Asset Class Returns - 7/31/2022

Looking at the table above, the monthly positive returns for July were approximately the same size but opposite sign as the monthly losses from June. The one exception is Emerging Markets which is the only negative reading in the monthly table above.

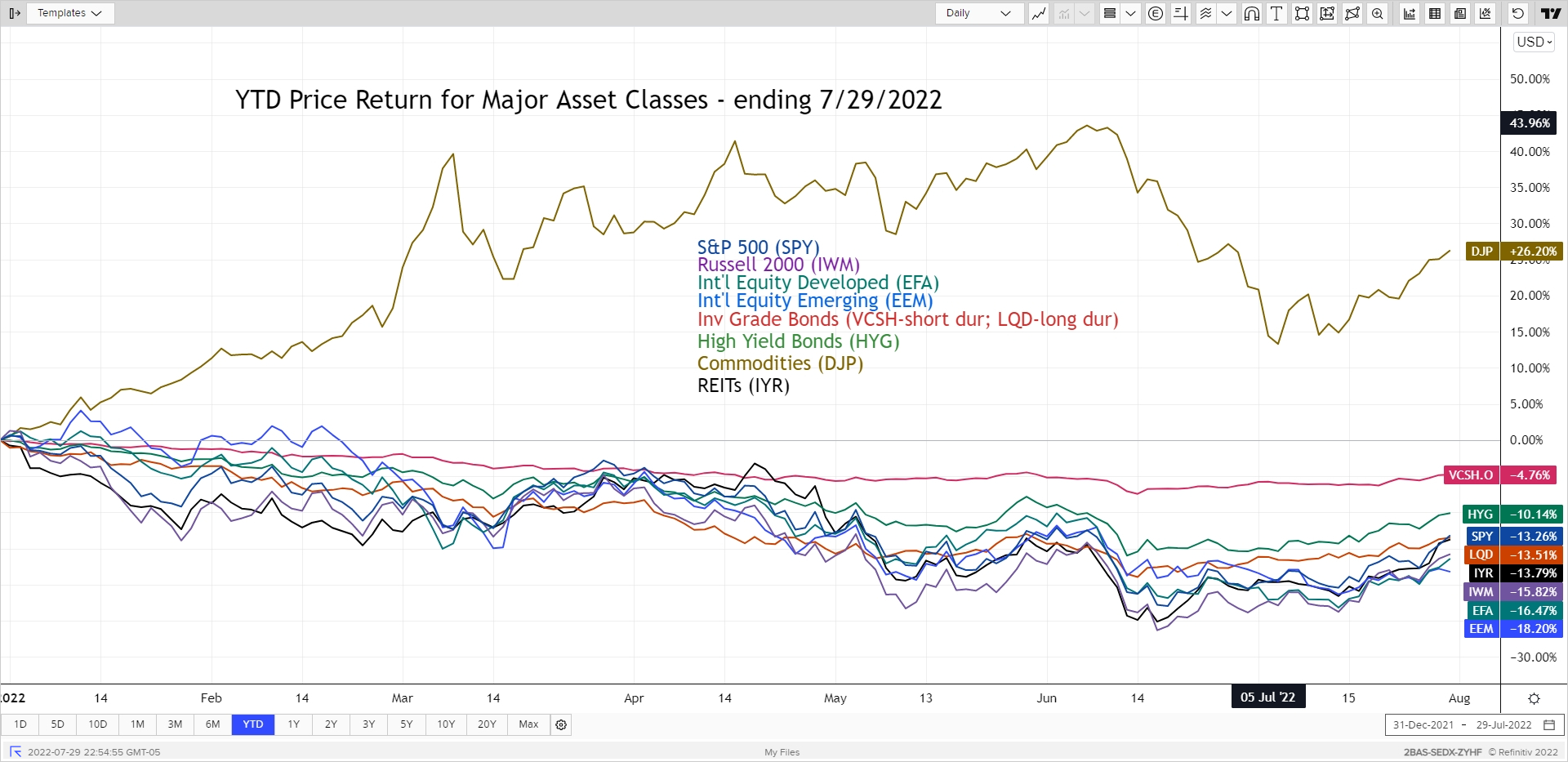

The YTD major asset classes graph below shows the usual asset classes including Commodities. The strong July run began mid-month and hasn’t looked back. The strong finish to the month was on the back of an FOMC meeting where market participants viewed the Chairman’s comments as potentially slowing the rate rises sooner than expected. I thought that was too generous of an interpretation by the markets.

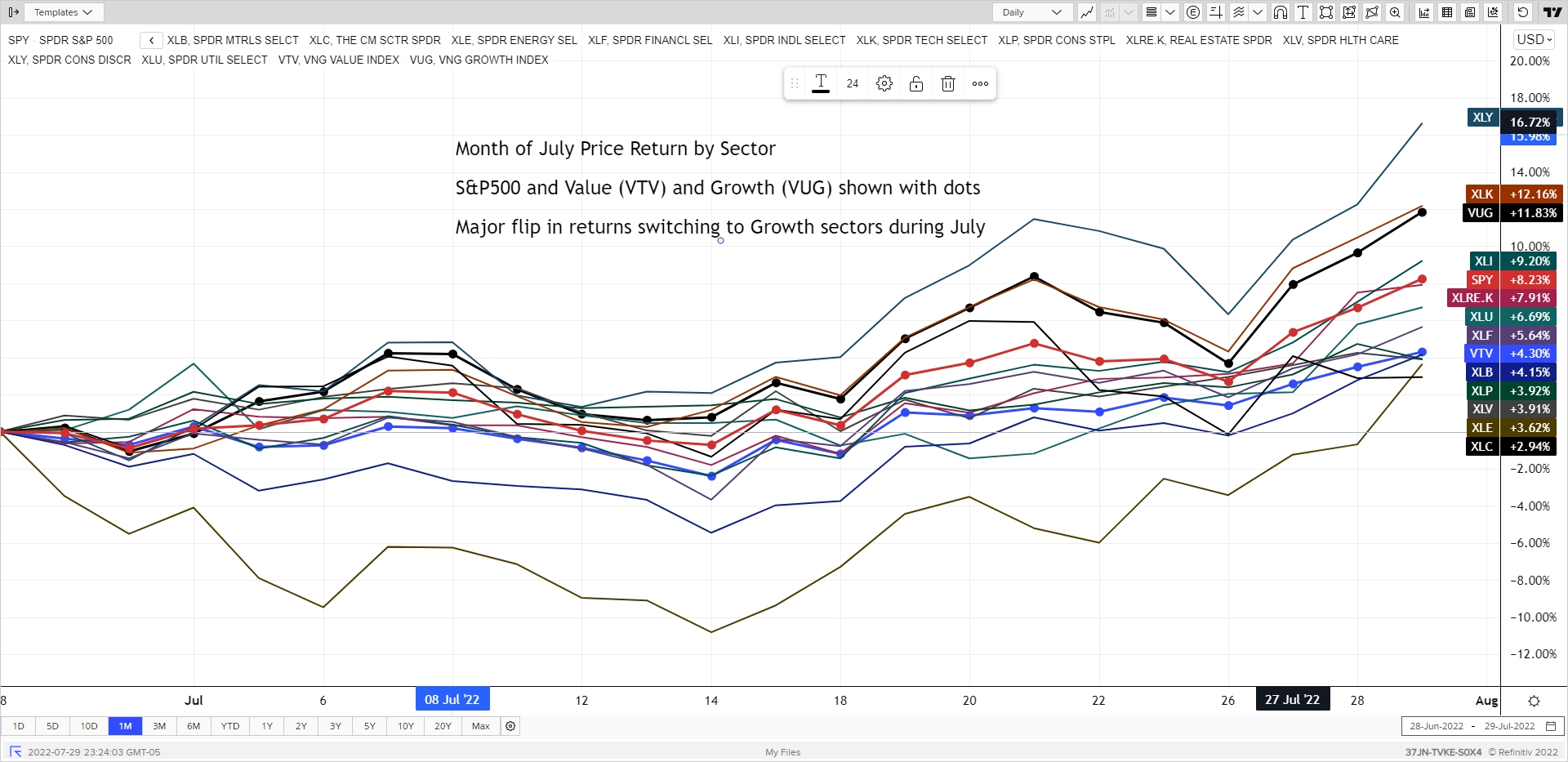

There was a noticeable flip in returns back to Growth sectors during July. The Tech sector and Consumer Discretionary which includes Amazon had 10+% returns for the month alone while Energy, Staples, Healthcare and Communications were at the bottom, though still very respectable monthly returns.

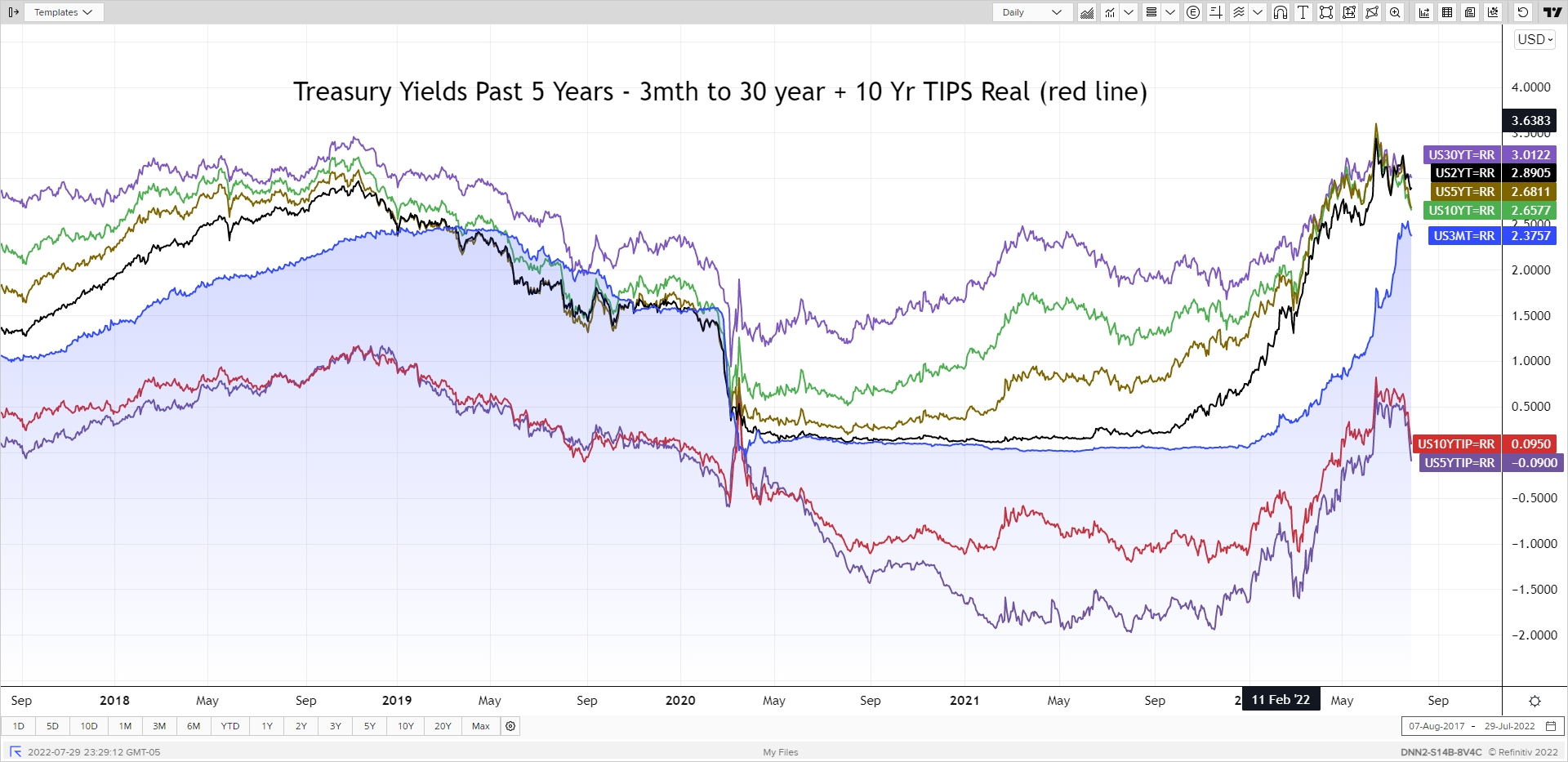

Another noticeable change in trends was found in the bond markets. Rates actually fell, quite substantially for bonds, as the market is starting to price in a potential slowing of rates increases from the Fed. I would be careful about that interpretation. The anomaly in rates: 3-month Treasury Bills now yielding over 2.35% with the active Fed.

Enjoy the month of August – whether end of summer vacations or getting the future leaders ready for school.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com