Asset Class Returns - 3/31/2024

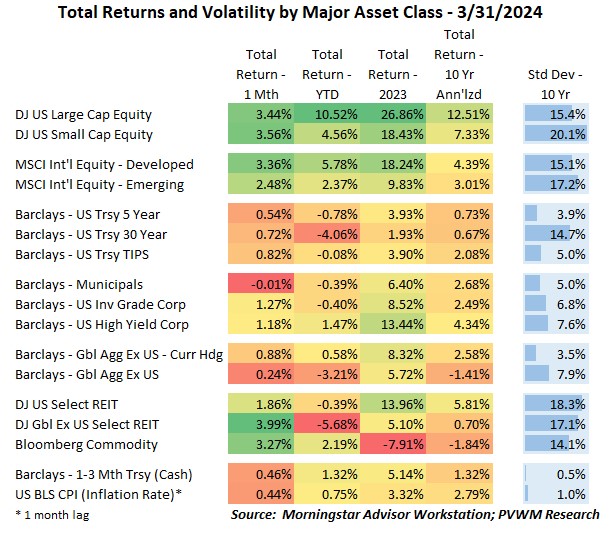

Despite the market now pricing in fewer rate cuts by the Federal Reserve, the markets continued to rise in March. The major US and International equities all performed similarly for March, though the YTD returns vary noticeably. Within the US, the tech sector continues to be the leader on a YTD basis but Energy, Financials and Industrials are catching up. For March alone, Energy and Utilities were the strongest performers. If not for the end of month rally, REITs would have shown a negative month. The fundamental news remains the same for this asset class and the focus is whether commercial loans can be refinanced as they come due. Most bond asset classes showed a respectable gain for the month, though interest rates are starting to climb again during the first few days of April.

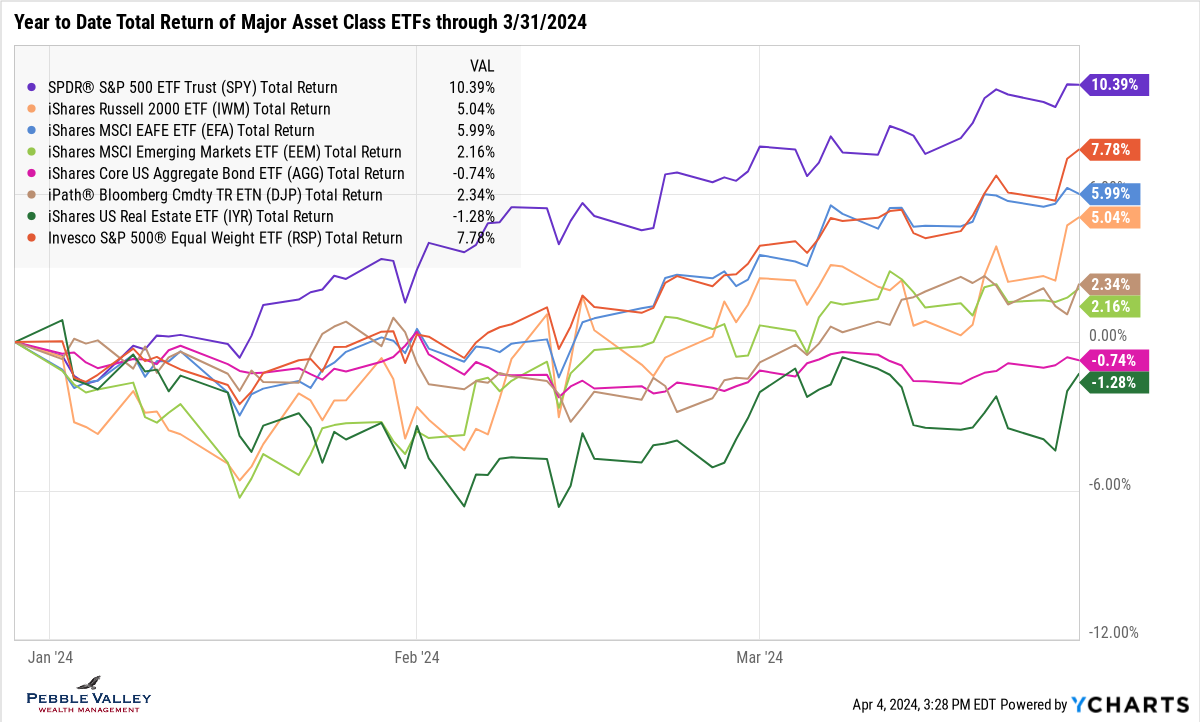

The graph below shows total returns of major asset class ETFs, including the equal-weighted S&P index ETF (ticker RSP) so you can compare to the market-weighted index (ticker SPY). Again this month, US small caps (IWM) were down during the first part but had a strong rally as regional financial stocks caught a bid. REITs (IYR) continue to bring up the rear of YTD returns though that month-end pop I mentioned above is quite visible in the graph. The magenta line capturing the aggregate bond index (AGG) meanders just below 0% return as the positive coupon carry fights off the small price drop as interest rates rise. The coupon is losing that fight in early April.

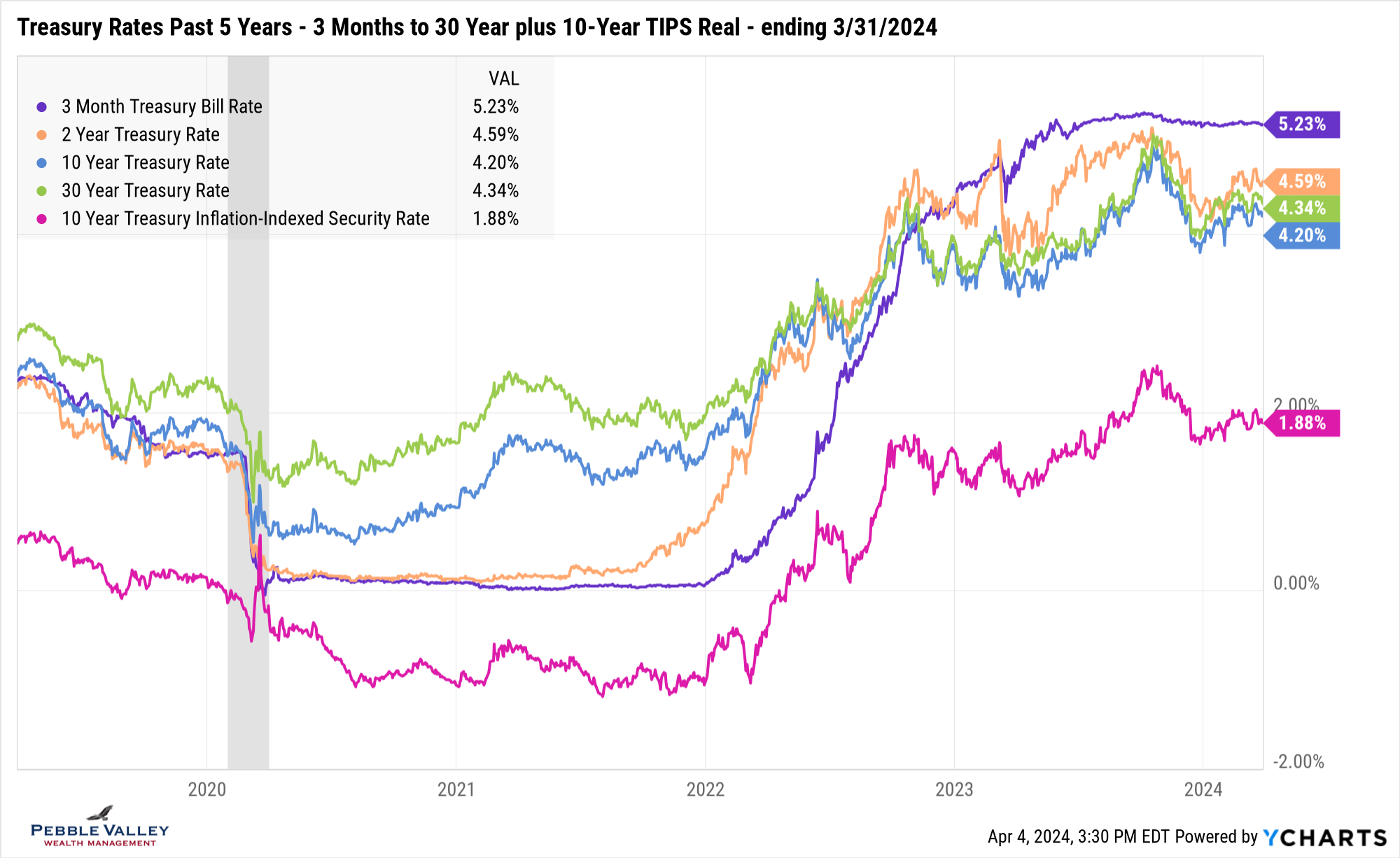

Treasury rates wiggled up and down during March but ended the month close to where they started. Looking at the shape of the curve, the 10-year minus the 2-year yield remains negative about -0.40%. This “negative yield curve” was as tight at -0.15% toward the end of January but fell close to -0.45% in early March. Lately the market’s attention seems to be focusing on long-term debt issues and the continued huge supply of treasury issuance. This keeps prices down => yields up on the longer end of the curve. This can be a slow-moving train wreck but something to be aware of. Note the TIPS real yield – fixed coupon received IN ADDITION to actual inflation – is about 0.40% lower than it was in late October 2023. This is very important for I Bonds which will be reset on May 1st. The last set was on November 1st with a fixed coupon rate of 1.30%. If real yield remain at similar levels I expect the new I Bond fixed rate to be lower, so if planning to do an I Bond purchase for 2024 – recall $10,000 maximum per person – you may want to do before May 1st.

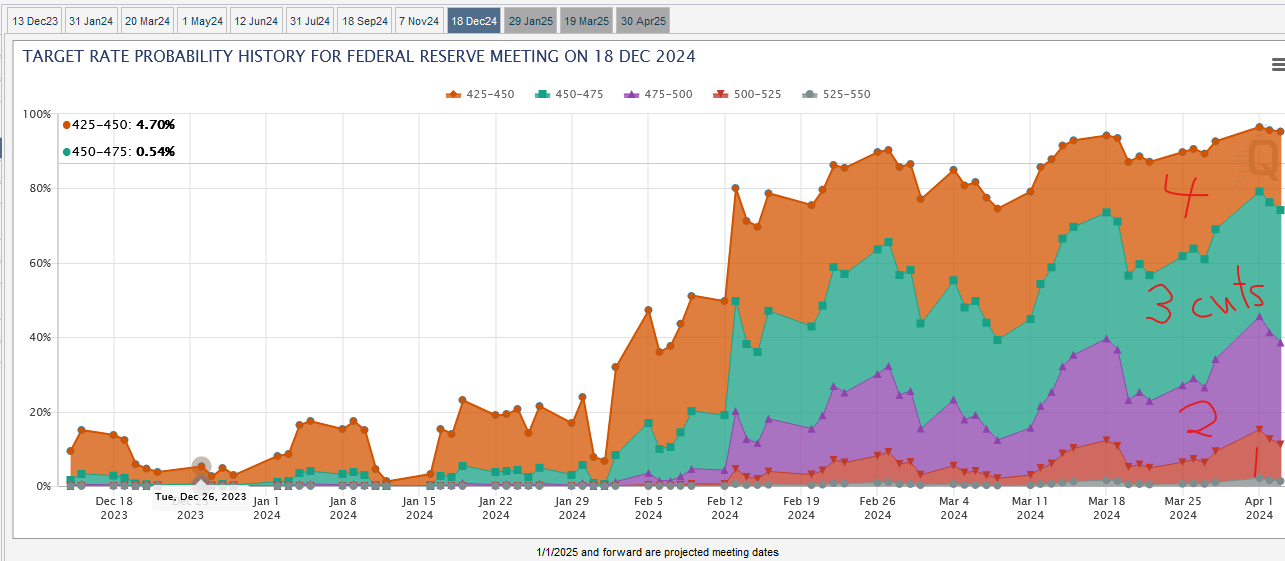

The March 20th FOMC meeting concluded with no rate cut as expected. Recall this meeting also included an updated Summary of Economic Projections. All eyes were on the “dot plot” - where Fed Reserve members see Fed Funds rate at the end of next three years. The end of 2024 rate remained at 4.6% implying three 0.25% rate cuts this year – the same as the December estimate. Markets loved this as there was concern the Fed may have indicated fewer rate cuts given the higher inflation backdrop. However, the median was only one person away from showing only two rate cuts. In fact, the 2025 and 2026 did INCREASE from last projection, which surprisingly didn’t get much attention. The other economic projections indicated an improving economy (higher GDP, lower unemployment) but also showed Core PCE inflation gauge to be 0.20% higher by the end of 2024. Hmmm… Using my favorite CME Fedwatch tool, the market is now pricing in the first rate cut for June (about 60%). The market also began backing away from the fourth rate cut by year-end (see the widening green shaded area below since mid-March) – Source: CME Fedwatch 4/4/24. Also note we get the next jobs report this coming Friday.

The special topics this month:

- See my recent blog post for last minute tax planning (mainly IRA and HSA contributions!) and common tax forms needed by your accountant. As a reminder if file for an extension, still need to pay the estimated taxes due to avoid interest and penalties. IRA and HSA contributions also must be done, though employer contributions enjoy the extension.

- I Bond’s attractive 1.3% fixed coupon available for new contributions through April 30th. At that time a new fixed rate will be set (for new contributions over the next six months) and based on current market rates it may be lower. Consider making 2024 I Bond contributions before May 1 if planning to do this year.

Enjoy the season. During the soggy days, remember the May flowers!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com