Asset Class Returns - 9/30/2019

Uncertainty but resiliency.

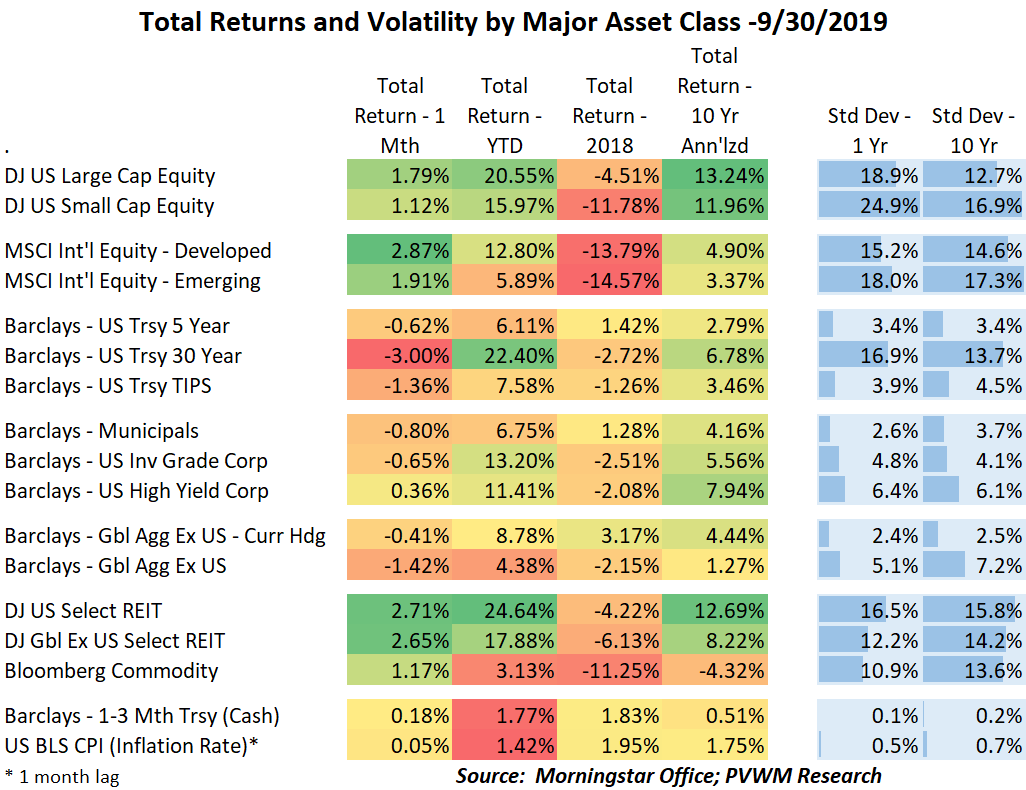

Many of the same themes from previous months continued into September – Fed rate cuts, trade negotiations, slowing global growth and low rates. The added volatile events were the attack on Saudi oil fields and the impeachment inquiry by the House. Yet despite all these events, the markets remained steady (though the start of October is choppy).

US equity markets inched up toward all time highs again before drifting back slightly toward the end of the month. US small caps trailed slightly though the difference vs large caps remain noticeable on a YTD basis. At the sector level, Financials were the strongest for the month followed by Utilities and Energy. International equities performed slightly better than US though are lower YTD than the US, though still solid returns for 9 months of work.

Rates finally stopped their march lower in yield and drifted up slightly. This led to negative returns for bonds (recall price down, yield up), something we haven’t see in a while. The long treasury bond had a loss of 3% for the month alone but a quick glance at the YTD return of 22.4% reminds you how far rates dropped leading up to this month. The high yield market managed to show a positive monthly return but higher quality corporate bonds remain the winner YTD. REITs continue to be on fire and commodities ended the month in positive territory despite the Saudi attack.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com