$233,610 to raise a child – excluding college? Seriously?

The USDA recently issued Expenditures on Children by Families, 2015 or more commonly known as “The Cost of Raising a Child” report. The answer: $233,610 per child for a middle-income couple with two children. This is in today’s dollars (not inflation adjusted) through age 17 and does NOT include the cost of a college education. This post will break down the components of this number and show how quickly $13,000 per year can add up. At the end I mention ways to help soften the cost through employee benefits, tax advantaged savings and simply being smart about spending.

Understanding this breakdown also helps inform the additional savings capacity available after children are grown and how spending may change in retirement (though new categories are typically added). A more accurate title for the USDA report could be “What the Average Family Spends on a Child” since some items are discretionary. For single parents, the estimates were only slightly less. For grandparents thinking the costs for raising your children weren’t near this high, see the graphic at the end – hint: only slightly less.

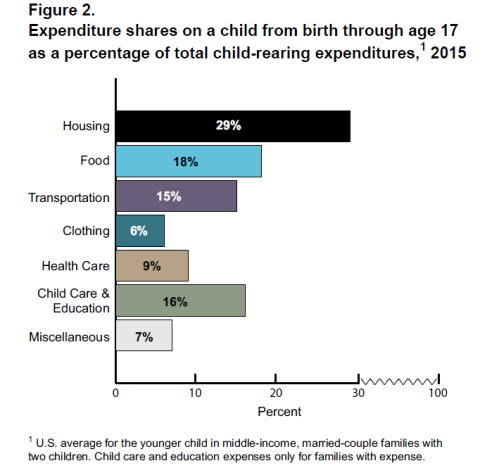

Let’s start by looking at the breakdown by major category. I initially dismissed the large housing component as a wild research-paper assumption but you will see below where I explain these major categories that is not the case.

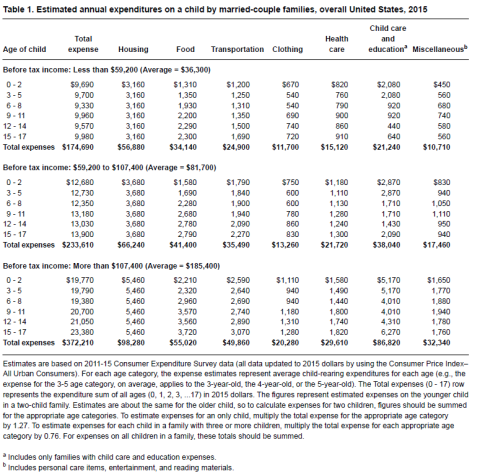

The next graphic shows annual numbers for these major categories by age of child. Three annual income breakdowns are shown. Implicit in the income ranges may be the breakout for different regions of the country or urban vs. rural areas. This detail is also shown in the USDA report but I’m sure you will quickly find the applicable range for your circumstances. Compare the category average to your own budget to see if higher or lower. While there are many variables that can impact how much one spends on a child, one key driver is amount of discretionary income. The annual cost ranges from about $9,500 for lower income couples to around $20,000 or more for high income.

So what assumptions were used to arrive at the average cost? Below are the key assumptions used for each category. See the link to the report for further details. I’m sure you will find some assumptions overstate your circumstances while others understate or are missing. Focus on the major items to trigger things you may have overlooked; if it doesn’t apply to you, adjust accordingly.

Housing – 29%

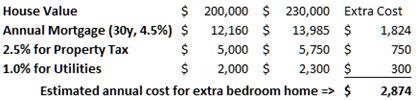

- Used the average cost of an additional bedroom from housing data

- Taxes, utilities (including cellphone!) and maintenance scaled as a %

- Below are estimates for the annual additional cost of maintaining a home worth $30,000 more to reflect the cost of an additional bedroom

Food – 19%

- The obvious grocery bill

- Also includes dining at restaurants, that Friday night pizza money and school meals

Transportation – 15%

- Allocated 75% of total transportation costs to family, and of that, 50% to children

- Monthly payments for vehicles plus gas and maintenance

- Any public transportation and airline fares (presumably vacation related)

Clothing – 6%

- Diapers and onesies and blankets when young

- New pants to replace the “floods” later and the Sunday shoes for those special occasions

Health Care – 9%

- Medical and dental out-of-pocket costs

- Additional insurance premiums for children

Child Care and Education – 16%

- Baby sitting and day care

- Elementary and high school tuition, books, fees and supplies

- Miscellaneous – 7%

- Personal care like haircuts and first-aid supplies!

Reading material like books and magazines – paper or digital

Entertainment, sports equipment, lessons

Some additional child-related expenses not included in this study that will add to this number:

- Bringing the child into the world - prenatal care, fertility care, child birth and adoption

- Life insurance on the parent(s) that should be purchased

- Additional housing costs for those pursuing strong school districts and more space in the house and yard

- College education (tuition, fees, room/board) which average about $20,000/year for in-state public schools to $45,000 for private schools (varies by individual circumstances)

As mentioned at the beginning, these are per child estimates based on a married couple with two children. Now that you know the key items behind the estimate you will recognize some items benefit from economies of scale. Expenses for a one-child household are about 27% higher while a household with three or more children will be about 24% lower.

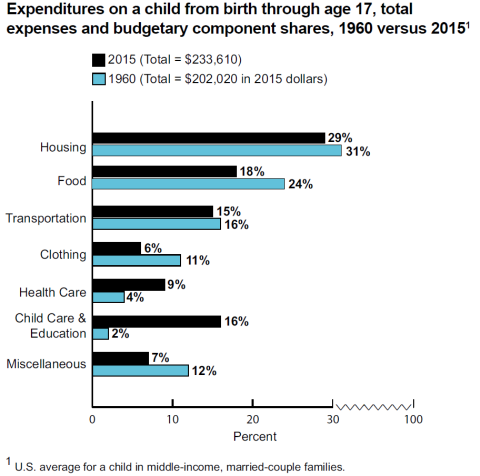

For the grandparents reading this post and thinking these expense estimates were not that high when you raised your children, you may find the next graphic interesting. While the total is less, it is still above $200,000 (in today’s dollars) and the distribution by major category was surprisingly similar for the big ticket items.

So how can parents (existing or future) help pay for this? First remember it is a $10k-$13k annual number you need to fund, not the full amount up-front. If funds are tight don’t let yourself drift up to the $20k/year spending level.

- Prepare a budget so you know where current funds are going and where to adjust

- Aggressively save for your retirement before children so if you need to dial back a little, you have a good start

- Ask relatives for hand-me-downs, especially at young ages; they grow quickly and are less likely to care what they wear (unlike their later years!)

- Take advantage of employer benefits with tax benefits that include dependent care savings accounts, the best medical plan for your new family, and low-cost group disability insurance for family income if disabled for a period of time

- Continue saving at least enough in the 401k for the maximum employer match (view as 100% return on your investment!)

- Don’t forget about Spousal IRAs if one stays home with the child to pick up a tax deduction for some (higher deductible limits than individual) and continue the savings even if not in the workforce

- It is important to first determine how much life insurance you need, then buy the policy that fits your budget; this may mean low-cost term insurance which is quite affordable especially for younger parents

- While college costs aren’t part of this study, if you begin saving take advantage of the tax benefits in 529 Savings Plans, especially those in-state plans that provide a state tax deduction

- After the children are gone dial up the tax-advantaged savings again to make up for any lost ground

The annual cost of raising a child usually isn’t the primary consideration when deciding to have children. And while the annual cost range may seem high, it is manageable. And the benefit of watching your child launch through eyes filled with pride and tears – priceless.