Asset Class Returns - 8/31/2021

Here is this month’s market summary. Unless noted, the time frame is year-to-date ending 9/2/2021.

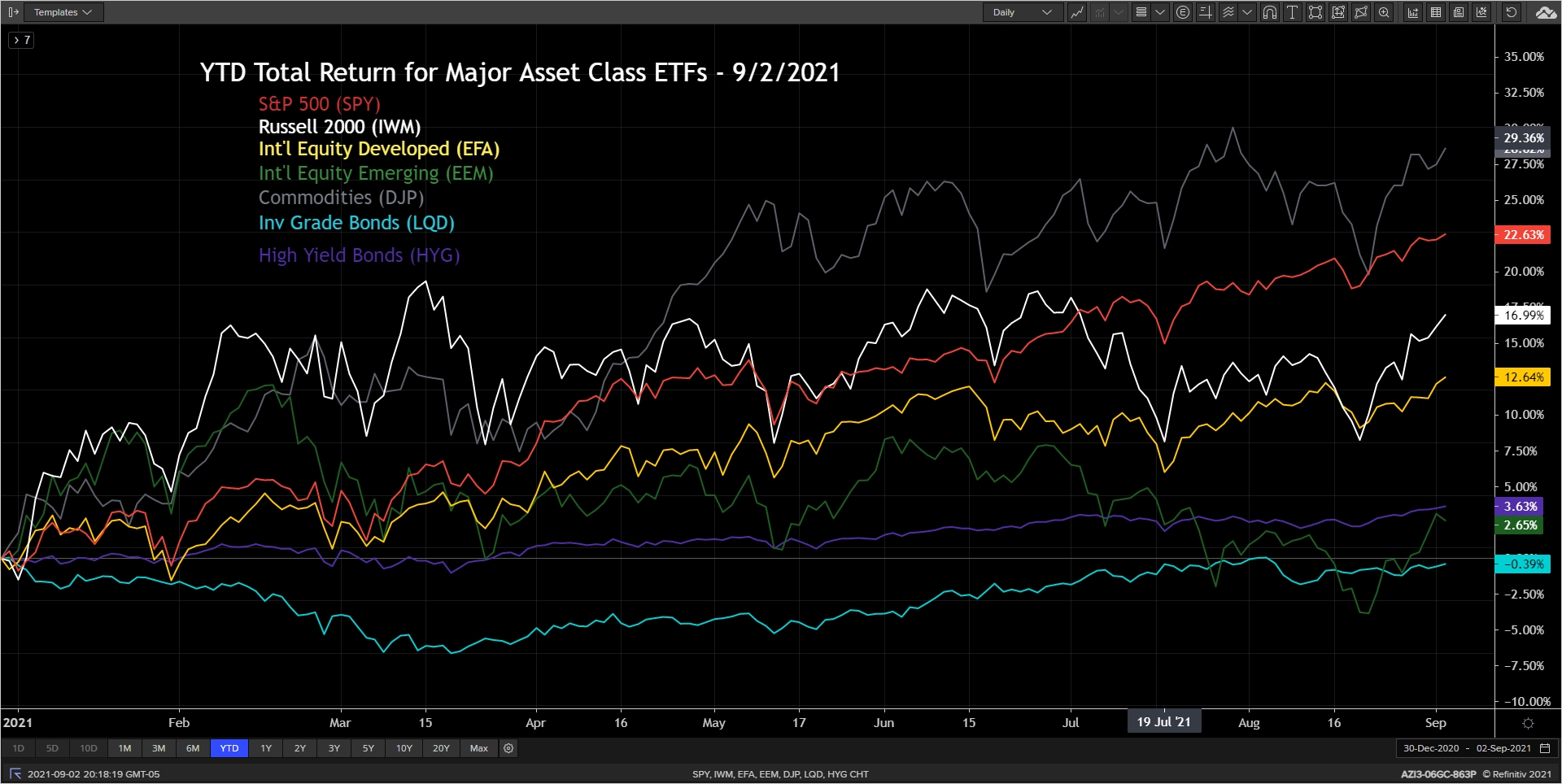

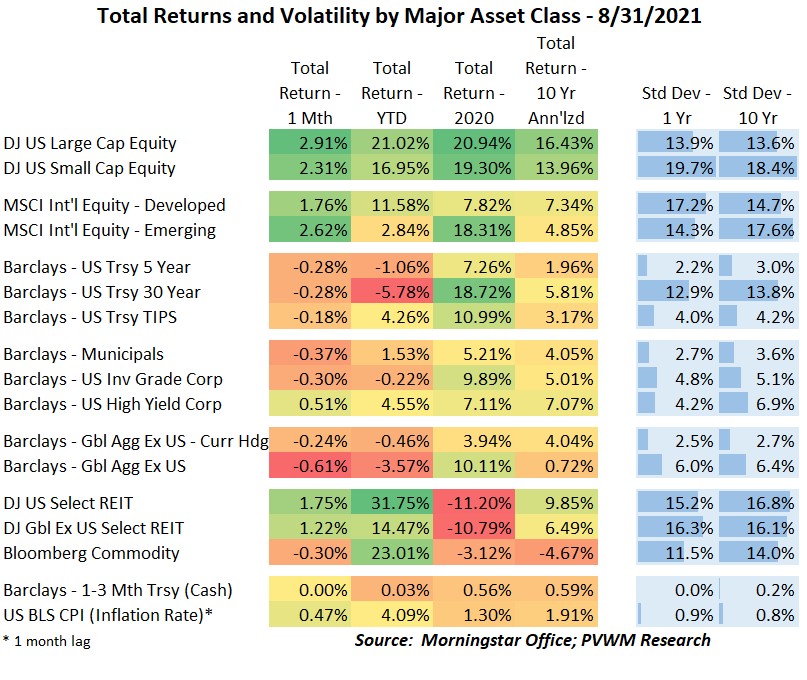

US and international equities notched another strong month. YTD returns for US large cap equities are above 21% while small caps are close behind at 17%. International equities for developed countries are above 11% YTD while emerging markets are just under 3%. The emerging market underperformance continued to be weighed down by China but participated in the mid-month bump as some investors felt the selling was overdone. High quality bonds continue to show negative YTD returns – including a negative month – except for TIPS, high yield and muni’s. COVID-related growth concerns weighed on the energy component of commodities.

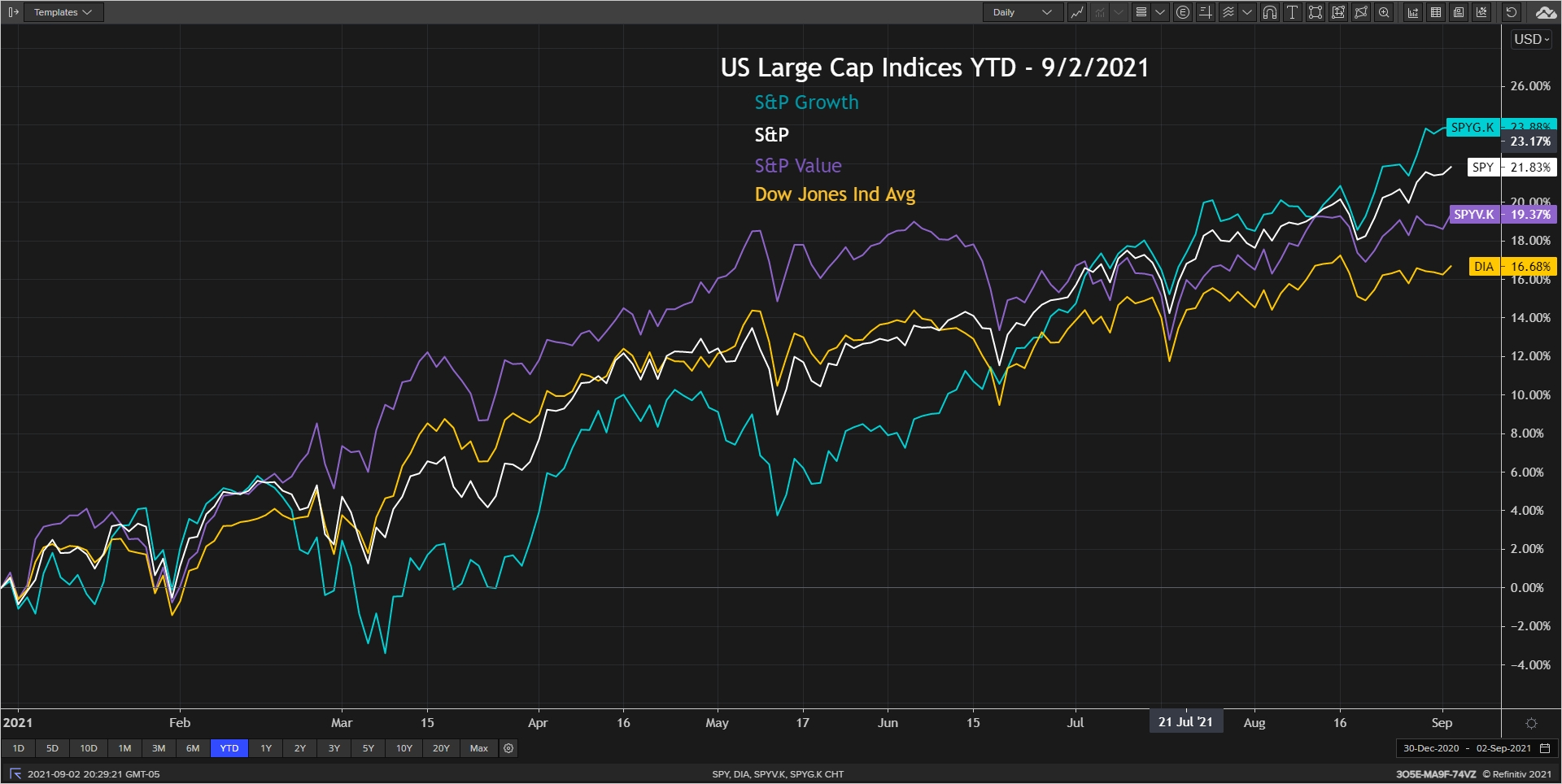

This month I go back to showing the Growth vs. Value chart. After a very strong outperformance of Value over Growth through mid-May, falling interest rates since then reversed the relationship and now Growth is noticeably higher YTD. A rising rate environment may change this dynamic. For the month at the sector level, Financials returned over 5% while Energy fell by more than 2%, though both remain at the top – along with REITS – on a YTD basis.

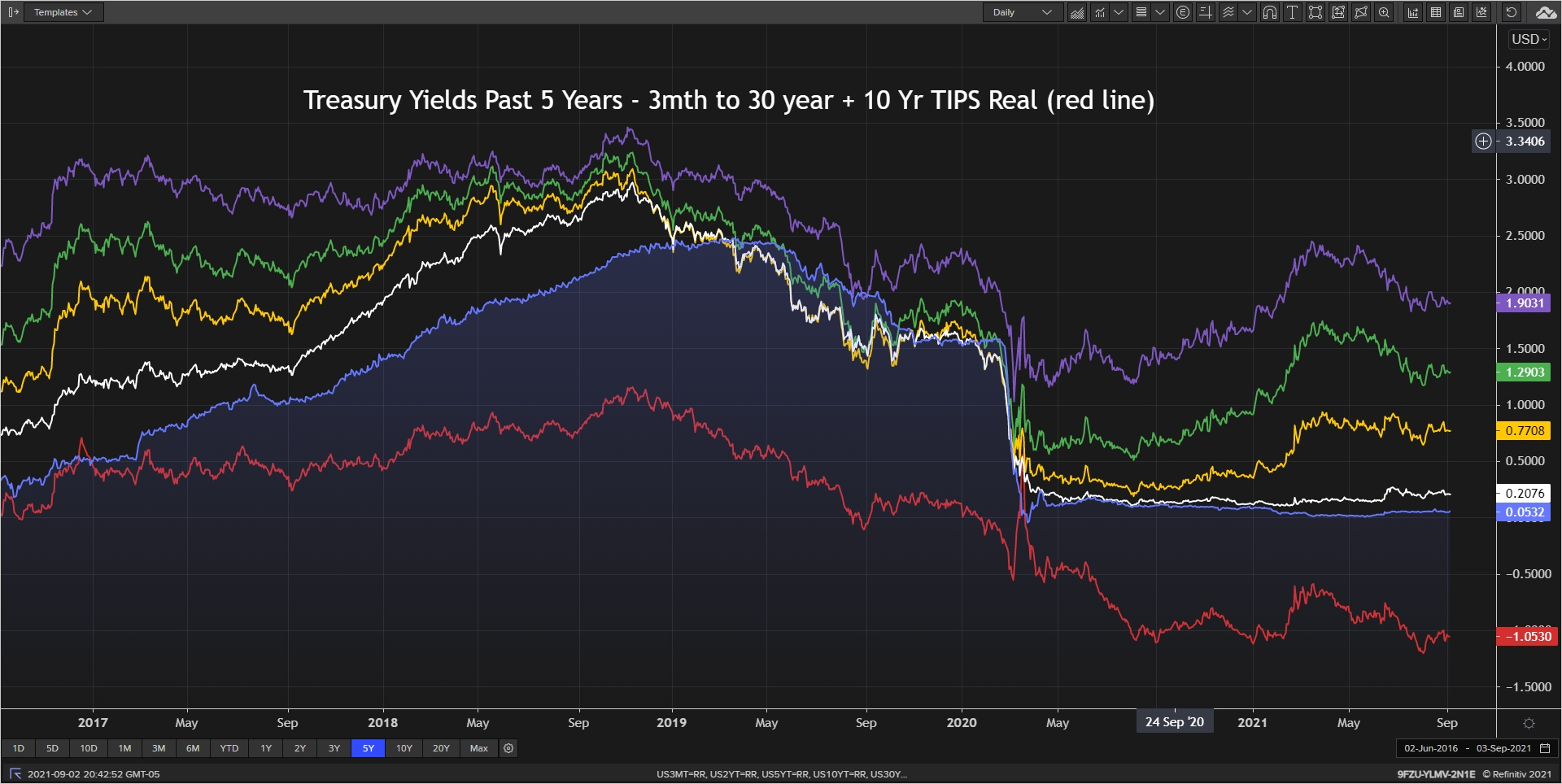

Interest rates remain at relatively low levels but drifted slightly higher this past month, causing a small loss in high quality bond indices. All eyes were on Fed Chair Powell’s Jackson Hole speech in late August. He reiterated the belief that the inflation spike is transitory but running higher than expected. He also highlighted there is more room for jobs improvement, but solid progress is being made. The Fed is expected to slow down the $120 billion per month bond buying later this year (tapering) but Chair Powell emphasized the timing of raising short-term rates is not linked to tapering. The jobs report on September 3 and FOMC meeting on September 22 will be important dates to provide further clarity on the topic.

Enjoy September with the new schedules of school and football at all levels.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com