Asset Class Returns - 2/28/2022

Here is this month’s market summary. Unless noted, the time frame is year-to-date with screen shots through 3/2/2022.

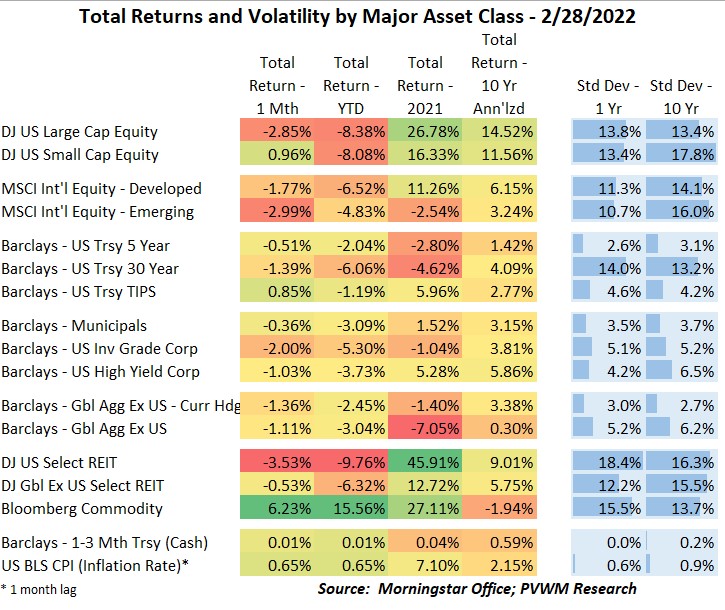

The optimistic rise of risky assets at the end of January did not follow through to February. The first half of February saw a choppy downward trend followed by a larger pullback in the back half of the month following the Russia/Ukraine news. There were three asset classes that had a positive month however – US Small Cap equities, TIPS and commodities.

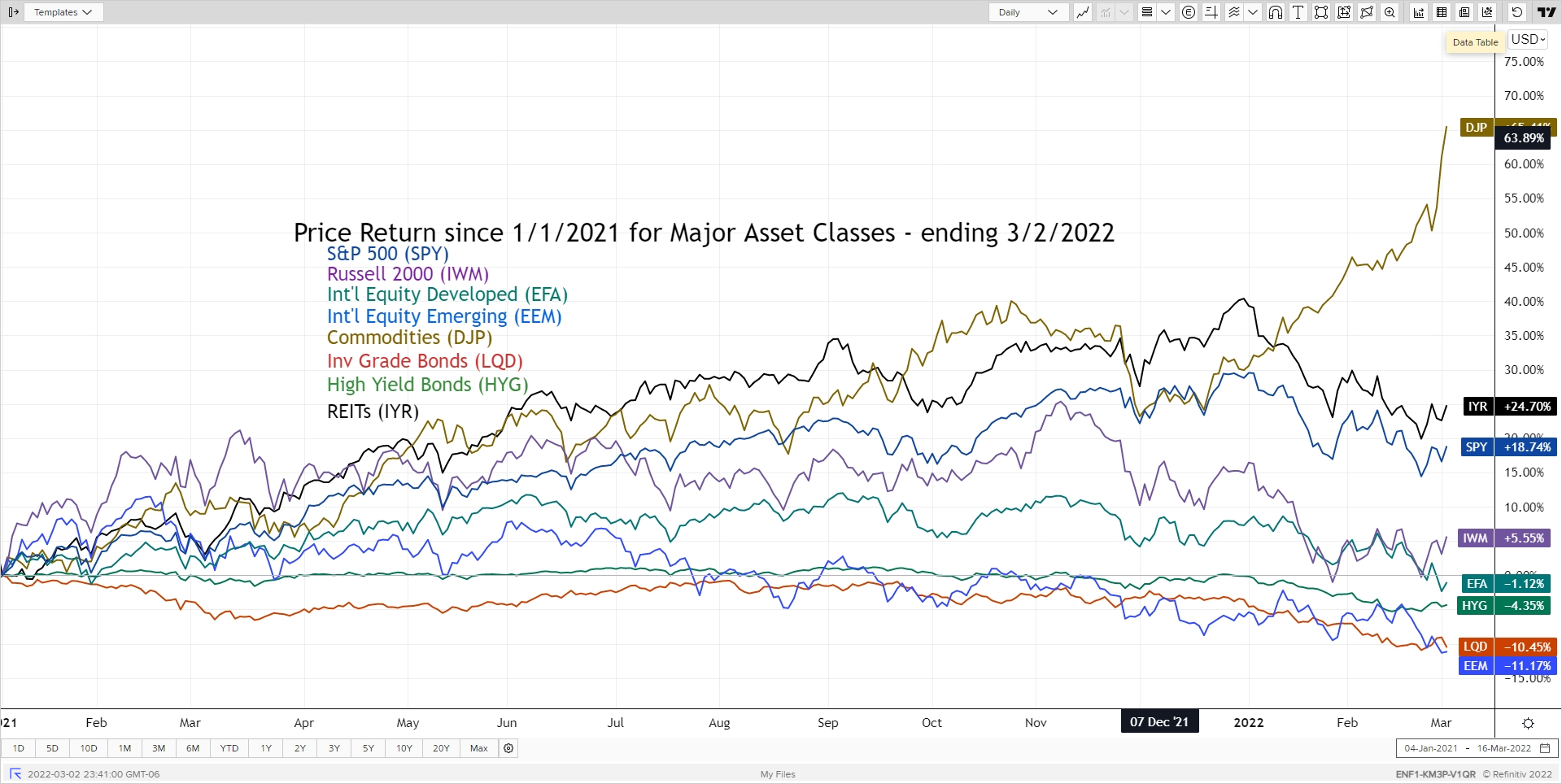

I continue to show the major asset class graph with a starting date of 1/1/2021 for context. The YTD returns for international equities have been holding up better than US equities. This relative outperformance was tested the last couple weeks with the war in Ukraine however. US small caps stabilized from the rough January and are now just above US large caps YTD. We all see the outlier to the upside – commodities – mainly driven by higher energy prices but the grains also contributed to higher prices as some supply chains were disrupted in Ukraine. US REITs continued to suffer – experiencing the largest monthly drop in the asset classes summarized.

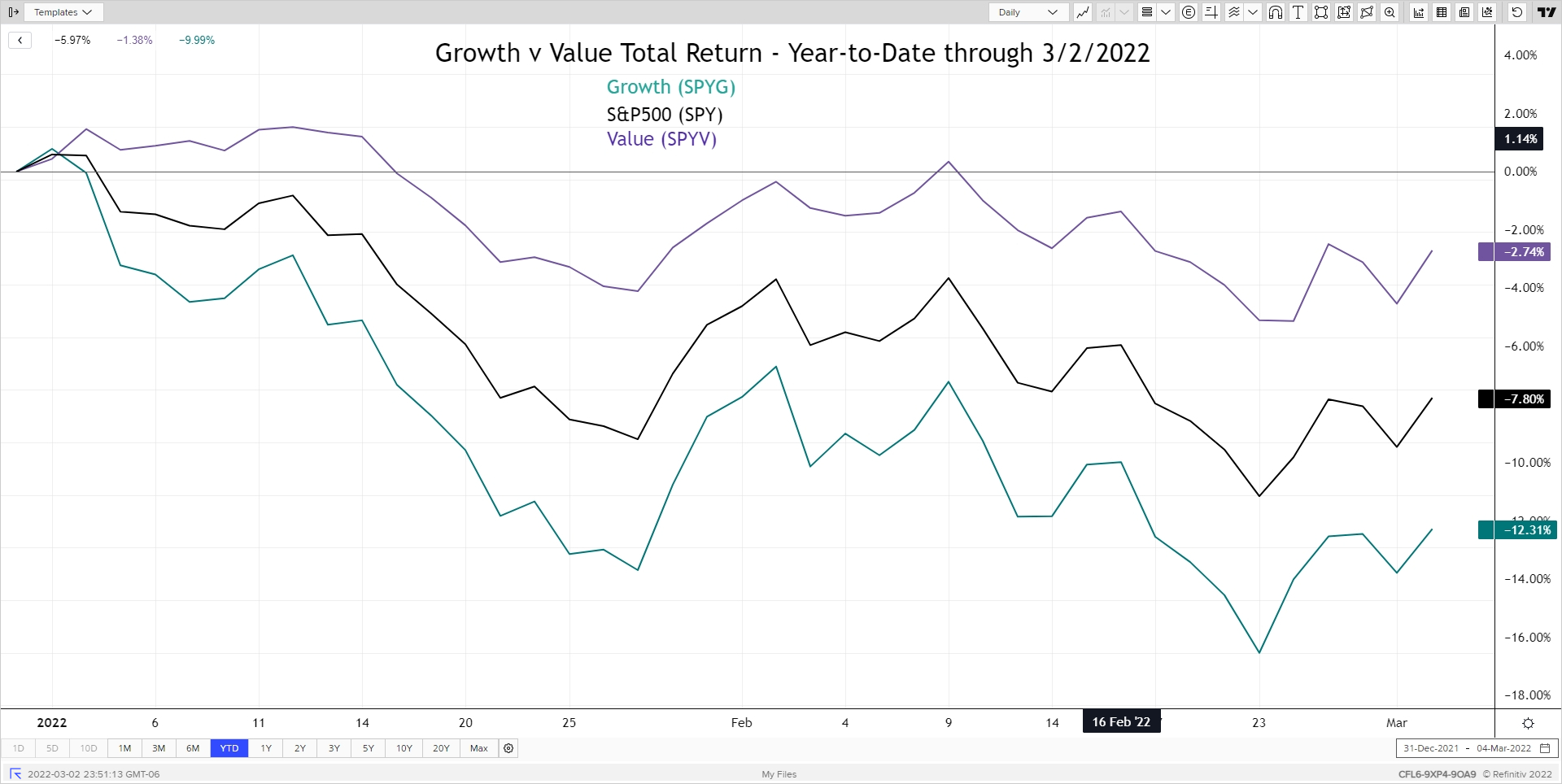

Value continues to hold up better than Growth for 2022. The market backed off on the number of rate hikes expected in 2022 giving some relief to Growth but the Value stocks – including Energy and Financials - continue to hold the gains.

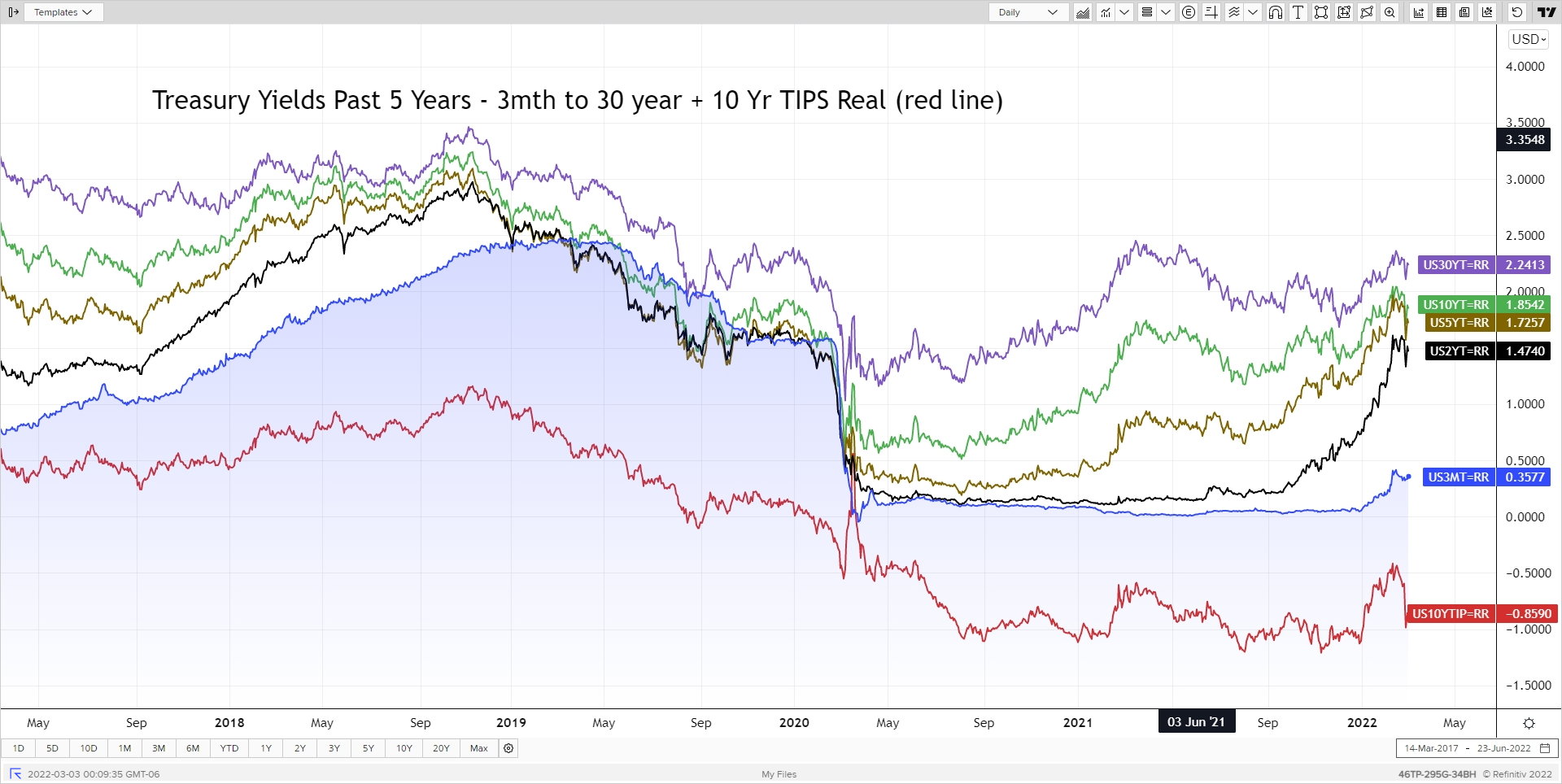

The usual rate graph shows the falling of rates as there was a flight to safety in the treasury market – investor buy bonds for safe holdings driving price up and yields down. While a noticeable move down in yields on some days, rates remain elevated. Economic data during the month also continued to show strong numbers – GDP growth, inflation running hot, strong jobs report. The Fed will have a look at one more jobs and inflation report before their next FOMC meeting.

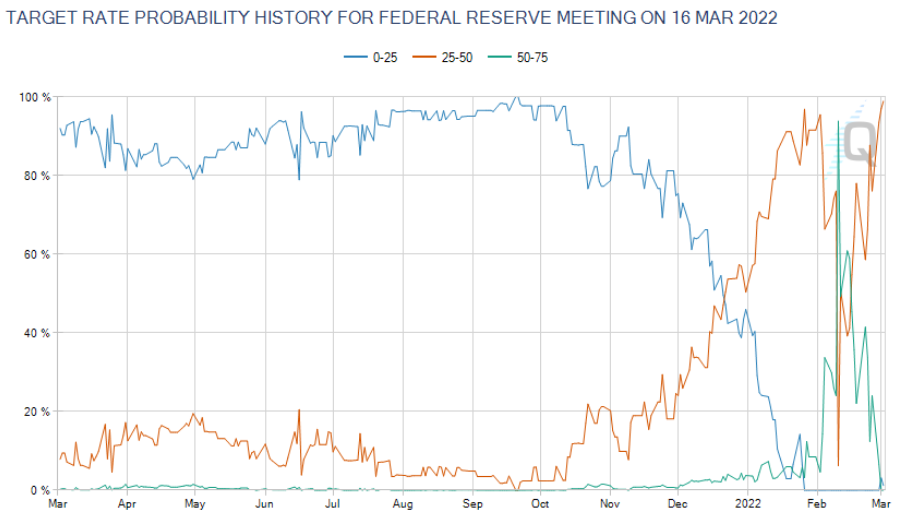

March 16 is the conclusion of that next FOMC meeting. After the hot inflation reading for January, the market began pricing a 0.50% rate hike at this meeting – hitting over 90% implied probability of happening from the Fed Funds futures (see CMEGroup graph below). At one point in mid February the market was even pricing in over a 20% chance of having 8 rate hikes during 2022. That has since been priced out of the market.

Enjoy the warmer weather – temperatures are choppy like the markets but getting there. The clock springs forward on March 13 – smiles for some, frowns from others. I smile.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com