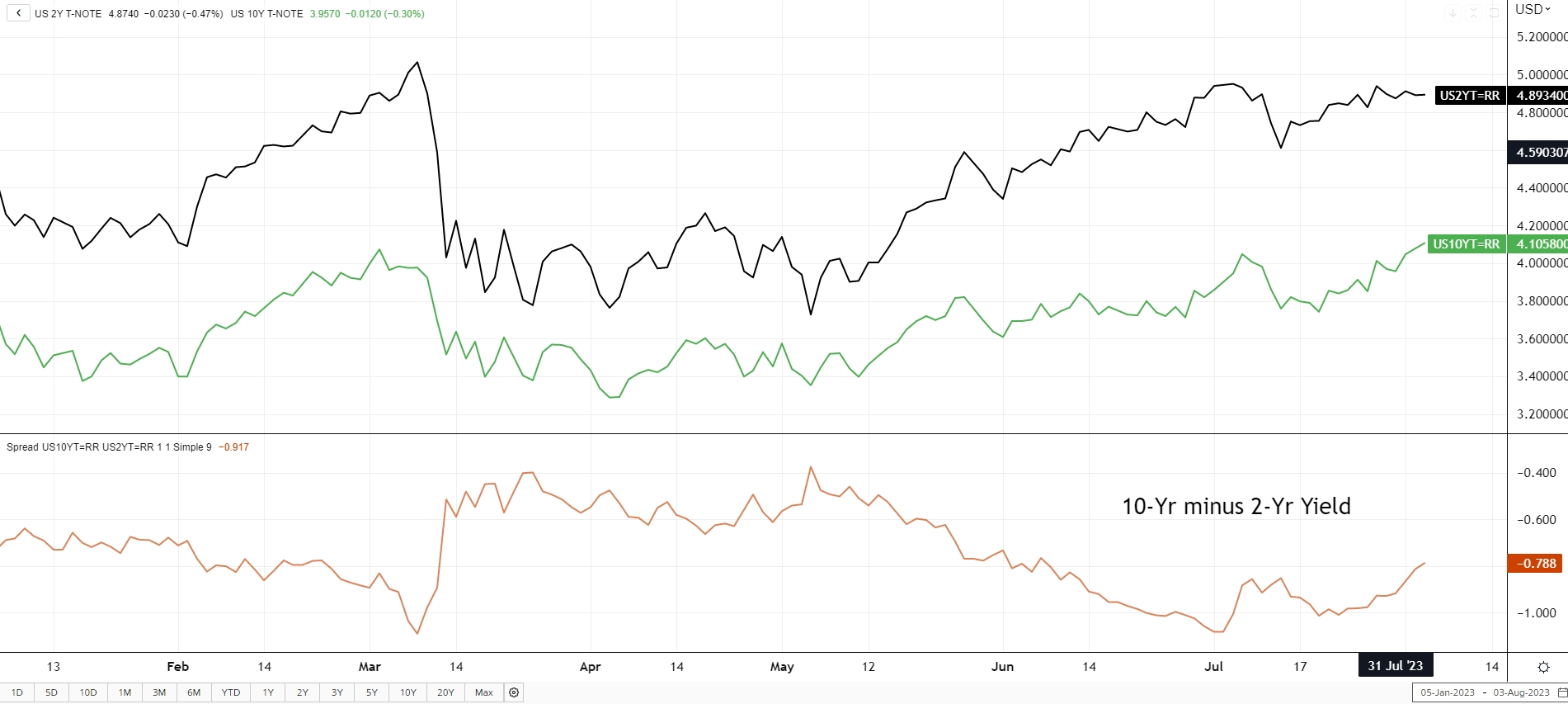

Turning to the treasury rate graph, all rates seem… higher. True, not a large jump for the month but there has been a steady grind higher throughout the summer. Yield levels are approaching the highs seen just before the banking issues of early March. 3-month T-Bills are above 5.40% - another friendly reminder to be sure to mind your cash pile and put it to work. And while still quite inverted, the 2s / 10s curve (10-yr rate minus 2-yr rate) converged by about 0.25% as the longer-end quietly drifts higher (see second graph below – as of 8/2/2023; note long-end not so quiet first days of August).

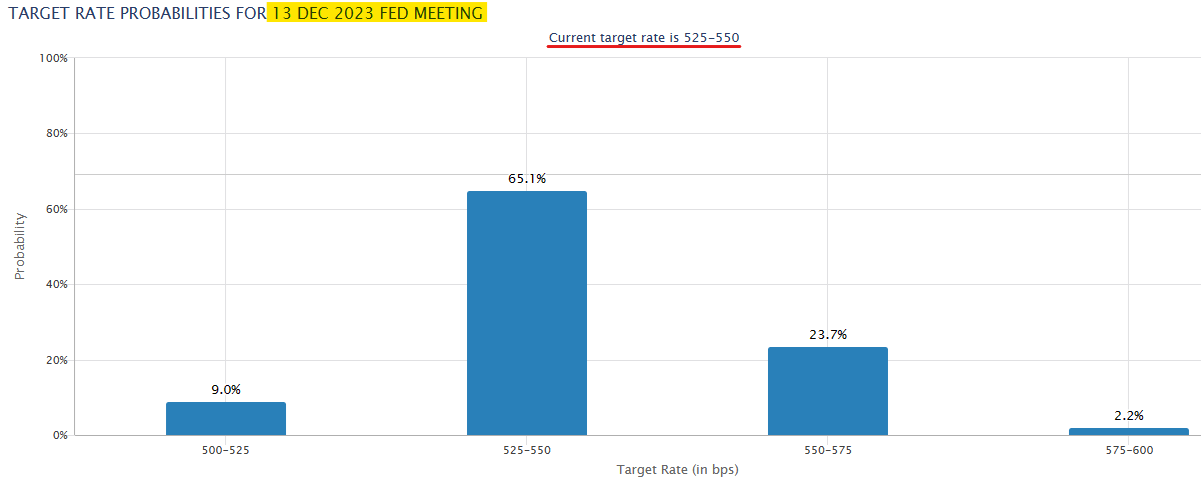

The Fed raised rates by 0.25% to a target range of 5.25% - 5.50% at the last Fed meeting on July 26th. Recall the Fed indicated in June the target may be at 5.50% - 5.75% at year-end 2023. Recent inflation readings showed continued declines so the market is not pricing in a very high likelihood of another rate hike in 2023 based on CME FedWatch Tool - the graph below shows less than 25% chance of another hike (as of 8/2/2023). The jobs market remains quite strong and without a cooling, the Fed may have to continue raising rates. And don’t forget, the Fed’s Balance Sheet continues to decrease at a $95 billion clip per month. Separately, this August the July CPI print will be the first of the three-month average that will be used for the Social Security inflation adjustment for 2024 – likely much lower than last year’s 8.7% increase!

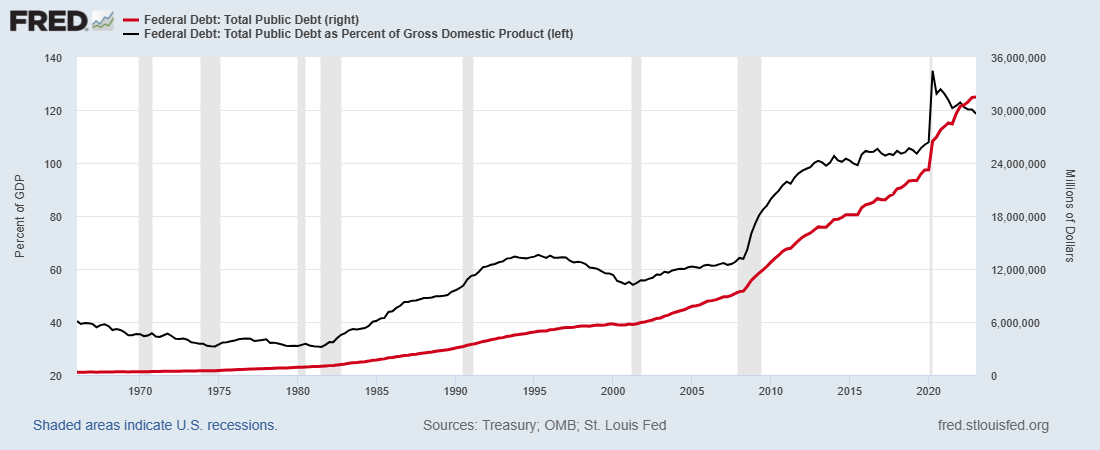

This occurred late in the day August 1, but Fitch downgraded the credit rating of US Government by a notch from AAA to AA+. The initial reaction may have seemed quite muted and Treasury officials and the media are downplaying it, but it is a reminder that budget negotiations still need to occur before October 1st and the size of our debt is growing extremely large. True the nominal amount will get larger as our economy grows. But when expressed as a % of GDP, it is getting up to alarming levels. Exceeding 100% was a big deal this past decade - we are now in the 120% zone! And be aware this is only the public debt; it does not include the large “IOU’s” from the Social Security system. Here is link to the US Debt Clock with all the numbers. But it is August, and I won’t attempt to tackle that topic at this time.

Enjoy your August – and all that it brings – including those two full moons!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com