401k Loan: Are you really paying yourself? What are other choices?

Some people turn to their 401k when they need a loan. “Why not pay yourself the interest?” is one common thought. But what really goes on when you take out a 401k loan and how does it compare to other borrowing choices? Below I outline the mechanics of a 401k loan, then compare it to a home equity line and credit card. There are benefits and pitfalls for each type so understand the impacts before making your choice.

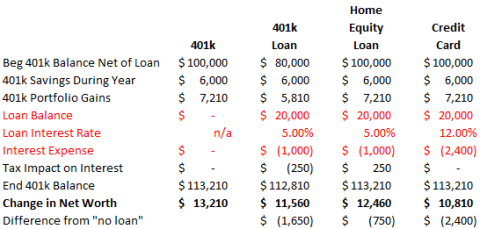

To illustrate the differences, assume a $20,000 loan is needed at the beginning of the year, you have a $100,000 401k balance with $6,000 of planned savings earning 7% return, and the loan will be paid off with interest at the end of year. The key drivers illustrated in the example below are:

- Assumed return on 401k portfolio

- Interest rate charged on the different loan choices

- Tax impact on the interest cost, both explicit and implicit (assume 25% tax rate).

The metric to compare the choices will be the change in net worth considering the growth of the 401k through savings and investment return, the cost of borrowing and any tax impact from the loan. The first column shows the 401k performance with no loan so you can see what changes when a loan is added. To highlight the tax nuances, I assumed the 401k and home equity line had the same loan rate.

When a 401k loan is used, you are removing the loan portion from the 401k earning investment returns. It is true the interest paid on that loan gets credited back to the 401k (“pay yourself the interest” comment) but it may be less than what the portfolio earned. The other subtle difference is that the loan interest is paid back with after-tax dollars and is not deductible while portfolio gains are generated tax-free (from your perspective). It is also true both portfolio gains and 401k interest paid will be taxed as ordinary income when later withdrawn, but the latter will be double-taxed.

The home equity line also is paid off with after-tax dollars but most of the time that interest cost will be deductible. Not only do you get the deduction but your full 401k portfolio growth is generated tax-free (from your perspective) since funds weren’t removed for the loan. If you have a line established and sufficient equity built up in your home, this is likely your best option.

The credit card option is typically the worst option from both a loan rate perspective (typically much higher) and lack of deductible interest. However, sometimes this is the only access to cash available on short notice. If the loan is needed for a short time only, the high interest rate may not sting as much but don’t view this as long-term funding and be aware of your credit card capacity.

There are also a few additional features of a 401k loan to be aware of:

- Not all plans allow 401k loans; note individual IRA accounts DO NOT allow loans

- The most you can borrow is lesser of 50% balance or $50,000 (sometimes employer contributions are excluded from ‘balance’ for 50% calculation)

- 401k interest rate is typically set around Prime Rate + 1-2%

- Loans typically have minimum amounts required and a small set-up fee

- Typical 401k loan repayment term is 5 years (may be exceptions if used for home down payment)

- If you leave the company, typically must pay the loan back in full within 60-90 days

- If you are not able to pay the loan, the unpaid balance will be treated as a 401k distribution which is a taxable event and if below age 59.5, a 10% penalty applies – OUCH!

There are situations where a 401k loan may provide the best loan choice, but you won’t know until after the loan is paid back. This occurs if the underlying 401k portfolio experiences poor investment performance. Taking out the 401k loan would be beneficial since you removed those funds from investment returns. But remember, given the tax drag of a 401k loan relative to a home equity line, it takes more than just a return lower than the loan rate to tip the scales in that favor.

Finally, I showed the annual savings in the example above to point out the danger of reducing your monthly 401k contribution so the net paycheck remains the same during loan payoff. If you do this and your contributions fall below the maximum employer match, you will also be giving up that free money – DOUBLE OUCH!

So yes, a 401k loan feature is there as an option, but don’t view it as free money that you pay yourself back anyway. There is a cost of borrowing for any loan taken, and best reserved for funding stable or appreciating assets.