Asset Class Returns - 10/31/2023

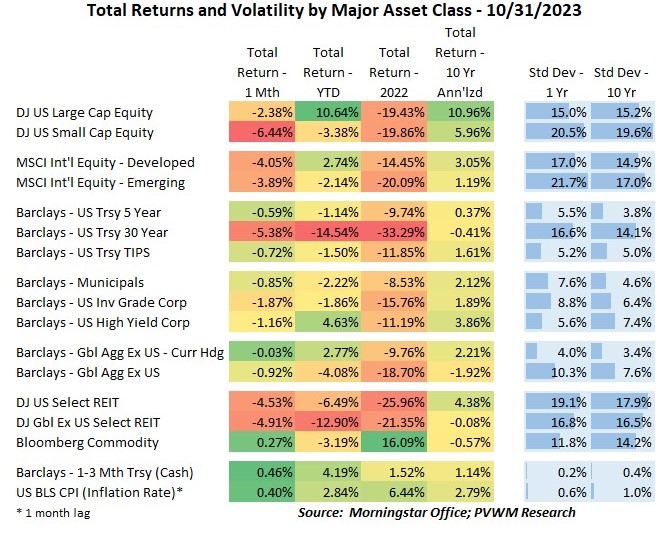

October was another negative return month across the board – except for commodities, cash and inflation. Unlike last month, this month’s largest negative return belongs to US Small Caps at -6.44%, though 30-year treasury bonds were close behind at -5.38%. The worst YTD returns is held by 30-year treasuries. The rate-sensitive REIT asset classes take the second- and third-worst spots. Ending this paragraph on an optimistic note, on a YTD basis the US Large Caps have the highest +10.64% return (down noticeably from 7/31), followed by High Yield at +4.63% and cash, yes cash, at +4.19%!

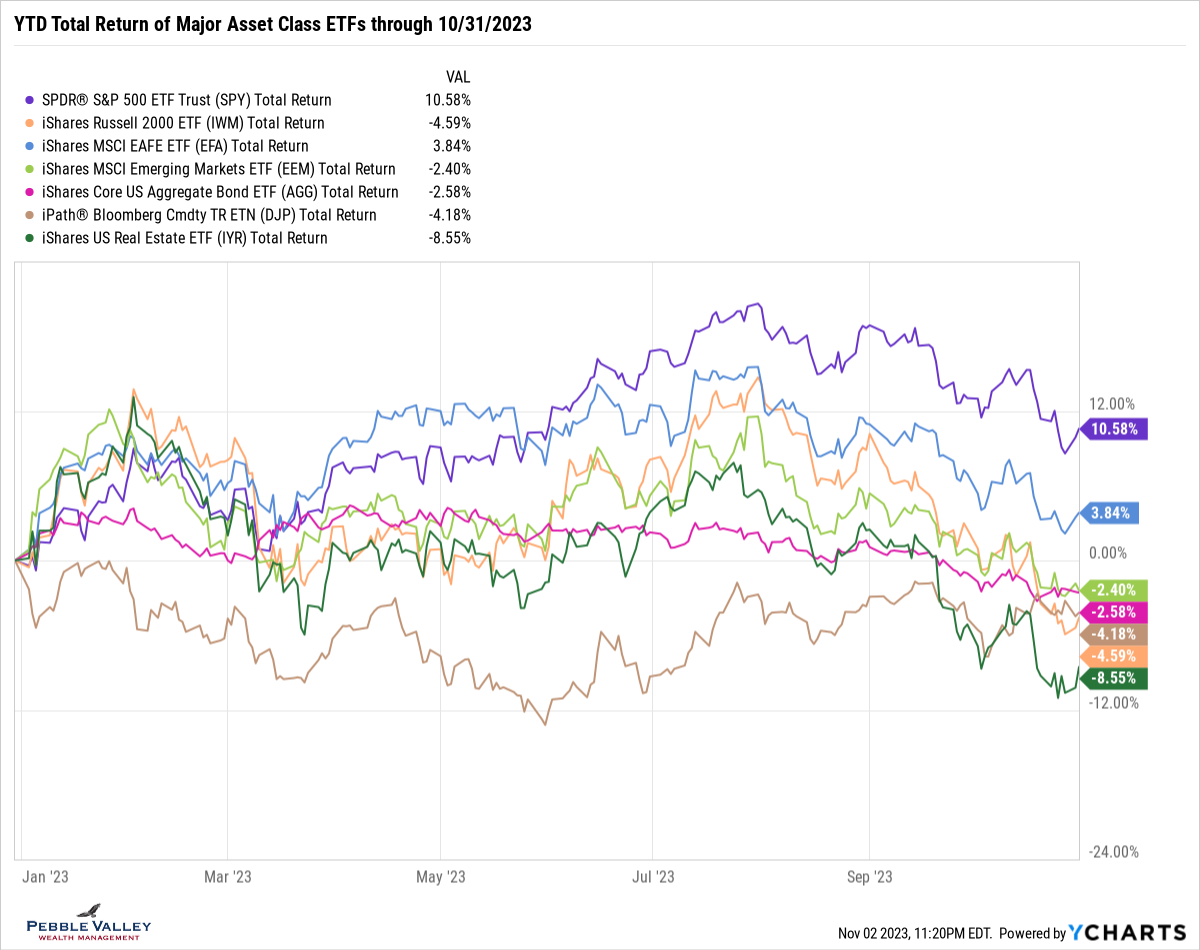

The graph below shows YTD total returns of major asset class ETFs. Regular blog readers will notice this is a new graph and I said TOTAL RETURN, not price-only returns this month. The relative highs of July looks even further away after yet another month of pullback. US Large caps and International developed are the only positive YTD returns. While not the lowest YTD return, US Small Caps had a noticeable drop this past month as continued high rates weighed on the smaller companies. From a historic valuation perspective, they remain attractive.

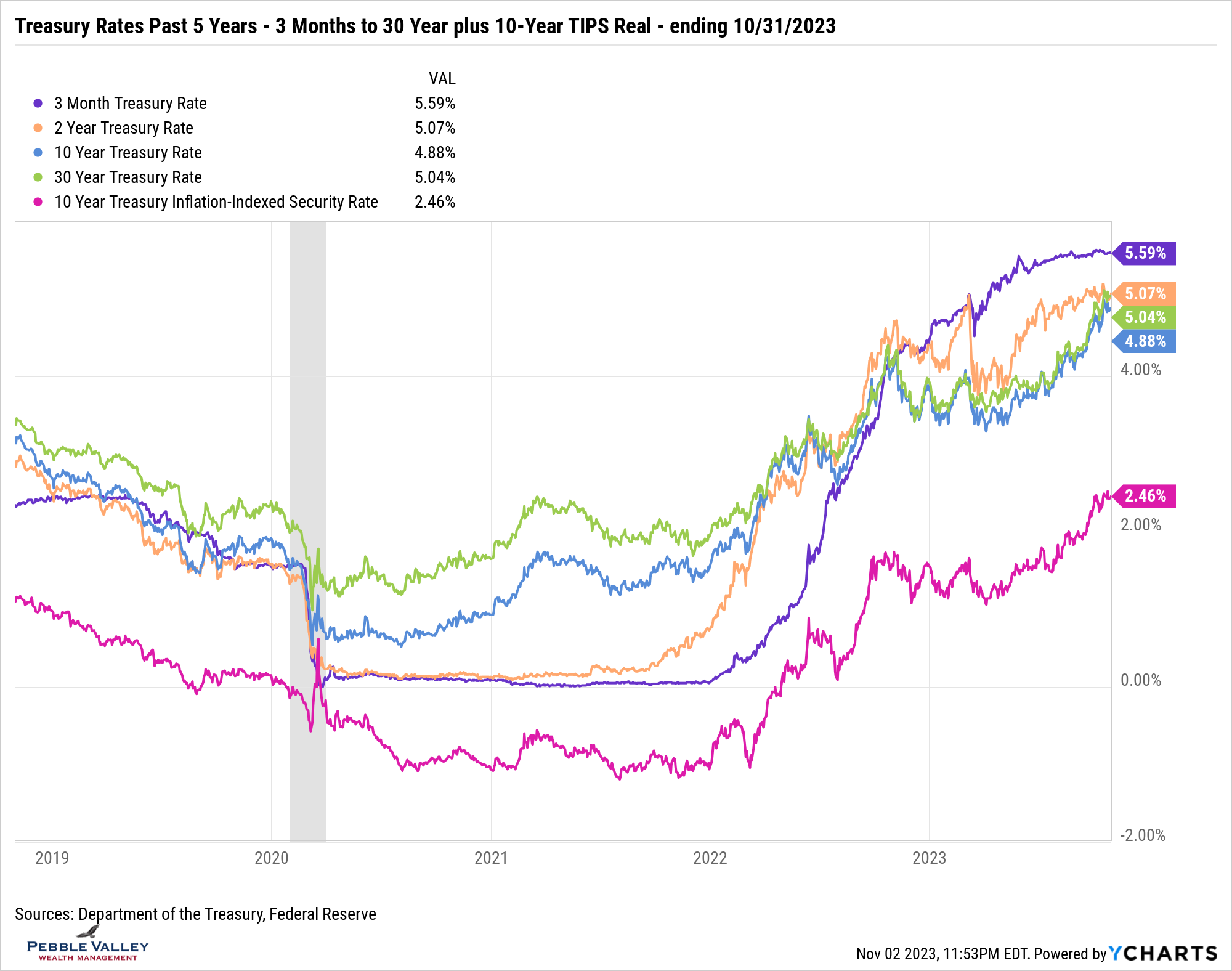

The longer end of the curve (10- and 30-year) continued the rapid march higher in rates, including the real yield from 10-year TIPS (magenta line). The shorter end (3-month and 2-year) were actually flat to down on the month, allowing the yield curve to dis-invert even more. As I mentioned last month, given the curve shape movement, it appears the bond market is not currently driven by an inflation scare but rather the large amount of treasury debt coming due to refinance and the projected new issuance to fill the hole in the budget deficit. The first day of November included the latest FOMC meeting (see below) which saw rates fall noticeably as the market consensus was a dovish Fed. My interpretation was a neutral-to-hawkish Fed however and am surprised by the near-term rate action. The Fed continues to let $95 billion roll off the balance sheet each month.

The latest FOMC meeting concluded November 1st. As expected, the Fed didn’t raise short-term rates and the statement had very few changes. The next Summary of Economic Projections will be released at the December 13th meeting so the main focus of this meeting was placed on the press conference Chair Powell holds after each meeting. After decreasing inflation readings and rising rates on the long-end perhaps doing some of the Fed’s work, many questions centered on whether the Fed was done hiking rates this cycle. Powell was consistent in his message emphasizing the strong commitment to hitting the 2% inflation target and the Fed wants to be confident they have a stance that will achieve that. He said the FOMC cannot confidently say they are or are not there yet and continue to watch the data. The market broadly viewed this as dovish and is expecting the Fed may be done. My interpretation wasn’t as dovish given the continued and consistent emphasis on the inflation path back to 2%. The CME Fedwatch graph shows the market sentiment expects only a 20% chance of a hike at the December meeting as captured by Fed Funds futures.

There are two special topics this month:

- Year-end tax planning. Depending on your situation, this can range from making sure on pace to max out 401k/3b contributions, fund 529 college plans if state deduction, complete required distributions from IRAs/401ks, make any charitable contributions (from IRA if qualify, into Donor Advised Fund for large deduction, or directly with cash or securities) and partial Roth conversions if your tax situation warrants. It is true you can make 2023 tax-year contributions to IRAs and HSAs before tax filing next spring but payroll-driven activity is limited.

- I Bond rate reset. This occurs each May 1 and November 1. Not only is the semi-annual inflation component that applies to all cohorts calculated but a new fixed-rate component is set for the latest I Bond cohort (new money deposited over next six months) based on Treasury discretion but informed by TIPS real yields. Given the market rate increase, the fixed rate set isn’t as high as I expected, but still a very attractive 1.3% fixed. New money deposited into an I Bond will earn 5.27% annualized rate. Those individuals who have a previous cohort with 0% fixed rate – yes all you who jumped when rate was 9.62% - and haven’t made their 2023 contribution may want to consider cashing in (provided held at least 12 months and yes, lose last 3 months’ interest and pay Fed taxes – not state – on gains), then rolling into new I bond with 1.3% fixed rate for life of I Bond. Again, still subject to $10,000 per year per person/entity of new money. You can’t roll into new beyond that limit.

I read that Starbucks is introducing the “red cups” on November 2. A bit early, but that time of year is approaching.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com