Asset Class Returns - 5/31/2019

April showers bring… more May showers – in the sky and in markets.

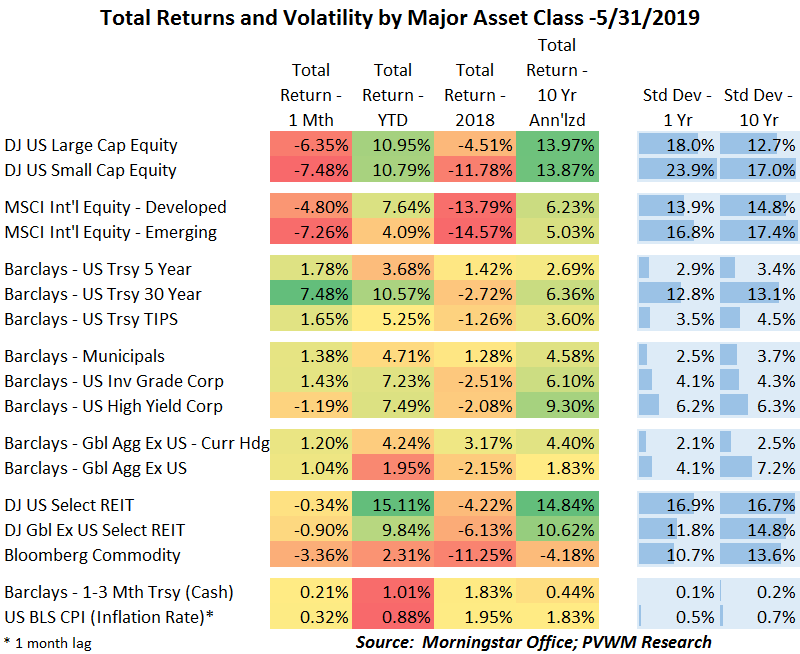

Recall last month I commented on the oversized YTD returns as a surprise to the upside. This past month’s returns had a lot of red in risky asset classes, though YTD returns are still quite respectable for five months of work.

For equities, the month started off strong but pulled back after trade negotiations with China stalled, adding to concerns of slowing global growth. The energy sector led the pullback but as the month progressed, the bond market began pricing in an economic slowdown with rates dropping significantly just after mid-month. This fed back into equity markets causing further pullback. Then at the end of the month additional tariffs were threatened against Mexico knocking the market down further.

The international equity market began the month on a weak tone, not only from trade concerns but continued weakness in global economies relative to the US and added uncertainty on Brexit being delayed yet again and requiring new leadership to propose in what form it gets implemented. Developed markets didn’t fall as much as the US, with some of the negative expectations already priced in to those markets. Emerging markets fell harder, though ended the month on a positive tone.

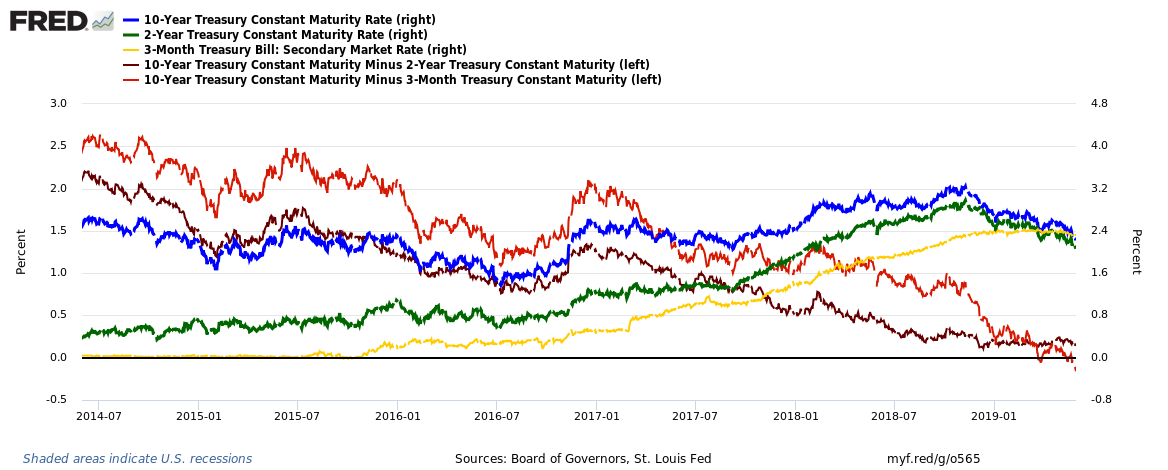

The biggest surprise for the month was seen in bond markets, especially the 30-year treasury bond. For the month alone this long duration bond was up over 7% as yields fell about 0.40%. This brings YTD returns over 10% for the long bond. High yield bonds were down for the month along with risky assets but other high-quality bonds had a solid month. The large drop in longer maturity treasury rates rekindled curve inversion talk last seen in late March. While the 2s/10s curve is around the same 0.16% level, the 3m/10s is even more negative at -0.16%. A negative level may signal an upcoming recession; not signaled is how soon or how deep.

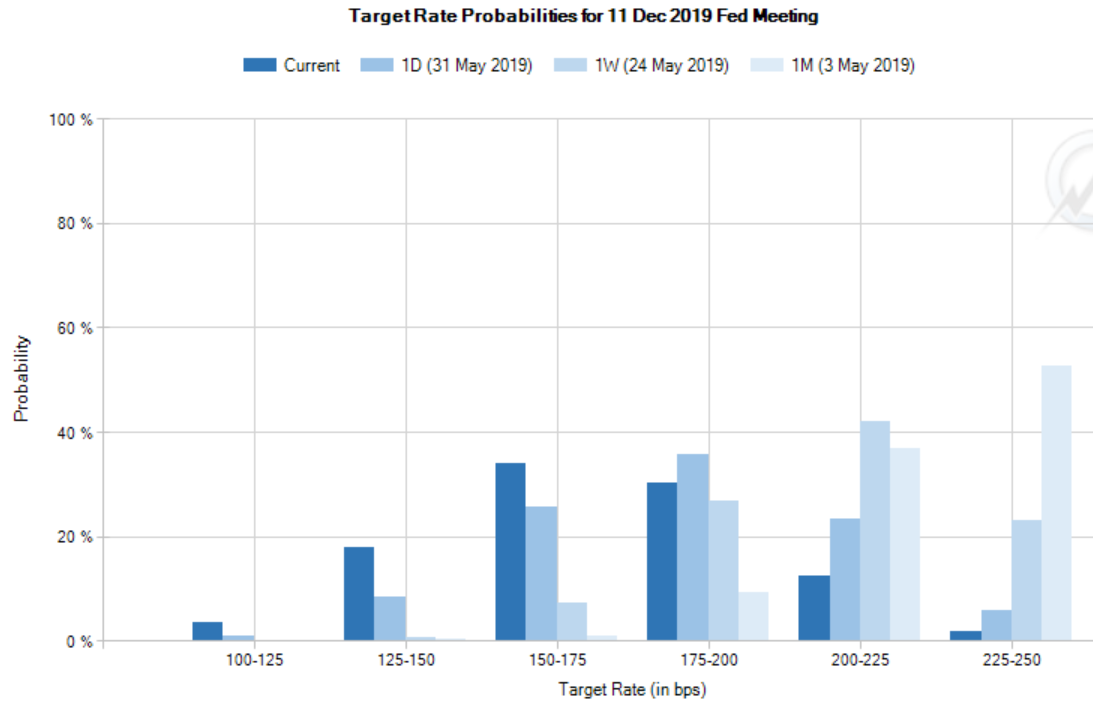

The next FOMC meeting concludes June 19th. This meeting will include the Fed’s “Summary of Economic Projections” including expected inflation and Fed Funds rate (short-term rate the Fed controls). After the May 1st meeting, Fed Chair Powel stated “we don’t see a strong case for moving [rates] in either direction…”. The market disagrees. This past month alone the market priced in (using Fed Funds futures) at least one rate cut with 99% probability and two or more rate cuts at 85% probability (Source: CME Group FEDWATCH). Just a month ago there was a 55% probability there would be no rate cut. These recent levels seem extreme to me.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com