Asset Class Returns - 6/30/2021

Here is this month’s market summary. Unless noted, the time frame is year-to-date ending 7/2/2021.

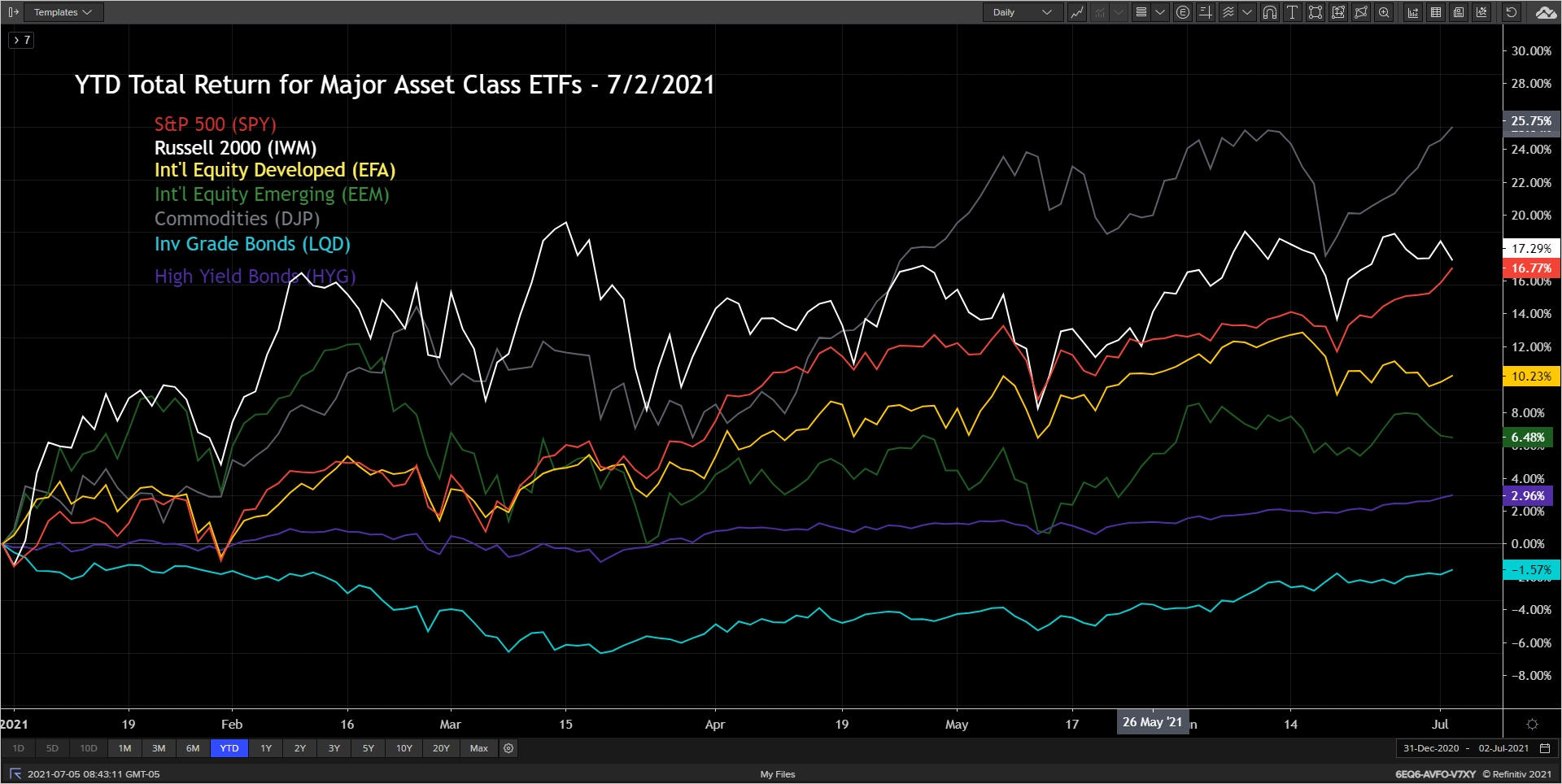

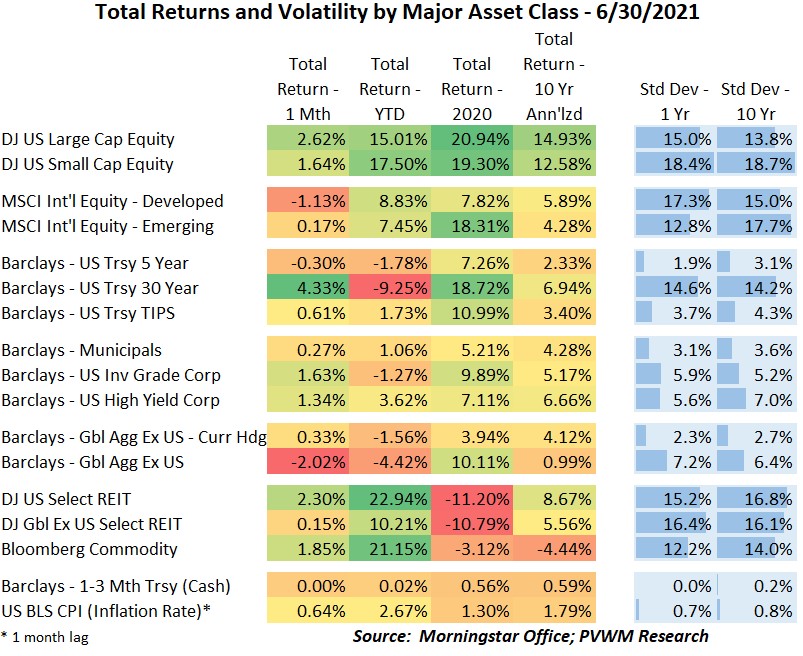

The major asset classes begin the show. It is interesting that investment-grade bonds are the only negative returning of these major seven asset classes. The equity markets began pulling back but after the Fed meeting the US equities resumed the rally, slightly surpassing the previous month. International equities remain flat as COVID concerns remain in some countries. Commodities continue to hold the dominant lead.

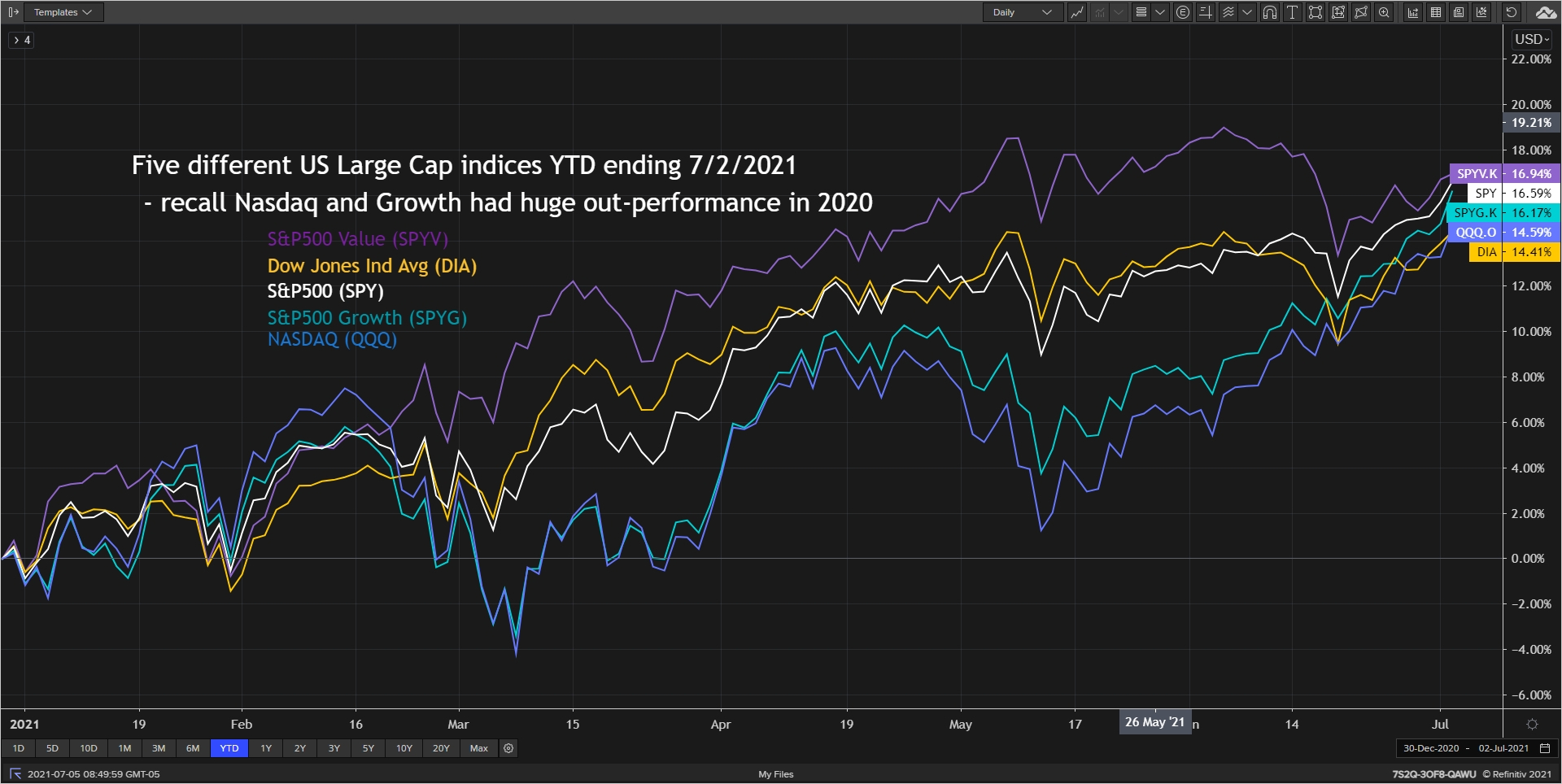

About that widening of outperformance of Value over Growth I mentioned last month… gone! It was a surprising move from my perspective and bears watching if able to continue.

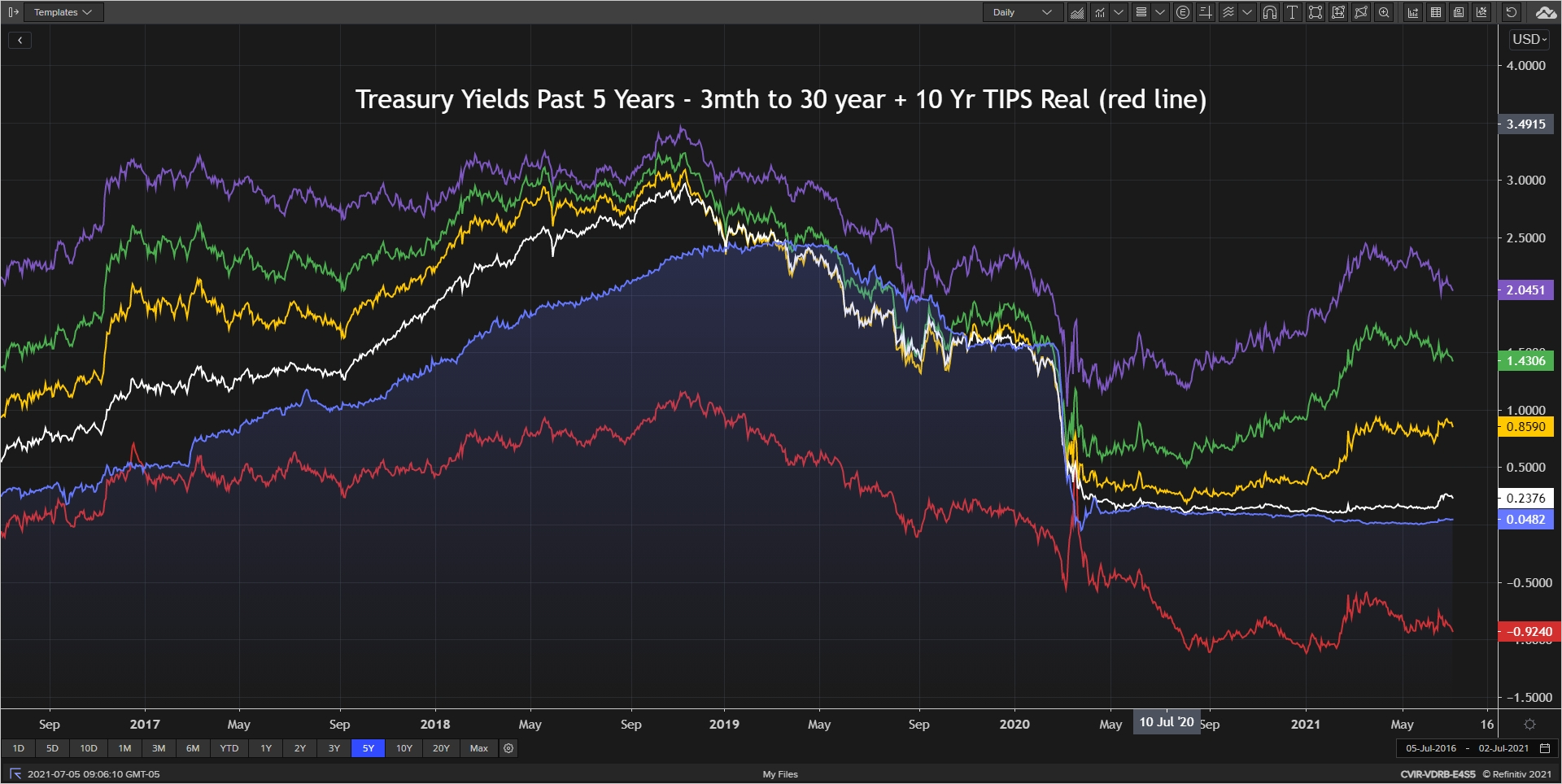

After a rapid rise in interest rates from the beginning of the year, longer-term rates have drifted back down slowly during this past quarter. Shorter maturities (2-yr and 5-yr) however rose since mid-June after the Federal Reserve meeting where some market participants expect the Fed to begin raising rates sooner than expected. Bear in mind a rate rise is still very likely over a year away but the marginal tone from the meeting – based on press conference and economic projections (including the dot plot) – indicated the Fed will consider tapering bond purchases this year and possibly rate rises in late 2022. The market reaction felt a little overdone from my perspective (long-term rates fell too much). Real yields from TIPS remain close to all time lows which helped the growth equity rally.

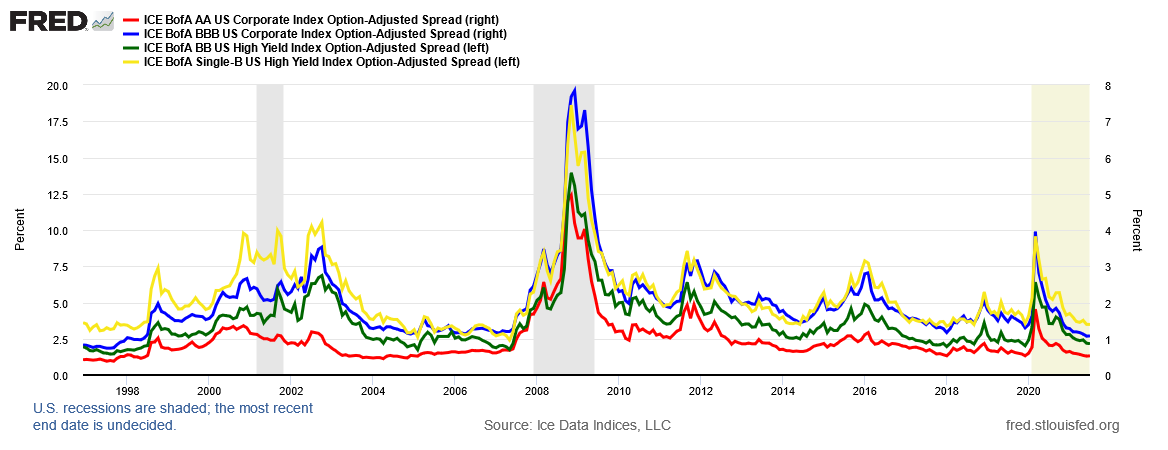

Treasury rates have risen since the beginning of the year but credit spreads have tightened, especially since the Fed intervention after COVID shock in March 2020. Note credit spreads are the extra yield bond investors receive for taking on the risk of only getting a portion of their money back if a company goes bankrupt. The graph below shows spreads going back to 1996 for investment grade (red, blue, right-hand-scale) and high yield (green, yellow, left-hand-scale). We are back to the historic tight spreads almost as fast as we entered the recession. Adding this tight spread to low treasury rates makes one look to non-corporate bonds, structured or floating-rate bonds in this environment.

Oh yeah, that last row in the table below - inflation. Social Security recipients may be happy this fall and the Federal Reserve still believes it is transitory though acknowledged it may not be. However, wages are rising along with many other prices that may remain sticky – kind of like the summer weather.

Note only one month of summer is over – enjoy the next couple months!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com