Asset Class Returns - 9/30/2021

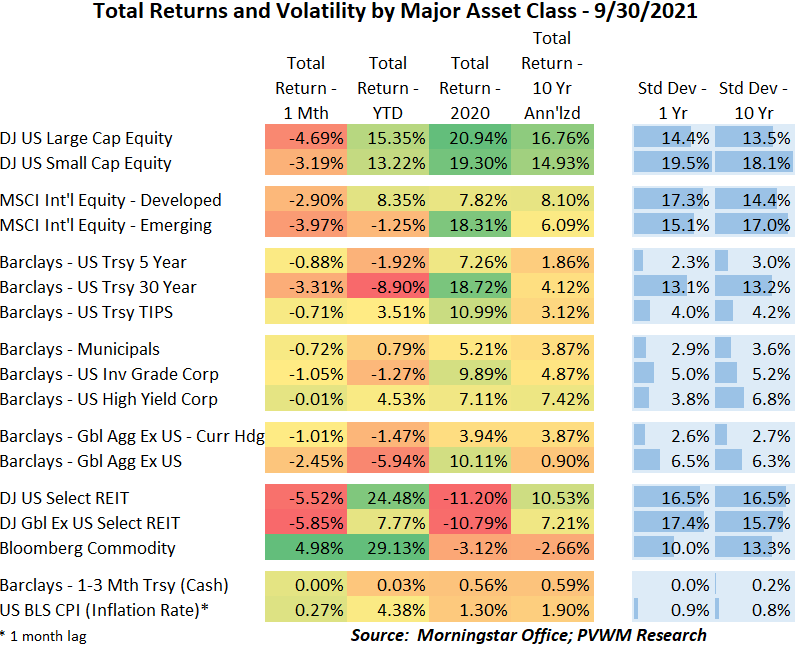

September and October are historically volatile months in the equity markets – and borrowing a line from Mark Twain - as are March, February, April, December, November, January, June, August, May and July! The equity markets for both US and international cooled for the month. Even with the 4% pullback in September, YTD returns are still above 12% for US equities, though the international YTD returns are around 5% for developed markets and negative (that’s right, negative) 4% for emerging. Trouble with China real estate developer Evergrande was the initial impetus for selling earlier in the month but so far it appears the Chinese-controlled banking system will work it out without major systemic risk. All bond indices were also negative as rates began to rise following a delayed reaction from the September FOMC meeting (see below). The positive standout on the board – Commodities – gaining 5% for the month and 30% YTD.

Given the large move in commodities, I thought I would go back to the S&P Sector graph this month. The bold red line below is the overall S&P 500 and the other colored spaghetti lines are the eleven different sectors within the index. Energy has been one of the top sectors throughout the year but had significant pullbacks in both July and August. That was reversed in September after signs of increased travel and other economic activity picked up. The outliers to the downside are Utilities and Consumer Staples, two sectors that feel the brunt of rising rates and inflation if they are not able to keep up with necessary price increases due to regulatory controls or consumer substitution in the grocery aisles.

Interest rates resumed their march higher one day after the September 22 FOMC meeting where the Fed announced their plans to begin tapering (slowing down the $120 billion per month bond buying) later this year. That announcement was expected but the market didn’t expect them to finish tapering by mid-year. This led some to believe the first rate high could begin as soon as late 2022. In addition to the rising rate blips again, one thing that caught my attention is that the 5-year rate never fell back too far from late March relative peak. The other driver of higher rates is inflation that continues to linger. Recall in the past the Fed has described inflation as transitory but in late September it acknowledged that supply chain problems may be “holding up inflation longer than we had thought.”

Watch the markets in October. According to Mark Twain, it may be volatile.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com