2025 Year-End Tax Planning

Thanksgiving is next week! Then the stroll – don’t sprint! – to the Christmas season and year-end festivities. There are also some important year-end reminders and tax strategies to consider before that - and take action if necessary. In addition to maxing out contributions, tax loss harvest (or gains!) and RMDs and Roth conversions, the impacts from the One Big Beautiful Bill Act (OBBBA) passed in early July must also be considered. See my recent blog post for some key provisions of OBBBA.

This blog post will focus mainly on Federal taxes, not State. Please note this is not formal tax advice. I am not an accountant, nor do I prepare tax returns. But as a financial planner, I understand these topics very well and perform detailed tax planning for our clients. This gives them more control and minimizes tax surprises next spring. Reach out if that sounds appealing.

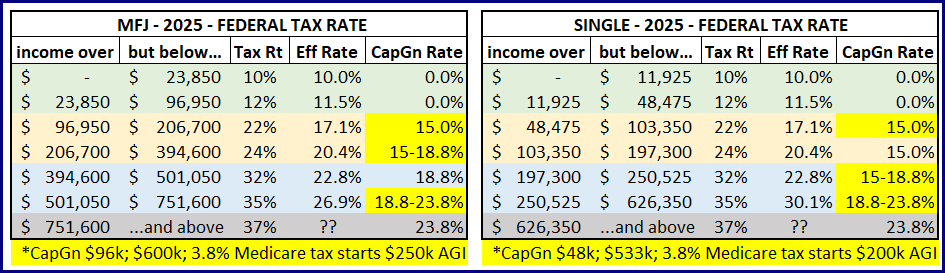

Marginal Federal Tax Brackets for Income and Capital Gains

An important driver in assessing different tax strategies is “What is this worth?”. The answer lies in the type of taxable income impacted – ordinary income or capital gains (and qualified dividends) – and your marginal tax rate (how the next $1 of income is taxed). The table below shows income and capital gains tax rates for Single and Married Filing Jointly. You can also reference my recent blog post describing key lines of your tax return.

Max out contributions for accounts with year-end deadlines

Some of the tax-favored accounts must have contributions done by year-end while others allow up to tax filing next spring (or later) and can apply to the 2025 tax year. Here are the most common accounts with year-end deadlines. Some of these account’s contributions come via payroll deductions so you can crank up the % contribution now, but be sure to adjust back in January to the annual run rate.

401k/3b Employee Contributions

If made to a Traditional, the contribution is deductible from income; a Roth is not deductible; there are no income limits

Max contribution in 2025 is $23,500 plus extra $7,500 if 50 or older; an additional $3,750 on top of $7,500 if age 60-63 at year-end (catch-up changes in ’26!)

If working for company or self-employed with S-Corp, must make via payroll deductions by adjusting withholding

If plan allows and max out 401k/3b, can also make “after-tax” contributions (different than Roth 401k/3b); ideally move to Roth IRA soon after contribution

College Savings Plans (529s) – most of them anyway

Contributions deductible at some states only, up to limits that vary by state; not deductible at Federal level

Investment gains not taxed at Federal and State if for qualified education costs

Fund Donor Advised Fund (DAF) if charitably inclined

Get deduction in year of contribution (ideally in high tax bracket); donations from DAF in future years not deductible but ideally in lower tax bracket

if contribute appreciated securities can deduct full MV but avoid capital gains tax

May allow for additional Roth conversions if done in same year

Charitable deduction “below the line” so no help with Medicare IRMAA bands

OBBBA Impact – starting in ’26 first 0.50% of AGI excluded from deduction if itemize; if same tax situation in ’26 as ’25, consider doing in ‘25

Accounts where contributions can be made next spring for 2025 tax year

Some people like to make contributions as soon as possible, while others may need to first confirm their income allows certain types of contributions, if a deduction would help the tax return, or are waiting for extra cash-flow to fund. Here is list of tax-favored accounts that allow contributions next spring for tax year 2025.

Traditional and Roth IRAs

whether deductible for Traditional or allowed for Roth depends on income

Health Savings Accounts (HSAs)

No income limits; must have High Deductible Heath Plan for tax year contribute

Self-employed as single-member LLC or Sole Proprietor 401ks

Employer contributions into 401k/3b

Handful of states allow 529 contributions

Accounts that may require a distribution before year-end

The above discussion described maximizing contributions. There are some accounts where distributions must be done before year-end or penalties may occur.

529 reimbursement

Income tax-free if used for qualified expense

Must withdraw qualified education expenses in same calendar year incurred

Flexible Spending Accounts (FSA) – both Health Care and Dependent Care

Income tax-free if used for qualified expense

Unlike HSA, these accounts are “use it or lose it” each year

Many plans offer 2.5 month grace period for submitting claims

Many plans allow carryforward of $660 for Health Care; $0 for Dependent Care

Required Minimum Distribution (RMD) from IRAs/401k/3b – can’t delay tax forever

Own Roth IRA/401k/3b

NONE

Own Traditional IRA/401k/3b

Must begin age 73 (was 70.5, then 72; those born 1960+ will be age 75)

Can delay first RMD until April 1 following year but then have double RMD second year, so watch total income and bracket impact

Ordinary income unless past non-deductible contributions (see Form 8606)

Can use RMD for Qualified Charitable Distribution; not for Roth conversion

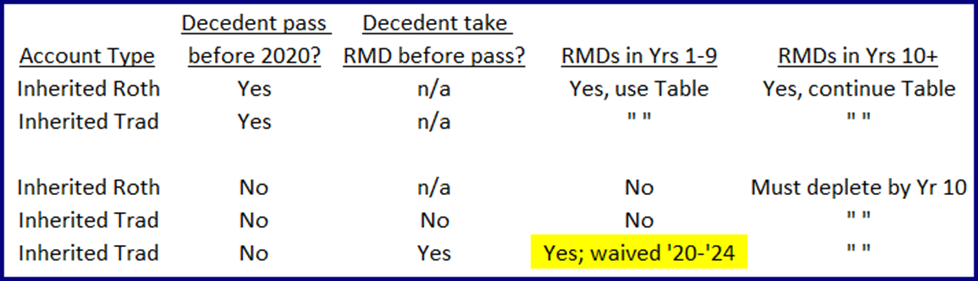

Inherited Roth or Traditional IRA/401k/3b – YES INCLUDING ROTHs

For this blog, I will not address rules for “eligible designated beneficiary” (spouse, minor children, disabled, chronically ill, less than 10 years younger)

Ordinary income (see Form 8606); use RMD for QCD; no Roth conversions

Some inherited IRAs received in 2020 or later MUST BEGIN RMDs in 2025

Allowed to take more than RMD without penalty; ideally delay Roth; may want to for Trad to avoid taxable income jump in year 10

Qualified Charitable Distributions (QCD) for own or inherited IRA – NOT 401k/3b

Only applies if above age 70.5; must wait until “.5”; age NOT changed like RMD

Make direct contribution from IRA to qualified charity; counts toward RMD requirements above but QCD must be done before RMD taken out

Maximum amount is $108,000 for 2025 (indexed to inflation starting in ‘24)

Attractive for charitably inclined if taking standard tax deduction since weren’t getting any tax benefit

Also reduces income for Medicare IRMAA while itemized deductions do not

TELL ACCOUNTANT next spring; only show total withdrawal on Form 1099-R

OBBBA Impact – starting in ’26, if take standard deduction allowed to deduct up to $1k Single filer / $2k MFJ

Review realized capital gain/loss and search for harvesting – both losses and possibly gains

Recall gains from a security held more than 1 year get favorable tax treatment; if 1 year or less it counts toward ordinary income. Any losses offset gains, first short against short and long against long, then each other. If losses exceed gains, can reduce ordinary income up to $3,000, then carry forward rest. Be careful with “wash sale rules” - can’t buy back same or substantially similar +/- 30 days, including spouse account if joint filer! If in 12% or lower income bracket (approximately), capital gains rate is 0% so may harvest gains; note state tax may apply! Extra 3.8% Medicare tax kicks in at $200k / $250k AGI for Single / MFJ; extra 5.0% tax kicks in around $533k / $600k taxable income for Single / MFJ. Don’t forget about mutual fund distributions if held in taxable account. See funds’ websites for estimates or better yet, hold ETFs in these accounts!

OBBBA Impact – some features that begin in ’25 (see recent blog post) have income limits where begin to lose the tax benefit. Be aware what capital gains may do to some of those benefits if applicable.

Partial Roth Conversions

Roth conversions requires a complicated analysis, not only of current year taxable income estimates (including all factors above) but also expected future taxable income, including Social Security and RMDs. Recall withdrawals not used for charity from Traditional IRAs and 401k/3b are taxed as ordinary income (states vary) unless past non-deductible contributions (see Form 8606). The concept is to convert part of a Traditional IRA/401k/3b into a Roth if in a lower or same tax bracket as expect to be in the future. A few of the complications to consider:

Be aware of different income limits on deductions, contributions, tax credits, Medicare IRMAA and how Roth conversion will impact.

If lower income without Roth conversion and receiving Social Security, Roth conversion may force more Social Security income to be taxable (ranges from 0% - 85%)

Ideally pay related tax from other account, not part of conversion; requires “estimated tax payment” with deadlines and may require accountant to use timing of income; DO NOT pay taxes as part of conversion if under age 59.5; incur 10% early withdraw penalty

If age 63 or older, be aware of Medicare IRMAA premiums and how conversion impacts; yes, Medicare can start age 65 but IRMAA uses tax return from 2 years prior

OBBBA Impact – same comment as previous section; be aware of key income limits and the impact from Roth conversion. New deductions, including $6,000 Senior Exemption (age 65+; income limits) may open more room but again, watch the SS tax torpedo!

Review year-to-date tax withholdings vs. expected total taxes due and adjust

If you are still with me, you must really like tax planning so let’s get in the weeds here – ok, deeper in the weeds! Throughout the year you have taxes withheld from paycheck and/or paid via estimated tax payments due 4/15, 6/15, 9/15 and 1/15 of next year. To avoid a tax penalty (costs more recently with higher interest rates) you want at least the amount withheld that puts you in the “safe harbor” zone. If expect to fall short of “safe harbor”, update Form W4 with employer and specify extra dollar amount per paycheck (adjust back in Jan!) or pay estimated tax by 1/15 next year. If doing an RMD or Roth conversion, you can also adjust the taxes withheld during that action. The nice thing about that approach is the tax was assumed to be paid throughout the year so the specific timing technique may not be required by accountant. That is not ideal for Roth conversion (DO NOT do this for Roth conversion if under age 59.5) if have taxable account to pay the taxes, but some like the “easy button”.

OBBBA Impact – starting in ’25 receive extra standard deduction of $750 if Single filer / $1,500 MFJ, with no income limits; if itemize, SALT may be increased depending on income. The Senior Exemption above may change total taxes due.

Who said taxes aren’t fun. Ok, maybe not fun, but there are plenty of actions one can take now rather than complaining about the large tax bill next spring. Grab your piece of the pie! Happy Thanksgiving!

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com