529 Deduction – The Silver Lining of Illinois Tax Rate Increase

The recent Illinois income tax increase caused many reactions. Asking taxpayers for more funds in return for reforms that can begin to fix the core problem is one thing, but that will have to wait again. One thing the higher tax rate did however is make the maximum 529 college savings contribution benefit more valuable – up to $990 per contribution year for joint filers. This post will describe the 529 deduction in general, then show the Illinois tax deduction impact in particular.

Most tax deductions are expressed relative to federal taxes. Common deductions include state and property taxes, mortgage interest and charitable contributions. The sum of these deductions (and other items found on Schedule A) are entered on Line 40 of your federal tax return, unless the standard deduction allowed is larger. This amount among other things reduces your adjusted gross income (bottom of page 1 - line 37) to arrive at taxable income exposed to federal tax brackets. There are various credits and other taxes but I will stop here for this purpose!

One deduction you will not find on your federal tax return is a contribution to a 529 Plan. However, many states (but not all) allow this deduction, up to limits, on the state tax return if an in-state plan is used. Illinois for example starts with federal adjusted gross income, then adjusts up or down based on items listed in Schedule M. One deduction is Illinois-based 529 Plans, up to $20,000 for a joint filer ($10,000 for single) regardless of how many accounts are used. Other states may have a smaller deduction or apply at the account level. There are a handful of states with no deduction, either because it is not allowed or there is no state tax.

So how does a higher state income tax rate benefit a college saver that uses an in-state plan?

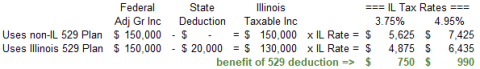

Let’s assume a family files a joint return with federal adjusted gross income of $150,000 and no state adjustments other than a $20,000 contribution to a 529 Plan. Here are the state income tax impacts if this is an Illinois resident under the old and new tax rates and whether using an in-state 529 plan. You can see the maximum annual Illinois tax benefit is now up to $990 given the higher income tax rate (an extra $240 if already utilizing).

There are some 529 tax benefits that apply to both federal and state taxes. All investment gains are not taxable at either level while growing in the account nor are they taxed when withdrawn provided funds are used for qualified education expenses. There are also a few myths worth clarifying that may have prevented some from using 529 College Savings Plans.

- 529 College Savings Plans are different than 529 Prepaid Tuition Plans; the Savings Plans provide investment flexibility (and market risk) but are not exposed to state credit risk

- You do not have to attend an in-state school if using a given state’s 529 plan

- You can change the beneficiary to another family member if all funds are not needed, but funds must be used for education purposes to avoid a penalty upon withdrawal

- The 529 balance counts as a parent’s asset, not the child’s, on financial aid forms.

So yes, your tax bill will be higher in Illinois. But if you are contributing to an IL 529 plan, it will be softened by $240. And if you are contributing to a non-IL plan, I encourage you to revisit the IL 529 College Savings Plans options. An extra $990 goes a long way in making up minor difference in fees or investment choices for out-of-state plans.

For more information on what a 529 Plan is, and how to use one, tune in to this podcast episode:

Interested in learning more about working with our firm? Schedule a call by clicking here!