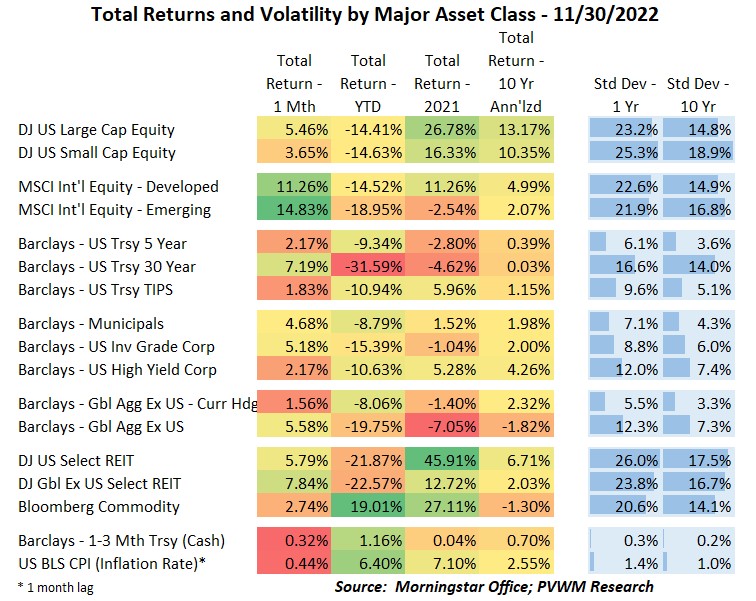

Asset Class Returns - 11/30/2022

Wow! That was a solid month. Admittedly it was boosted by a monster rally on the last day of the month after Fed Chair Powell comments at the Brookings Institute, but still strong. Not only were US large cap equities up over 5%, but international equities were up over 10% - yes for the month alone. What gives? The US dollar – as measured by DXY – was down about 6% for the month. Recall when convert international holdings back into US returns, that also captures any dollar moves. The dollar has been very strong during 2022 with the Fed aggressively raising rates, and was due for a pullback as other Central Banks also begin to tighten and the market expecting the Fed to slow. Recall last month the US equity returns dominated, the opposite this month – a good reminder of the benefits of a diversified portfolio. The bond market also saw relatively large gains as rates fell significantly for the month. The market is pricing in a slowing economy and Fed not only pausing but cutting in 2023 – I believe a bit premature.

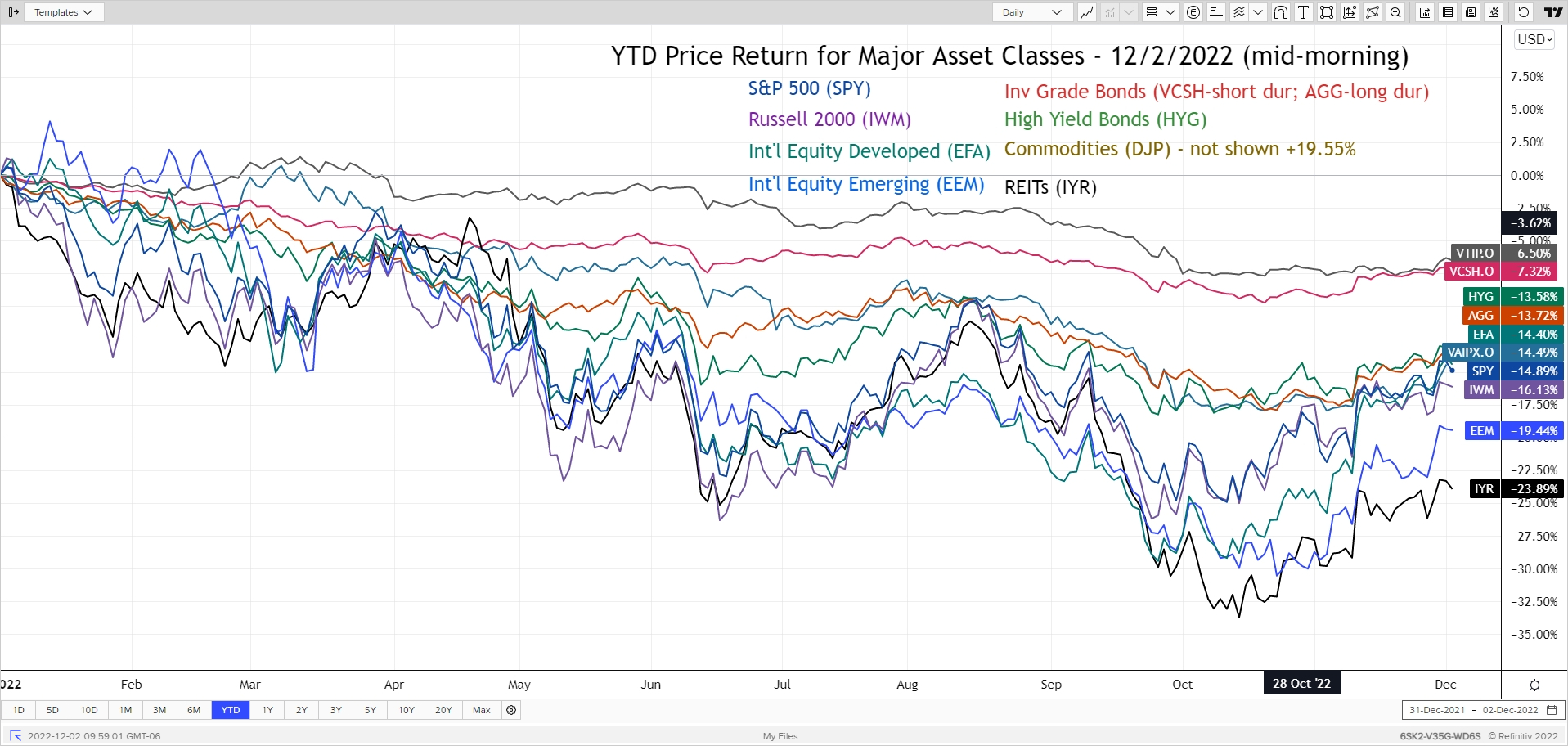

The YTD major asset classes graph below (mid-morning 12/2/22) once again excludes Commodities for better refinement of all other negative-returning asset classes. Markets were already drifting upward coming into November. Then, despite the Nov 2nd FOMC meeting where Powell reiterated the Fed has “some ways to go” in raising rates - even stating to a level higher than expected at September - the market just kept chugging higher. This implies an expectation of a Fed not only slowing rate rises, but cuts into 2023. Good luck with that given inflation readings and a strong jobs market. Two other things caught my attention: International equities rallied hard on the back of weaker dollar (as discussed above) and how all bond indices – corporate, TIPS, HY – are moving in similar fashion after adjusting for duration, implying credit spreads remain relatively tame.

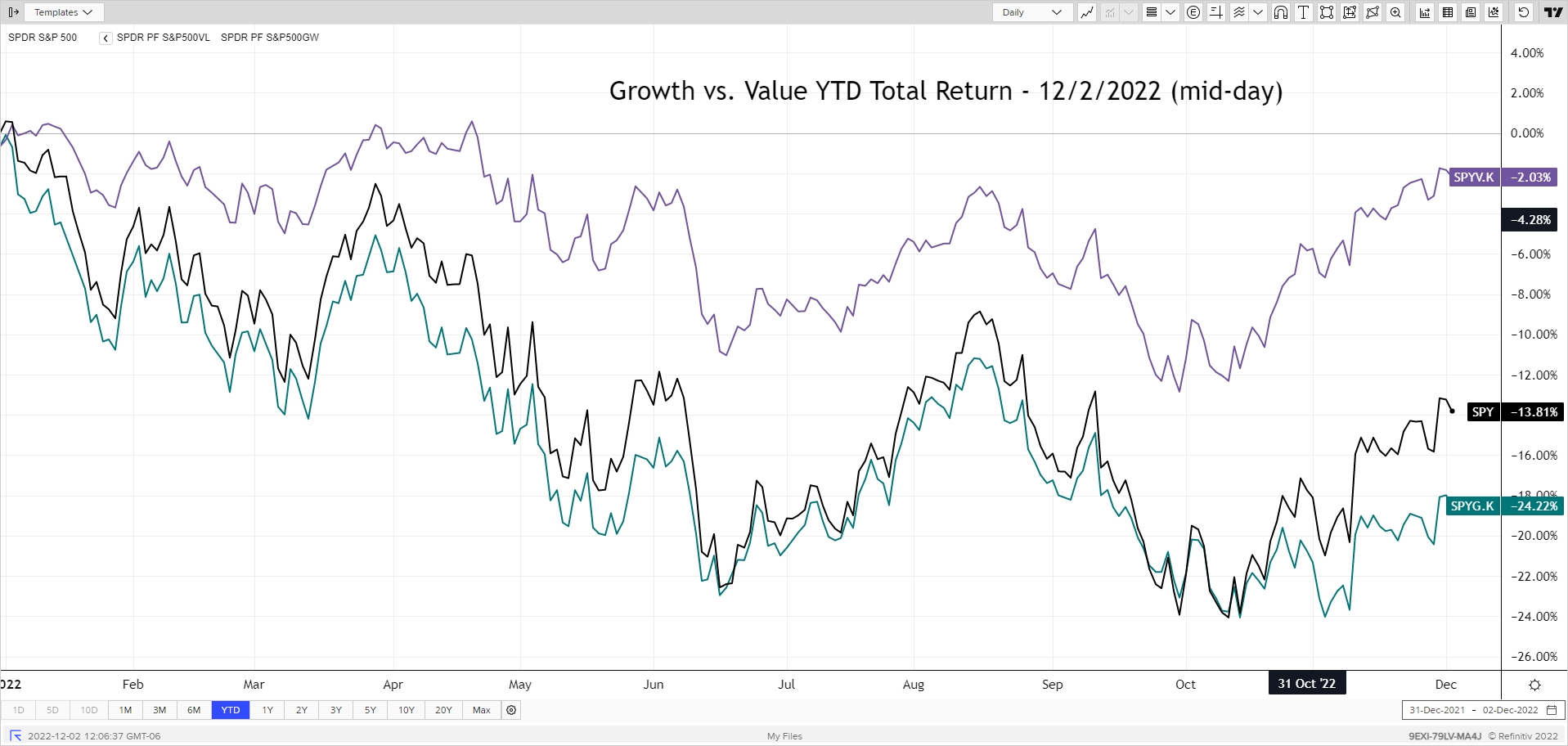

This month I am showing just the “Growth v. Value” disparity for 2022, compared to the overall S&P500 level. It is the similar theme of Value outperforming, but what is interesting this month is that Growth didn’t rally as hard. There have been a number of tech companies announcing layoffs and perhaps the market reflects this outlook. It is surprising nonetheless.

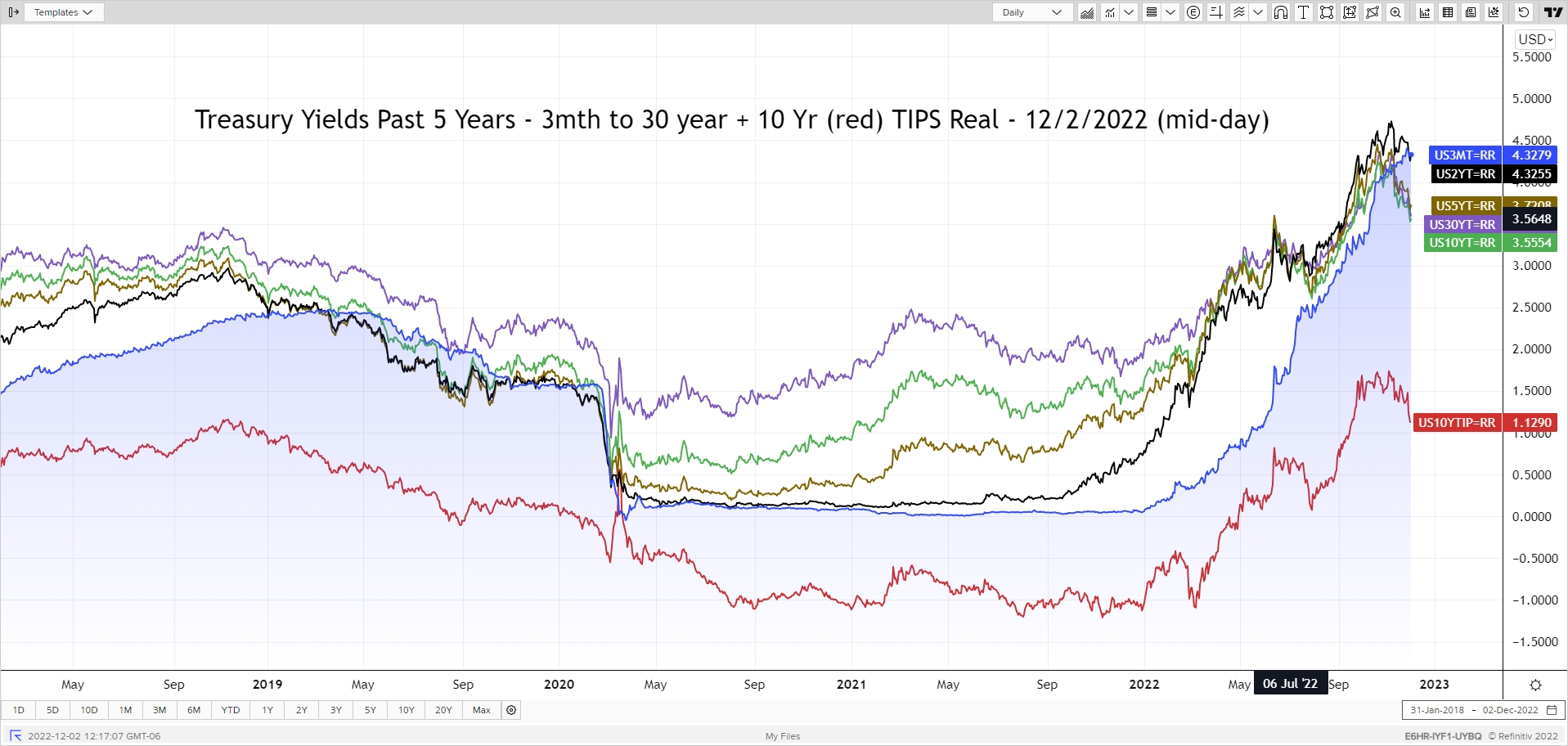

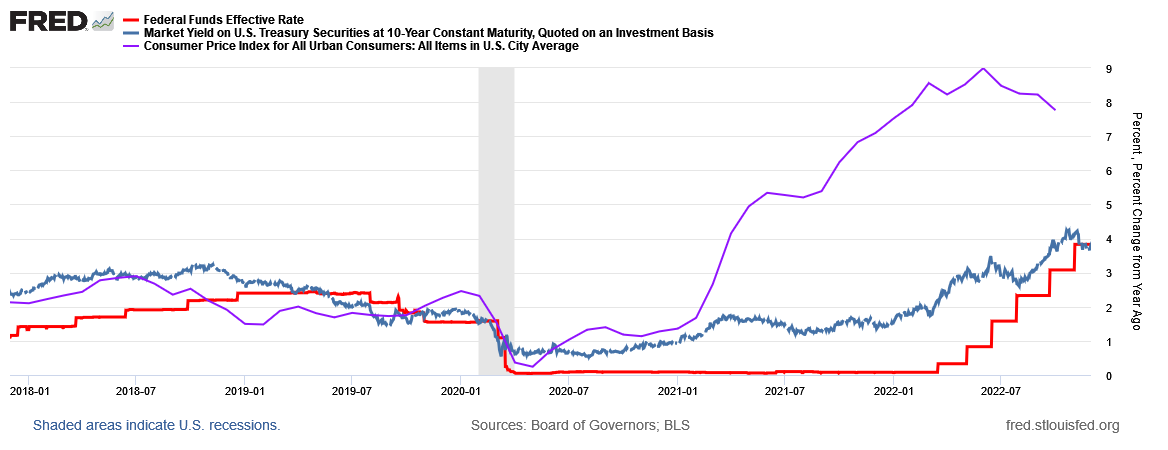

What interesting piece of information does the treasury rate graph give us this month? Huh - rates are down? Down. Huh? The reason must be… huh? 3-month T-Bill rates continue to rise.

The FOMC concludes its next meeting December 14th. Based on Powell’s comments Wednesday at the Brookings Institute, the Fed is expected to raise rates by 0.50% (was 0.75% last 4 meetings) bringing Fed Funds rate level to 4.25 – 4.50%. This meeting will also contain an update to the “Summary of Economic Projections (SEP)”. The September SEP had Fed Funds rate at 4.6% by the end of 2023. Given Powell comments after the November FOMC meeting and again Wednesday, that number is expected to be higher. This implies not only are there more rate hikes to come after December, but the Fed will likely hold rates high throughout 2023. The equity and bond markets disagree based on price action this past week. The graph below shows Fed Funds rate relative to 10-year treasury and CPI over past 5 years. The purple (CPI) and red (Fed Funds) lines should converge. How much will the blue (10-year) line lag?

I normally don’t include crypto-assets in the monthly summary but given the collapse of FTX early this month I do. You can reference my recent blog post or podcast for a deeper dive. Overall levels fell on the back of recent shock news, but then stabilized. However, they have not risen, though Ethereum recovered some over the last few months on the shift to “proof of stake”. Trust is low for many and some are waiting for another shoe to drop after the FTX collapse. BlockFi did file for bankruptcy this past week but the market took it in stride, perhaps expected since closely tied to FTX.

December is here. It can be busy, exciting, stressful – and cold. But it’s here. Enjoy the season, focus where you have to, and make it a great end to the year.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com