Back to School Special – Higher Student Loan Rates!

It is hard to believe but soon there will be “back to school specials”. One critical supply many college students need is student loans. This year's fashion includes a higher interest rate. Like most products linked to interest rates, the rate is up from the previous year. The rate charged depends on the type of loan but for most students using the Federal Direct Loan program, the rate will be 5.05% for undergraduates and 6.60% for graduate students, which is 0.60% higher than last year. Students and parents using the PLUS program will pay 7.60%. This blog post will provide a brief overview of Federal Direct student loans, rates charged and the monthly payment impact from the higher rate.

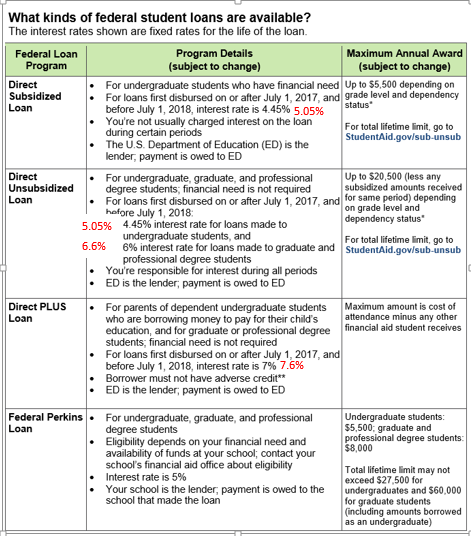

There are two main categories of federal student loans for undergraduates and graduate students – Direct Loan and Perkins Loan – and within Direct Loans, a further distinction of Subsidized, Unsubsidized and PLUS. The amount a student can borrow varies by school year but is not a function of financial need; whether a loan is subsidized is, however. While the interest rate is the same, a subsidized loan does not begin accruing interest until six months after graduation when payments must begin. The unsubsidized loan does begin accruing once funds are received, though payments are also delayed until after graduation. There is also a private student loan market which is not addressed here. The rates for private loans are typically higher, require a credit check, typically do not have payment deferment options and are not eligible for income-based repayment plans.

Note that everyone is eligible for at least a Direct Unsubsidized Loan regardless of income provided the student completes and submits a Free Application for Federal Student Aid (FAFSA). The FAFSA is not as bad as it sounds and it provides access to a fixed-rate loan at relatively attractive rates if current savings and income are insufficient. It is still important to look for value in school choices and be aware of expected loan payment amounts after graduation relative to expected income.

Here is a summary table of the different loans, rates, and amounts allowed to borrow the first year. Further details can be found at the federal loans site. The rates for the 2018-19 school year are inserted in red (the government hasn't updated the table yet!). This rate is fixed for the life of the loan. The undergraduate and graduate rate was 6.8% from 2006 – 2013. After that, the rate was set annually relative to the 10-year treasury rate and has been lower. The graduate rate is set 1.55% higher than the undergraduate rate and PLUS are set at 2.55% higher.

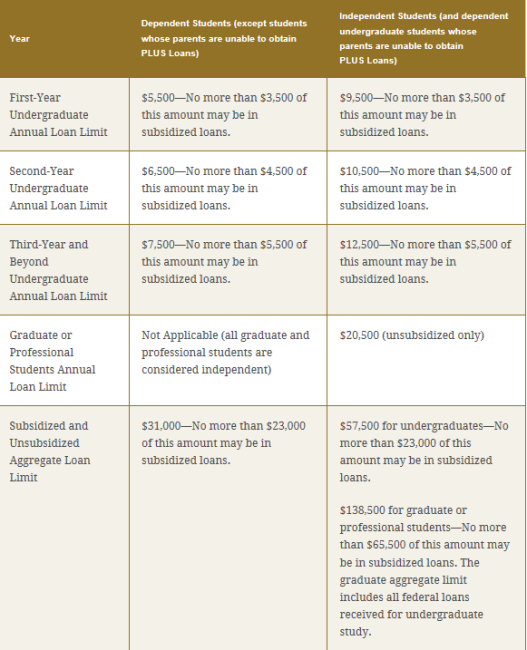

Before I show the monthly and annual payment impact from these higher rates, I first show the amount that can be borrowed each year and in aggregate from the Federal Direct student loan program. A student needs to complete and submit a Free Application for Federal Student Aid (FAFSA). There is also a one-time loan origination fee of 1.066% for Direct Loans and 4.264% for PLUS loans if the first installment is taken before 10/1/2018. Also note the actual cost of attending college will very likely be much higher but I focus here on the maximum amount you can borrow from the Federal Direct Loan program. Additional funds may come from previous savings (crank up your 529!), part-time work, parents' or relative's generosity, PLUS loans or private loans.

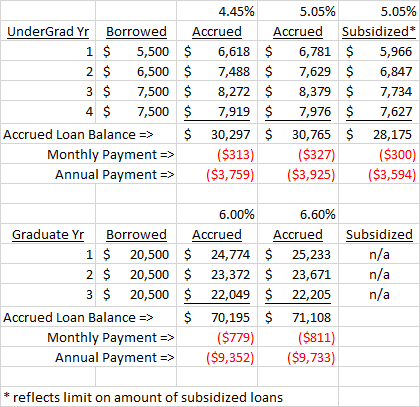

So what does this rate change mean for the monthly payment? Let’s assume the student takes the maximum amount allowed for each of four years of undergrad and three years of graduate school. Also assume the full amount is borrowed each August 1st (in reality, half done Dec), graduation occurs May 1stand loans are repaid over ten years. The table below shows the monthly and annual payments for paying back the loans. The higher rate this year will increase the annual payment by $166 for the undergrad example and $381 for the graduate student - just over a 4% increase in payments. The annual benefit of a subsidized loan for an undergrad (if qualify) is $331 which is an 8.4% decrease in payments over the unsubsidized amount.

So in addition to needing the Kleenex for the drop-off day (I will save mine for wedding days if applicable), you may want to save a tissue for that seventh month after graduation when you begin paying off the loans for the investment in your career.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com