Asset Class Returns - 11/30/2025

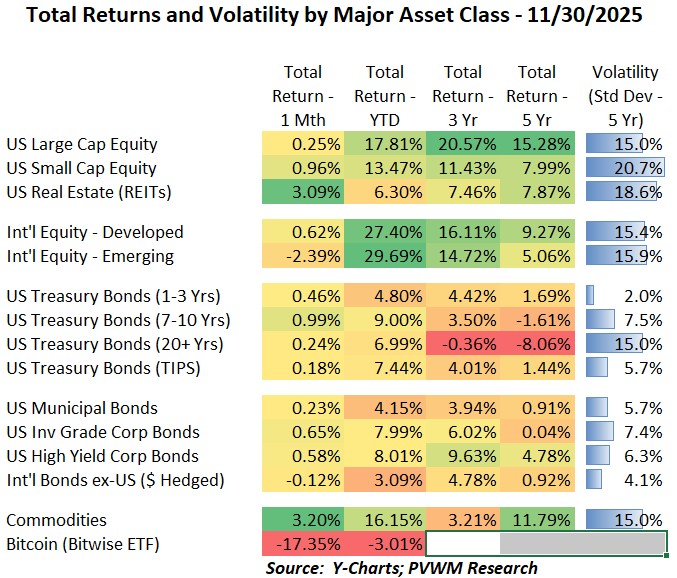

While most asset classes saw a positive month (except EM, Int’l Bonds, Bitcoin) the returns are more muted than recent monthly summaries. The two positive exceptions with stronger gains are REITs and Commodities. Recall REITs were on the naughty list last month with one of the few negative returns. If you expand out to the full year on REITs (or look at YTD return column above) you will see they have been lagging, so not as much euphoria to take out. Commodities just keep on keeping on, helped again by precious metals – and not hurt by energy. A few other things to note from the table:

- While US equities were muted, the YTD returns remain impressive

- Int’l equities divergence flipped from last month’s action; Emerging Markets noticeably lagged this month but still hold the top spot for YTD returns at just under 30%!

- Treasury bonds have delivered equity-like returns (normal equity returns anyway) but the quick glance to the right shows still digging out of past years’ losses

- US Credit Bonds were positive again for the month, though not as much as Treasuries; credit spreads widened (i.e. rates rise / price falls) between 0.10% - 0.20% this month

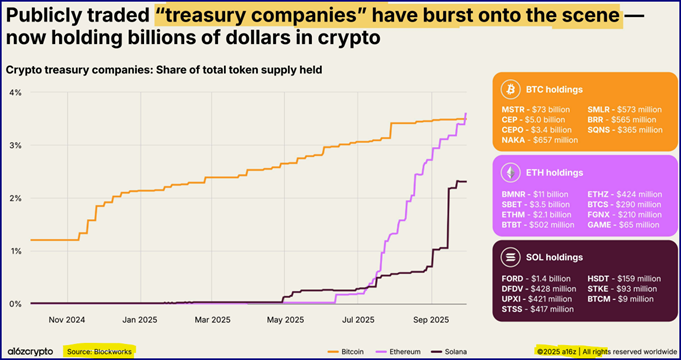

- Bitcoin was hit this month after relative peak Oct 7; demand and related leverage from Digital Asset Treasury companies (DATs) cooled as positions were unwound (see later).

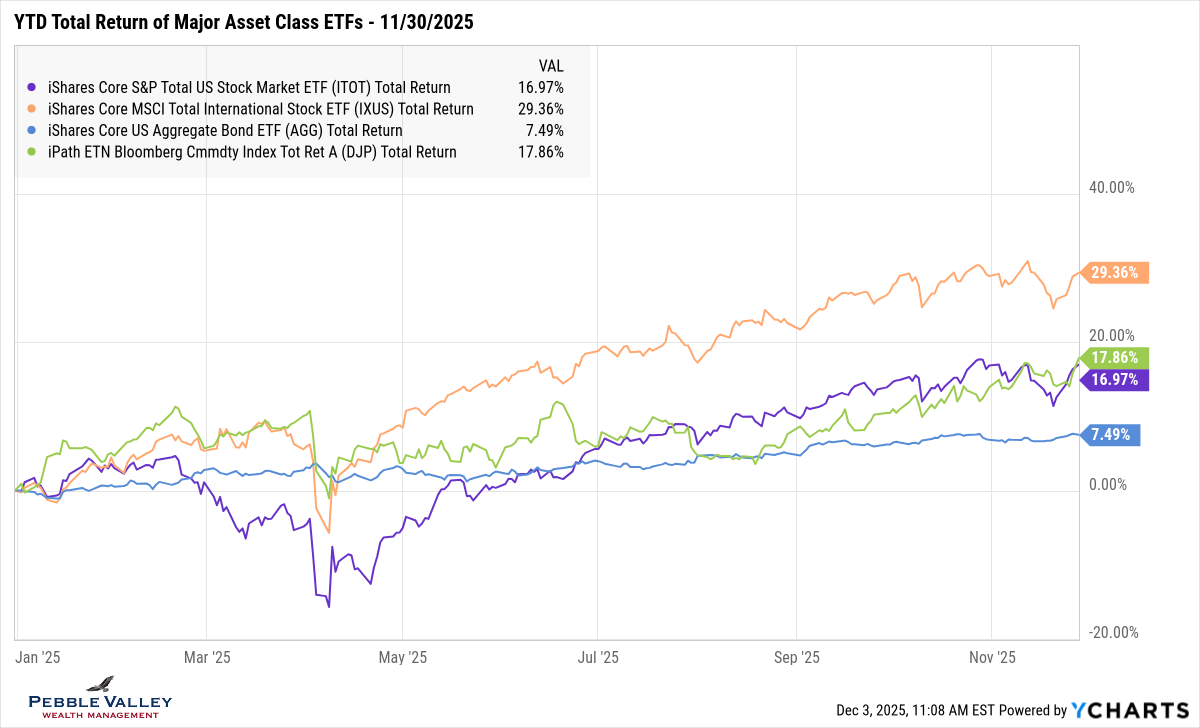

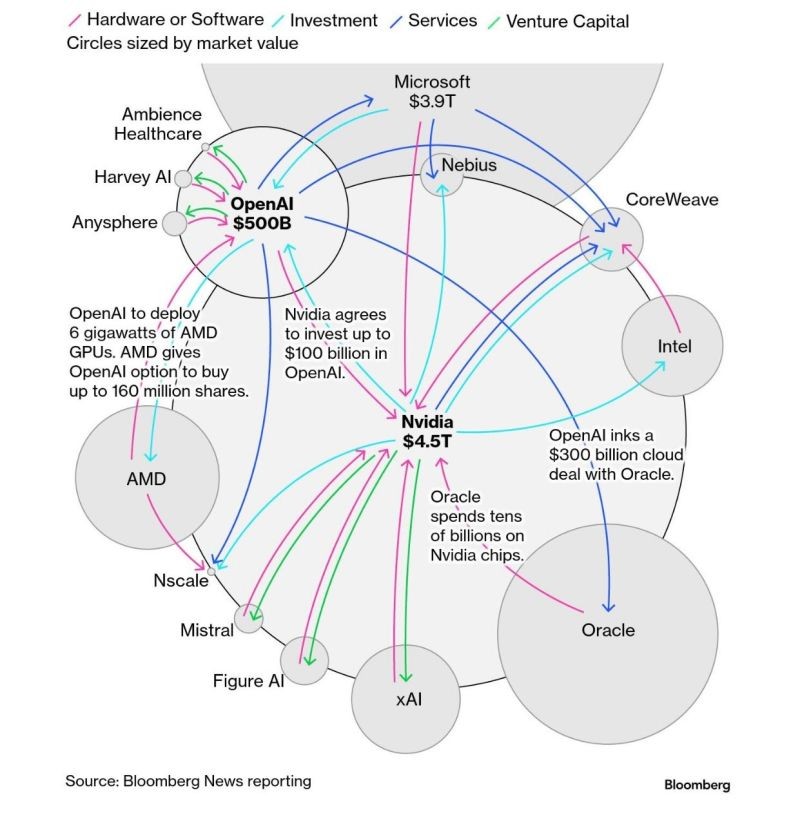

The graph below shows YTD total returns of high-level major asset class ETFs. Like October, you can see the mid-month drop in markets as market participants began questioning the dollars being spent on AI build-out (see later). Concerns included whether future revenue would cover earnings expectations and the ability to pay back ever-increasing debt being issued by these companies. This pullback was quickly reversed by the delayed September jobs report released on 11/20 that showed unemployment rising to 4.4% which put the Fed back in play for a rate cut in December (see below) and got the market excited again. The November jobs reports (also reflecting some October data) will be released 12/16.

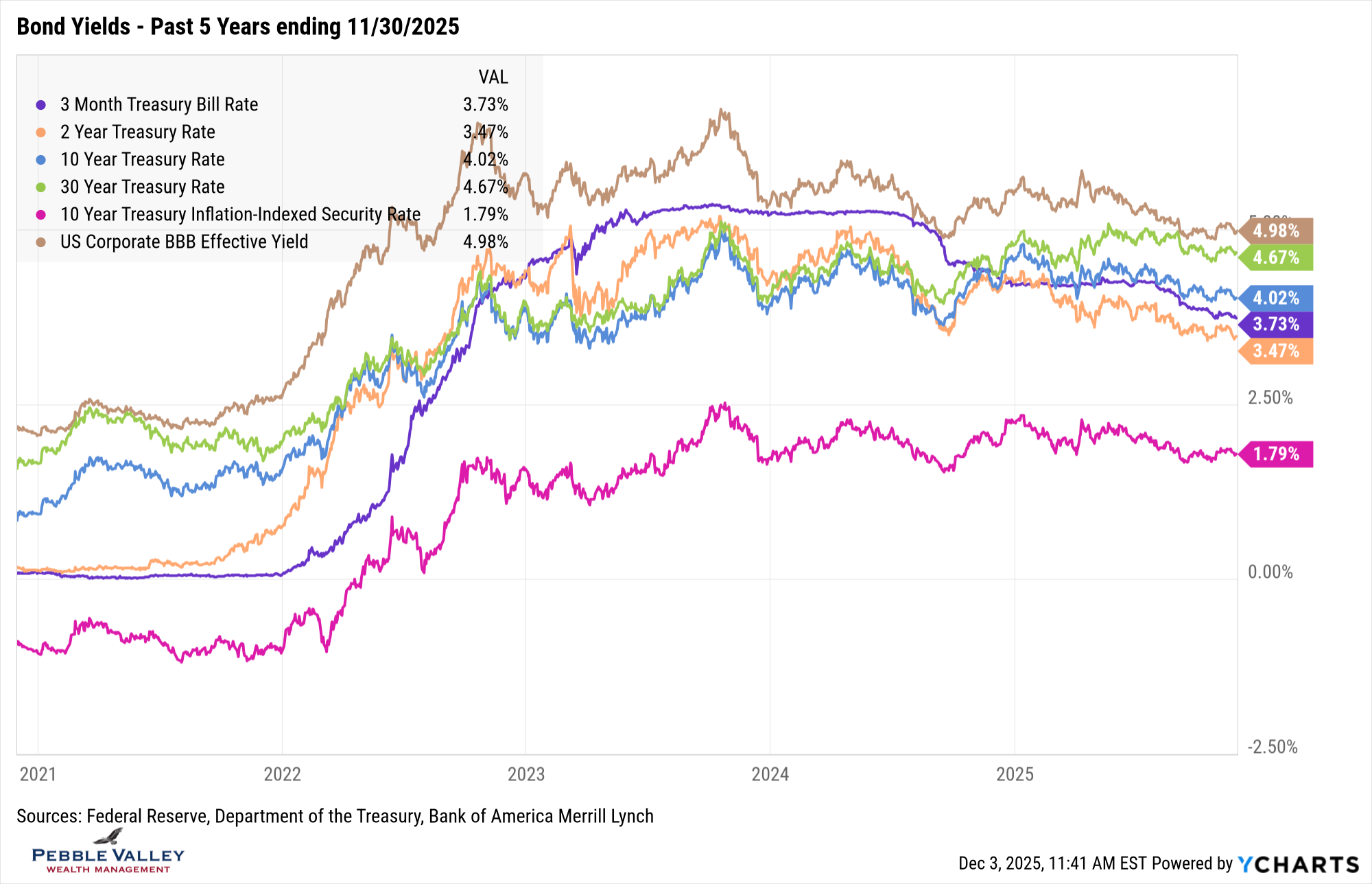

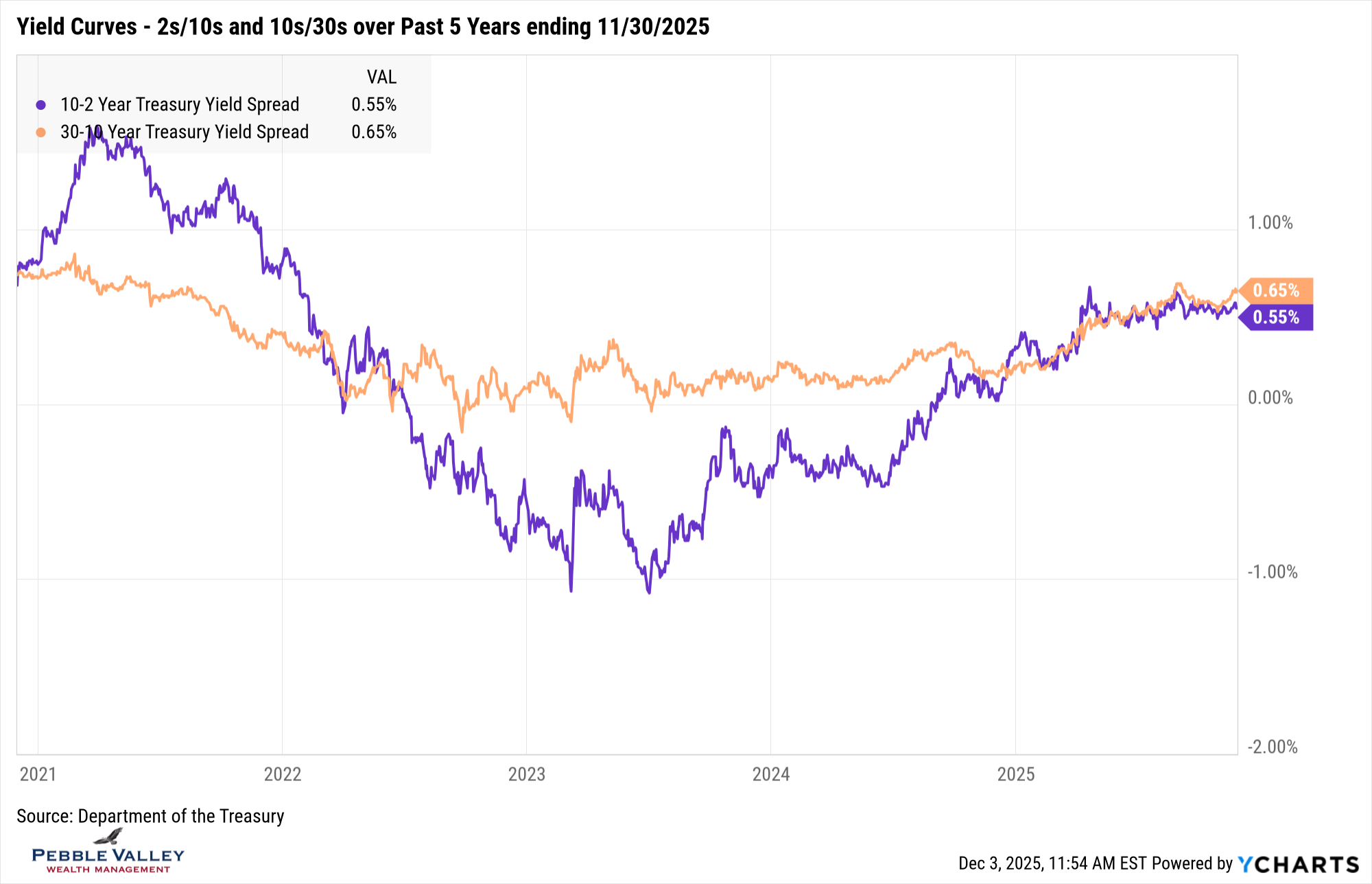

The bond yield graph for the past five years shows yields continuing their slow grind lower. The 2-year rate remains low and reflects continued rate cut expectations from the Fed. The 10-year yield almost has a “3-handle” and BBB yield is back below 5% again. Notice how the 2-year rate is drifting lower than the 10- and 30-year bonds. This is called “curve steepening”. The common maturities used to take the difference in yields are the 2- vs. 10-year maturities. It is also instructive to look at the 10s vs. 30s spread as well. I added a second graph to isolate these two curves. I highlight this to point out that just because the Fed may continue to cut rates, that impacts short-maturity bonds while longer-maturity bonds are more driven by inflation and supply/demand. For those looking for lower fixed-rate mortgages, that is driven by longer-maturity bonds.

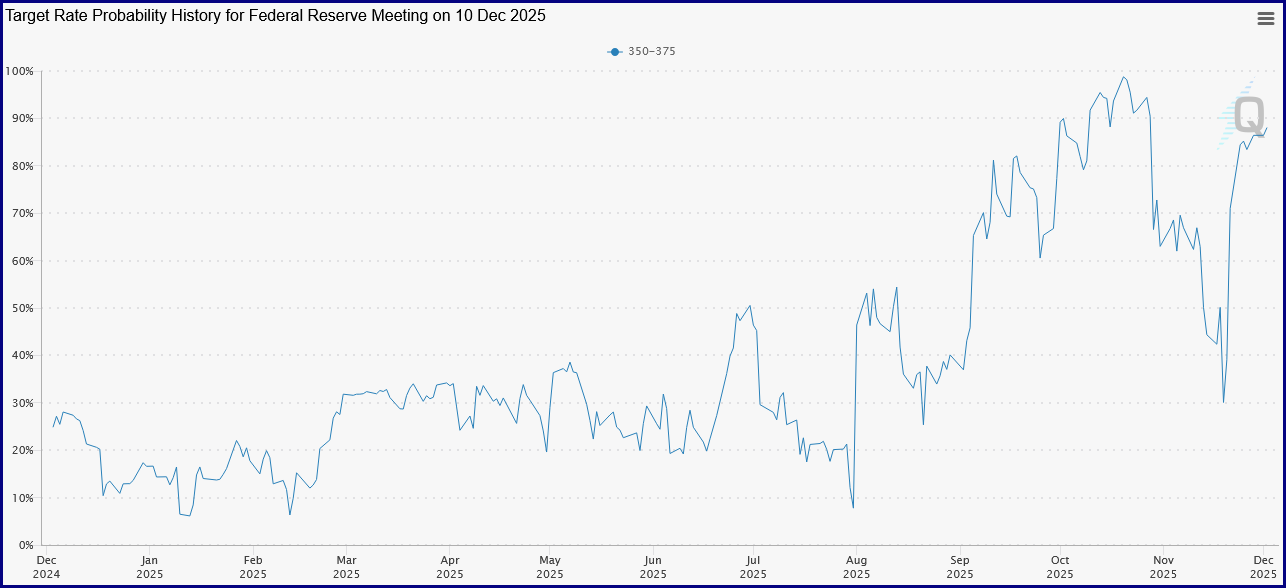

The next FOMC meeting concludes on December 10th. The market expectations of a Fed cut has swung wildly this past month. Going into the last Fed meeting on Oct 29th the expectation of a December rate cut was fully priced in. Recall during the 10/29 press conference, Fed Chair Powell stated “A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it, policy is not on a preset course.” This caused a big move in the Fed Funds futures market. Since then, the probability of a cut kept falling until the September jobs report released on Nov 20 showed the unemployment rate ticked up to 4.4%. The next jobs report will be released after the Fed meeting and market participants believe the latest unemployment rate will allow the Fed to cut rates, despite the sticky inflation (recall Fed has dual mandate). The implied probability of a rate cut is now close to 90% and will very likely be delivered. See chart below (Source: CME Fedwatch; Dec 3).

I have two special topics this month.

- Crypto Prices – Since the October 7th peak, crypto prices have fallen significantly. Bitcoin is down over 25% while Ethereum and Solana are down over 35%. While it is natural to ask what is causing the large drop, the same question is rarely asked on the way up of a large gain. Oftentimes it can be one of the key drivers for each. I believe that is the case with the impact of Digital Asset Treasury companies (see graph below – Source: A16z). These are companies that raise capital to buy the underlying crypto and provide crypto exposure in an equity wrapper which is attractive to some investors. DATs engage in yield strategies, sometimes bitcoin mining, but also with inherent leverage. Leverage amplifies price swings – in both directions!.

- Happy 3rd Birthday to ChatGPT – Since ChatGPT introduction, AI-related investments and corporate and consumer use of AI has exploded. Adoption rates and applications of this powerful technology continue to unfold and experts (and myself) believe it is early innings. I personally am a fan/user of Perplexity Pro for research. The companies involved in supporting and delivering AI capabilities also agree with very large investments occurring. This will keep on going until it doesn’t. Clearly growing AI demand will be there, but concerns are being raised on the size of future revenue needed to support these investments, the debt loads being incurred and the interconnectedness of the companies (see graphic below – Source: Bloomberg). I remain a strong user of AI for research. It is also prudent to conduct strong research in related investments.

Enjoy the last month of the year and the festivities it brings!

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com