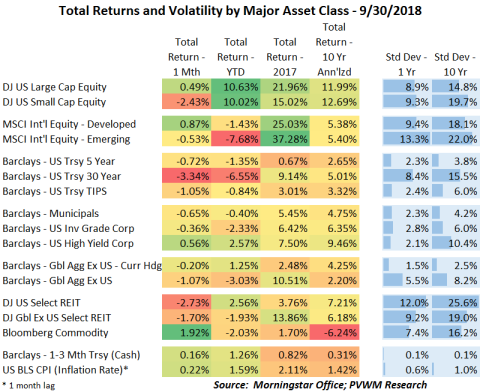

Asset Class Returns - 9/30/2018

The month of August saw mostly negative returns for the major asset classes I list below. The exceptions - US Large Caps, International Equity Developed, High Yield and Commodities.

The US equity market has logged impressive returns year-to-date despite the flattish month. Both large and small cap have similar YTD returns after small caps were down for August, cooling from their strong run. Communications, Health Care and Energy sectors had returns over 2.5% for the month while REITs, Financials and Materials were down more than 2%. International equity markets outperformed the US markets as the US Dollar weakened against some currencies. The YTD returns are still negative and drastically underperformed US equities. The commodity index was up close to 2%. Energy had a strong month as oil prices were up but Livestock performed even better while Grains continued to lag. The 1-year historic volatility as measured by standard deviation in the table below is starting to drift toward the long-run average in the equity asset classes but the corporate bonds still remain quite low. Implied volatility as measured by VIX (the forward-looking vol) also remains low.

The biggest negative for the month was in long-dated treasury bonds. Treasury rates were up about 0.20% for the month and after applying the duration factor (prices of longer bonds more sensitive to interest rate changes), 30-year bonds had the largest loss for the month of the asset classes listed. The Fed raised short-term rates another 0.25% in September and are expected to raise another 0.25% in December. The Fed's updated projections also show three more rate hikes in 2019. Recall a great tool to gauge how much the market is pricing in is the CME FedWatch Tool. Currently the market implies an 80% chance of another hike in December but only a 45% chance of a further hike by March 2019.

Another positive number in the table below I don't mention often is the CPI inflation rate. The CPI data released on October 11th will provide the final number to finalize Social Security inflation adjustments for 2019. My preliminary estimate is an increase of 2.8% using 2 of the 3 known values for the quarterly average. See my recent blog post for details.